概述

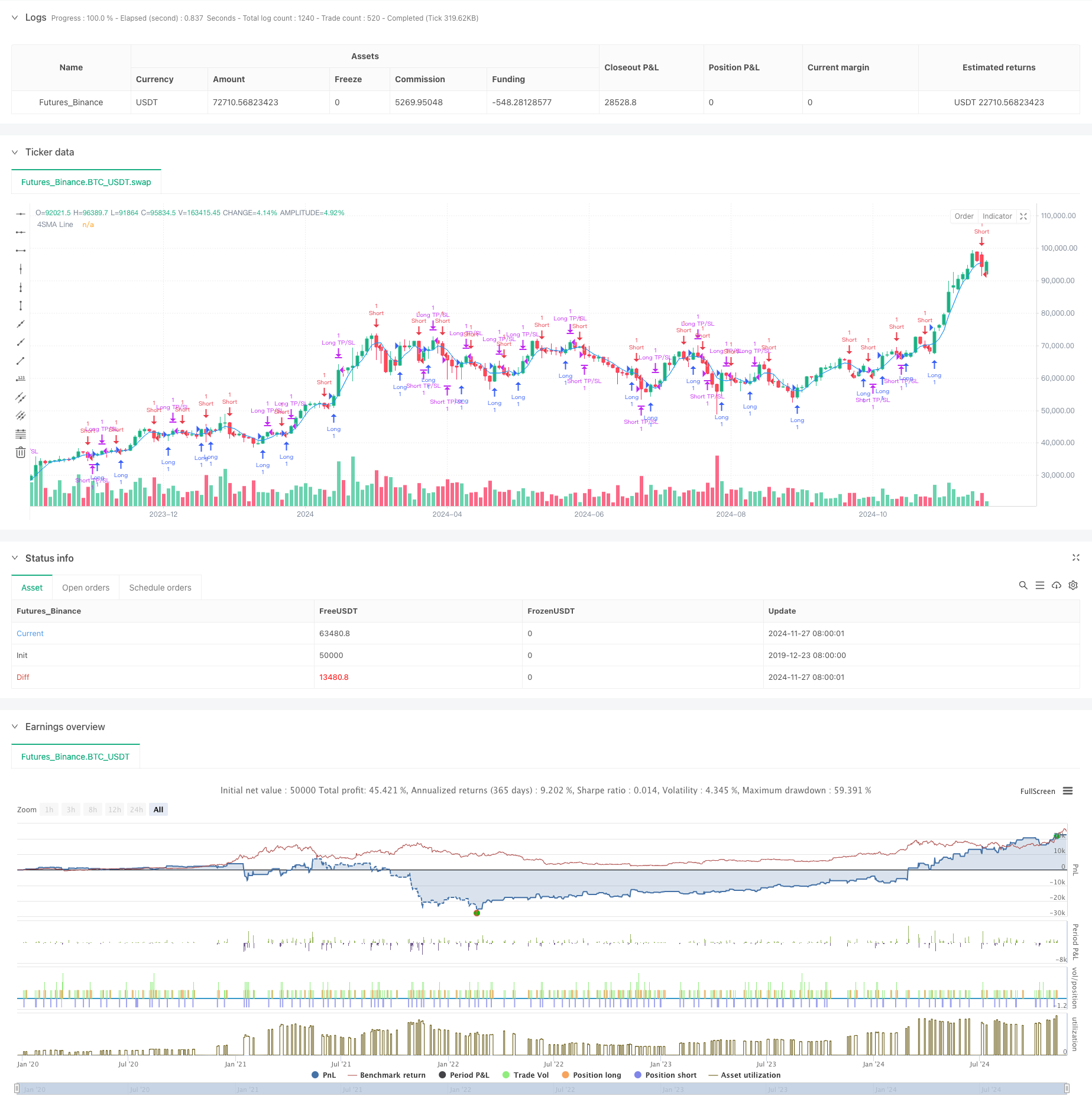

这是一个基于四周期简单移动平均线的交易策略系统,集成了动态止盈止损管理机制。该策略通过监控价格与短期均线的交叉关系来捕捉市场趋势的转折点,并采用百分比方式设置止盈止损以实现风险管理。策略的核心在于利用短周期均线对市场快速反应的特性,结合严格的资金管理规则,以实现稳健的交易效果。

策略原理

策略运行基于以下核心逻辑:首先计算4周期简单移动平均线(SMA)作为主要指标,当价格向上穿越SMA时,系统识别为看多信号并开仓做多;当价格向下穿越SMA时,系统识别为看空信号并开仓做空。每笔交易都设置了基于开仓价格的动态止盈止损点,止盈默认为2%,止损默认为1%。这种设置确保了盈亏比为2:1,符合专业的资金管理原则。

策略优势

- 响应速度快:采用4周期的短期均线,能够快速捕捉市场波动,适合短线交易。

- 风险控制严格:集成了动态止盈止损机制,每笔交易都有明确的退出点。

- 策略逻辑简单:使用经典的均线交叉方式,易于理解和执行。

- 参数可调整性强:止盈止损百分比可根据不同市场特性灵活调整。

- 双向交易:支持多空双向操作,可以充分把握市场机会。

策略风险

- 震荡市场风险:在横盘震荡市场容易产生虚假信号,导致频繁交易。

- 滑点风险:由于使用短周期均线,交易频率较高,可能面临较大滑点损失。

- 系统性风险:在市场剧烈波动时,止损可能无法及时执行。

- 参数敏感性:策略效果对参数设置较为敏感,需要持续优化。

策略优化方向

- 增加趋势过滤器:可以添加长周期均线作为趋势过滤条件,减少震荡市场的假信号。

- 优化止盈止损:可以根据市场波动率动态调整止盈止损比例。

- 加入成交量指标:将成交量作为辅助指标,提高入场信号的可靠性。

- 设置时间过滤:添加交易时间段过滤,避免在不适合交易的时段操作。

总结

这是一个结构完整、逻辑清晰的量化交易策略。它通过短期均线捕捉市场动量,辅以严格的风险控制机制,适合追求稳健收益的交易者。虽然存在一定的优化空间,但策略的基本框架具有良好的扩展性,通过持续优化和调整,有望实现更好的交易效果。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 2d

basePeriod: 2d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("4SMA Strategy with Targets and Stop Loss", overlay=true)

// Input parameters for SMA

smaLength = input.int(4, title="SMA Length", minval=1)

// Input parameters for stop loss and take profit

takeProfitPercent = input.float(2.0, title="Take Profit (%)", step=0.1) // Default: 2%

stopLossPercent = input.float(1.0, title="Stop Loss (%)", step=0.1) // Default: 1%

// Calculate 4-period SMA

sma = ta.sma(close, smaLength)

// Plot SMA

plot(sma, color=color.blue, title="4SMA Line")

// Entry Conditions

longCondition = ta.crossover(close, sma) // Price crosses above SMA (bullish signal)

shortCondition = ta.crossunder(close, sma) // Price crosses below SMA (bearish signal)

// Strategy Logic

if (longCondition)

strategy.entry("Long", strategy.long) // Enter long position

if (shortCondition)

strategy.entry("Short", strategy.short) // Enter short position

// Calculate Take Profit and Stop Loss

longTakeProfit = strategy.position_avg_price * (1 + takeProfitPercent / 100) // TP for long

longStopLoss = strategy.position_avg_price * (1 - stopLossPercent / 100) // SL for long

shortTakeProfit = strategy.position_avg_price * (1 - takeProfitPercent / 100) // TP for short

shortStopLoss = strategy.position_avg_price * (1 + stopLossPercent / 100) // SL for short

// Exit for Long

if (strategy.position_size > 0) // If in a long position

strategy.exit("Long TP/SL", from_entry="Long", limit=longTakeProfit, stop=longStopLoss)

// Exit for Short

if (strategy.position_size < 0) // If in a short position

strategy.exit("Short TP/SL", from_entry="Short", limit=shortTakeProfit, stop=shortStopLoss)

相关推荐