概述

该策略是一个基于枢轴点分析的高级交易系统,通过识别市场中的关键转折点来预测潜在的趋势反转。策略采用创新的”枢轴的枢轴”方法,结合波动率指标ATR进行仓位管理,形成了一个完整的交易体系。该策略适用于多个市场,可以根据不同市场的特点进行参数优化。

策略原理

策略的核心是通过两个层次的枢轴点分析来识别市场反转机会。第一层枢轴点是基本的高低点,第二层枢轴点则是在第一层枢轴点中筛选出的显著转折点。当价格突破这些关键水平时,系统会产生交易信号。同时,策略使用ATR指标来度量市场波动性,用于确定止损止盈位置和仓位大小。

策略优势

- 适应性强:策略可以适应不同的市场环境,通过调整参数来适应不同的波动率水平。

- 风险管理完善:使用ATR进行动态止损设置,能够根据市场波动性自动调整保护措施。

- 多层次确认:通过两层枢轴点分析,降低了假突破的风险。

- 灵活的仓位管理:根据账户规模和市场波动性动态调整仓位大小。

- 清晰的入场规则:有明确的信号确认机制,减少主观判断。

策略风险

- 滑点风险:在高波动市场中可能面临较大滑点。

- 假突破风险:市场震荡时可能产生错误信号。

- 过度杠杆风险:不当的杠杆使用可能带来严重损失。

- 参数优化风险:过度优化可能导致过拟合。

策略优化方向

- 信号过滤:可以添加趋势过滤器,只在主趋势方向交易。

- 动态参数:根据市场状态自动调整枢轴点参数。

- 多时间周期:增加多时间周期确认来提高准确率。

- 智能止损:开发更智能的止损策略,如跟踪止损。

- 风险控制:增加更多的风险控制措施,如相关性分析。

总结

这是一个设计完善的趋势反转交易策略,通过双层枢轴点分析和ATR波动率管理,构建了一个稳健的交易系统。策略的优势在于其适应性强且风险管理完善,但仍需要交易者谨慎使用杠杆并持续优化参数。通过建议的优化方向,策略还有提升空间。该策略适合稳健型交易者使用,是一个值得深入研究和实践的交易系统。

策略源码

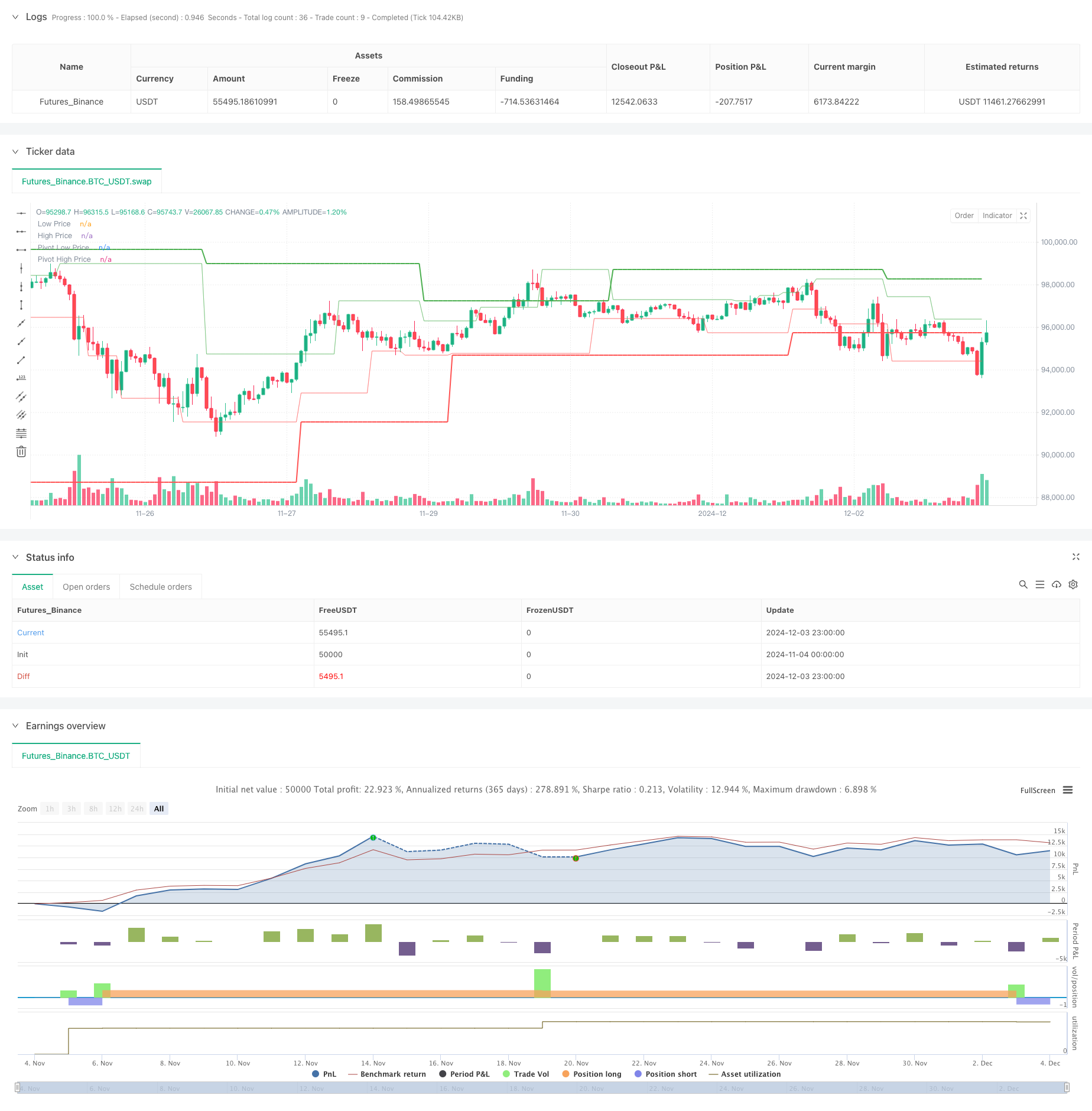

/*backtest

start: 2024-11-04 00:00:00

end: 2024-12-04 00:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Pivot of Pivot Reversal Strategy [MAD]", shorttitle="PoP Reversal Strategy", overlay=true, commission_type=strategy.commission.percent, commission_value=0.1, slippage=3)

// Inputs with Tooltips

leftBars = input.int(4, minval=1, title='PP Left Bars', tooltip='Number of bars to the left of the pivot point. Increasing this value makes the pivot more significant.')

rightBars = input.int(2, minval=1, title='PP Right Bars', tooltip='Number of bars to the right of the pivot point. Increasing this value delays the pivot detection but may reduce false signals.')

atr_length = input.int(14, minval=1, title='ATR Length', tooltip='Length for ATR calculation. ATR is used to assess market volatility.')

atr_mult = input.float(0.1, minval=0.0, step=0.1, title='ATR Multiplier', tooltip='Multiplier applied to ATR for pivot significance. Higher values require greater price movement for pivots.')

allowLongs = input.bool(true, title='Allow Long Positions', tooltip='Enable or disable long positions.')

allowShorts = input.bool(true, title='Allow Short Positions', tooltip='Enable or disable short positions.')

margin_amount = input.float(1.0, minval=1.0, maxval=100.0, step=1.0, title='Margin Amount (Leverage)', tooltip='Set the leverage multiplier (e.g., 3x, 5x, 10x). Note: Adjust leverage in strategy properties for accurate results.')

risk_reward_enabled = input.bool(false, title='Enable Risk/Reward Ratio', tooltip='Enable or disable the use of a fixed risk/reward ratio for trades.')

risk_reward_ratio = input.float(1.0, minval=0.1, step=0.1, title='Risk/Reward Ratio', tooltip='Set the desired risk/reward ratio (e.g., 1.0 for 1:1).')

risk_percent = input.float(1.0, minval=0.1, step=0.1, title='Risk Percentage per Trade (%)', tooltip='Percentage of entry price to risk per trade.')

trail_stop_enabled = input.bool(false, title='Enable Trailing Stop Loss', tooltip='Enable or disable the trailing stop loss.')

trail_percent = input.float(0.5, minval=0.0, step=0.1, title='Trailing Stop Loss (%)', tooltip='Percentage for trailing stop loss.')

start_year = input.int(2018, title='Start Year', tooltip='Backtest start year.')

start_month = input.int(1, title='Start Month', tooltip='Backtest start month.')

start_day = input.int(1, title='Start Day', tooltip='Backtest start day.')

end_year = input.int(2100, title='End Year', tooltip='Backtest end year.')

end_month = input.int(1, title='End Month', tooltip='Backtest end month.')

end_day = input.int(1, title='End Day', tooltip='Backtest end day.')

date_start = timestamp(start_year, start_month, start_day, 00, 00)

date_end = timestamp(end_year, end_month, end_day, 00, 00)

time_cond = time >= date_start and time <= date_end

// Pivot High Significant Function

pivotHighSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if high[right] < high[right + i] + atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if high[right] < high[i] + atr * atr_mult

pp_ok := false

pp_ok ? high[right] : na

// Pivot Low Significant Function

pivotLowSig(left, right) =>

pp_ok = true

atr = ta.atr(atr_length)

for i = 1 to left

if low[right] > low[right + i] - atr * atr_mult

pp_ok := false

for i = 0 to right - 1

if low[right] > low[i] - atr * atr_mult

pp_ok := false

pp_ok ? low[right] : na

swh = pivotHighSig(leftBars, rightBars)

swl = pivotLowSig(leftBars, rightBars)

swh_cond = not na(swh)

var float hprice = 0.0

hprice := swh_cond ? swh : nz(hprice[1])

le = false

le := swh_cond ? true : (le[1] and high > hprice ? false : le[1])

swl_cond = not na(swl)

var float lprice = 0.0

lprice := swl_cond ? swl : nz(lprice[1])

se = false

se := swl_cond ? true : (se[1] and low < lprice ? false : se[1])

// Pivots of pivots

var float ph1 = 0.0

var float ph2 = 0.0

var float ph3 = 0.0

var float pl1 = 0.0

var float pl2 = 0.0

var float pl3 = 0.0

var float pphprice = 0.0

var float pplprice = 0.0

ph3 := swh_cond ? nz(ph2[1]) : nz(ph3[1])

ph2 := swh_cond ? nz(ph1[1]) : nz(ph2[1])

ph1 := swh_cond ? hprice : nz(ph1[1])

pl3 := swl_cond ? nz(pl2[1]) : nz(pl3[1])

pl2 := swl_cond ? nz(pl1[1]) : nz(pl2[1])

pl1 := swl_cond ? lprice : nz(pl1[1])

pphprice := swh_cond and ph2 > ph1 and ph2 > ph3 ? ph2 : nz(pphprice[1])

pplprice := swl_cond and pl2 < pl1 and pl2 < pl3 ? pl2 : nz(pplprice[1])

// Entry and Exit Logic

if time_cond

// Calculate order quantity based on margin amount

float order_qty = na

if margin_amount > 0

order_qty := (strategy.equity * margin_amount) / close

// Long Position

if allowLongs and le and not na(pphprice) and pphprice != 0

float entry_price_long = pphprice + syminfo.mintick

strategy.entry("PivRevLE", strategy.long, qty=order_qty, comment="PivRevLE", stop=entry_price_long)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_long = na

float trail_points_long = na

if risk_reward_enabled

float risk_amount = entry_price_long * (risk_percent / 100)

stop_loss_price := entry_price_long - risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_long + profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_long := (trail_percent / 100.0) * entry_price_long

trail_points_long := trail_offset_long / syminfo.pointvalue

strategy.exit("PivRevLE Exit", from_entry="PivRevLE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_long, trail_offset=trail_points_long)

// Short Position

if allowShorts and se and not na(pplprice) and pplprice != 0

float entry_price_short = pplprice - syminfo.mintick

strategy.entry("PivRevSE", strategy.short, qty=order_qty, comment="PivRevSE", stop=entry_price_short)

if risk_reward_enabled or (trail_stop_enabled and trail_percent > 0.0)

float stop_loss_price = na

float take_profit_price = na

float trail_offset_short = na

float trail_points_short = na

if risk_reward_enabled

float risk_amount = entry_price_short * (risk_percent / 100)

stop_loss_price := entry_price_short + risk_amount

float profit_target = risk_amount * risk_reward_ratio

take_profit_price := entry_price_short - profit_target

if trail_stop_enabled and trail_percent > 0.0

trail_offset_short := (trail_percent / 100.0) * entry_price_short

trail_points_short := trail_offset_short / syminfo.pointvalue

strategy.exit("PivRevSE Exit", from_entry="PivRevSE",

stop=stop_loss_price, limit=take_profit_price,

trail_points=trail_points_short, trail_offset=trail_points_short)

// Plotting

plot(lprice, color=color.new(color.red, 55), title='Low Price')

plot(hprice, color=color.new(color.green, 55), title='High Price')

plot(pplprice, color=color.new(color.red, 0), linewidth=2, title='Pivot Low Price')

plot(pphprice, color=color.new(color.green, 0), linewidth=2, title='Pivot High Price')

相关推荐