Kuberan-Strategie: Der Konfluenzansatz zur Marktbeherrschung

Schriftsteller:ChaoZhang, Datum: 2024-03-22 14:08:11Tags:

Strategieübersicht

Die Kuberan-Strategie ist eine leistungsstarke Handelsstrategie, die von Kathir entwickelt wurde. Sie kombiniert mehrere analytische Techniken, um einen einzigartigen und starken Handelsansatz zu bilden.

Kuberan ist mehr als nur eine Strategie; es ist ein umfassendes Handelssystem. Es integriert Trendanalyse, Schwungindikatoren und Volumenmetriken, um Handelsmöglichkeiten mit hoher Wahrscheinlichkeit zu identifizieren.

Strategieprinzipien

Der Kern der Kuberan-Strategie ist das Prinzip des Zusammenflusses von mehreren Indikatoren. Sie nutzt eine einzigartige Kombination von Indikatoren, die in Harmonie arbeiten, um Lärm und falsche Signale zu reduzieren.

- Trendrichtung: Durch den Vergleich der aktuellen Preise mit Unterstützungs- und Widerstandsniveaus wird die vorherrschende Trendrichtung bestimmt.

- Unterstützungs- und Widerstandsniveaus: Identifiziert die wichtigsten Unterstützungs- und Widerstandsniveaus anhand des Zickzackindikators und der Drehpunkte.

- Abweichungserkennung: Vergleicht die Kursentwicklung mit Dynamikindikatoren, um potenzielle Trendumkehrungen zu erkennen, die durch Abweichungen signalisiert werden.

- Anpassung an die Volatilität: Anpassung an die unterschiedlichen Marktvolatilitäten durch dynamische Anpassung der Stop-Loss-Level anhand des ATR-Indikators.

- Kerzenmustererkennung: Bestätigt Trend- und Umkehrsignale mithilfe spezifischer Kerzenkombinationen.

Durch die umfassende Berücksichtigung dieser Faktoren kann sich die Kuberan-Strategie an verschiedene Marktbedingungen anpassen und Handelschancen mit hoher Wahrscheinlichkeit nutzen.

Strategische Vorteile

- Multi-Indikator-Zusammenfluss: Kuberan nutzt die Synergie mehrerer Indikatoren, verbessert die Signalzuverlässigkeit erheblich und reduziert die Geräuschstörungen.

- Hohe Anpassungsfähigkeit: Durch dynamische Parameteranpassungen kann sich die Strategie an veränderte Marktumgebungen anpassen und eine Veralterung vermeiden.

- Klare Signale: Kuberan liefert klare Ein- und Ausstiegssignale und vereinfacht den Handelsentscheidungsprozess.

- Robuste Backtesting: Die Strategie hat eine strenge historische Backtesting durchlaufen und zeigt eine gleichbleibende Leistung in verschiedenen Marktszenarien.

- Breite Anwendbarkeit: Kuberan ist auf mehrere Märkte und Instrumente anwendbar, nicht nur auf bestimmte Handelsinstrumente.

Strategische Risiken

- Parameterempfindlichkeit: Die Leistung der Kuberan-Strategie ist empfindlich gegenüber der Parameterwahl; unangemessene Parameter können zu suboptimalen Ergebnissen führen.

- Schwarze Schwanereignisse: Die Strategie stützt sich hauptsächlich auf technische Signale und hat eine begrenzte Fähigkeit, grundlegende Schwarze Schwanereignisse zu behandeln.

- Risiko einer Überanpassung: Wenn bei der Optimierung von Parametern zu viele historische Daten berücksichtigt werden, kann die Strategie zu sehr an die Vergangenheit angepasst werden und ihre Anpassungsfähigkeit an zukünftige Marktbedingungen verringern.

- Hebelrisiko: Die Verwendung von übermäßiger Hebelwirkung birgt das Risiko von Margin Calls bei erheblichen Rücknahmen.

Um diese Risiken zu mindern, können geeignete Kontrollmaßnahmen wie regelmäßige Anpassungen der Parameter, die Festlegung angemessener Stop-Losses, die Moderation des Leverages und die Überwachung grundlegender Veränderungen durchgeführt werden.

Optimierungsrichtlinien

- Optimierung des maschinellen Lernens: Einführung von Algorithmen des maschinellen Lernens zur dynamischen Optimierung von Strategieparametern und Verbesserung der Anpassungsfähigkeit.

- Einbeziehung von fundamentalen Faktoren: Überlegen Sie, die Integration von fundamentalen Analysen in Handelsentscheidungen zu berücksichtigen, um Situationen zu bewältigen, in denen technische Signale versagen.

- Portfoliomanagement: Auf der Ebene des Kapitalmanagements ist die Kuberan-Strategie in ein diversifiziertes Portfolio aufzunehmen, um eine effektive Absicherung mit anderen Strategien zu erreichen.

- Marktspezifische Optimierung: Anpassung der Strategieparameter an die Merkmale der verschiedenen Märkte und Instrumente.

- Hochfrequenzumwandlung: Anpassen der Strategie in eine Hochfrequenzhandelsversion, um mehr kurzfristige Handelsmöglichkeiten zu erfassen.

Schlussfolgerung

Kuberan ist eine leistungsfähige und zuverlässige Handelsstrategie, die auf geniale Weise mehrere technische Analysemethoden kombiniert. Durch das Prinzip der Indikatorenverschmelzung zeichnet sie sich durch die Erfassung von Trends und die Identifizierung von Wendepunkten aus. Während keine Strategie gegen Risiken immun ist, hat Kuberan seine Robustheit beim Backtesting bewiesen. Mit geeigneten Risikokontrollmaßnahmen und Optimierungsbemühungen kann diese Strategie Händlern helfen, im Marktkampf einen Vorteil zu erzielen und langfristiges, stetiges Wachstum ihres Anlageportfolios voranzutreiben.

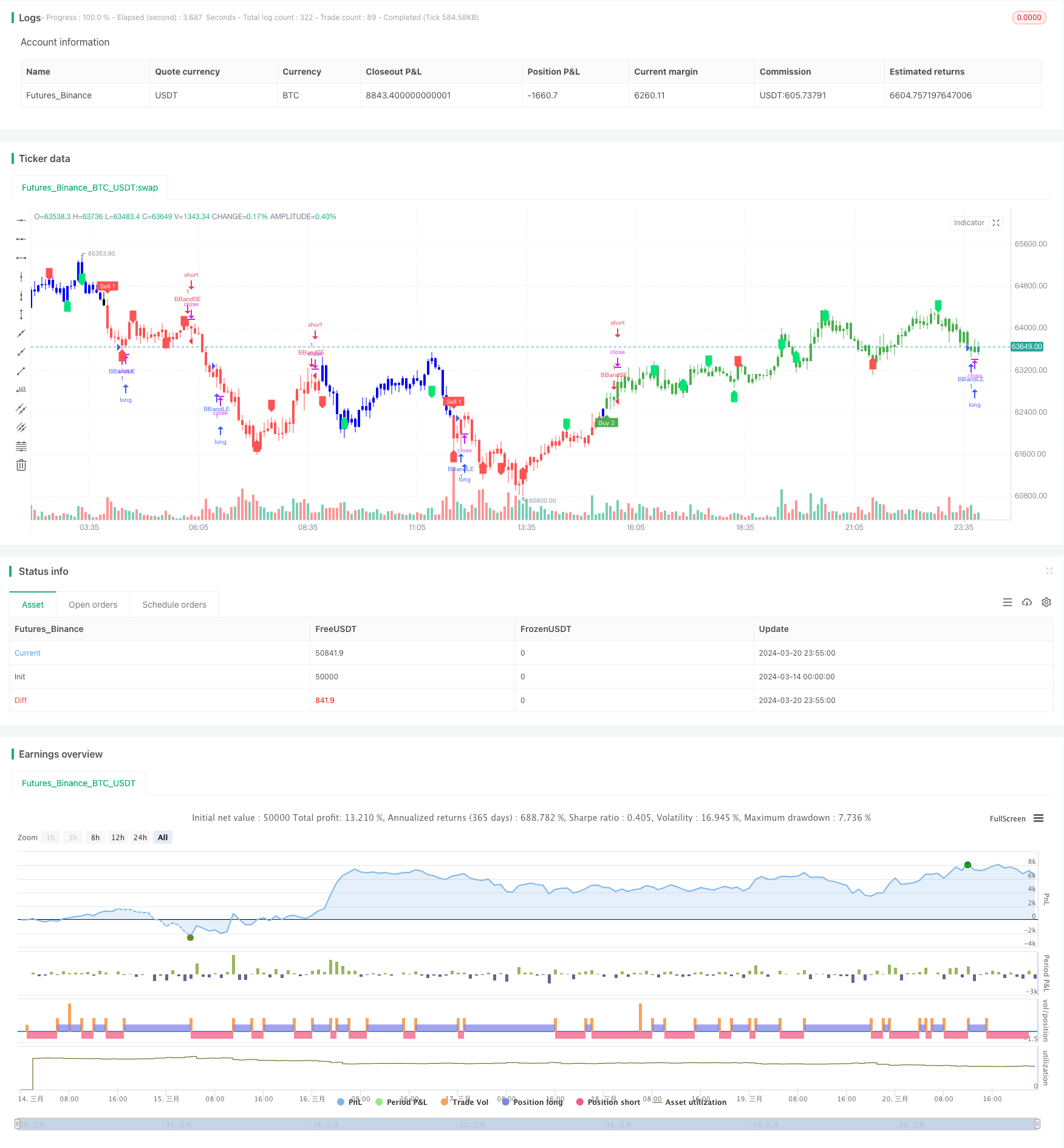

/*backtest

start: 2024-03-14 00:00:00

end: 2024-03-21 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

//@version=5

strategy('Kuberan*', overlay=true, max_lines_count=500)

lb = input.int(5, title='Left Bars', minval=1)

rb = input.int(5, title='Right Bars', minval=1)

showsupres = input.bool(false, title='Support/Resistance', inline='srcol')

supcol = input.color(color.lime, title='', inline='srcol')

rescol = input.color(color.red, title='', inline='srcol')

// srlinestyle = input(line.style_dotted, title='Line Style/Width', inline='style')

srlinewidth = input.int(3, title='', minval=1, maxval=5, inline='style')

changebarcol = input.bool(true, title='Change Bar Color', inline='bcol')

bcolup = input.color(color.blue, title='', inline='bcol')

bcoldn = input.color(color.black, title='', inline='bcol')

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multTLiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

ehl = hl == 1 ? -1 : 1

loc1 = 0.0

loc2 = 0.0

loc3 = 0.0

loc4 = 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

float a = na

float b = na

float c = na

float d = na

float e = na

if not na(hl)

[loc1, loc2, loc3, loc4] = findprevious()

a := zz

b := loc1

c := loc2

d := loc3

e := loc4

e

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(_hl, title='Higher Low', style=shape.labelup, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(_hh, title='Higher High', style=shape.labeldown, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(_ll, title='Lower Low', style=shape.labelup, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(_lh, title='Lower High', style=shape.labeldown, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol ? iff_4 : na)

// Inputs

A1 = input(5, title='Key Value. \'This changes the sensitivity\' for sell1')

C1 = input(400, title='ATR Period for sell1')

A2 = input(6, title='Key Value. \'This changes the sensitivity\' for buy2')

C2 = input(1, title='ATR Period for buy2')

h = input(false, title='Signals from Heikin Ashi Candles')

xATR1 = ta.atr(C1)

xATR2 = ta.atr(C2)

nLoss1 = A1 * xATR1

nLoss2 = A2 * xATR2

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop1 = 0.0

iff_5 = src > nz(xATRTrailingStop1[1], 0) ? src - nLoss1 : src + nLoss1

iff_6 = src < nz(xATRTrailingStop1[1], 0) and src[1] < nz(xATRTrailingStop1[1], 0) ? math.min(nz(xATRTrailingStop1[1]), src + nLoss1) : iff_5

xATRTrailingStop1 := src > nz(xATRTrailingStop1[1], 0) and src[1] > nz(xATRTrailingStop1[1], 0) ? math.max(nz(xATRTrailingStop1[1]), src - nLoss1) : iff_6

xATRTrailingStop2 = 0.0

iff_7 = src > nz(xATRTrailingStop2[1], 0) ? src - nLoss2 : src + nLoss2

iff_8 = src < nz(xATRTrailingStop2[1], 0) and src[1] < nz(xATRTrailingStop2[1], 0) ? math.min(nz(xATRTrailingStop2[1]), src + nLoss2) : iff_7

xATRTrailingStop2 := src > nz(xATRTrailingStop2[1], 0) and src[1] > nz(xATRTrailingStop2[1], 0) ? math.max(nz(xATRTrailingStop2[1]), src - nLoss2) : iff_8

pos1 = 0

iff_9 = src[1] > nz(xATRTrailingStop1[1], 0) and src < nz(xATRTrailingStop1[1], 0) ? -1 : nz(pos1[1], 0)

pos1 := src[1] < nz(xATRTrailingStop1[1], 0) and src > nz(xATRTrailingStop1[1], 0) ? 1 : iff_9

pos2 = 0

iff_10 = src[1] > nz(xATRTrailingStop2[1], 0) and src < nz(xATRTrailingStop2[1], 0) ? -1 : nz(pos2[1], 0)

pos2 := src[1] < nz(xATRTrailingStop2[1], 0) and src > nz(xATRTrailingStop2[1], 0) ? 1 : iff_10

xcolor1 = pos1 == -1 ? color.red : pos1 == 1 ? color.green : color.blue

xcolor2 = pos2 == -1 ? color.red : pos2 == 1 ? color.green : color.blue

ema1 = ta.ema(src, 1)

ema2 = ta.ema(src, 1)

above1 = ta.crossover(ema1, xATRTrailingStop1)

below1 = ta.crossover(xATRTrailingStop1, ema1)

above2 = ta.crossover(ema2, xATRTrailingStop2)

below2 = ta.crossover(xATRTrailingStop2, ema2)

buy1 = src > xATRTrailingStop1 and above1

sell1 = src < xATRTrailingStop1 and below1

buy2 = src > xATRTrailingStop2 and above2

sell2 = src < xATRTrailingStop2 and below2

barbuy1 = src > xATRTrailingStop1

barsell1 = src < xATRTrailingStop1

barbuy2 = src > xATRTrailingStop2

barsell2 = src < xATRTrailingStop2

// plotshape(buy1, title="Buy 1", text='Buy 1', style=shape.labelup, location=location.belowbar, color=color.green, textcolor=color.white, transp=0, size=size.tiny)

plotshape(sell1, title='Sell 1', text='Sell 1', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(buy2, title='Buy 2', text='Buy 2', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// plotshape(sell2, title="Sell 2", text='Sell 2', style=shape.labeldown, location=location.abovebar, color=color.red, textcolor=color.white, transp=0, size=size.tiny)

// barcolor(barbuy1 ? color.green : na)

barcolor(barsell1 ? color.red : na)

barcolor(barbuy2 ? color.green : na)

// barcolor(barsell2 ? color.red : na)

// alertcondition(buy1, "UT Long 1", "UT Long 1")

alertcondition(sell1, 'UT Short 1', 'UT Short 1')

alertcondition(buy2, 'UT Long 2', 'UT Long 2')

// strategy.entry('long', strategy.long, when=buy2)

source = close

length = input.int(20, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

buyEntry = ta.crossover(source, lower)

sellEntry = ta.crossunder(source, upper)

if (ta.crossover(source, lower) )

strategy.entry("BBandLE", strategy.long, stop=lower, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if (ta.crossunder(source, upper))

strategy.entry("BBandSE", strategy.short, stop=upper, oca_name="BollingerBands",comment="BBandSE")

else

strategy.cancel(id="BBandSE")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

lengthTL = input.int(14, 'Swing Detection Lookback')

multTL = input.float(1., 'Slope', minval = 0, step = .1)

calcMethod = input.string('Atr', 'Slope Calculation Method', options = ['Atr','Stdev','Linreg'])

backpaint = input(true, tooltip = 'Backpainting offset displayed elements in the past. Disable backpainting to see real time information returned by the indicator.')

//Style

upCss = input.color(color.teal, 'Up Trendline Color', group = 'Style')

dnCss = input.color(color.red, 'Down Trendline Color', group = 'Style')

showExt = input(true, 'Show Extended Lines')

//-----------------------------------------------------------------------------}

//Calculations

//-----------------------------------------------------------------------------{

var upperTL = 0.

var lowerTL = 0.

var slope_phTL = 0.

var slope_plTL = 0.

var offset = backpaint ? lengthTL : 0

n = bar_index

srcTL = close

phTL = ta.pivothigh(lengthTL, lengthTL)

plTL = ta.pivotlow(lengthTL, lengthTL)

//Slope Calculation Method

slope = switch calcMethod

'Atr' => ta.atr(lengthTL) / lengthTL * multTL

'Stdev' => ta.stdev(srcTL,lengthTL) / lengthTL * multTL

'Linreg' => math.abs(ta.sma(srcTL * n, lengthTL) - ta.sma(srcTL, lengthTL) * ta.sma(n, lengthTL)) / ta.variance(n, lengthTL) / 2 * multTL

//Get slopes and calculate trendlines

slope_phTL := phTL ? slope : slope_phTL

slope_plTL := plTL ? slope : slope_plTL

upperTL := phTL ? phTL : upperTL - slope_phTL

lowerTL := pl ? pl : lowerTL + slope_plTL

var upos = 0

var dnos = 0

upos := phTL ? 0 : close > upperTL - slope_phTL * lengthTL ? 1 : upos

dnos := pl ? 0 : close < lowerTL + slope_plTL * lengthTL ? 1 : dnos

- Zweifelhafte exponentielle bewegliche durchschnittliche Cloud-Crossover-automatische Handelsstrategie

- Lang-Kurzzeit-Strategie für die EMA mit doppelten Zeitrahmen

- Strategie für die Verlagerung des gleitenden Durchschnitts des Rumpfes

- Doppel gleitender Durchschnitt mit optimierter Stop-Loss-Strategie

- Strategie für den Trendbruch von ATR

- Mehrfache gleitende Durchschnitte und RSI-Crossover-Handelsstrategie

- Der Wert des Wertes des Wertes des Wertes des Wertes des Wertes des Wertes des Wertes

- Bollinger-Bänder + EMA-Trend nach Strategie

- Trendfolgende Strategie auf der Grundlage des doppelten gleitenden Durchschnitts Crossover und des Multi-Timeframe-DMI-Indikators

- Die Unterstützung/Widerstands-Psychologie-Candlestick Feedback-Geldmanagement-Strategie

- Strategie zur Filterung von Kerzenmustern

- Doppel gleitender Durchschnittstrend nach Strategie

- Dynamische Stop-Loss- und Take-Profit-Strategie auf der Grundlage eines doppelten ATR-Trailing-Stops

- MACD+EMA Mehrzeitrahmen-Breakout-Strategie

- Unfehlbarer Sieg DCA-Strategie für Dynamik und Volatilität

- Multi-Timeframe Trend Trading Strategie auf Basis von MACD, ADX und EMA200

- RSI-Doppelrichtungs-Handelsstrategie mit anfänglichem Stop Loss

- Automatische Vorhersage der Stop-Loss-Strategie für die langen und kurzen Ziele auf der Grundlage von 9:15 High/Low

- SMC-Strategie, die MACD und EMA kombiniert

- Dynamische Multi-SMA- und MACD-basierte XAUUSD-Handelsstrategie