概述

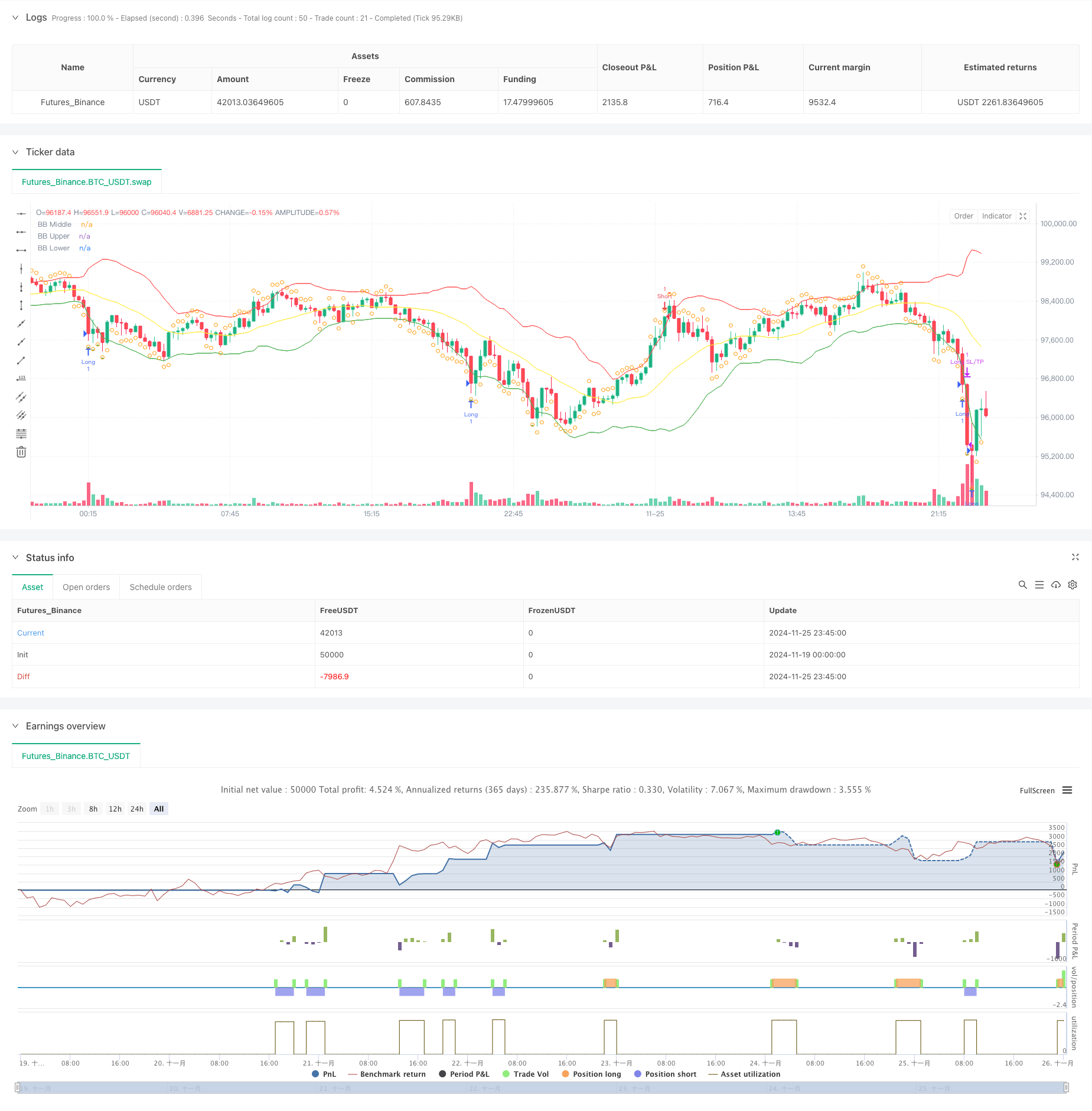

本策略是一个基于均值回归理论的量化交易系统,结合了布林带、RSI指标以及ATR动态止损机制。策略通过识别价格偏离均值的极端情况进行交易,当价格触及布林带下轨且RSI处于超卖区域时做多,当价格触及布林带上轨且RSI处于超买区域时做空,通过ATR动态设置止损止盈位置,实现风险收益的有效管理。

策略原理

策略采用20周期布林带作为主要趋势判断指标,标准差倍数设为2.0,用于确定价格波动的上下边界。同时引入14周期RSI作为辅助指标,RSI低于30视为超卖,高于70视为超买。当价格跌破布林带下轨且RSI低于30时,表明市场可能超卖,系统发出做多信号;当价格突破布林带上轨且RSI高于70时,表明市场可能超买,系统发出做空信号。策略使用布林带中轨作为获利了结点,并结合RSI反向突破进行仓位管理。此外,策略还引入了基于14周期ATR的动态止损止盈机制,止损设为2倍ATR,止盈设为3倍ATR,以实现更精确的风险控制。

策略优势

- 结合多指标交叉验证:通过布林带和RSI的协同配合,有效过滤虚假信号,提高交易准确率。

- 动态止损机制:采用ATR动态调整止损止盈位置,使风险管理更适应市场波动。

- 完整的交易闭环:包含明确的入场、出场条件和风险管理机制,逻辑完整清晰。

- 适应性强:策略参数可根据不同市场特征进行优化调整。

策略风险

- 趋势市场风险:均值回归策略在强趋势市场中可能频繁止损。

- 参数敏感性:布林带周期、RSI阈值等参数的设置对策略表现影响较大。

- 平仓时机把握:中轨平仓可能导致提前退出有利行情。

- 止损幅度:固定倍数的ATR止损在波动剧烈时可能过大。

策略优化方向

- 增加趋势过滤器:考虑添加更长周期的移动平均线,在强趋势市场中避免逆势交易。

- 引入成交量指标:将成交量作为交易信号的确认指标,提高交易质量。

- 优化止盈机制:可考虑采用trailing stop或分批止盈方式,提高盈利能力。

- 动态调整参数:基于市场波动率自适应调整布林带和RSI的参数设置。

总结

该策略通过布林带和RSI的组合应用,构建了一个完整的均值回归交易系统。ATR动态止损的引入有效控制了风险,使策略具有良好的风险收益特性。虽然存在一定的优化空间,但整体设计理念清晰,实用性较强。建议交易者在实盘应用时,根据具体市场特征调整参数,并持续监控策略表现。

策略源码

/*backtest

start: 2024-11-19 00:00:00

end: 2024-11-26 00:00:00

period: 15m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("SOL/USDT Mean Reversion Strategy", overlay=true)

// Input parameters

length = input(20, "Bollinger Band Length")

std_dev = input(2.0, "Standard Deviation")

rsi_length = input(14, "RSI Length")

rsi_oversold = input(30, "RSI Oversold")

rsi_overbought = input(70, "RSI Overbought")

// Calculate indicators

[middle, upper, lower] = ta.bb(close, length, std_dev)

rsi = ta.rsi(close, rsi_length)

// Entry conditions

long_entry = close < lower and rsi < rsi_oversold

short_entry = close > upper and rsi > rsi_overbought

// Exit conditions

long_exit = close > middle or rsi > rsi_overbought

short_exit = close < middle or rsi < rsi_oversold

// Strategy execution

if (long_entry)

strategy.entry("Long", strategy.long)

if (short_entry)

strategy.entry("Short", strategy.short)

if (long_exit)

strategy.close("Long")

if (short_exit)

strategy.close("Short")

// Stop loss and take profit

atr = ta.atr(14)

strategy.exit("Long SL/TP", "Long", stop=strategy.position_avg_price - 2*atr, limit=strategy.position_avg_price + 3*atr)

strategy.exit("Short SL/TP", "Short", stop=strategy.position_avg_price + 2*atr, limit=strategy.position_avg_price - 3*atr)

// Plot indicators

plot(middle, color=color.yellow, title="BB Middle")

plot(upper, color=color.red, title="BB Upper")

plot(lower, color=color.green, title="BB Lower")

// Plot entry and exit points

plotshape(long_entry, title="Long Entry", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(short_entry, title="Short Entry", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

plotshape(long_exit, title="Long Exit", location=location.abovebar, color=color.orange, style=shape.circle, size=size.small)

plotshape(short_exit, title="Short Exit", location=location.belowbar, color=color.orange, style=shape.circle, size=size.small)

相关推荐