概述

本策略是一个结合了多重技术指标的趋势跟踪交易系统。它融合了移动平均线(EMA)、波动率跟踪(ATR)、成交量趋势(PVT)和动量振荡器(Ninja)等多个维度的市场信号,通过信号协同来提高交易的准确性。策略采用了动态止损机制,在追踪趋势的同时对风险进行了严格控制。

策略原理

策略的核心逻辑建立在四个主要支柱之上: 1. 使用200周期EMA作为主要趋势判断依据,将市场分为多头和空头两种状态 2. 基于ATR的Chandelier Exit系统,通过跟踪最高价和最低价并结合波动率来确定趋势的转折点 3. PVT指标通过将价格变化与成交量相结合,用于确认价格趋势的有效性 4. Ninja振荡器通过比较短期和中期均线来捕捉市场动量的变化

交易信号的产生需要满足以下条件: - 做多:价格站在200EMA之上,且Chandelier Exit出现买入信号,同时PVT或Ninja指标确认 - 做空:价格站在200EMA之下,且Chandelier Exit出现卖出信号,同时PVT或Ninja指标确认

策略优势

- 多指标协同确认,大大降低了假突破的风险

- 结合了趋势、波动率、成交量和动量等多个维度的市场信息

- 采用动态止损机制,能够根据市场波动情况自动调整止损位置

- 系统化的交易规则,减少了主观判断带来的干扰

- 具备良好的风险控制机制,每笔交易都有明确的止损位

策略风险

- 在震荡市场中可能产生频繁的假信号

- 多重确认机制可能导致入场时机略有滞后

- 在市场快速反转时,止损位置可能相对宽松

- 参数优化可能存在过度拟合的风险

- 需要较大的资金缓冲以承受回撤

策略优化方向

- 引入市场环境识别机制,在不同市场状态下使用不同的参数组合

- 增加交易量分析维度,优化仓位管理系统

- 考虑加入基于波动率的动态参数调整机制

- 优化多指标之间的权重分配

- 引入时间过滤器,避开市场波动较大的时段

总结

该策略通过多指标协同和动态止损机制,构建了一个相对完整的交易系统。策略的核心优势在于其多维度的信号确认机制和严格的风险控制。虽然存在一定的滞后性和假信号风险,但通过持续优化和完善,该策略有望在不同市场环境下保持稳定的表现。建议交易者在实盘使用前,进行充分的回测和参数优化。

策略源码

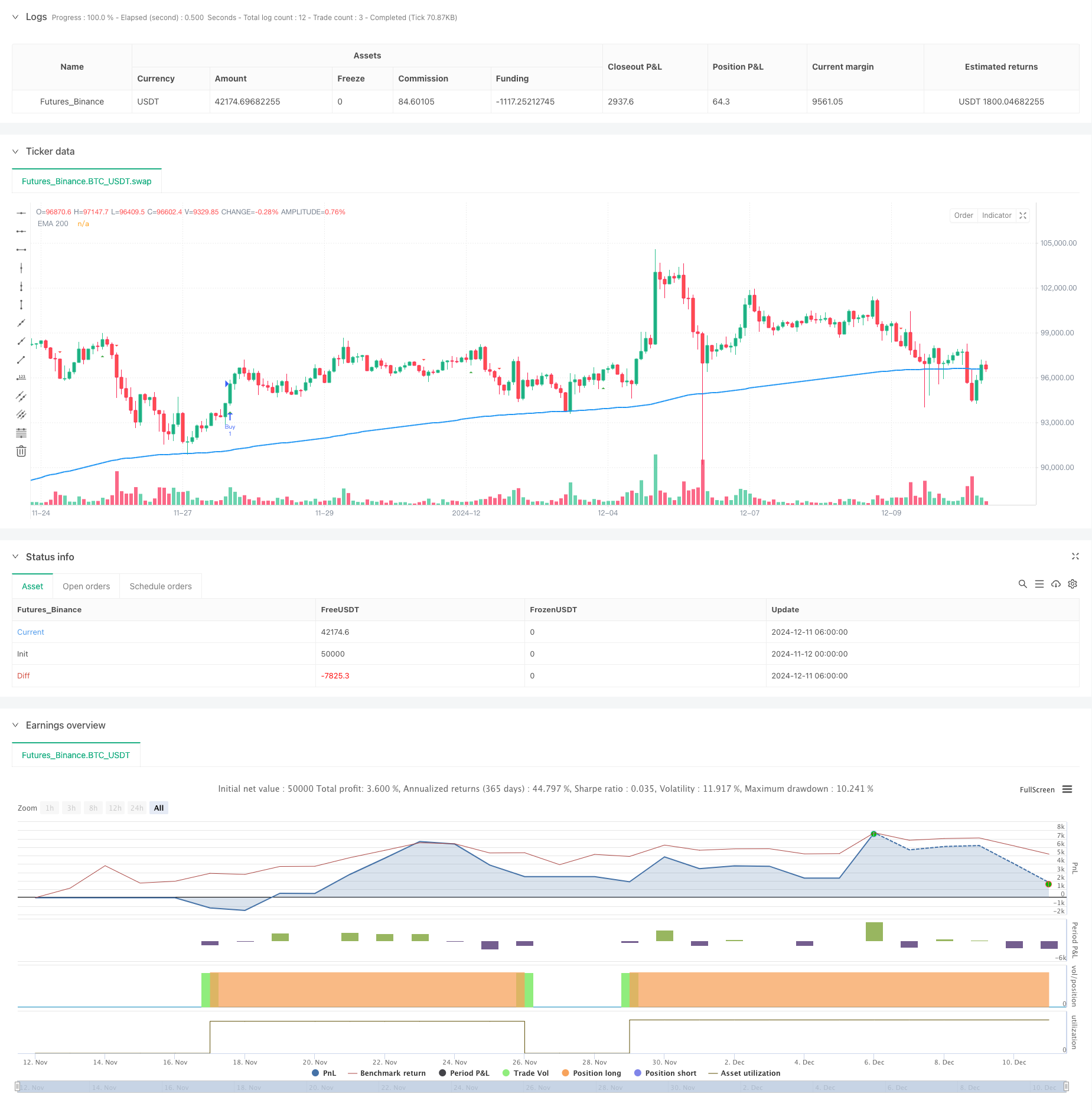

/*backtest

start: 2024-11-12 00:00:00

end: 2024-12-11 08:00:00

period: 2h

basePeriod: 2h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Triple Indicator Strategy", shorttitle="TIS", overlay=true)

// --- Inputs ---

var string calcGroup = "Calculation Parameters"

atrLength = input.int(22, title="ATR Period", group=calcGroup)

atrMult = input.float(3.0, title="ATR Multiplier", step=0.1, group=calcGroup)

emaLength = input.int(200, title="EMA Length", group=calcGroup)

// --- ATR and EMA Calculations ---

atr = atrMult * ta.atr(atrLength)

ema200 = ta.ema(close, emaLength)

// --- Chandelier Exit Logic ---

longStop = ta.highest(high, atrLength) - atr

shortStop = ta.lowest(low, atrLength) + atr

var int dir = 1

dir := close > shortStop ? 1 : close < longStop ? -1 : dir

buySignal = dir == 1 and dir[1] == -1

sellSignal = dir == -1 and dir[1] == 1

// --- Price Volume Trend (PVT) ---

pvt = ta.cum((close - close[1]) / close[1] * volume)

pvtSignal = ta.ema(pvt, 21)

pvtBuy = ta.crossover(pvt, pvtSignal)

pvtSell = ta.crossunder(pvt, pvtSignal)

// --- Ninja Indicator ---

ninjaOsc = (ta.ema(close, 3) - ta.ema(close, 13)) / ta.ema(close, 13) * 100

ninjaSignal = ta.ema(ninjaOsc, 24)

ninjaBuy = ta.crossover(ninjaOsc, ninjaSignal)

ninjaSell = ta.crossunder(ninjaOsc, ninjaSignal)

// --- Strategy Conditions ---

longCondition = buySignal and close > ema200 and (pvtBuy or ninjaBuy)

shortCondition = sellSignal and close < ema200 and (pvtSell or ninjaSell)

if longCondition

strategy.entry("Buy", strategy.long)

strategy.exit("Exit Long", "Buy", stop=low - atr)

if shortCondition

strategy.entry("Sell", strategy.short)

strategy.exit("Exit Short", "Sell", stop=high + atr)

// --- Plotting ---

plot(ema200, title="EMA 200", color=color.blue, linewidth=2)

plotshape(buySignal, title="Chandelier Buy", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(sellSignal, title="Chandelier Sell", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// --- Labels for Buy/Sell with price ---

if buySignal

label.new(bar_index, low, "Buy: " + str.tostring(close), color=color.green, style=label.style_label_up, yloc=yloc.belowbar, size=size.small)

if sellSignal

label.new(bar_index, high, "Sell: " + str.tostring(close), color=color.red, style=label.style_label_down, yloc=yloc.abovebar, size=size.small)

// --- Alerts ---

alertcondition(longCondition, title="Buy Alert", message="Buy Signal Triggered!")

alertcondition(shortCondition, title="Sell Alert", message="Sell Signal Triggered!")

相关推荐