概述

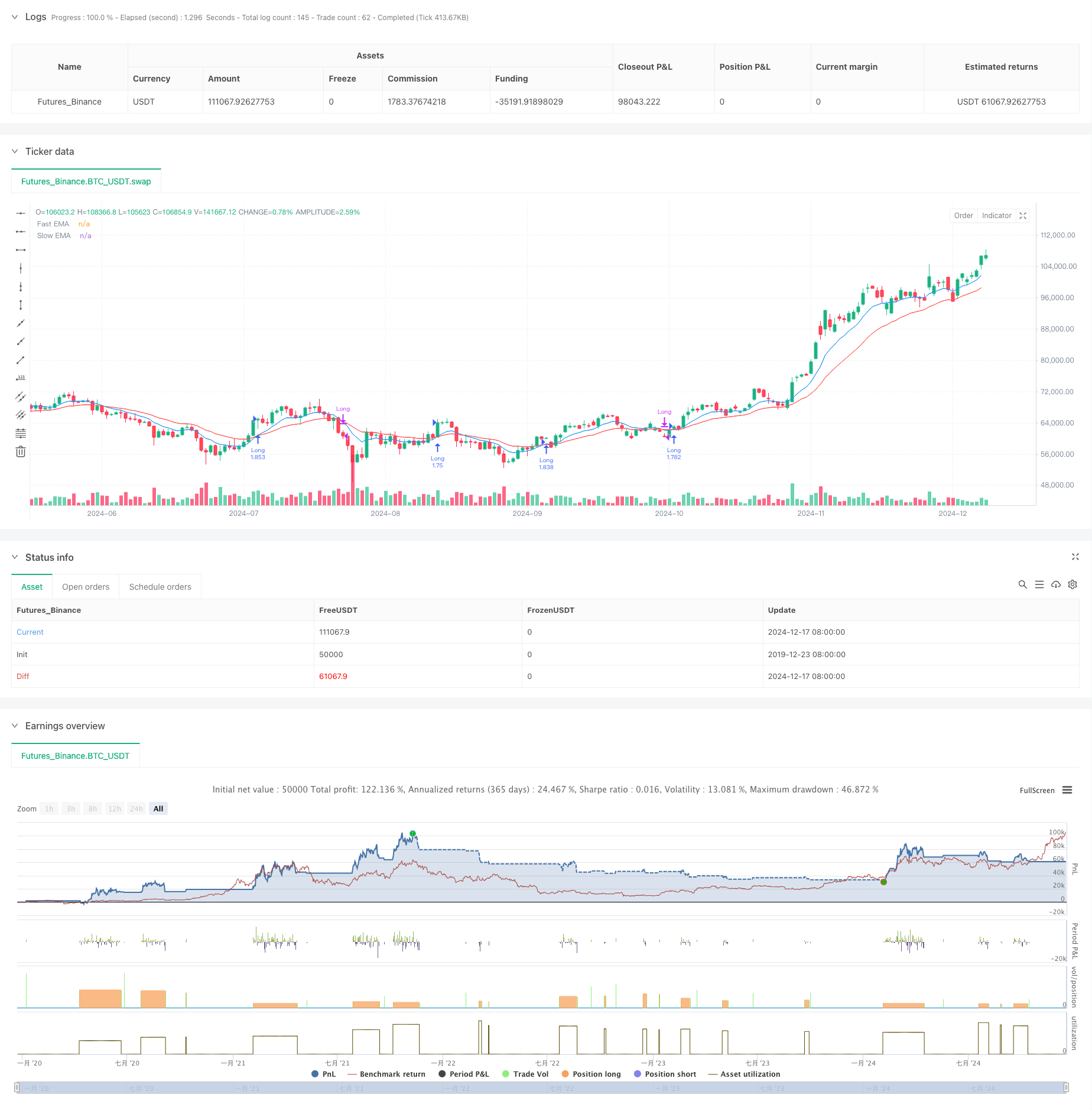

该策略是一个基于指数移动平均线(EMA)交叉的趋势跟踪系统,结合了动态仓位管理和风险控制。策略使用快速与慢速EMA的交叉信号来识别市场趋势,同时通过百分比风险计算来动态调整交易规模,并采用移动止损来保护盈利。

策略原理

策略的核心逻辑基于两条不同周期(默认为9和21)的指数移动平均线。当快速EMA向上穿越慢速EMA时,系统产生做多信号;当快速EMA向下穿越慢速EMA时,系统平仓。每笔交易的规模基于账户总资金的固定风险比例(默认1%)动态计算,同时设置了基于风险回报比的止盈水平和百分比移动止损。

策略优势

- 动态仓位管理确保了每笔交易风险的一致性,避免了固定仓位可能带来的过度风险。

- 移动止损机制能够有效锁定盈利,在趋势反转时及时出场。

- 风险回报比的设置保证了每笔交易都有明确的盈亏比例。

- EMA交叉信号能够有效捕捉中长期趋势,减少虚假信号。

- 系统完全自动化,消除了人为情绪干扰。

策略风险

- 在震荡市场中可能产生频繁的虚假交叉信号,导致连续亏损。

- 移动止损可能在高波动性市场中过早触发,错过大趋势。

- 固定百分比的风险设置可能在市场波动性变化时不够灵活。

- 在快速反转市场中,止损位可能被跳空越过,实际亏损超过预期。

策略优化方向

- 引入波动率指标(如ATR)来动态调整止损和止盈水平。

- 增加趋势强度过滤器,如RSI或ADX,以减少震荡市场中的虚假信号。

- 开发基于市场波动性的动态EMA周期调整机制。

- 加入交易量确认指标,提高信号可靠性。

- 实现基于近期亏损的动态风险调整机制。

总结

这是一个将经典的技术分析方法与现代风险管理理念相结合的完整交易系统。策略通过动态仓位管理和移动止损来控制风险,同时利用EMA交叉捕捉趋势性机会。虽然存在一些固有的局限性,但通过建议的优化方向,可以进一步提升策略的稳健性和适应性。策略特别适合追求风险可控的长期趋势交易。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-18 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bitcoin Exponential Profit Strategy", overlay=true)

// User settings

fastLength = input.int(9, title="Fast EMA Length", minval=1)

slowLength = input.int(21, title="Slow EMA Length", minval=1)

riskPercent = input.float(1, title="Risk % Per Trade", step=0.1) / 100

rewardMultiplier = input.float(2, title="Reward Multiplier (R:R)", step=0.1)

trailOffsetPercent = input.float(0.5, title="Trailing Stop Offset %", step=0.1) / 100

// Calculate EMAs

fastEMA = ta.ema(close, fastLength)

slowEMA = ta.ema(close, slowLength)

// Plot EMAs

plot(fastEMA, color=color.blue, title="Fast EMA")

plot(slowEMA, color=color.red, title="Slow EMA")

// Account balance and dynamic position sizing

capital = strategy.equity

riskAmount = capital * riskPercent

// Define Stop Loss and Take Profit Levels

stopLossLevel = close * (1 - riskPercent)

takeProfitLevel = close * (1 + rewardMultiplier * riskPercent)

// Trailing stop offset

trailOffset = close * trailOffsetPercent

// Entry Condition: Bullish Crossover

if ta.crossover(fastEMA, slowEMA)

positionSize = riskAmount / math.max(close - stopLossLevel, 0.01) // Prevent division by zero

strategy.entry("Long", strategy.long, qty=positionSize)

strategy.exit("TakeProfit", from_entry="Long", stop=stopLossLevel, limit=takeProfitLevel, trail_offset=trailOffset)

// Exit Condition: Bearish Crossunder

if ta.crossunder(fastEMA, slowEMA)

strategy.close("Long")

// Labels for Signals

if ta.crossover(fastEMA, slowEMA)

label.new(bar_index, low, "BUY", color=color.green, textcolor=color.white, style=label.style_label_up)

if ta.crossunder(fastEMA, slowEMA)

label.new(bar_index, high, "SELL", color=color.red, textcolor=color.white, style=label.style_label_down)

相关推荐