Swing trading and swing trading

Author: Inventors quantify - small dreams, Created: 2017-04-07 16:30:41, Updated:Swing trading and swing trading

But every time I think of these so-called "old-timers" losing money on their own trades, I can't help but whine, all the training courses are talking about these three classic trading skills, why do so many investors still win and lose so much in the market?

- #### Today, we're going to focus on the ups and downs of trading.

What is a bullish trend? It is the so-called trend in the market, and the trend trading means following the direction of the bullish trend to trade, for example, the euro and the dollar in the uptrend, Liu Xiaobo told us that in this case, you can only do more and not do nothing, this is the trend trading.

But why do the investors who trade in the bullish trend still lose money? Because all investors who simply stick to the bullish trend, I can only define them as novice investors. The law of win and lose tells us that 80% of the novice investors lose money, you don't lose money, how do the remaining 20% make money, and how do we get into the winning 20%?

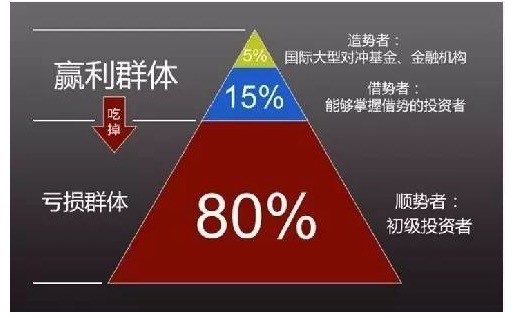

Let's look at a picture first:

The chart above shows who is the winner and who is the loser in the financial investment sector.

From the perspective of trend trading, the long-term stable and profitable group is made up of the buyer and the borrower, while the long-term loss-making group is made up of the progressive trader. 5% of the buyer, such as large international hedge funds, financial institutions, or colloquially, Soros, Buffett, VC, they have billions and billions of dollars, they can move the market, but it is impossible for the general investor to fit into this 5% group, and our retail goal is to go from 80% of the initial buyer to 15% of the buyer.

First of all, you have to understand the trends. There are many ways to determine trends, the simplest of which is to judge by the MA (average line), while others do not use any indicator to judge the K line with the naked eye. There are also different trends in different cycle charts, such as the one-hour cycle chart, the trend is downward, but in the chart the trend is still up, the downward trend of the small cycle may be just a small reversal in the big cycle trend.

This article will not be about how to judge trends, but rather tell the novice investor a market law that when you want to enter a trade, which is when you think it is a moment of good luck, you want to understand one thing: the vast majority of investors will also think of the current trend as a so-called bullish bullish trade, where the market should continue to move forward as expected, and you will take full advantage of it.

However, in the eyes of the 5% of the wolves, you are one of the many wolf sheep, and when the wolves show their fangs, they simply observe that the flock is not big enough, and when the profit is rich enough and the fat lamb is attractive enough, they immediately make a fuss.

How can we take advantage of the trend? The above article mentions that understanding the trend is not easy, but it is still difficult to really take advantage of the trend, which requires continuous learning, research and practice.

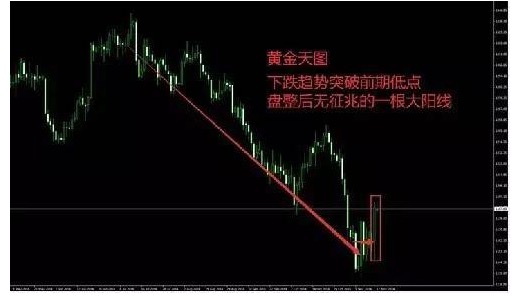

The chart above shows the sudden rise of gold in the hours before the end of the week on November 14, 2014 (Friday) near the end of the week, with hundreds of thousands of hands trading. According to the axiom of smooth trading, the big trend is downward, after breaking the previous low, it should continue downward, but at this time, the makers choose to do more, analysts interpret the Swiss gold referendum, or the US Michigan consumer confidence data that night is a new 12-year low.

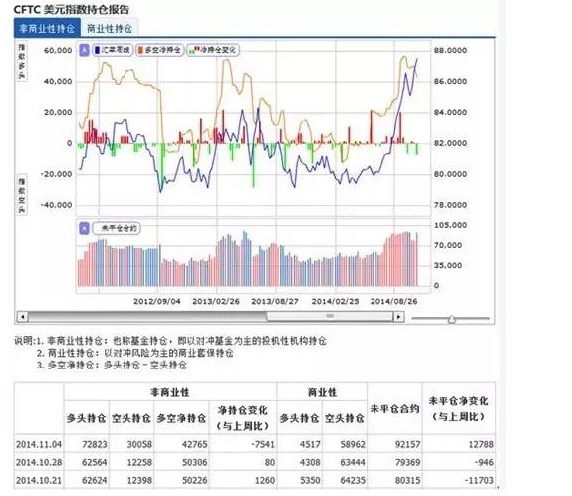

In the first week of November, based on the non-commercial holdings of the CFTC dollar index, the multi-headed holdings increased by 10,000 hands, but it is worth noting that the number of empty holdings increased significantly, increasing to 18,000 hands in a single week. This effort also created the largest single-week increase in empty holdings since the beginning of the year, indicating that the institution has already moved to the US dollar.

The above two graphs are just an example of how it takes a lot of study and research to get the momentum of a 5% buyer. If you really like trading and want to survive in the financial markets for a long time, or if you want to get out of a long-term loss state, I suggest you rethink your trading ideas and move from a simple buyer to a buyer.

The main point of this article is that I do not intend and cannot teach the general investor how to judge trends and how to borrow trends through a short article. I just want to advise you through some trading experience, how to win and lose in trend trading. If you are still sticking to the idea of a bullish trend trading bullish as your core idea, then you are really only in the phase of the novice investor, and the 80% of novice investors must be losing money.

(Shared by Sina Blog)

- Playing games

- The Mystery of Leisure

- Sharp is 0.6, should we throw it out?

- Voting is not a matter of time and strategy.

- Can you give an explanation of the parameters of the retest results?

- In the future, the rings will be fixed.

- The various strategies for stopping losses are detailed

- What does a more complete trading system include?

- From exploiting the vulnerabilities of the delivery system to the combination of cross-term leverage, this is how the good guys play copper.

- Subjective and quantitative, synthetic and comparative

- How to use a template for drawing two Y-axes

- 7 issues to consider when dealing in virtual currency

- We hope to support the Bitmex platform

- Support for Coinbase and itbit

- MacD, please look at this.

- Indicator of the performance of trading algorithms -- Sharpe ratio

- A new kind of grid trading law

- I feel like you guys cut the cabbage, and I'm still holding the coin.

- Systematically learn regular expressions (a): basic essay

- Python and the Simple Bayes Application