Strategie für einen doppelten gleitenden Durchschnitts-Brechpunkt von Kryptowährungs-Futures (Teaching)

Schriftsteller:- Ich bin ein Idiot., Erstellt: 2022-04-08 11:46:22, Aktualisiert: 2022-04-08 11:58:28Strategie für einen doppelten gleitenden Durchschnitts-Brechpunkt von Kryptowährungs-Futures (Teaching)

Dieser Artikel erklärt die Gestaltung einer einfachen Trendstrategie, nur aus der Ebene der Strategieentwicklung, um Anfängern zu helfen zu lernen, wie man eine einfache Strategie entwirft und den Ausführungsprozess des Strategieprogramms versteht.

Strategieentwurf

Bei der Verwendung der beiden EMA-Indikatoren und der beiden gleitenden Durchschnittswerte gibt es einen Bruchpunkt, wobei die Bruchpunkte als Signal zur Eröffnung von Long- und Short-Positionen (oder Umkehrung) verwendet werden, um eine feste Zielgewinnspanne für Schließpositionen zu erstellen.

Strategie-Code

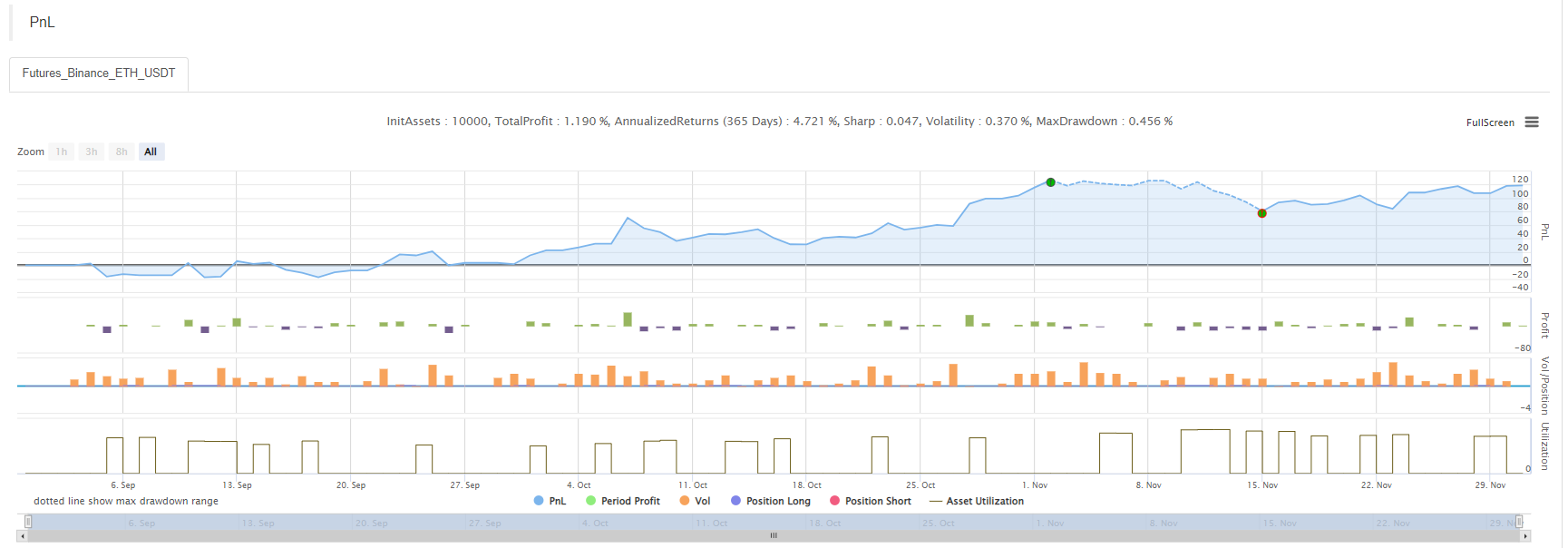

/*backtest

start: 2021-09-01 00:00:00

end: 2021-12-02 00:00:00

period: 1h

basePeriod: 5m

exchanges: [{"eid":"Futures_Binance","currency":"ETH_USDT"}]

*/

// above /**/ inside these are the default backtest settings; the backtest page can be reset by the related controls on the backtest page

var LONG = 1 // mark of holding long positions; enum constant

var SHORT = -1 // mark of holding short positions; enum constant

var IDLE = 0 // mark of not holding no position; enum constant

// obtain the positions with a specified direction; positions indicates position data; direction indicates the direction of the positions to be obtained

function getPosition(positions, direction) {

var ret = {Price : 0, Amount : 0, Type : ""} // define a structure when holding no position

// traverse positions, among which find the positions conforming to the direction

if (pos.Type == direction) {

ret = pos

}

})

// return the positions found

return ret

}

// cancel all pending orders of the current trading pair and contract

function cancellAll() {

// infinite loop, detect without stop, until break is triggered

while (true) {

// obtain the pending orders data of the current trading pair and contract, namely orders

var orders = _C(exchange.GetOrders)

if (orders.length == 0) {

// when orders is a null array, namely orders.length == 0, execute "break" statement to break the while loop

break

} else {

// traverse all the current pending orders, and cancel them one by one

for (var i = 0 ; i < orders.length ; i++) {

// the function to cancel a specified order, canceling the order with an ID of:orders[i].Id

exchange.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// function of closing position, which executes close position, according to the passed tradeFunc and direction

function cover(tradeFunc, direction) {

var mapDirection = {"closebuy": PD_LONG, "closesell": PD_SHORT}

var positions = _C(exchange.GetPosition) // obtain the position data of the current trading pair and contract

var pos = getPosition(positions, mapDirection[direction]) // find the position information of the specified close position direction

// when position volume is over 0 (only when there is a position, you can operate close position)

if (pos.Amount > 0) {

// cancel all possibly existing pending orders

cancellAll()

// set trading direction

exchange.SetDirection(direction)

// execute close position tradefunc

if (tradeFunc(-1, pos.Amount)) {

// if ordering successfully, return true

return true

} else {

// if the ordering fails, return false

return false

}

}

// no position returns true

return true

}

// strategy main function

function main() {

// used to switch to OKEX V5 simulated bot

if (okexSimulate) {

exchange.IO("simulate", true) // switch to OKEX V5 simulated bot to test

Log("switch to OKEX V5 simulated bot")

}

// set contract code; set ct to swap, namely set the current operated contract to a perpetual contract

exchange.SetContractType(ct)

// the initial status is no position

var state = IDLE

// the initial position price is 0

var holdPrice = 0

// innitialize the timestamp for comparison, to compare whether the current K-line BAR changes

var preTime = 0

// strategy main loop

while (true) {

// obtain the K-line data of the current trading pair and contract

var r = _C(exchange.GetRecords)

// obtain the K-line length, namely 1

var l = r.length

// judge the K-line length of 1, which has to be longer than the indicator period (if the length is less than the indicator period, the indicator function cannot calculate the effective indicatorr data); if not, the loop will be restarted

if (l < Math.max(ema1Period, ema2Period)) {

// wait 1000 miliseconds, namely 1 second, to avoid rotating too fast

Sleep(1000)

// ignore the code after "if" at the moment, and restart the while loop

continue

}

// calculate EMA indicator data

var ema1 = TA.EMA(r, ema1Period)

var ema2 = TA.EMA(r, ema2Period)

// plot

$.PlotRecords(r, 'K-line') // draw K-line chart

// when the timestamp of the last BAR changes, namely when the new K-line BAR is generated

if(preTime !== r[l - 1].Time){

// before the new K-line BAR is generated, it is the last update of the last BAR

$.PlotLine('ema1', ema1[l - 2], r[l - 2].Time)

$.PlotLine('ema2', ema2[l - 2], r[l - 2].Time)

// draw the EMA lines of the new BAR, namely the EMA indicator data on the current last BAR

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

// update the timestamp for comparison

preTime = r[l - 1].Time

} else {

// at the moment when there is no new BAR generated, just update the EMA indicator data of the last BAR in the chart

$.PlotLine('ema1', ema1[l - 1], r[l - 1].Time)

$.PlotLine('ema2', ema2[l - 1], r[l - 1].Time)

}

// condition of open long position, breakpoint

var up = (ema1[l - 2] > ema1[l - 3] && ema1[l - 4] > ema1[l - 3]) && (ema2[l - 2] > ema2[l - 3] && ema2[l - 4] > ema2[l - 3])

// condition of open short position, breakpoint

var down = (ema1[l - 2] < ema1[l - 3] && ema1[l - 4] < ema1[l - 3]) && (ema2[l - 2] < ema2[l - 3] && ema2[l - 4] < ema2[l - 3])

// when the condition of open long position is triggered and currently short positions are held, or when the condition of open long position is triggered but there is no position

if (up && (state == SHORT || state == IDLE)) {

// if holding short, close first

if (state == SHORT && cover(exchange.Buy, "closesell")) {

// after close positions, mark the status of no position

state = IDLE

// reset the position price to 0

holdPrice = 0

// mark on the chart

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// after close positions, reverse to open long

exchange.SetDirection("buy")

if (exchange.Buy(-1, amount)) {

// mark the current status

state = LONG

// record the current price

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openLong', 'L')

}

} else if (down && (state == LONG || state == IDLE)) {

// similar to the judge of up condition

if (state == LONG && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

}

exchange.SetDirection("sell")

if (exchange.Sell(-1, amount)) {

state = SHORT

holdPrice = r[l - 1].Close

$.PlotFlag(r[l - 1].Time, 'openShort', 'S')

}

}

// stop profit

if (state == LONG && r[l - 1].Close - holdPrice > profitTarget && cover(exchange.Sell, "closebuy")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverLong', 'CL')

} else if (state == SHORT && holdPrice - r[l - 1].Close > profitTarget && cover(exchange.Buy, "closesell")) {

state = IDLE

holdPrice = 0

$.PlotFlag(r[l - 1].Time, 'coverShort', 'CS')

}

// display the time on the status bar

LogStatus(_D())

Sleep(500)

}

}

Strategie-Quellcode:https://www.fmz.com/strategy/333269

Die Strategie ist nur ein Lehrplan für das Programmdesign, also benutzen Sie sie bitte nicht in einem Bot.

Mehr

- Realisieren Sie einen einfachen Auftragsüberwachungsbot von Cryptocurrency Spot

- Eine Plattform, die auf FMZ basiert.

- Kryptowährungs-Kontrakt einfacher Auftragsüberwachungsbot

- Wenn Sie mit getdepth die entsprechende Zeitschrift erhalten möchten

- Ignoriert, gelöst

- Die Frage nach dem Gesichtswert

- dYdX-Strategie-Entwurfsbeispiel

- Erste Erforschung der Anwendung von Python Crawler auf FMZ

Crawling Binance Ankündigungsinhalt - Hedge-Strategie-Design-Forschung & Beispiel für offene Spot- und Futures-Orders

- Aktuelle Situation und empfohlene Anwendung der Finanzierungsrate-Strategie

- Strategie für einen doppelten gleitenden Durchschnitt mit mehreren Symbolen (Teaching)

- Realisierung von Fisher Indicator in JavaScript und Plotting auf FMZ

- Treuhänder

- 2021 Kryptowährungs-TAQ-Überprüfung & Einfachste verpasste Strategie der 10-fachen Erhöhung

- Kryptowährungs-Futures Multi-Symbol ART-Strategie (Lehre)

- Aktualisieren! Kryptowährungs Futures Martingale Strategie

- Die Getrecords-Funktion kann keine K-Stringkarte in Sekunden erhalten

- Konstruktion eines FMZ-basierten Auftragsmanagementsystems (2)

- Die Volumen-Daten, die Getticker zurückgegeben hat, sind falsch.

- Gestaltung eines FMZ-basierten Auftragssynchronmanagementsystems (1)