概述

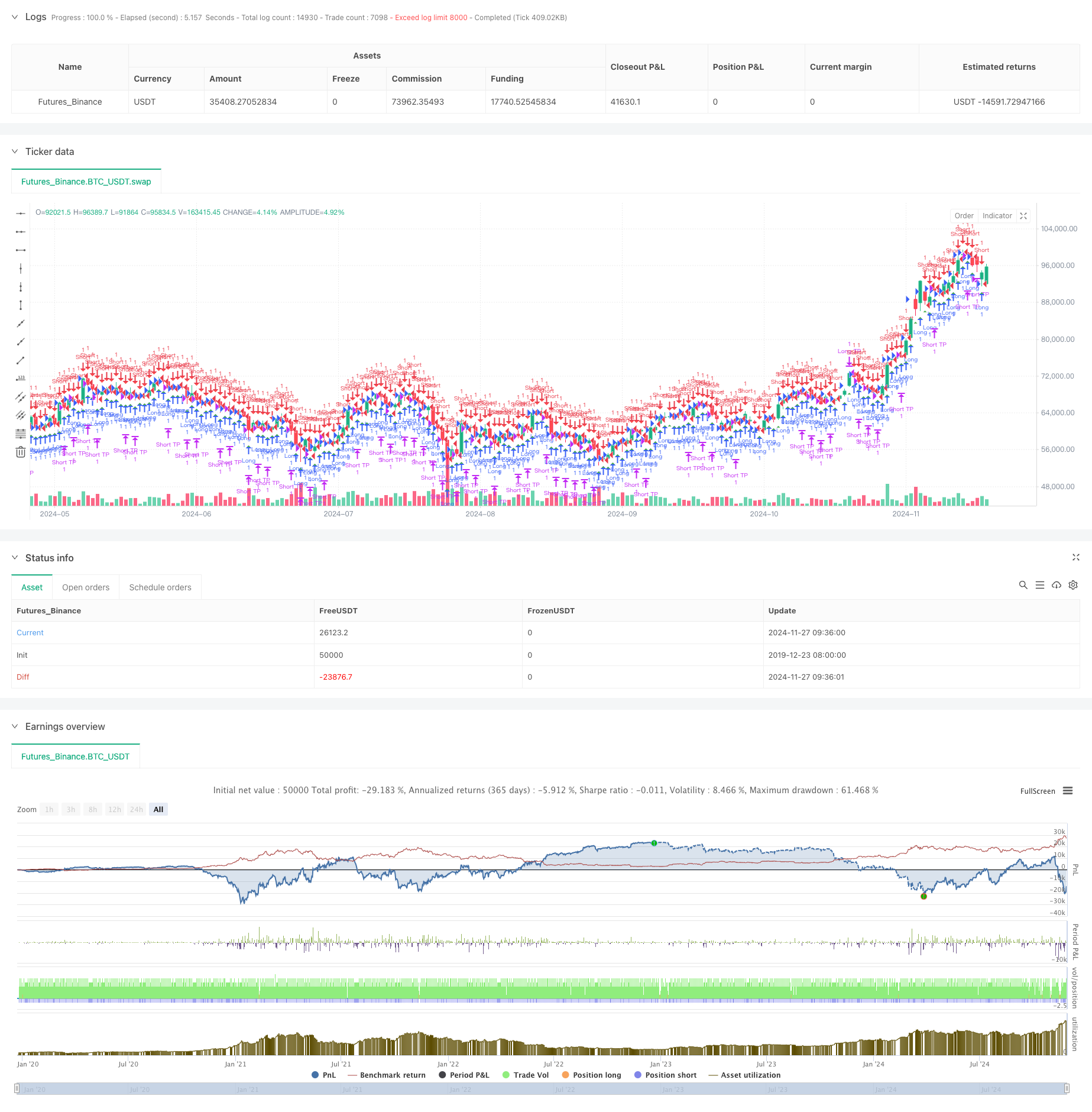

这是一个基于公允价值缺口(FVG)的交易策略,结合了动态风险管理和固定获利目标。该策略在15分钟时间周期上运行,通过识别市场中的价格缺口来捕捉潜在的交易机会。根据回测数据显示,在2023年11月至2024年8月期间,该策略实现了284.40%的净收益率,总计完成153笔交易,其中盈利率达到71.24%,获利因子为2.422。

策略原理

策略的核心是通过监测连续三根K线之间的价格关系来识别公允价值缺口。具体来说: 1. 多头FVG形成条件:当前一根K线的最高价低于前两根K线的最低价 2. 空头FVG形成条件:当前一根K线的最低价高于前两根K线的最高价 3. 入场信号由FVG阈值参数控制,只有当缺口大小超过价格一定百分比时才触发 4. 风险控制采用账户权益的固定比例(1%)作为止损标准 5. 获利目标采用固定点数(50点)设置

策略优势

- 风险管理科学合理:采用账户权益比例止损,可以实现动态风险控制

- 交易规则明确:使用固定的获利目标,避免主观判断

- 性能表现优异:较高的盈利率和获利因子表明策略具有良好的稳定性

- 实现方式简单:代码逻辑清晰,易于理解和维护

- 适应性强:可以通过参数调整适应不同的市场环境

策略风险

- 市场波动风险:在高波动市场中,固定点数的获利目标可能不够灵活

- 滑点风险:频繁交易可能导致较高的滑点成本

- 参数依赖:策略表现强烈依赖于FVG阈值的设置

- 假突破风险:部分FVG信号可能是假突破,需要额外的确认指标

- 资金管理风险:固定比例止损在连续亏损时可能导致资金快速缩水

策略优化方向

- 引入市场波动率指标,动态调整获利目标

- 增加趋势过滤器,避免在横盘市场中交易

- 开发多重时间周期确认机制

- 优化仓位管理算法,引入浮动仓位系统

- 增加交易时间过滤,避开高波动时段

- 开发信号强度评分系统,筛选高质量交易机会

总结

该策略通过结合公允价值缺口理论和科学的风险管理方法,展现出了良好的交易效果。策略的高盈利率和稳定的获利因子表明其具有实战价值。通过建议的优化方向,策略还有进一步提升空间。建议交易者在实盘使用前进行充分的参数优化和回测验证。

策略源码

/*backtest

start: 2019-12-23 08:00:00

end: 2024-11-28 00:00:00

period: 1d

basePeriod: 1d

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Fair Value Gap Strategy with % SL and Fixed TP", overlay=true, initial_capital=500, default_qty_type=strategy.fixed, default_qty_value=1)

// Parameters

fvgThreshold = input.float(0.5, "FVG Threshold (%)", minval=0.1, step=0.1)

// Fixed take profit in pips

takeProfitPips = 50

// Function to convert pips to price

pipsToPriceChange(pips) =>

syminfo.mintick * pips * 10

// Function to detect Fair Value Gap

detectFVG(dir) =>

gap = 0.0

if dir > 0 // Bullish FVG

gap := low[2] - high[1]

else // Bearish FVG

gap := low[1] - high[2]

math.abs(gap) > (close * fvgThreshold / 100)

// Detect FVGs

bullishFVG = detectFVG(1)

bearishFVG = detectFVG(-1)

// Entry conditions

longCondition = bullishFVG

shortCondition = bearishFVG

// Calculate take profit level

longTakeProfit = strategy.position_avg_price + pipsToPriceChange(takeProfitPips)

shortTakeProfit = strategy.position_avg_price - pipsToPriceChange(takeProfitPips)

// Calculate stop loss amount (5% of capital)

stopLossAmount = strategy.equity * 0.01

// Execute trades

if (longCondition)

strategy.entry("Long", strategy.long)

if (shortCondition)

strategy.entry("Short", strategy.short)

// Set exit conditions

if (strategy.position_size > 0)

strategy.exit("Long TP", "Long", limit=longTakeProfit)

strategy.close("Long SL", when=strategy.openprofit < -stopLossAmount)

else if (strategy.position_size < 0)

strategy.exit("Short TP", "Short", limit=shortTakeProfit)

strategy.close("Short SL", when=strategy.openprofit < -stopLossAmount)

// Plot signals

plotshape(longCondition, "Buy Signal", location = location.belowbar, color = color.green, style = shape.triangleup, size = size.small)

plotshape(shortCondition, "Sell Signal", location = location.abovebar, color = color.red, style = shape.triangledown, size = size.small)

相关推荐