Strategie zur Kombination von Doppel gleitenden Durchschnitten und Williams-Durchschnitten

Schriftsteller:ChaoZhangTags:

Übersicht

Strategie Logik

Analyse der Vorteile

Risikoanalyse

Optimierungsrichtlinien

-

Einführung von Algorithmen für maschinelles Lernen zur automatischen Optimierung von Parametern.

Schlussfolgerung

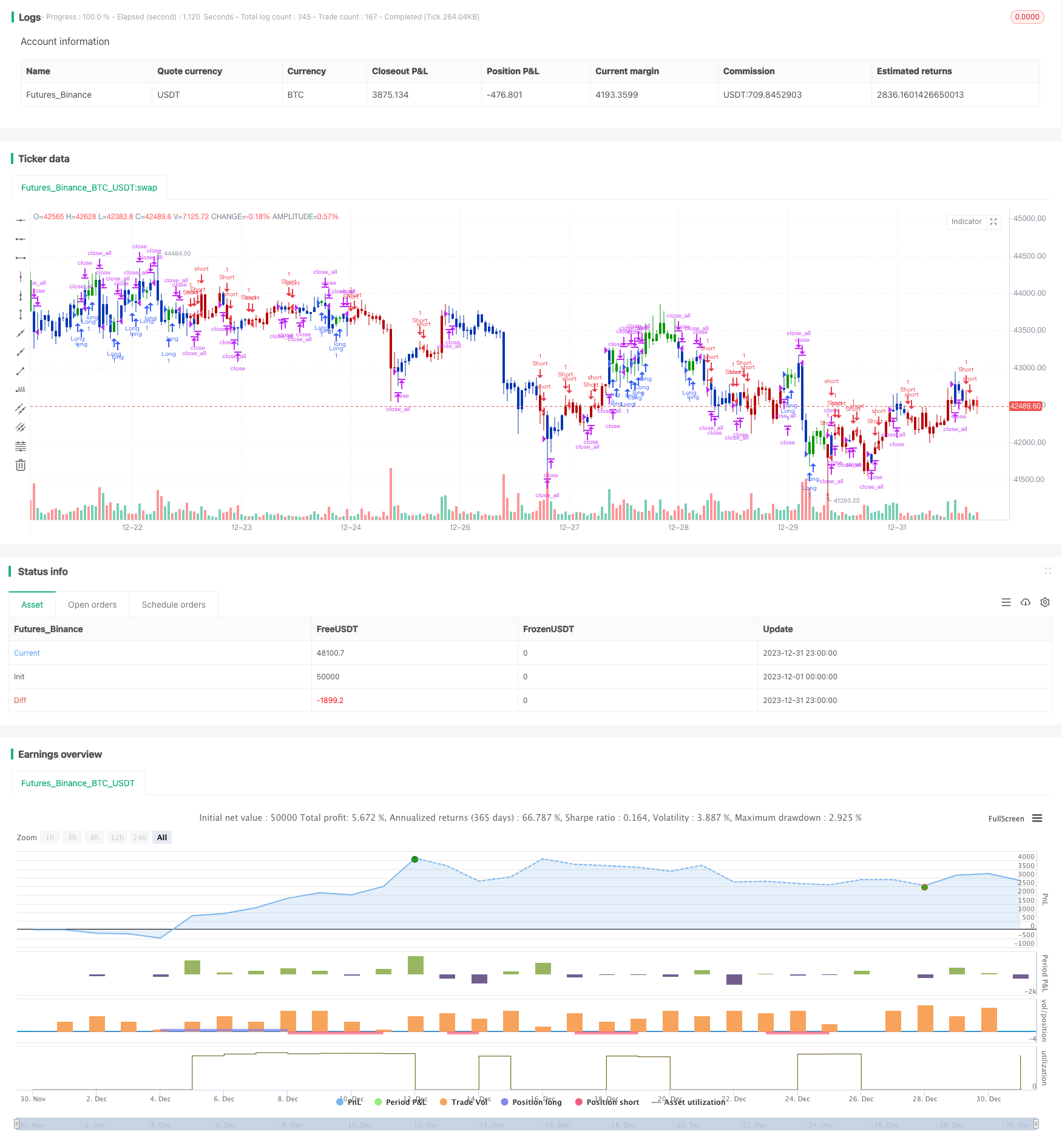

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// This indicator calculates 3 Moving Averages for default values of

// 13, 8 and 5 days, with displacement 8, 5 and 3 days: Median Price (High+Low/2).

// The most popular method of interpreting a moving average is to compare

// the relationship between a moving average of the security's price with

// the security's price itself (or between several moving averages).

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

BWA3Lines(LLength,MLength,SLength,LOffset,MOffset,SOffset) =>

pos = 0.0

xLSma = ta.sma(hl2, LLength)[LOffset]

xMSma = ta.sma(hl2, MLength)[MOffset]

xSSma = ta.sma(hl2, SLength)[SOffset]

pos := close < xSSma and xSSma < xMSma and xMSma < xLSma ? -1 :

close > xSSma and xSSma > xMSma and xMSma > xLSma ? 1 : nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & Bill Williams Averages. 3Lines', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ 3Lines ═════●'

LLength = input.int(13, minval=1, group=I2)

MLength = input.int(8,minval=1, group=I2)

SLength = input.int(5,minval=1, group=I2)

LOffset = input.int(8,minval=1, group=I2)

MOffset = input.int(5,minval=1, group=I2)

SOffset = input.int(3,minval=1, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosBWA3Lines = BWA3Lines(LLength,MLength,SLength,LOffset,MOffset,SOffset)

iff_1 = posEMA20 == -1 and prePosBWA3Lines == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosBWA3Lines == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)

Mehr

- Strategie für den Durchbruch des gleitenden Durchschnittskanals

- Strategie zur Festzeit-Rücklaufprüfung

- Zeit- und Raumoptimierte Multi-Zeitrahmen-MACD-Strategie

- Quantitative Handelsstrategie auf Basis von RSI und MFI

- Multi-Indikator-Gesamthandelsstrategie

- Kurzfristige Handelsstrategie der Crossover EMA

- Trend nach Strategie auf Basis eines dynamischen Stop-Loss-Systems für den Dual-EMA-Crossover

- Auftritt des Bullenmarktes Darvas Box Kaufstrategie

- Die relative Dynamikstrategie

- Wellenentwicklung und VWMA-basierte Entwicklung nach Quant-Strategie

- Adaptive Dreifach-Supertrend-Strategie

- Strategie für die Verlagerung des gleitenden Durchschnitts

- Mengenmäßige Handelsstrategie mit mehreren Indikatoren

- Market Cypher Welle B Automatische Handelsstrategie

- Wichtige Strategie zur Umkehrung von Backtests

- Die drei EMA Stochastic RSI Crossover Golden Cross-Strategie

- Strategie zur Umkehrung der Backtesting-Strategie

- Die RSI-Strategie wird von Ehlers-Smoothed angewendet.

- Swing-High-Low-Price-Channel-Strategie V.1

- Handelsstrategie zur Umkehrung der Dynamik