Multi-Time-Frame-Handelsstrategie basierend auf RSI und gleitenden Durchschnitten

Überblick

Die Kernidee dieser Strategie ist es, einen Trendwendepunkt zu identifizieren, der gleichzeitig einen relativ starken Index (RSI) und einen beweglichen Durchschnitt für verschiedene Zeiträume verwendet, um einen mittleren und langen Trend zu erfassen und gleichzeitig einen kurzen Trend zu erzielen. Die Strategie kombiniert mehrere Handelssignale und zielt darauf ab, die Erfolgsrate des Handels zu erhöhen.

Strategieprinzip

- Berechnen Sie den RSI-Indikator sowie den Fastline-EMA und den Slowline-WMA Moving Average.

- Wenn die RSI-Indikatorlinie den WMA-Moving Average durchbricht, wird ein Kauf-/Verkaufssignal erzeugt.

- Wenn die schnelle EMA-Linie die langsame WMA-Linie durchbricht, wird ein Kauf-/Verkaufssignal erzeugt.

- Wenn der RSI und die EMA gleichzeitig die WMA durchbrechen, erzeugt dies ein starkes Kauf-/Verkaufssignal.

- Der Hauptsignal kann auch verstärkt werden, wenn der Preis den unterstützten Moving Average durchbricht.

- Setzen Sie die Stop-Loss-Bedingungen.

Die Strategie kombiniert die Durchbruchsignale verschiedener Technikindikatoren mit den beweglichen Durchschnitten, die mit verschiedenen Parametern eingestellt sind, um Trends in verschiedenen Zeitabschnitten zu erkennen, wodurch die Zuverlässigkeit der Strategie verbessert wird. Der RSI-Indikator beurteilt den Überkauf, die EMA-Schnelllinie beurteilt den kurzfristigen Trend, die WMA-Langlinie beurteilt den mittleren Trend, die Preise und die Durchbruchbestätigung der Hilfsmittel. Die Kombination verschiedener Signale verbessert die Strategie.

Analyse der Stärken

- Der RSI-Indikator ist ein Trend, der sich im Überkauf-Überverkauf-Bereich widerspiegelt.

- Hilfsbewegter Durchschnitt als Trendfilter, um falsche Durchbrüche zu vermeiden.

- Die Kombination von mehreren Zeiträumen ermöglicht es, sowohl langfristige Trends zu verfolgen als auch kurzfristige Chancen zu erfassen.

- Die Integration von mehreren Indikatoren signalisiert eine höhere Erfolgsrate.

- Setzen Sie eine Stop-Loss-Strategie ein, um Risiken aktiv zu kontrollieren.

Risikoanalyse

- Der RSI ist anfällig für falsche Signale und benötigt eine zusätzliche Filterung der Moving Averages.

- Ein Rückschlag im Rahmen eines grossen zyklischen Trends kann ein umgekehrtes Handelssignal auslösen und muss mit Vorsicht behandelt werden.

- Optimierte Parameter-Einstellungen wie die Länge der RSI-Zyklen und die Perioden der Moving Averages.

- Die Einstellung des Stopp-Loss-Punktes ist vorsichtig und vermeidet, dass sie eingeschlossen wird.

Risiken können durch Parameteroptimierung, strenge Stop-Loss-Strategie und Berücksichtigung von Big Cycle Trends verringert werden.

Optimierungsrichtung

- Optimieren Sie die RSI-Parameter und finden Sie die optimale Zeitspanne.

- Verschiedene Arten von Moving-Average-Kombinationen werden getestet.

- Hinzugefügt werden Volatilitätsindikatoren wie ATR, dynamische Anpassung der Stop-Loss-Stufen.

- Das Modul zur Verwaltung des Transaktionsvolumens wurde hinzugefügt.

- Parameteroptimierung und Bewertung der Signalqualität mit Hilfe von Machine Learning.

Zusammenfassen

Die Strategie integriert Trend-Tracking und Polar-Reversal-Trading-Konzepte, kombiniert mit mehreren Zeitfenstern und einer Vielzahl von Indikatoren, um die Erfolgsrate zu erhöhen. Der Schlüssel ist, das Risiko zu kontrollieren, die Parameter-Einstellungen zu optimieren und die Auswirkungen von Big Cycle-Trends auf den Handel zu berücksichtigen.

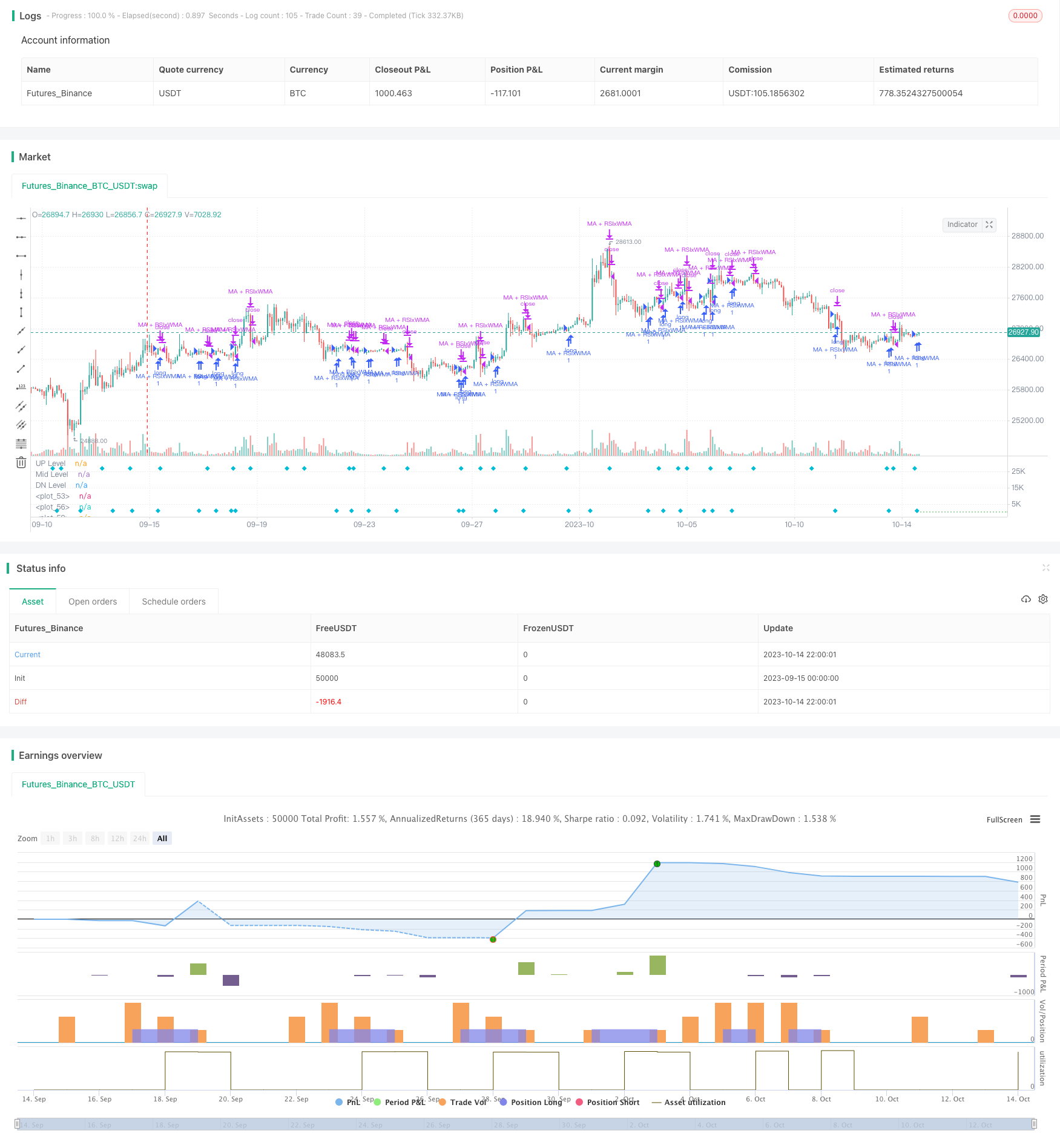

/*backtest

start: 2023-09-15 00:00:00

end: 2023-10-15 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HamidBox

//@version=4

// strategy("H-M By HamidBox-YT", default_qty_type=strategy.cash, default_qty_value= 100, initial_capital=100, currency='USD', commission_type=strategy.commission.percent, commission_value=0.1)

ma(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

WMA(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

WithMA(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

rsi_inline = input(true , title="RSI Value)", inline="rsi")

rsiLength = input(title="Length:", type=input.integer, defval=9, minval=1, inline="rsi")

rsiLineM = input(title="Level:", type=input.integer, defval=50, minval=1, inline="rsi")

rsi_OSOBinline = input(true , title="RSI)", inline="rsiosob")

rsiLineU = input(title="O-BOUGHT", type=input.integer, defval=70, minval=1, inline="rsiosob")

rsiLineD = input(title="O-SOLD", type=input.integer, defval=30, minval=1, inline="rsiosob")

ma_inline = input(true , title="Price-MA)", inline="ma")

ma_type = input(title="Type", defval="EMA", options=["EMA","SMA","WMA","VWMA"], inline="ma")

emaLength = input(title="Length", type=input.integer, defval=3, inline="ma")

wma_inline = input(true , title="Trending-MA)", inline="wma")

ma_type2 = input(title="", defval="WMA", options=["EMA","SMA","WMA","VWMA"], inline="wma")

wmaLength = input(title="Length", type=input.integer, defval=21, inline="wma")

////////////////////////////////////////////////////////////////////////////////

startTime = input(title="Start Time", type = input.time, defval = timestamp("01 Jan 2021 00:00 +0000"), group="Backtest Time Period")

endTime = input(title="End Time", type = input.time, defval = timestamp("01 Jan 2200 00:00 +0000"), group="Backtest Time Period")

inDateRange = true

////////////////////////////////////////////////////////////////////////////////

rsi = rsi(close , rsiLength)

r = plot(rsi_inline ? rsi : na, color=color.yellow, linewidth=2)

EMA = ma(rsi, emaLength, ma_type)

e = plot(ma_inline ? EMA : na, color=color.lime)

myWMA = ma(rsi, wmaLength, ma_type2)

w = plot(wma_inline ? myWMA : na, color=color.white, linewidth=2)

up = hline(rsiLineU, title='UP Level', linewidth=1, color=color.red, linestyle=hline.style_dotted)

mid = hline(rsiLineM, title='Mid Level', linewidth=2, color=color.white, linestyle=hline.style_dotted)

dn = hline(rsiLineD, title='DN Level', linewidth=1, color=color.green, linestyle=hline.style_dotted)

col_e_w = EMA > myWMA ? color.new(color.green , 85) : color.new(color.red , 85)

col_r_w = rsi > myWMA ? color.new(color.green , 85) : color.new(color.red , 85)

fill(e , w, color=col_e_w)

fill(r , w, color=col_r_w)

////////////////////////////////////////////////////////////////////////////////

//Signals = input(true,group="👇 🚦 --- Backtesting Signals Type --- 🚦 ")

///////////////////////////////////////////////////////////////////////////////

RSI_Cross = input(false, "RSI x Trending-MA", inline="wma_cross",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsiBuySignal = crossover(rsi , myWMA)

plotshape(RSI_Cross ? rsiBuySignal : na, title="RSI Crossover", style=shape.labelup, location=location.bottom, color=color.green)

rsiSellSignal = crossunder(rsi , myWMA)

plotshape(RSI_Cross ? rsiSellSignal : na, title="RSI Crossunder", style=shape.labeldown, location=location.top, color=color.red)

if rsiBuySignal and RSI_Cross and inDateRange

strategy.entry("RSIxWMA", strategy.long)

if rsiSellSignal and RSI_Cross and inDateRange

strategy.close("RSIxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

MA_Cross = input(false, "MA x Trendin-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

maBuySignal = crossover(EMA, myWMA)

plotshape(MA_Cross ? maBuySignal : na, title="MA Cross", style=shape.circle, location=location.bottom, color=color.lime)

maSellSignal = crossunder(EMA , myWMA)

plotshape(MA_Cross ? maSellSignal : na, title="RSI Crossunder", style=shape.circle, location=location.top, color=color.maroon)

if maBuySignal and MA_Cross and inDateRange

strategy.entry("MAxWMA", strategy.long)

if maSellSignal and MA_Cross and inDateRange

strategy.close("MAxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

Mix = input(false, "RSI + EMA x Trending-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_ma_buy = crossover(rsi , myWMA) and crossover(EMA, myWMA)

rsi_ma_sell = crossunder(rsi , myWMA) and crossunder(EMA, myWMA)

plotshape(Mix ? rsi_ma_buy : na, title="RSI Crossunder", style=shape.circle, location=location.bottom, color=color.lime, size=size.tiny)

plotshape(Mix ? rsi_ma_sell : na, title="RSI Crossunder", style=shape.circle, location=location.top, color=color.yellow, size=size.tiny)

if rsi_ma_buy and Mix and inDateRange

strategy.entry("RSI+EMA x WMA", strategy.long)

if rsi_ma_sell and Mix and inDateRange

strategy.close("RSI+EMA x WMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

wma_cross = input(false, "Trending-MA x 50",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

wma_buy = crossover(myWMA , rsiLineM)

plotshape(wma_cross ? wma_buy : na, title="WMA Cross", style=shape.diamond, location=location.bottom, color=color.aqua)

wma_sell = crossunder(myWMA , rsiLineM)

plotshape(wma_cross ? wma_sell : na, title="WMA Cross", style=shape.diamond, location=location.top, color=color.aqua)

if wma_buy and wma_cross and inDateRange

strategy.entry("WMA x 50", strategy.long)

if wma_sell and wma_cross and inDateRange

strategy.close("WMA x 50", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

rsi_50 = input(false, "RSI x 50",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_50_buy = crossover(rsi , rsiLineM)

plotshape(rsi_50 ? rsi_50_buy : na, title="WMA Cross", style=shape.cross, location=location.bottom, color=color.purple)

rsi_50_sell = crossunder(rsi , rsiLineM)

plotshape(rsi_50 ? rsi_50_sell : na, title="WMA Cross", style=shape.cross, location=location.top, color=color.purple)

if rsi_50_buy and rsi_50 and inDateRange

strategy.entry("RSI Cross 50", strategy.long)

if rsi_50_sell and rsi_50 and inDateRange

strategy.close("RSI Cross 50", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

RSI_OS_OB = input(false, "RSI OS/OB x Trending-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_OB_buy = (rsi < rsiLineD or rsi[1] < rsiLineD[1] or rsi[2] < rsiLineD[2] or rsi[3] < rsiLineD[3] or rsi[4] < rsiLineD[4] or rsi[5] < rsiLineD[5]) and rsiBuySignal

plotshape(RSI_OS_OB ? rsi_OB_buy : na, title="RSI OB + Cross", style=shape.circle, location=location.bottom, color=color.lime, size=size.tiny)

rsi_OS_sell = (rsi > rsiLineU or rsi[1] > rsiLineU[1] or rsi[2] > rsiLineU[2] or rsi[3] > rsiLineU[3] or rsi[4] > rsiLineU[4] or rsi[5] > rsiLineU[5]) and maSellSignal

plotshape(RSI_OS_OB ? rsi_OS_sell : na, title="RSI OS + Cross", style=shape.circle, location=location.top, color=color.red, size=size.tiny)

if rsi_OB_buy and RSI_OS_OB and inDateRange

strategy.entry("RSI-OBOS x WMA", strategy.long)

if rsi_OS_sell and RSI_OS_OB and inDateRange

strategy.close("RSI-OBOS x WMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

rsi_OB_OS = input(false, "RSI Over Sold/Bought",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsiBuy = crossover(rsi , rsiLineD)

rsiSell = crossunder(rsi, rsiLineU)

rsiExit = crossunder(rsi, rsiLineD)

plotshape(rsi_OB_OS ? rsiBuy : na, title="RSI OB", style=shape.cross, location=location.bottom, color=color.purple)

plotshape(rsi_OB_OS ? crossunder(rsi, rsiLineU) : na, title="RSI OS", style=shape.cross, location=location.top, color=color.purple)

plotshape(rsi_OB_OS ? rsiExit : na, title="RSI OS", style=shape.cross, location=location.bottom, color=color.red)

if rsiBuy and rsi_OB_OS and inDateRange

strategy.entry("RSI OB", strategy.long)

if (rsiSell or rsiExit) and rsi_OB_OS and inDateRange

strategy.close("RSI OB", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

With_MA_Vis = input(true , title="With MA Signal)", inline="WITH MA", group="With MA")

withMA_type = input(title="", defval="SMA", options=["EMA","SMA","WMA","VWMA"], inline="WITH MA", group="With MA")

with_MALen = input(title="", defval=9, type=input.integer, inline="WITH MA", group="With MA")

// TAKE-PROFIT / STOP-LOSS

Stop_Take_Vis = input(true, "TP-SL")

LongSLValue = input(title="SL %", type=input.float, defval=3, minval=0.5) * 0.01

LongTPValue = input(title="TP %", type=input.float, defval=15, minval=0.5) * 0.01

LongSLDetermine = strategy.position_avg_price * (1 - LongSLValue)

LongTPDetermine = strategy.position_avg_price * (1 + LongTPValue)

//////////////////////////

with_ma = WithMA(close, with_MALen, withMA_type)

Close_buy_MA = crossover(close , with_ma)

Close_sell_MA = crossunder(close , with_ma)

// PLOT OPTION

WithMaSignal = input(true, "MA + RSI x Trending-MA",group="With MA") // INPUT

// CONDITION IN VARIABLE

withMA_RSI_BUY = (Close_buy_MA and rsiBuySignal) and WithMaSignal and inDateRange

withMA_RSI_SELL = (Close_sell_MA and rsiSellSignal) and WithMaSignal and inDateRange

// PLOT ING

plotshape(WithMaSignal ? withMA_RSI_BUY : na, title="With MA", style=shape.diamond, location=location.bottom, color=color.aqua)

plotshape(WithMaSignal ? withMA_RSI_SELL : na, title="With MA", style=shape.diamond, location=location.top, color=color.aqua)

if withMA_RSI_BUY

strategy.entry("MA + RSIxWMA", strategy.long)

if withMA_RSI_SELL

strategy.close("MA + RSIxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

// FOR SL - TP

if (strategy.position_size > 0) and Stop_Take_Vis

strategy.exit("BUY", stop=LongSLDetermine, limit=LongTPDetermine)