Voting is not a matter of time and strategy.

Author: Inventors quantify - small dreams, Created: 2017-04-17 15:12:19, Updated:Voting is not a matter of time and strategy.

The youngsters are very enthusiastic about the game, but many of them are still biased. Don't rush, listen to the students slowly.

- ###############################################################################################################################################################################################################################################################

Some fund companies neglect to invest for 20 years, and even more so, as pension money. The fund company wants your management fees, of course, they want you to hold for as long as possible, and we want to be responsible and think independently.

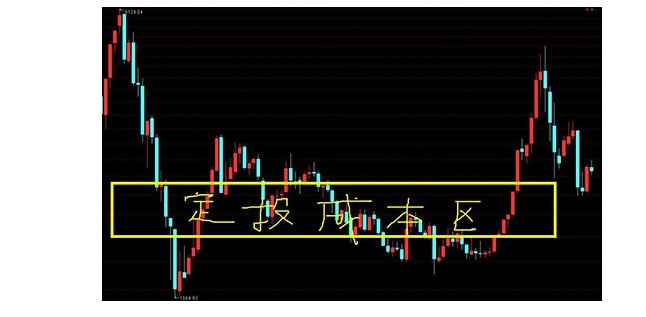

First of all, we should know that the purpose of fixed bids is to equalise costs.

Let's say you invest 1000 yuan every month for 10 years. The next 1000 yuan is only 1/121 of the total investment. Even if you buy the last 1000 yuan at the lowest point, the average cost of the investment will play a small role.

(To quote, you don't have to start with the lowest point. The same goes for the high and low of your first 1000 yuan investment point, which has little impact on your future total earnings. We are looking for a relatively low area.)

What's even more tragic is that if you've invested for 10 years, and the total investment is already huge, a slight drop in the net worth of the fund can lead to a significant decrease in your total return. This is not only economically unacceptable, but also a test of psychological resilience.

In fact, if I were to invest in the country, I would start investing on December 27, 2007, and I would invest 2000 yuan a month, and I have a total profit of 31954.61 yuan to date.

If I choose to redeem it on June 1, 2015, the total profit can be up to 138670 yuan.

You need to have a concept of the cost of investing, and look at the chart below, when should you sell first. Of course, when you look for an opportunity, you sell, and when you fall, you waste a big profit opportunity.

The more time it takes, the worse the effect may be.

- #### ## ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ### ###

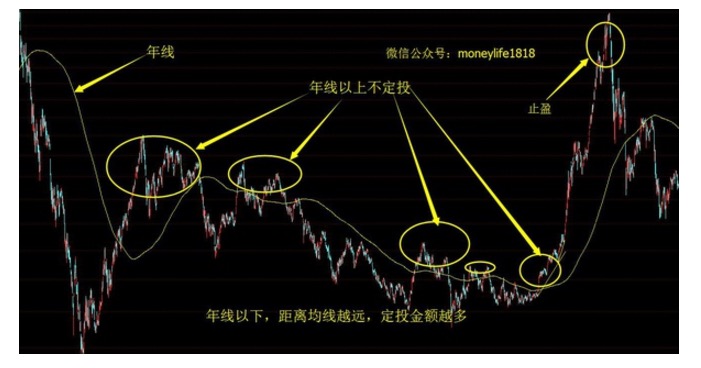

The previous article also mentioned some strategies for investing, and a simple one. Use the even line calendar to set the amount of investments you buy.

The annual line is the 250-day average line, the average line does not invest, the average line is invested. At the same time, the further below the average line, the greater the investment amount can be.

Please note:

1. Select a reference index that matches the style of the fund. The Shenzhen 300 represents the value of the large disk, the S&P 500 represents the value of the medium disk, the S&P 500 represents the growth of the medium disk, and the S&P 500 represents the growth of the small disk.

2.应选择长期均线作为参考,短期均线效果不明显

3.均线定投法的定投次数有所减少,应在年线以下逐步加大投资金额,实现更大的收益。

- ###############################################################################################################################################################################################################################################################

If someone tells you that betting will make you a millionaire in 20 years, they are lying to you.

If you start with a mechanical investment in 1991 and a few rounds of bulls and bears, by the end of 2015, it will be exactly 25 years. The cumulative return on investment is 250.18% and the annual rate of return is only 5.15%.

In fact, it is a compulsory savings, an upgrade of the zero-account banking system. Although it is known as a "silly investment", it is not a good idea if you are too silly.

We must constantly monitor the market dynamics, redeem funds at relatively high levels and start investing again at relatively low levels. At the same time, as I have always stressed, join the strategy of investing, buying more at low points, buying less at high points, and achieving a pyramidal capital structure.

Translated from the original German by:

- Three graphs to understand machine learning: basic concepts, five genres and nine common algorithms

- The consistency of the dividend that determines profitability

- 2.14 How to call an exchange's API

- What do you think of the latest Ethereum and Ethereum platforms?

- null

- Six tips to keep your futures safe overnight

- The gold standard for overnight futures trading (trend trading)

- Playing games

- The Mystery of Leisure

- Sharp is 0.6, should we throw it out?

- Can you give an explanation of the parameters of the retest results?

- In the future, the rings will be fixed.

- The various strategies for stopping losses are detailed

- What does a more complete trading system include?

- From exploiting the vulnerabilities of the delivery system to the combination of cross-term leverage, this is how the good guys play copper.

- Subjective and quantitative, synthetic and comparative

- Swing trading and swing trading

- How to use a template for drawing two Y-axes

- 7 issues to consider when dealing in virtual currency

- We hope to support the Bitmex platform