策略概述

该策略是一个结合了多重时间周期分析、公平价值缺口(FVG)和结构突破(BOS)的综合交易系统。它通过在更高时间周期上识别价格结构的突破,同时在较低时间周期上寻找公平价值缺口形成的机会,从而确定潜在的交易入场点。该策略还集成了风险管理系统,包括止损和获利目标的自动设置。

策略原理

策略的核心逻辑建立在三个主要支柱之上:首先,利用更高时间周期(默认1小时或以上)来识别价格结构的突破(BOS),这为交易方向提供了基础框架。其次,在较低时间周期上寻找公平价值缺口(FVG),FVG的形成表明市场在该区域存在潜在的供需不平衡。最后,将这两个条件与当前价格位置相结合,当价格处于有利位置时触发交易信号。系统通过风险收益比和止损因子来管理每笔交易的风险。

策略优势

- 多维度分析:通过结合多个时间周期的分析,提高了交易信号的可靠性。

- 风险管理完善:内置的风险收益比设置和止损控制机制,确保每笔交易都有明确的风险控制。

- 视觉反馈:策略提供了清晰的视觉反馈,包括FVG盒子的显示和潜在交易机会的标记。

- 适应性强:通过参数调整,策略可以适应不同的市场条件和交易风格。

策略风险

- 假突破风险:市场可能出现假突破,导致错误的交易信号。解决方案是增加信号确认机制。

- 信号延迟:由于使用更高时间周期数据,可能存在信号滞后。建议结合其他技术指标进行确认。

- 市场波动风险:在高波动期间,FVG的形成可能不够稳定。可以通过调整FVG的观察长度来适应。

策略优化方向

- 信号过滤:可以添加成交量确认机制,只有在成交量支持的情况下才确认信号。

- 动态参数:可以根据市场波动率动态调整风险收益比和止损因子。

- 趋势过滤:增加趋势判断指标,只在趋势方向上开仓。

- 时间过滤:添加交易时间段过滤,避免在不利的市场时段交易。

总结

该策略通过综合运用多时间周期分析、价格结构突破和公平价值缺口,构建了一个完整的交易系统。其优势在于多维度的分析方法和完善的风险管理机制,但仍需要交易者根据实际市场情况进行适当的参数优化和风险控制。后续优化可以从信号确认、动态参数调整和市场环境过滤等方面入手,进一步提高策略的稳定性和可靠性。

策略源码

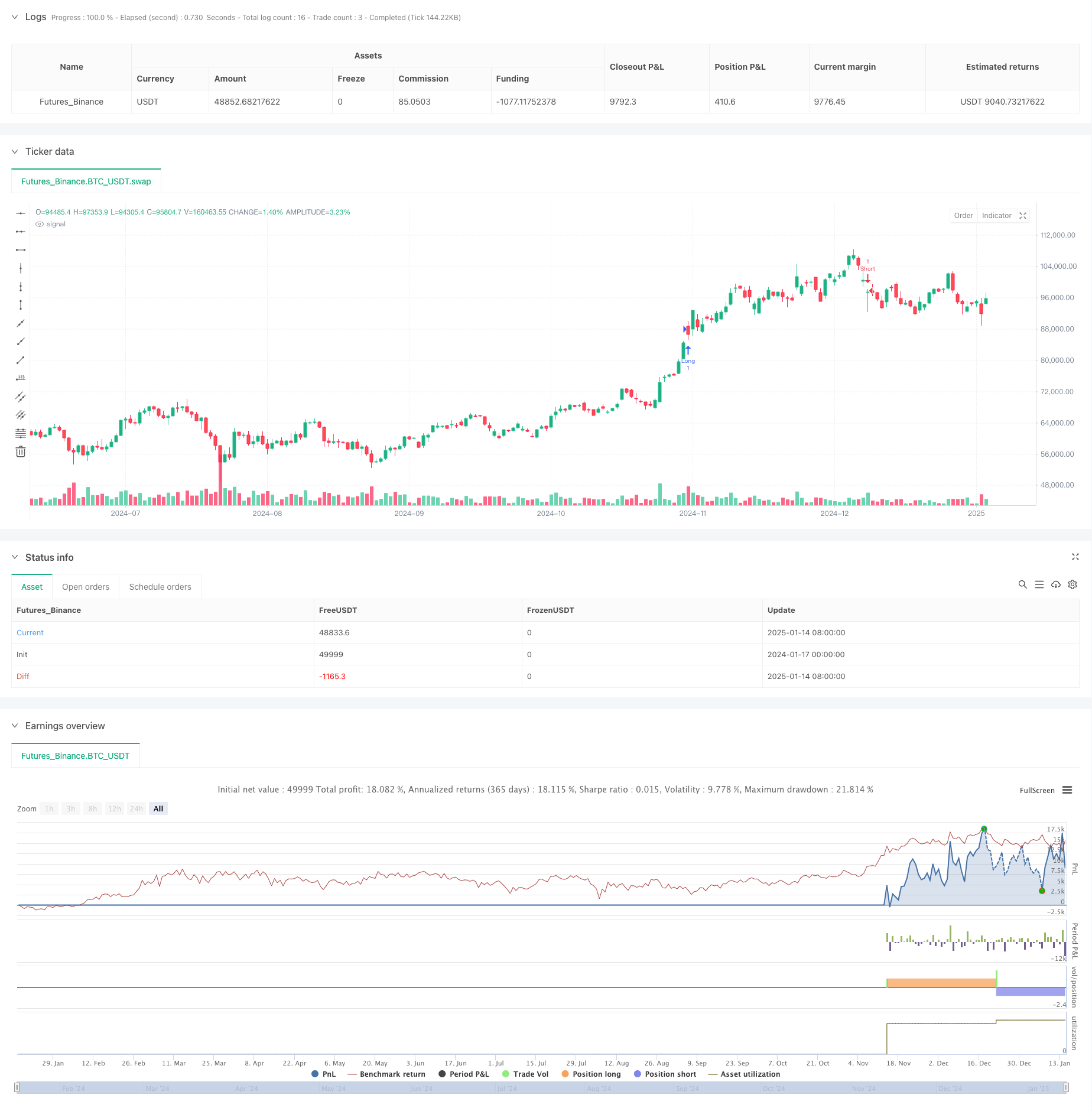

/*backtest

start: 2024-01-17 00:00:00

end: 2025-01-15 08:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT","balance":49999}]

*/

//@version=5

strategy("ICT Strategy with Historical Backtest", overlay=true)

// === Настройки ===

tf = input.timeframe("60", title="Higher Timeframe (1H or above)") // Таймфрейм для анализа BOS

fvg_length = input(3, title="FVG Lookback Length") // Длина для поиска FVG

risk_reward = input(2, title="Risk-Reward Ratio") // Риск-вознаграждение

show_fvg_boxes = input(true, title="Show FVG Boxes") // Показывать FVG

stop_loss_factor = input.float(1.0, title="Stop Loss Factor") // Множитель для стоп-лосса

// === Переменные для анализа ===

var float bos_high = na

var float bos_low = na

// Получаем данные с более старшего таймфрейма

htf_high = request.security(syminfo.tickerid, tf, high)

htf_low = request.security(syminfo.tickerid, tf, low)

htf_close = request.security(syminfo.tickerid, tf, close)

// Определение BOS (Break of Structure) на старшем таймфрейме

bos_up = ta.highest(htf_high, fvg_length) > ta.highest(htf_high[1], fvg_length)

bos_down = ta.lowest(htf_low, fvg_length) < ta.lowest(htf_low[1], fvg_length)

// Обновляем уровни BOS

if (bos_up)

bos_high := ta.highest(htf_high, fvg_length)

if (bos_down)

bos_low := ta.lowest(htf_low, fvg_length)

// === Определение FVG (Fair Value Gap) ===

fvg_up = low > high[1] and low[1] > high[2]

fvg_down = high < low[1] and high[1] < low[2]

// Визуализация FVG (Fair Value Gap)

// if (show_fvg_boxes)

// if (fvg_up)

// box.new(left=bar_index[1], top=high[1], right=bar_index, bottom=low, bgcolor=color.new(color.green, 90), border_color=color.green)

// if (fvg_down)

// box.new(left=bar_index[1], top=high, right=bar_index, bottom=low[1], bgcolor=color.new(color.red, 90), border_color=color.red)

// === Логика сделок ===

// Условия для входа в Лонг

long_condition = bos_up and fvg_up and close < bos_high

if (long_condition)

strategy.entry("Long", strategy.long, stop=low * stop_loss_factor, limit=low + (high - low) * risk_reward)

// Условия для входа в Шорт

short_condition = bos_down and fvg_down and close > bos_low

if (short_condition)

strategy.entry("Short", strategy.short, stop=high * stop_loss_factor, limit=high - (high - low) * risk_reward)

// === Надписи для прогнозируемых сделок ===

if (long_condition)

label.new(bar_index, low, text="Potential Long", color=color.green, style=label.style_label_up, textcolor=color.white, size=size.small)

if (short_condition)

label.new(bar_index, high, text="Potential Short", color=color.red, style=label.style_label_down, textcolor=color.white, size=size.small)

相关推荐