概述

这是一个结合了多重技术分析形态识别和支撑阻力水平的策略系统。该策略主要通过识别双底形态(亚当与夏娃底部形态)、结合斐波那契回调水平以及支撑阻力线来进行交易决策。策略的核心在于通过多维度的技术指标验证,提高交易信号的可靠性,同时利用支撑阻力水平作为风险控制的重要参考。

策略原理

策略采用三重验证机制进行交易决策:首先通过特定的算法识别双底形态,包括较为尖锐的”亚当底”和较为圆润的”夏娃底”;其次,利用斐波那契回调水平(0.618和1.618)来确定目标区域;最后,通过支撑阻力水平的验证来确认交易信号。交易信号的生成需要同时满足形态识别、斐波那契水平和支撑阻力水平的条件。具体而言,当支撑阻力水平高于1.618斐波那契延伸位时触发做多信号,当支撑阻力水平低于0.618斐波那契回调位时触发做空信号。

策略优势

- 多重验证机制大大提高了交易信号的可靠性

- 通过形态识别算法准确捕捉市场转折点

- 结合斐波那契水平提供了精确的目标区域

- 支撑阻力水平的验证增加了交易的安全性

- 策略参数可调节性强,适应不同市场环境

- 自动化程度高,减少主观判断带来的偏差

策略风险

- 形态识别可能存在滞后性,影响入场时机

- 在高波动市场中可能产生假信号

- 支撑阻力水平的有效性受市场环境影响

- 参数设置不当可能导致过度交易

- 需要较大的观察周期,可能错过一些快速机会

策略优化方向

- 引入波动率指标来过滤市场环境

- 增加趋势过滤器以提高形态识别的准确性

- 优化支撑阻力水平的计算方法

- 加入成交量指标作为辅助确认

- 开发更灵活的止损止盈机制

- 引入机器学习算法提高形态识别的准确率

总结

该策略通过综合运用形态识别、斐波那契水平和支撑阻力线等多重技术分析方法,构建了一个相对完善的交易系统。策略的优势在于其多重验证机制提供了较高的可靠性,而其可调节性也使其能够适应不同的市场环境。虽然存在一些固有风险,但通过持续优化和完善,该策略有望在实际交易中取得稳定的表现。通过加入更多的技术指标和优化算法,策略的性能还有很大的提升空间。

策略源码

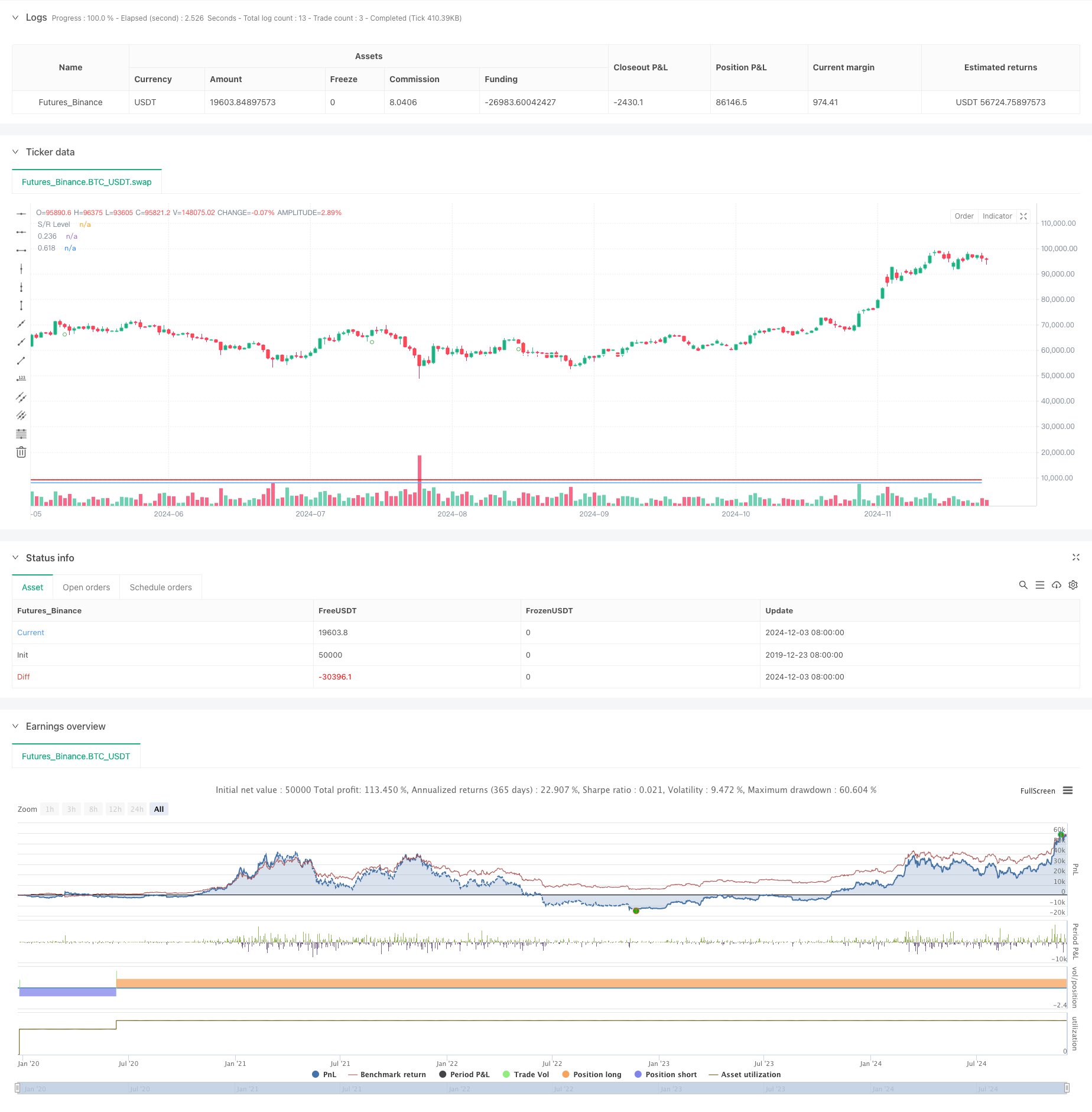

/*backtest

start: 2019-12-23 08:00:00

end: 2024-12-04 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Double Bottom with Support/Resistance Strategy - Aynet", overlay=true)

// Inputs

lookbackPeriod = input(21, "Lookback Period")

swingLowThreshold = input(1.5, "Swing Low Threshold")

fibLevel1 = input(0.618, "Fibonacci Level 1")

fibLevel3 = input(1.618, "Fibonacci Level 2")

srPeriod = input(21, "Support/Resistance Period")

srThreshold = input(3, "Support/Resistance Touch Points")

// Support/Resistance Function

get_sr_level(idx) =>

var level = 0.0

var count = 0

if bar_index % srPeriod == 0

highCount = 0

lowCount = 0

for i = 0 to srPeriod - 1

if math.abs(high[i] - high) < (high * 0.001)

highCount += 1

if math.abs(low[i] - low) < (low * 0.001)

lowCount += 1

if highCount >= srThreshold

level := high

count := highCount

if lowCount >= srThreshold

level := low

count := lowCount

[level, count]

// Pattern Detection Functions

isSwingLow(src, left, right) =>

isLow = true

for i = 0 to left + right

if src[i] < src[right]

isLow := false

isLow

getSpikeSharpness(index) =>

priceRange = high[index] - low[index]

bodyRange = math.abs(close[index] - open[index])

sharpness = priceRange / bodyRange

sharpness

// Pattern Variables

var float firstBottom = na

var float secondBottom = na

var bool isAdam = false

var bool isEve = false

var float level1Value = na

var float level3Value = na

// Pattern Detection

bottom = isSwingLow(low, lookbackPeriod, lookbackPeriod)

if bottom

sharpness = getSpikeSharpness(0)

if na(firstBottom)

firstBottom := low

isAdam := sharpness > swingLowThreshold

else if low <= firstBottom * 1.02 and low >= firstBottom * 0.98

secondBottom := low

isEve := sharpness <= swingLowThreshold

// Calculate Fibonacci

if not na(secondBottom)

highPoint = ta.highest(high, lookbackPeriod)

fibDistance = highPoint - math.min(firstBottom, secondBottom)

level1Value := math.min(firstBottom, secondBottom) + fibDistance * fibLevel1

level3Value := math.min(firstBottom, secondBottom) + fibDistance * fibLevel3

// Get S/R Level

[srLevel, srCount] = get_sr_level(0)

// Trading Logic

longCondition = srLevel > level3Value

shortCondition = srLevel < level1Value

if longCondition

strategy.entry("Long", strategy.long)

if shortCondition

strategy.entry("Short", strategy.short)

// Reset Pattern

if high > ta.highest(high[1], lookbackPeriod)

firstBottom := na

secondBottom := na

isAdam := false

isEve := false

var table logo = table.new(position.top_right, 1, 1)

table.cell(logo, 0, 0, 'Double Bottom with Support/Resistance Strategy - Aynet', text_size=size.large, text_color=color.white)

// Plots

plot(level1Value, "0.236", color=color.rgb(245, 0, 0), style=plot.style_line)

plot(level3Value, "0.618", color=color.rgb(82, 166, 255), style=plot.style_line)

plot(srLevel, "S/R Level", color=color.white)

plotshape(bottom and not na(firstBottom) and na(secondBottom), "Adam Bottom", shape.circle, location.belowbar, color.green)

plotshape(bottom and not na(secondBottom), "Eve Bottom", shape.circle, location.belowbar, color.yellow)

相关推荐