Python's chase and kill strategy

Author: Inventors quantify - small dreams, Created: 2020-01-11 14:49:08, Updated: 2024-12-12 20:57:43

Python's chase and kill strategy

Trend strategies generally use a variety of indicators to judge the direction of the market, using the results of the numerical contrast of each indicator as trading signals. This avoids the use of parameters, calculating indicators. Since parameters are used, there will be a fit. The strategy performs very well in some markets, but if the market trend is very unfriendly to the current parameters, it may perform very poorly.

This is the code of the strategy:

import time

basePrice = -1

ratio = 0.05

acc = _C(exchange.GetAccount)

lastCancelAll = 0

minStocks = 0.01

def CancelAll():

while True :

orders = _C(exchange.GetOrders)

for i in range(len(orders)) :

exchange.CancelOrder(orders[i]["Id"], orders[i])

if len(orders) == 0 :

break

Sleep(1000)

def main():

global basePrice, acc, lastCancelAll

exchange.SetPrecision(2, 3)

while True:

ticker = _C(exchange.GetTicker)

if basePrice == -1 :

basePrice = ticker.Last

if ticker.Last - basePrice > 0 and (ticker.Last - basePrice) / basePrice > ratio :

acc = _C(exchange.GetAccount)

if acc.Balance * ratio / ticker.Last > minStocks :

exchange.Buy(ticker.Last, acc.Balance * ratio / ticker.Last)

basePrice = ticker.Last

if ticker.Last - basePrice < 0 and (basePrice - ticker.Last) / basePrice > ratio :

acc = _C(exchange.GetAccount)

if acc.Stocks * ratio > minStocks :

exchange.Sell(ticker.Last, acc.Stocks * ratio)

basePrice = ticker.Last

ts = time.time()

if ts - lastCancelAll > 60 * 5 :

CancelAll()

lastCancelAll = ts

LogStatus(_D(), "\n", "行情信息:", ticker, "\n", "账户信息:", acc)

Sleep(500)

Strategy is simple analysis

The strategy is very simple, it doesn't use any indicators, it just uses the current price as the basis for triggering the trade, and the main parameter is only one.ratioControl the opening trigger.

Do more triggers:

if ticker.Last - basePrice > 0 and (ticker.Last - basePrice) / basePrice > ratio

Using the current price, contrast the base price, when the current price is greater than the base price and the price is aboveratio * 100 %When you click on the link, you can click on more links.

After placing the order, the basic price is updated to the current price.

The blank card triggered:

if ticker.Last - basePrice < 0 and (basePrice - ticker.Last) / basePrice > ratio

The same principle applies when the current price is lower than the base price and the price is higher than the base price.ratio * 100 %When you click on the button, you can see the empty list.

After placing the order, the basic price is updated to the current price.

The amount of money available for each orderratio * 100 %I'm not sure.

Unless the next order calculated is less than the minimum transaction volume set by the parameterminStocksI'm not sure if I'll be able to make it or not.

This allows the strategy to follow price changes and chase them downwards.

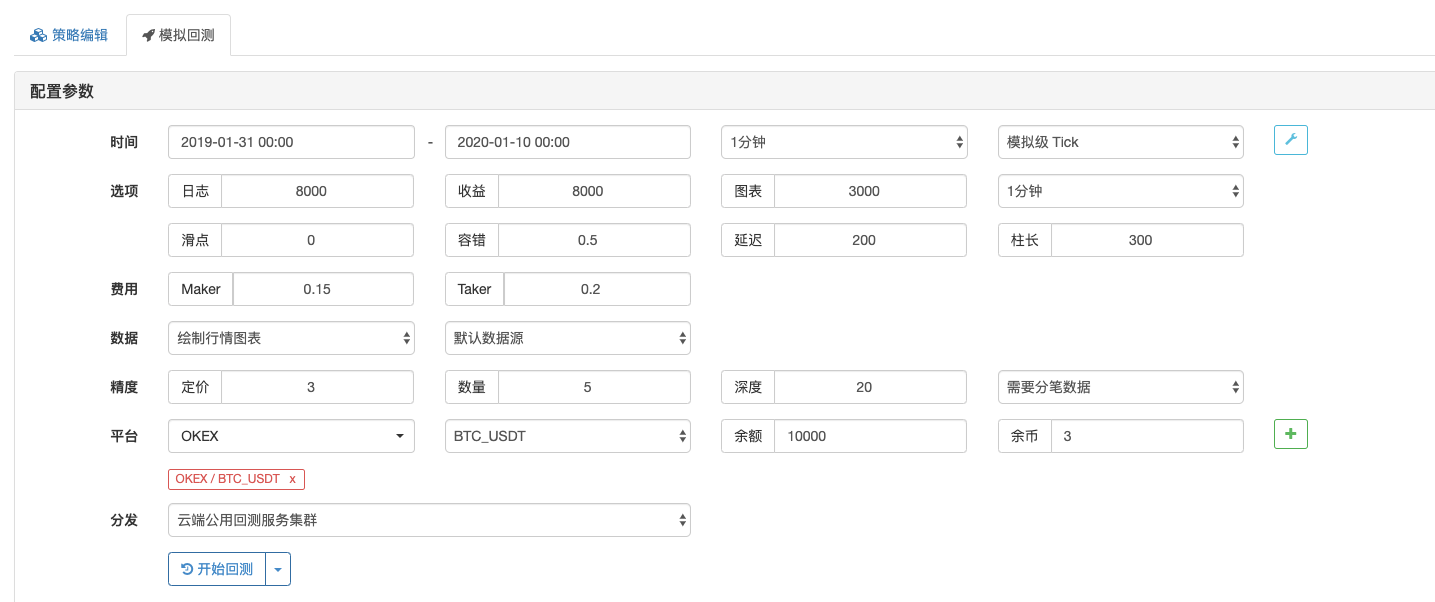

Re-tested

The review period is about one year.

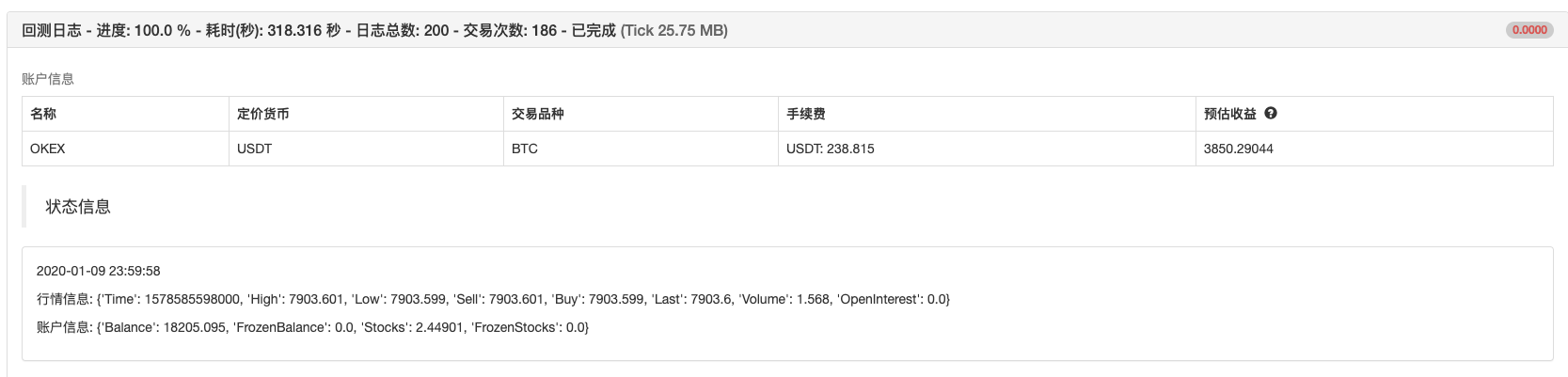

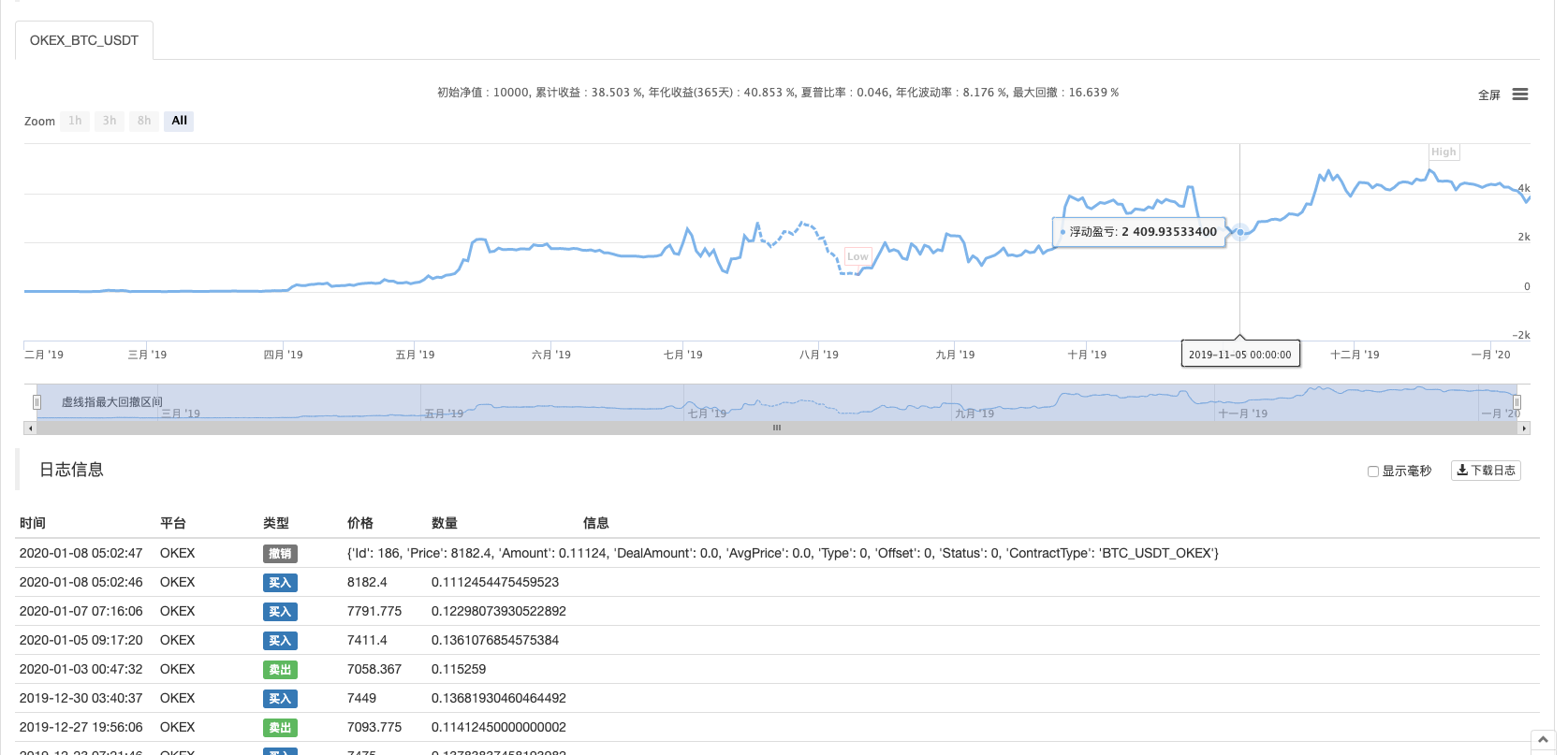

The results:

Recent users have said that there are fewer Python strategies, and they have since shared more of the strategies written in Python. The strategy code is also very simple, very suitable for inventors to quantify beginner learning. The policy address:https://www.fmz.com/strategy/181185

The strategy is for reference learning only, retesting tests, and interest in optimizing upgrades.

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (2)

- Introduction to the Lead-Lag suite in the digital currency (2)

- Discussion on External Signal Reception of FMZ Platform: A Complete Solution for Receiving Signals with Built-in Http Service in Strategy

- Discussing FMZ platform external signal reception: a complete set of strategies for the reception of signals from built-in HTTP services

- Introduction to Lead-Lag Arbitrage in Cryptocurrency (1)

- Introduction to the Lead-Lag suite in digital currency (1)

- Discussion on External Signal Reception of FMZ Platform: Extended API VS Strategy Built-in HTTP Service

- External signal reception on FMZ platforms: extended API vs. built-in HTTP services

- Discussion on Strategy Testing Method Based on Random Ticker Generator

- Strategy testing methods based on random market generators explored

- New Feature of FMZ Quant: Use _Serve Function to Create HTTP Services Easily

- The strategy of cross-currency arbitrage based on the Brin Belt

- Timing start or stop widgets for quantified trading robots using Python

- Corrupt Sisters Speak at the First Session of the General Assembly

- Quantitative fractional rate trading strategy

- The Python spreadsheet platform balancing strategy

- The old farmer's journey to the pit

- The story of a post-95 coin collector

- Hands-on teaches you how to convert a Python single-variety policy into a multi-variety policy.

- My automation loss and FMZ shore trip

- FMZ heartbeat pathway - leap forward strategy included

- Python version of simple grid policy

- Quantified trading tools for open-source digital currency options

- Handshake teaches you how to write a K-line syntax in Python

- Handshake teaches you how to add support for multiple charts to a policy

- Linear hang single-stream strategy based on data playback feature development

- Hands-on to teach you how to transplant a Macanese language strategy (progress)

- Q&A about how to get started with cryptocurrency

- Inventors Quantify FMex Mining Strategy and Use Guide

- Cross-currency hedging strategies in blockchain asset quantification

- Modified Deribit futures API to accommodate options quantitative trading