Multi-Indikator Quant Trading Strategie

Schriftsteller:ChaoZhang, Datum: 2024-02-21 11:53:30Tags:

Übersicht

Diese Strategie integriert verschiedene technische Indikatoren, darunter Parabolic SAR, Chandelier Exit, Zero Lag SMA, EMA und Heikin Ashi, um potenzielle Kauf- und Verkaufssignale auf dem Chart zu identifizieren.

Strategie Logik

Schlüsselindikatoren

- Parabolische SAR: Wird zur Bestimmung von Stop-Loss- und potenziellen Einstiegspunkten verwendet

- Chandelier Exit Strategy: Wird zur Bestimmung der Trendrichtung verwendet

- Nullverzögerung SMA: Gibt einen gleitenden Durchschnitt mit geringer Verzögerung an

- EMA: Verfolgt die Entwicklung und die Kursschwankungen

- Glatter Heikin Ashi: Erzeugt glatte Heikin Ashi Kerzen

Handelssignale

- Long, wenn Parabolische SAR einen Aufwärtstrend zeigt und der Preis über 99 EMA liegt; Short, wenn ein Abwärtstrend besteht und der Preis unter 99 EMA liegt

- Kombination mit Chandelier Exit Signalen zur weiteren Bestätigung des Trends

- Glatter Heikin Ashi hilft, Fehlbrüche zu vermeiden

Risikomanagement

- Stop-Loss und Profit setzen

- Berücksichtigen Sie die Wiederaufstellung der Bedingungen, um die Positionen flexibel anzupassen.

Stärkenanalyse

Die größte Stärke ist die umfassende Kombination von Indikatoren für eine effektive Trendidentifizierung. Parabolische SAR erkennt potenzielle Umkehrungen; Chandelier Exit beurteilt den Haupttrend; gleitende Durchschnitte filtern falsche Signale.

Darüber hinaus kontrollieren Stop-Loss und Take-Profit Risiken. Glättete Linien vermeiden kurzfristigen Lärm. Die Strategie ist stabil.

Risikoanalyse

Gegensätzliche Signale können Schwierigkeiten verursachen. Falsche Parameter-Einstellungen können auch den Handel negativ beeinflussen.

Es gibt Risiken im technischen Handel, die Verluste verursachen können. Vorsichtiger Betrieb ist ein Muss. Blindes Folgen sollte vermieden werden.

Optimierungsrichtlinien

- Test und Optimierung von Parametern, um die beste Kombination zu finden

- Einführung von Modellen des maschinellen Lernens für höhere Genauigkeit

- Einbeziehung von Stimmungsindikatoren und Nachrichten zur Bewertung der Marktbedingungen und dynamische Verwaltung von Positionen

- Verbesserung der Logik der Wiederherstellungsbedingungen für eine flexiblere Signaldetektion

Schlussfolgerung

Diese Strategie integriert Indikatoren zur Signalidentifizierung. Zu den Stärken gehören hohe Genauigkeit, Stabilität und solide Risikokontrolle. Insgesamt ein lohnendes Handelsschema. Weitere Verbesserungen können durch Parameter-Tuning, Modelltraining und Stimmungsindikatorintegration erzielt werden.

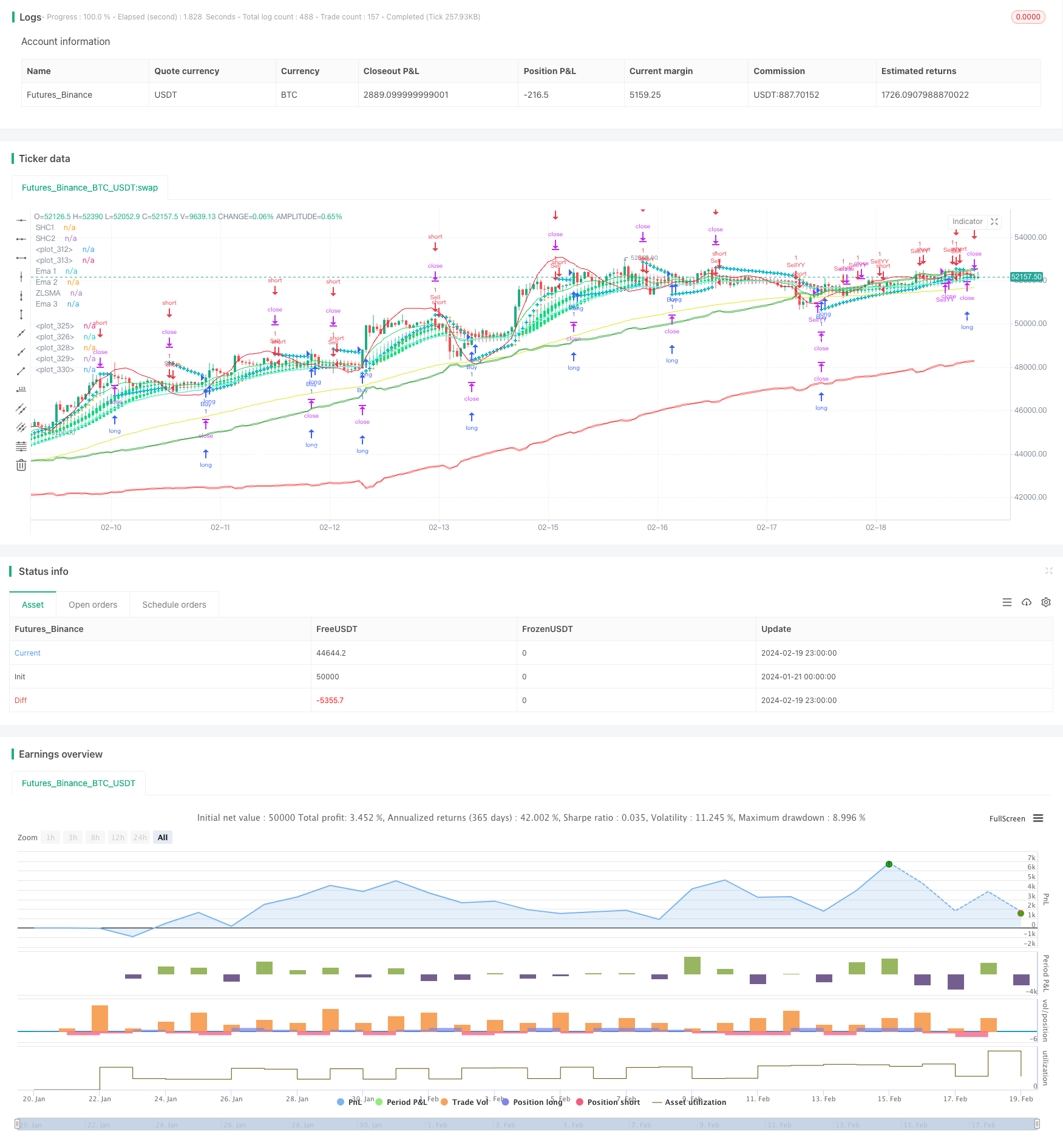

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("CE-ZLSMA-EMA-SAR-SHC", overlay=true)

// Parabolic SAR Strategy

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

var bool longSar = false

var bool shortSar = false

//input smoothed HAC 1

len=input.int(title="Length SHC1", defval = 10)

o=ta.ema(open,len)

c=ta.ema(close,len)

h=ta.ema(high,len)

l=ta.ema(low,len)

haclose = (o+h+l+c)/4

var haopen = 0.0

if na(haopen[1])

haopen := (o + c) / 2

else

haopen := (haopen[1] + haclose[1]) / 2

hahigh = math.max (h, math.max(haopen,haclose))

halow = math.min (l, math.min(haopen,haclose))

len2=input(10)

o2=ta.ema(haopen, len2)

c2=ta.ema(haclose, len2)

h2=ta.ema(hahigh, len2)

l2=ta.ema(halow, len2)

col=o2>c2 ? color.red : color.lime

bool shc1Green = o2 > c2

bool shc1Lime = o2 < c2

//input smoothed HAC 1

lenSHC2=input.int(title="Length SHC2 ", defval = 20)

oShc2=ta.ema(open,lenSHC2)

cShc2=ta.ema(close,lenSHC2)

hShc2=ta.ema(high,lenSHC2)

lShc2=ta.ema(low,lenSHC2)

hacloseShc2 = (oShc2+hShc2+lShc2+cShc2)/4

var haopenShc2 = 0.0

if na(haopenShc2[1])

haopenShc2 := (oShc2 + cShc2) / 2

else

haopenShc2 := (haopenShc2[1] + hacloseShc2[1]) / 2

hahighShc2 = math.max (hShc2, math.max(haopenShc2,hacloseShc2))

halowShc2 = math.min (lShc2, math.min(haopenShc2,hacloseShc2))

len2Shc2=input(10)

o2Shc2=ta.ema(haopenShc2, len2Shc2)

c2Shc2=ta.ema(hacloseShc2, len2Shc2)

h2Shc2=ta.ema(hahighShc2, len2Shc2)

l2Shc2=ta.ema(halowShc2, len2Shc2)

colShc2=o2Shc2>c2Shc2 ? color.red : color.lime

bool shc2Green = o2Shc2 > c2Shc2

bool shc2Lime = o2Shc2 < c2Shc2

//end smooth

bool shcGree = shc1Green and shc2Green

bool shcLime = shc1Lime and shc2Lime

//zlsma

lengthZlsma = input.int(title="Length", defval=32)

offset = input.int(title="Offset", defval=0)

src = input(close, title="Source")

lsma = ta.linreg(src, lengthZlsma, offset)

lsma2 = ta.linreg(lsma, lengthZlsma, offset)

eq= lsma-lsma2

zlsma = lsma+eq

// ema 10

len4 = input.int(10, minval=1, title="Length")

src4 = input.source(close, title="Source")

out4 = ta.ema(src4, len4)

//End of format

// ema 34

len5 = input.int(34, minval=1, title="Length")

src5 = input.source(close, title="Source")

out5 = ta.ema(src5, len5)

//end ema 34

// ema 99

len6 = input.int(99, minval=1, title="Length")

src6 = input.source(close, title="Source")

out6 = ta.ema(src6, len6)

// end ema 99

//kiem tra dieu kien gia dong cua lon hon ema99 thi moi me lenh long

bool onEma99 = close > out6

bool downEma99 = open < out6

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := math.max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := math.min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := math.min(AF + increment, maximum)

else

if low < EP

EP := low

AF := math.min(AF + increment, maximum)

if uptrend

SAR := math.min(SAR, low[1])

if bar_index > 1

SAR := math.min(SAR, low[2])

else

SAR := math.max(SAR, high[1])

if bar_index > 1

SAR := math.max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

if barstate.isconfirmed

if uptrend

// log.info("true")

strategy.entry("ParSE", strategy.short, stop=nextBarSAR, comment="ParSE")

strategy.cancel("ParLE")

shortSar := false

longSar := true

else

// log.info("false")

strategy.entry("ParLE", strategy.long, stop=nextBarSAR, comment="ParLE")

strategy.cancel("ParSE")

longSar := false

shortSar := true

// Chandelier Exit Strategy

length = input.int(title="ATR Period", defval=1)

mult = input.float(title="ATR Multiplier", step=0.1, defval=1.1)

showLabels = input.bool(title="Show Buy/Sell Labels ?", defval=true)

useClose = input.bool(title="Use Close Price for Extremums ?", defval=true)

highlightState = input.bool(title="Highlight State ?", defval=true)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var bool longOpened = false

var bool shortOpended = false

// Entry and exit logic

if (dir == 1)

if longSar

if not longOpened

strategy.close("Sell", disable_alert = true)

strategy.order("Buy", strategy.long)

longOpened := true

shortOpended := false

if (dir == -1)

if shortSar

if not shortOpended

strategy.close("Buy", disable_alert = true)

strategy.order("Sell", strategy.short)

shortOpended := true

longOpened := false

//strategy YY

// ~~~~~~~~~~~ INPUTS ~~~~~~~~~~~ //

lenYY = input.int(80, "Trend Length:", tooltip="How far back should we span this indicator?\nThis length effects all lengths of the indicator")

purchaseSrc = input.source(close, "Purchase Source (Long and Short):", tooltip="What source needs to exit the purchase zone for a purchase to happen?")

exitSrc = input.source(close, "Exit Source (Long and Short):", tooltip="What source needs to hit a exit condition to stop the trade (Take profit, Stop Loss or hitting the other sides Purchase Zone)?")

useTakeProfit = input.bool(true, "Use Take Profit", tooltip="Should we take profit IF we cross the basis line and then cross it AGAIN?")

useStopLoss = input.bool(true, "Use Stop Loss", tooltip="Stop loss will ensure you don't lose too much if its a bad call")

stopLossMult = input.float(0.1, "Stoploss Multiplier %:", tooltip="How far from the purchase lines should the stop loss be")

resetCondition = input.string("Entry", "Reset Purchase Availability After:", options=["Entry", "Stop Loss", "None"],

tooltip="If we reset after a condition is hit, this means we can purchase again when the purchase condition is met. \n" +

"Otherwise, we will only purchase after an opposite signal has appeared.\n" +

"Entry: means when the close enters the purchase zone (buy or sell).\n" +

"Stop Loss: means when the close hits the stop loss location (even when were out of a trade)\n" +

"This allows us to get more trades and also if our stop loss initally was hit but it WAS a good time to purchase, we don't lose that chance.")

// ~~~~~~~~~~~ VARIABLES ~~~~~~~~~~~ //

var bool longStart = na

var bool longAvailable = na

var bool longTakeProfitAvailable = na

var bool longStopLoss = na

var bool shortStart = na

var bool shortAvailable = na

var bool shortTakeProfitAvailable = na

var bool shortStopLoss = na

resetAfterStopLoss = resetCondition == "Stop Loss"

resetAfterEntry = resetCondition == "Entry"

// ~~~~~~~~~~~ CALCULATIONS ~~~~~~~~~~~ //

// Mid Line

midHigh = ta.vwma(ta.highest(high, lenYY), lenYY)

midLow = ta.vwma(ta.lowest(low, lenYY), lenYY)

mid = math.avg(midHigh, midLow)

midSmoothed = ta.ema(mid, lenYY)

//Volume Filtered

avgVol = ta.vwma(volume, lenYY)

volDiff = volume / avgVol

midVolSmoothed = ta.vwma(midSmoothed * volDiff, 3)

//RSI Filtered

midDifference = ta.sma(midHigh - midLow, lenYY)

midRSI = ta.rsi(midVolSmoothed, lenYY) * 0.01

midAdd = midRSI * midDifference

//Calculate Zones

purchaseZoneHigh = midSmoothed + midAdd

purchaseZoneLow = midSmoothed - midAdd

purchaseZoneBasis = math.avg(purchaseZoneHigh, purchaseZoneLow)

//Create Stop Loss Locations

stopLossHigh = purchaseZoneHigh * (1 + (stopLossMult * 0.01))

stopLossLow = purchaseZoneLow * (1 - (stopLossMult * 0.01))

// ~~~~~~~~~~~ PURCHASE CALCULATIONS ~~~~~~~~~~~ //

//Long

longEntry = ta.crossunder(purchaseSrc, purchaseZoneLow)

longStart := ta.crossover(purchaseSrc, purchaseZoneLow) and longAvailable

longAvailable := ta.crossunder(purchaseSrc, purchaseZoneHigh) or (resetAfterStopLoss and longStopLoss) or (resetAfterEntry and longEntry) ? true : longStart ? false : longAvailable[1]

longEnd = ta.crossover(exitSrc, purchaseZoneHigh)

longStopLoss := ta.crossunder(exitSrc, stopLossLow)

longTakeProfitAvailable := ta.crossover(exitSrc, purchaseZoneBasis) ? true : longEnd ? false : longTakeProfitAvailable[1]

longTakeProfit = ta.crossunder(exitSrc, purchaseZoneBasis) and longTakeProfitAvailable

//Short

shortEntry = ta.crossover(purchaseSrc, purchaseZoneHigh)

shortStart := ta.crossunder(purchaseSrc, purchaseZoneHigh) and shortAvailable

shortAvailable := ta.crossover(purchaseSrc, purchaseZoneLow) or (resetAfterStopLoss and shortStopLoss) or (resetAfterEntry and shortEntry)? true : shortStart ? false : shortAvailable[1]

shortEnd = ta.crossunder(exitSrc, purchaseZoneLow)

shortStopLoss := ta.crossover(exitSrc, stopLossHigh)

shortTakeProfitAvailable := ta.crossunder(exitSrc, purchaseZoneBasis) ? true : shortEnd ? false : shortTakeProfitAvailable[1]

shortTakeProfit = ta.crossover(exitSrc, purchaseZoneBasis) and shortTakeProfitAvailable

// ~~~~~~~~~~~ STRATEGY ~~~~~~~~~~~ //

var bool openLongYY = false

var bool openShortYY = false

if (longStart)

strategy.order("BuyYY", strategy.long)

strategy.close("SellYY", disable_alert = true)

openLongYY := true

openShortYY := false

else if (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit))

strategy.close("BuyYY", disable_alert = true)

if (shortStart)

strategy.close("BuyYY", disable_alert = true)

strategy.order("SellYY", strategy.short)

openShortYY := true

openLongYY := false

else if (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

strategy.close("SellYY", disable_alert = true)

// ~~~~~~~~~~~ ALERTS ~~~~~~~~~~~ //

// if longStart or (longEnd or (useStopLoss and longStopLoss) or (useTakeProfit and longTakeProfit)) or shortStart or (shortEnd or (useStopLoss and shortStopLoss) or (useTakeProfit and shortTakeProfit))

// alert("{{strategy.order.action}} | {{ticker}} | {{close}}", alert.freq_once_per_bar)

// Plotting

plot(SAR, style=plot.style_cross, linewidth=1, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=3, color=color.aqua)

plot(zlsma, color=color.rgb(235, 15, 33), linewidth=1, title = "ZLSMA")

plot(out4, color=color.rgb(24, 209, 85), title="Ema 1")

plot(out5, color=color.rgb(139, 234, 231), linewidth = 2, title="Ema 2")

plot(out6, color=color.rgb(219, 230, 18), title="Ema 3")

plotcandle(o2, h2, l2, c2, title="SHC1", color=col)

plotcandle(o2Shc2, hShc2, l2Shc2, c2Shc2, title="SHC2", color=col)

// ~~~~~~~~~~~ PLOTS YY ~~~~~~~~~~~ //

shortLine = plot(purchaseZoneHigh, color=color.green)

shortStopLossLine = plot(stopLossHigh, color=color.green) //color=color.rgb(0, 97, 3)

fill(shortLine, shortStopLossLine, color = color.new(color.green, 90))

plot(purchaseZoneBasis, color=color.white)

longLine = plot(purchaseZoneLow, color=color.red)

longStopLossLine = plot(stopLossLow, color=color.red) //color=color.rgb(105, 0, 0)

fill(longLine, longStopLossLine, color=color.new(color.red, 90))

- Quantitative Handelsstrategie auf der Grundlage eines doppelten gleitenden Durchschnitts-Crossovers

- Beste ATR-Stopp-Mehrfachstrategie

- Bollinger Kreuzung Tod Goldene Strategie

- Umkehrhandelsstrategie mit Bollinger-Bändern, RSI, ADX und ATR

- DEMA Crossover Trend nach der Strategie

- Strategie zur Einrichtung einer extremen Umkehrung

- Trendbasierte OBV- und CCI-Indikatoren nach Strategie

- Breakout-Handelssystem

- Mehrzeitrahmen Bollinger Bands Breakout-Strategie mit RSI

- Momentumindikator Aggregation Handelsstrategie

- TradingVMA

Handelsstrategie mit variablem gleitendem Durchschnitt - RSI-Divergenzstrategie

- Doppel Donchian Channel Breakout Strategie

- Bollinger Bands Breakout-Handelsstrategie

- EMA-Strategie zur Durchbruchssperre

- Goldene Kreuz-Todeskreuz-Handelsstrategie

- Supertrendbasierte Multitimeframe Trendverfolgungsstrategie

- Manuelle Strategie für Kauf- und Verkaufswarnungen

- Quantitative Referenzstrategie für den Durchbruch im Aufwärtstrend

- Adaptive Netzhandelsstrategie auf Basis einer quantitativen Handelsplattform