Momentum-Crossover-Strategie mit dynamischem Trailing-Stop Loss

Schriftsteller:ChaoZhang, Datum: 2024-02-29 13:55:16Tags:

Übersicht

Diese Strategie kombiniert gleitende Durchschnittsindikatoren und Richtungsbewegungsindex (DMI) -Indikatoren, um Kauf- und Verkaufssignale zu erzeugen, die auf Dual-Indikator-Crossovers basieren.

Strategie Logik

- Erstellen Sie gleitende Durchschnittsindikatoren mit einem kurzen 9-tägigen EMA und einem langen 21-tägigen EMA. Ein Kaufsignal wird erzeugt, wenn der kurze EMA über den langen EMA überschreitet. Ein Verkaufssignal wird erzeugt, wenn der kurze EMA unter den langen EMA überschreitet.

- Erstellen Sie DMI-Indikatoren mit ADX, +DI und -DI. Ein Kaufsignal wird ausgelöst, wenn +DI über -DI geht. Ein Verkaufssignal wird ausgelöst, wenn -DI über +DI geht.

- Kombination der Signale von EMA und DMI, wobei beide Indikatoren Bedingungen erfüllen müssen, bevor tatsächliche Kauf- oder Verkaufssignale ausgegeben werden.

- Bei der Ermittlung der Höhe des Stop-Loss-Kurses werden die folgenden Informationen verwendet:

Analyse der Vorteile

- Kurzfristige Indikatoren erfassen Trendveränderungen, während langfristige die Gesamtrichtung bestimmen.

- Momentumindikatoren können Trendveränderungen frühzeitig mit einigen führenden Merkmalen erfassen.

- Dynamische Trailing-Stop-Loss-Systeme verhindern, dass Gewinne möglichst hoch sind und gleichzeitig Risiken kontrolliert werden.

Risikoanalyse

- Bei Dual-Indicator-Combos wird die Signalfrequenz reduziert und möglicherweise einige Möglichkeiten verpasst.

- Eine unzureichende Einstellung der Indikatoren kann zu einem Überhandel oder zu geringwertigen Signalen führen.

- Ein zu breit eingestellter Stop-Loss erhöht das Verlustrisiko, während ein zu eng eingestellter Stop-Loss das Risiko einer Trendauslösung erhöht.

Optimierungsrichtlinien

- Test EMA-Combos mit unterschiedlichen kurz- und langfristigen Längen, um das optimale Ergebnis zu finden.

- Optimierung der ADX-Parameter zur Verbesserung der DMI-Signalqualität.

- Die Stop-Loss-Parameter sind so abgestimmt, dass sie Gewinne erzielen und Risiken verwalten.

- Erwägen Sie, mehr Filter hinzuzufügen, um die Signalqualität weiter zu verbessern.

Schlussfolgerung

Diese Strategie kombiniert die Stärken von gleitenden Durchschnitten und Impulsindikatoren für die doppelte Bestätigung von Signalen und ergänzt sich gegenseitig, um die Rentabilität zu steigern.

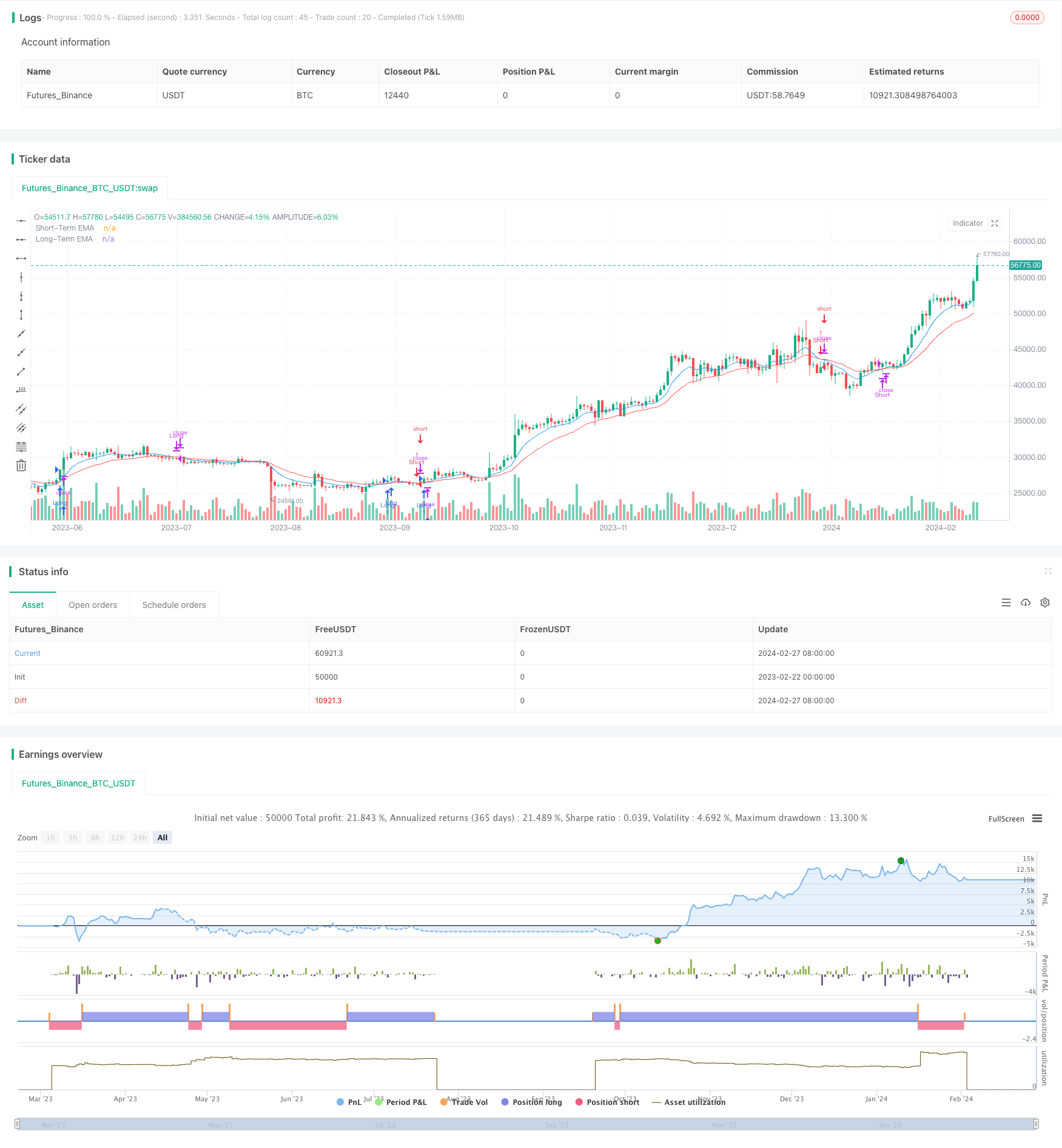

/*backtest

start: 2023-02-22 00:00:00

end: 2024-02-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Combined EMA and DMI Strategy with Enhanced Table", overlay=true)

// Input parameters for EMA

shortTermEMA = input.int(9, title="Short-Term EMA Period")

longTermEMA = input.int(21, title="Long-Term EMA Period")

riskPercentageEMA = input.float(1, title="Risk Percentage EMA", minval=0.1, maxval=5, step=0.1)

// Calculate EMAs

emaShort = ta.ema(close, shortTermEMA)

emaLong = ta.ema(close, longTermEMA)

// EMA Crossover Strategy

longConditionEMA = emaShort > emaLong and emaShort[1] <= emaLong[1]

shortConditionEMA = emaShort < emaLong and emaShort[1] >= emaLong[1]

// Input parameters for DMI

adxlen = input(17, title="ADX Smoothing")

dilen = input(17, title="DI Length")

// DMI Logic

dirmov(len) =>

up = ta.change(high)

down = -ta.change(low)

truerange = ta.tr

plus = fixnan(100 * ta.rma(up > down and up > 0 ? up : 0, len) / truerange)

minus = fixnan(100 * ta.rma(down > up and down > 0 ? down : 0, len) / truerange)

[plus, minus]

adx(dilen, adxlen) =>

[plus, minus] = dirmov(dilen)

sum = plus + minus

adxValue = 100 * ta.rma(math.abs(plus - minus) / (sum == 0 ? 1 : sum), adxlen)

[adxValue, plus, minus]

[adxValue, up, down] = adx(dilen, adxlen)

// DMI Conditions

buyConditionDMI = up > down or (up and adxValue > down)

sellConditionDMI = down > up or (down and adxValue > up)

// Combined Conditions for Entry

longEntryCondition = longConditionEMA and buyConditionDMI

shortEntryCondition = shortConditionEMA and sellConditionDMI

// Combined Conditions for Exit

longExitCondition = shortConditionEMA

shortExitCondition = longConditionEMA

// Enter long trade based on combined conditions

if (longEntryCondition)

strategy.entry("Long", strategy.long)

// Enter short trade based on combined conditions

if (shortEntryCondition)

strategy.entry("Short", strategy.short)

// Exit trades

if (longExitCondition)

strategy.close("Long")

if (shortExitCondition)

strategy.close("Short")

// Plot EMAs

plot(emaShort, color=color.blue, title="Short-Term EMA")

plot(emaLong, color=color.red, title="Long-Term EMA")

// Create and fill the enhanced table

var tbl = table.new(position.top_right, 4, 1)

if (barstate.islast)

table.cell(tbl, 0, 0, "ADX: " + str.tostring(adxValue), bgcolor=color.new(color.red, 90), width=15, height=4)

table.cell(tbl, 1, 0, "+DI: " + str.tostring(up), bgcolor=color.new(color.blue, 90), width=15, height=4)

table.cell(tbl, 2, 0, "-DI: " + str.tostring(down), bgcolor=color.new(color.orange, 90), width=15, height=4)

Mehr

- Adaptive Kanal-Ausbruchstrategie

- Eine fortgeschrittene EMA-Trendstrategie mit entspannten RSI- und ATR-Filtern

- Strategie zur Nachverfolgung von Trends durch dreifache Bestätigung

- Mehrfache Handelsstrategie für gleitende Durchschnitte

- Schildkrötenhandelsentscheidungssystem

- Welle Kauf und Verkauf Umkehrung 5 Minuten Zeitrahmen Strategie

- RSI-basierte Auto-Handelsstrategie

- Die Strategie des Komplexen Ausbruchs

- Die Strategie des Momentum Breakouts

- Trend nach der Strategie des gleitenden Durchschnitts

- Quantitative Handelsstrategie der EMA und des RSI

- Momentum-Trend-Strategie auf Basis von MACD und Bollinger-Bändern

- Mehrzeitrahmen-Stochastikstrategie

- Bewegliche durchschnittliche Crossover-Strategie mit Intraday-Candlestick-Mustern

- Bitcoin-Scalping-Strategie basierend auf gleitenden Durchschnitts-Crossover- und Candlestick-Mustern

- Kombination von Momentum und gleitendem Durchschnitt Langstrategie

- Momentum Durchschnittlicher Richtungsbewegungsindex Bewegtem Durchschnitt Kreuzungstrategie

- Strategie zur Beobachtung der Trendentwicklung durch doppelte EMA-Kreuzungen

- Handelsstrategie für die Kombination von doppelten gleitenden Durchschnitten und MACD

- Dynamische Trendstrategie für die Verschwemmung