概述

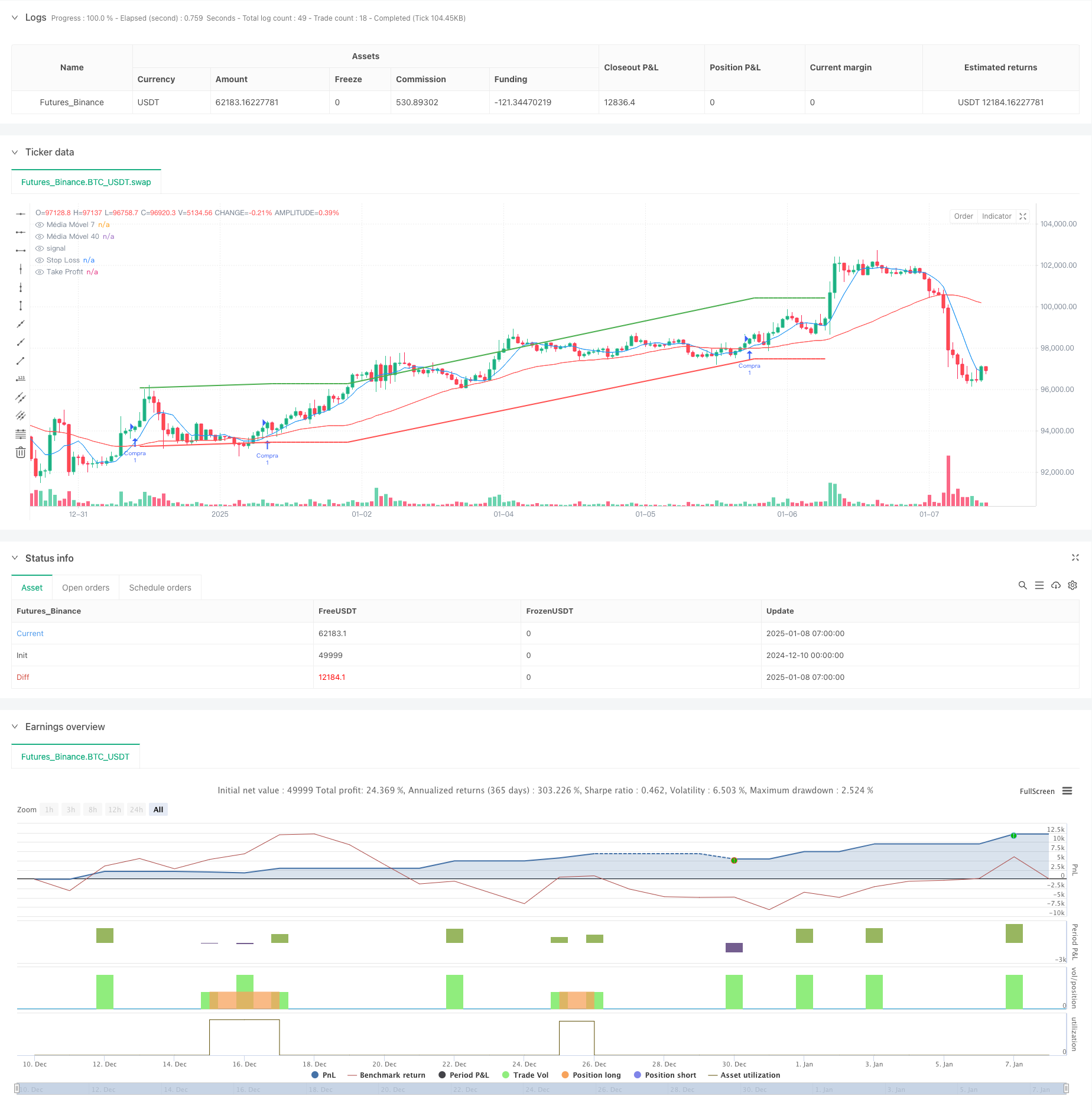

本策略是一个基于均线交叉信号的智能交易系统,结合了动态止盈止损管理机制。策略核心采用7周期和40周期两条简单移动平均线(SMA)的交叉来产生交易信号,同时集成了基于百分比的止盈止损控制系统,实现了对交易风险的精确管理。

策略原理

策略运作基于以下核心机制: 1. 信号生成:通过观察短周期(7日)均线与长周期(40日)均线的交叉情况产生交易信号。当短期均线向上穿越长期均线时产生买入信号,向下穿越时产生卖出信号。 2. 仓位管理:系统采用单一持仓机制,在已有持仓的情况下不会重复开仓,确保资金使用的有效性。 3. 风险控制:集成了基于开仓价格的动态止盈止损系统。止损位设置为开仓价格下方1%,止盈位设置为开仓价格上方2%,实现了对每笔交易风险的量化管理。

策略优势

- 信号可靠性:通过结合快速和慢速均线,能够有效捕捉价格趋势的变化。

- 风险管理完善:引入了动态止盈止损机制,对每笔交易的风险进行精确控制。

- 参数灵活性:所有关键参数均可通过界面进行调整,包括均线周期、止盈止损比例等。

- 可视化效果:在图表上清晰显示均线、止盈止损位置,便于交易者实时监控。

策略风险

- 均线滞后性:移动平均线本质上是滞后指标,在剧烈波动市场中可能产生延迟。

- 震荡市场风险:在横盘震荡市场中可能频繁产生虚假信号。

- 固定止损风险:百分比固定止损可能在某些市场条件下不够灵活。

策略优化方向

- 信号过滤:建议引入趋势过滤器,如ADX指标,用于识别趋势强度。

- 动态止损:可考虑将止损位与市场波动率挂钩,实现更智能的风险管理。

- 仓位管理:引入基于波动率的动态仓位管理系统。

- 市场适应性:增加市场状态识别模块,在不同市场条件下采用不同的参数设置。

总结

该策略通过均线交叉捕捉市场趋势,结合动态止盈止损实现风险管理,具有较强的实用性。虽然存在一定的滞后性风险,但通过建议的优化方向可以进一步提升策略的稳定性和盈利能力。策略的可配置性强,适合进一步完善和个性化调整。

策略源码

/*backtest

start: 2024-12-10 00:00:00

end: 2025-01-08 08:00:00

period: 1h

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("Cruzamento de Médias Móveis (Configuração Interativa)", overlay=true)

// Permite que o usuário defina os períodos das médias móveis na interface

periodo_ma7 = input.int(7, title="Período da Média Móvel 7", minval=1)

periodo_ma40 = input.int(40, title="Período da Média Móvel 40", minval=1)

// Definindo as médias móveis com os períodos configuráveis

ma7 = ta.sma(close, periodo_ma7)

ma40 = ta.sma(close, periodo_ma40)

// Parâmetros de stop loss e take profit

stop_loss_pct = input.float(1, title="Stop Loss (%)", minval=0.1) / 100

take_profit_pct = input.float(2, title="Take Profit (%)", minval=0.1) / 100

// Condições para compra e venda

compra = ta.crossover(ma7, ma40)

venda = ta.crossunder(ma7, ma40)

// Impede novas entradas enquanto já houver uma posição aberta

if (compra and strategy.position_size == 0)

strategy.entry("Compra", strategy.long)

// Cálculo do preço de stop loss e take profit

stop_loss_price = strategy.position_avg_price * (1 - stop_loss_pct)

take_profit_price = strategy.position_avg_price * (1 + take_profit_pct)

// Estratégia de saída com stop loss e take profit

strategy.exit("Saída", from_entry="Compra", stop=stop_loss_price, limit=take_profit_price)

// Sinal de venda (fechamento da posição)

if (venda)

strategy.close("Compra")

// Plotando as médias móveis no gráfico

plot(ma7, color=color.blue, title="Média Móvel 7")

plot(ma40, color=color.red, title="Média Móvel 40")

// Plotando o Stop Loss e Take Profit no gráfico

plot(stop_loss_price, color=color.red, style=plot.style_line, linewidth=2, title="Stop Loss")

plot(take_profit_price, color=color.green, style=plot.style_line, linewidth=2, title="Take Profit")

相关推荐