Building and implementing portfolio optimization using trading volume

Author: FMZ~Lydia, Created: 2024-11-11 13:56:43, Updated: 2024-11-11 13:58:40Although portfolio optimization usually focuses on risk and return forecasting, implementation costs are critical. However, forecasting transaction costs is challenging because for large investors, the biggest component is the price effect, which depends on the size of the transaction, the volume of other traders in it, and the identity of the trader, thus hindering a general solution. To address this problem, in August 2024, Rusian Goyenko, Bryan Kelly, Tobias Moskowitz, Yinan Su, and Chao Zhang, authors of the study Alphabet of Value-Added Trading, hypothesized that transaction volume is a valuable source of estimated transaction costs, assuming that transaction size is fixed, and that transaction costs should decrease with decreasing transaction volume.

They first pointed out that previous research (Frazzini, Israel, and Moskowitz, 2018) showed that transaction size in addition to daily trading volume (known as market participation in quantitative trading) is a key driver of price-influencing costs, and price-influencing is an incremental function of participation. The smaller the transaction volume, the greater the trader's influence on the price. Thus, the higher the forecast volume, the more amount traders can trade under the same conditions, because the price impact of each transaction is smaller.

Subsequently, the authors introduced a machine learning model used to predict trading volume. Their model was based on recursive neural networks. To predict trading volume, they used technical signals such as backward gains and backward trading volumes, as well as company characteristics that captured abnormal gains found in the literature. They then added indicators of various market-scale or company-level events related to trading volume fluctuations, including upcoming and past earnings reports, and used various neural networks to analyze linear and nonlinear prediction methods to maximize predictability outside the sample.

The authors then demonstrate how to use their model to build portfolios.

In order to quantify the economic significance of trading volume forecasting, we incorporate trading volume forecasting into the portfolio rationality problem. We have created a portfolio framework that uses the mean-difference efficiency function to maximize the net cost performance of the portfolio, where transaction costs are linearly related to participation rates (inspired by theoretical and empirical research in the literature). Optimization weighs the trade costs against the opportunity to not trade.

Similarly, note that in practice, when the transaction cost of one item is high, the other option is to trade something else. For example, if the transaction cost of A is too high, a lower transaction cost of B may be considered. This may be better than not trading, as many of them usually have similar characteristics, so the expected returns are similar, and the fund occasionally needs to trade (for example, for cash flow reasons).

Their sampling period is from 2018 to 2022, i.e. 1,258 days. The cross-section covers about 4,700 species, an average of 3,500 per day, or a total of 4,400,000 observations. Here is a summary of some of their major findings:

Their models are able to accurately predict various trading volumes.

- Price impact costs (assuming transaction size is fixed) are linearly related to participation rates, but nonlinearly related to transaction volume. Very low transaction volumes mean that impact costs are exponentially high, while very high transaction volumes mean that costs are negligible. Machine learning technologies can significantly improve the ability to predict transaction volumes, in part due to the nonlinearity of transaction volumes and their relationship to transaction costs. Big data significantly improves the accuracy of transaction volume predictions.

- Larger companies are more accurate in their forecasts than smaller companies, and smaller companies are not only less liquid on average, but also more difficult to predict and more volatile.

- If the transaction size remains unchanged, the price impact costs for those who demand liquidity are almost infinite (note that the liquidity provider is the opposite, which is why patient trading is important), whereas the impact costs are almost zero when the transaction volume increases.

- When the trading volume is low, the change in the trading volume forecast has a greater economic impact, resulting in asymmetric costs of quantitative forecast errors. However, the opportunity cost of tracking errors or not trading is not related to the trading volume. The combination of these two effects means that the penalty for optimizing a high-valued transaction is greater than the penalty for an undervalued transaction.

- The optimal trade-off between tracking error and tracking error will vary with the size of the portfolio, and the economic impact of trading volume forecasts will also vary. For smaller AUM, tracking error may be relatively less valuable than the economic benefits of trading cost forecasts. For larger AUM, transaction cost considerations dominate.

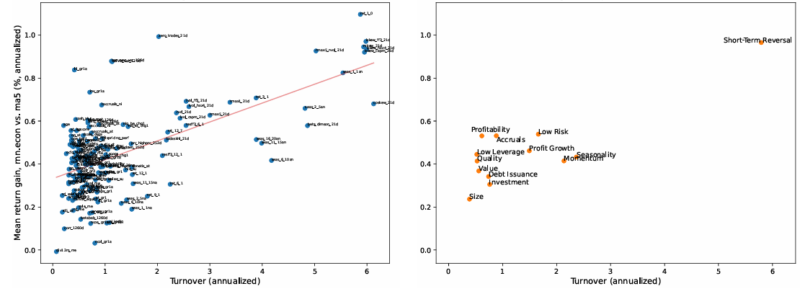

- Factors with a higher volume of transactions (e.g. momentum, short-term reversals) benefit more from portfolio optimization, which takes into account expected transaction costs (see chart) based on volume forecasts.

Graph: Improvement in average returns for each factor portfolio implemented

A. Implementation of combinations of factors B. Average by thematic cluster Each point implements a JKP-factored portfolio. The y-axis is the difference in the average excess return after the cost of implementing rnn.econall and ma5. The x-axis is the turnover rate of the factored portfolio objective (i.e. equation 15 where xi,ttxt = x-1). Panel B averages points 0 in A according to the style cluster (from JKP).

Each point implements a JKP-factored portfolio. The y-axis is the difference in the average excess return after the cost of implementing rnn.econall and ma5. The x-axis is the turnover rate of the factored portfolio objective (i.e. equation 15 where xi,ttxt = x-1). Panel B averages points 0 in A according to the style cluster (from JKP).

Results are hypothetical outcomes, not indicators of future outcomes, and do not represent any actual returns for investors. The index is not managed, does not reflect management or transaction fees, and investors cannot invest in the index directly.

- Volume alpha is very significant. The marginal improvement in volume alpha for a portfolio is as large as the discovery return alpha. For example, for a $1 billion fund, the performance improvement of the portfolio after cost deduction may be as high as twice the expected return or the Sharpe ratio after cost deduction. In the prevailing asset pricing model, the use of a moving average of deferred turnover to predict future trading, cost after return improvement ranges from 20 basis points to 100 basis points.

The results of their study lead the authors to conclude:

We found that trading volume forecasts are as valuable as earnings forecasts in achieving an optimal mean-difference portfolio after deduction of transaction costs. We found that incorporating the economic objective function directly into machine learning is more effective for obtaining useful forecasts. This feature may be applicable to many financial applications of machine learning, in which incorporating the economic objective directly may lead to a two-step process of first meeting a statistical objective and then incorporating a statistical object into the economic framework. For trading volume forecasts, the asymmetric costs between overvalued and undervalued transactions are captured by economic statistical objectives (ignored) and have considerable economic impact.

Summary

The paper "Trading Volume Alpha" makes a significant contribution to the volume literature. The authors provide a clear and concise overview of the existing literature. They also propose a novel machine learning model for predicting trading volume. Their findings have the potential to fundamentally change the way quantitative trading is constructed and implemented.

A more comprehensive search for predictive variables and a more accurate prediction of trading volume models may yield greater economic benefits than what we have shown here. Some promising additional features and method candidates include quantifying leading-lagged trading volume relationships between trades, more seasonal indicators, other market microstructure variables, and more sophisticated nn and rnn models.

The original link:https://alphaarchitect.com/2024/11/trading-volume/

- Inventors announce an API upgrade for their quantitative trading platform

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (3)

- When retesting, the data selects a real disk-level error 5416072

- Is this error occurring when the minimum transaction volume is set to 0.01?

- Please teach me the problem of reporting the error in the Bitcoin balance sheet.

- Please teach me JS code problems.

- Metcalfe's law in Bitcoin

- Rethinking Bitcoin's trend tracking and mean return strategy

- How many bitcoins should we allocate to the portfolio?

- How to profit from Bitcoin overnight trading?

- Why is the page always crashing?

- How do you update the parameters of a running disk?

- AI case studies: the strategy of multiple heads

- Strategy coding, professional quantification, former central company programmer, professional reliability.

- Simple versus advanced trading strategies - which is better?

- Python library for quantifying transactions

- Ornstein-Uhlenbeck simulation with Python

- Learn the PINE code, please ask what is the problem with the stop loss setting? Stop loss is not executed when retested, stop loss is executed when played, but subsequently does not open a straightforward, uninterrupted position according to the conditions.

- pine multi-cycle

- Summary of futures exchange orders and hold interface query details