概述

这是一个利用ATR指标和收盘价来捕捉趋势突破的量化交易策略。该策略通过动态计算上下趋势线来判断趋势方向,当收盘价突破趋势线时产生交易信号。该策略同时设置止损和目标价位,并可根据波动性进行移动止损。

策略原理

- 计算ATR信号: atr_signal = atr(atr_period)

- 计算上下趋势线:

- 下趋势线: lower_trend = low - atr_mult*atr_signal

- 上趋势线: upper_trend = high + atr_mult*atr_signal

- 动态调整趋势线,如果趋势线突破则保持不变,否则更新为最新值

- 根据收盘价与趋势线的相对位置给趋势线标色,用于判断趋势方向

- 产生交易信号:

- 做多信号: 当前无持仓且收盘价突破上趋势线

- 做空信号: 当前无持仓且收盘价突破下趋势线

- 设置止损和目标价:

- 止损: 最新交易价 ± 突破时ATR波动幅度factor

- 目标价: 最新交易价 ± 止损幅度 * 盈亏比rr

- 移动止损:

- 多头止损: 最高上趋势线

- 空头止损: 最低下趋势线

优势分析

- 基于波动率动态调整趋势线,适应不同市场状态

- 趋势线具有方向性的颜色标记,便于识别趋势

- 使用ATR作为波动率衡量,设置合理的止损和目标价

- 移动止损功能,在保证利润的同时尽可能降低回撤

- 参数化程度高,适应不同品种与周期

风险分析

- 趋势突破策略在震荡市容易产生过多信号导致亏损

- ATR参数选取不当可能导致趋势线过于敏感或迟钝,影响信号质量

- 固定的盈亏比可能无法适应不同的市场特征

- 移动止损可能割肉离场,错失趋势行情

解决方法: 1. 引入趋势过滤或震荡指标辅助判断,避免震荡市亏损 2. 根据品种与周期特性,分别优化ATR参数 3. 优化盈亏比和移动止损逻辑,提高策略收益风险比 4. 可结合趋势识别方法改进移动止损,捕捉更多趋势利润

优化方向

- 结合多时间周期,用大周期识别趋势,小周期触发信号

- 趋势线突破前加入量价指标验证,提高信号有效性

- 优化仓位管理,增加波段操作

- 对止损与盈亏比进行参数寻优

- 改进移动止损逻辑,减少趋势行情中过早止损

多时间周期有助于过滤噪音,趋势把握更稳定。突破前的量价指标验证可剔除虚假信号。仓位管理的优化可提高资金利用效率。止损与盈亏比参数的优化可改善策略收益风险比。移动止损逻辑的改进则可在控制回撤的同时获得更多趋势利润。

总结

该策略以ATR作为波动率衡量,动态调整趋势线位置,捕捉趋势突破行情。合理设置止损与盈利目标,并采用移动止损锁定利润。参数可调,适应性强。但趋势突破策略也容易受到震荡行情的影响,需要进一步优化与改进。可通过结合多周期、筛选信号、优化仓位管理、参数寻优等方式提升策略绩效和稳定性。量化策略需要在理解策略本质的基础上,不断测试与优化,力求为初学者提供更多思路与方向。

策略源码

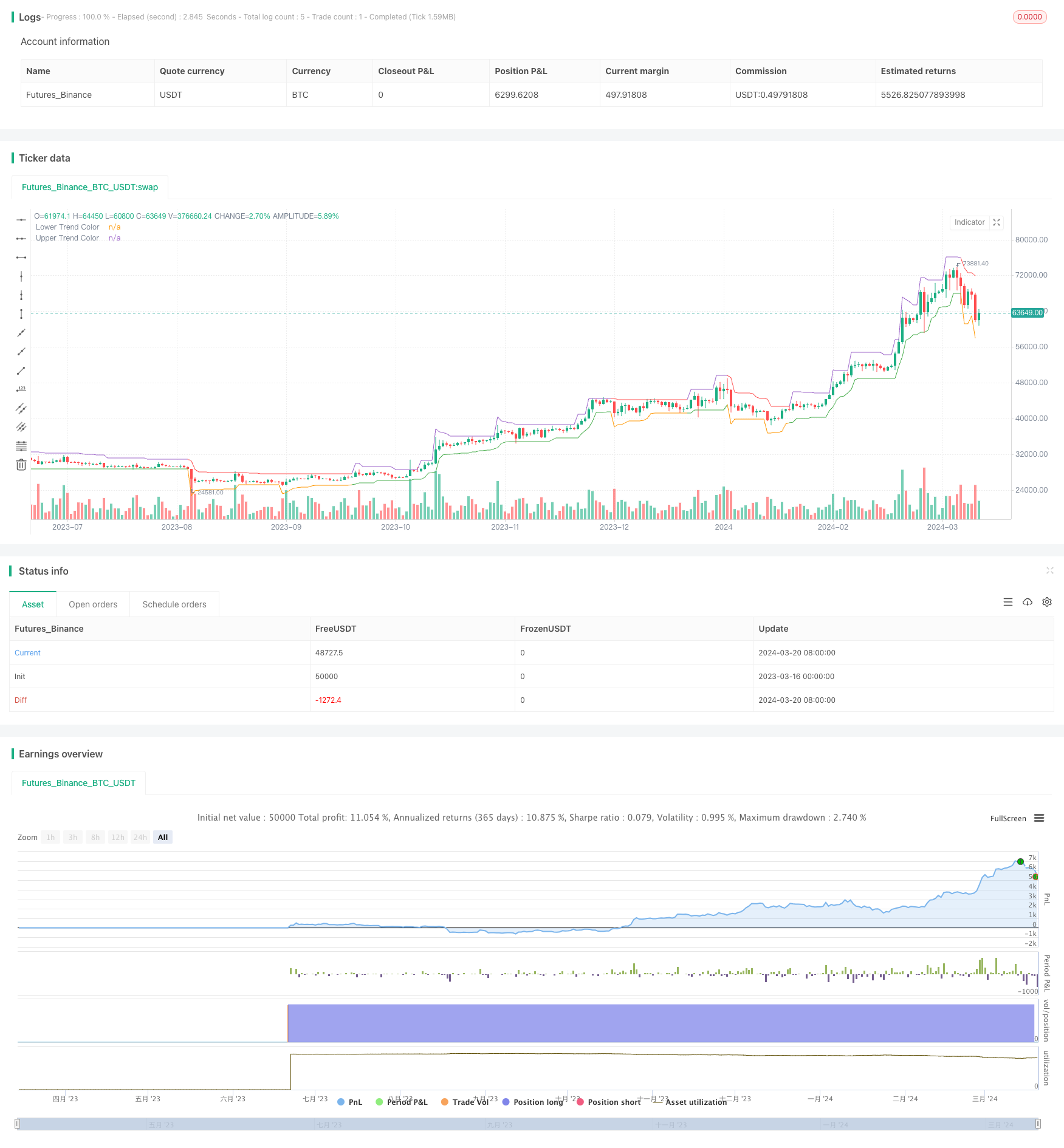

/*backtest

start: 2023-03-16 00:00:00

end: 2024-03-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = "Claw-Pattern", overlay=true, calc_on_every_tick=true, default_qty_type= strategy.percent_of_equity,default_qty_value=10, currency="USD")

//Developer: Trading Strategy Guides

//Creator: Trading Strategy Guides

//Date: 3/18/2024

//Description: A trend trading system strategy

atr_period = input(title="ATR Period", defval=120, type=input.integer)

atr_mult = input(title="ATR Multiplier", defval=2, type=input.integer)

dir = input(title="Direction (Long=1, Short=-1, Both = 0)", defval=1, type=input.integer)

factor = input(title="Stop Level Deviation (% Chan.)", defval=0.75, type=input.float)

rr = input(title="Reward to Risk Multiplier", defval=2, type=input.integer)

trail_bar_start = input(title="Trail Stop Bar Start", defval=20, type=input.integer)

col_candles = input(title="Enable Colored Candles", defval=false, type=input.bool)

atr_signal = atr(atr_period)

lower_trend = low - atr_mult*atr_signal

upper_trend = high + atr_mult*atr_signal

upper_trend := upper_trend > upper_trend[1] and close < upper_trend[1] ? upper_trend[1] : upper_trend

lower_trend := lower_trend < lower_trend[1] and close > lower_trend[1] ? lower_trend[1] : lower_trend

upper_color = barssince(cross(close, upper_trend[1])) > barssince(cross(close, lower_trend[1])) ? color.red : na

lower_color = barssince(cross(close, upper_trend[1])) > barssince(cross(close, lower_trend[1])) ? na : color.green

trend_line = lower_trend

plot(lower_trend, color=lower_color, title="Lower Trend Color")

plot(upper_trend, color=upper_color, title="Upper Trend Color")

is_buy = strategy.position_size == 0 and crossover(close, upper_trend[1]) and upper_color[1]==color.red and (dir == 1 or dir == 0)

is_sell = strategy.position_size == 0 and crossover(close, lower_trend[1]) and lower_color[1]==color.green and (dir == -1 or dir == 0)

if is_buy

strategy.entry("Enter Long", strategy.long)

else if is_sell

strategy.entry("Enter Short", strategy.short)