Dual Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2023-10-17 13:54:05Tags:

Overview

This strategy generates trading signals based on the difference between two moving averages with different timeframes. It calculates a faster SMA and a slower SMA, and produces buy signals when the fast SMA crosses above the slow SMA from below, and sell signals when the fast SMA crosses below the slow SMA from above.

How It Works

The core logic of this strategy is to compute two moving averages, SMA(len1) and SMA(len2), and their difference dif. Here len1 represents the period of the faster MA and len2 the slower MA. The faster MA responds quicker to price changes while the slower MA reflects the long term trend better.

When the faster MA crosses above the slower MA from below, it indicates the short term price has started to rise above the long term trend, and thus a long entry can be taken. When the faster MA crosses below the slower MA from above, it signals the short term price has started to fall below the trend, and a short position can be entered.

To filter out false signals, the strategy also uses out3 as the trading signal line, which is the smoothed difference between the faster MA and price midpoint. Only when out3 crosses dif will trades be triggered.

Specifically, the long variable holds positive values when out3 crosses above dif, giving buy signals. The short variable holds negative values when out3 crosses below dif, generating sell signals. strategy.entry entries long when long signal occurs, and strategy.close closes long when short signal emerges.

Advantage Analysis

This is a very simple and intuitive strategy to follow trends. It uses the crossover of two MAs of different periods to identify trend reversal points, which can be more reliable than a single MA system. The filter of trading signal line also helps avoid false signals in choppy markets to some extent.

Compared to stop loss, it adopts a trend following mindset to maximize profits during longer trends without being stopped out. At the same time, it also controls losses by closing positions in time when trend reverses.

This strategy has few parameters and is easy to understand and tune, making it suitable as a beginner’s algo trading strategy.

Risks and Improvements

The biggest risk of this strategy is improperly chosen MA periods resulting in bad signals. If len1 is too long, early trend moves will be missed; if too short, whipsaws increase. If len2 is too long, position adjustments will be delayed; if too short, it may be disturbed by market noise.

The parameters can be optimized by trying different len1 and len2 values to find the best combination. Adaptive MAs can also be tested to dynamically change periods. The filter can also be improved to further reduce false signals.

Trend following strategies should also control loss on single trades, through stop loss or position sizing.

Conclusion

The dual MA crossover strategy is a quintessential trend following representative. Its simple dual MA crossover system provides steady signals, while the filter helps avoid noise. With optimized MA periods, it can achieve good performance. The strategy serves well as a beginner’s algo trading strategy to learn.

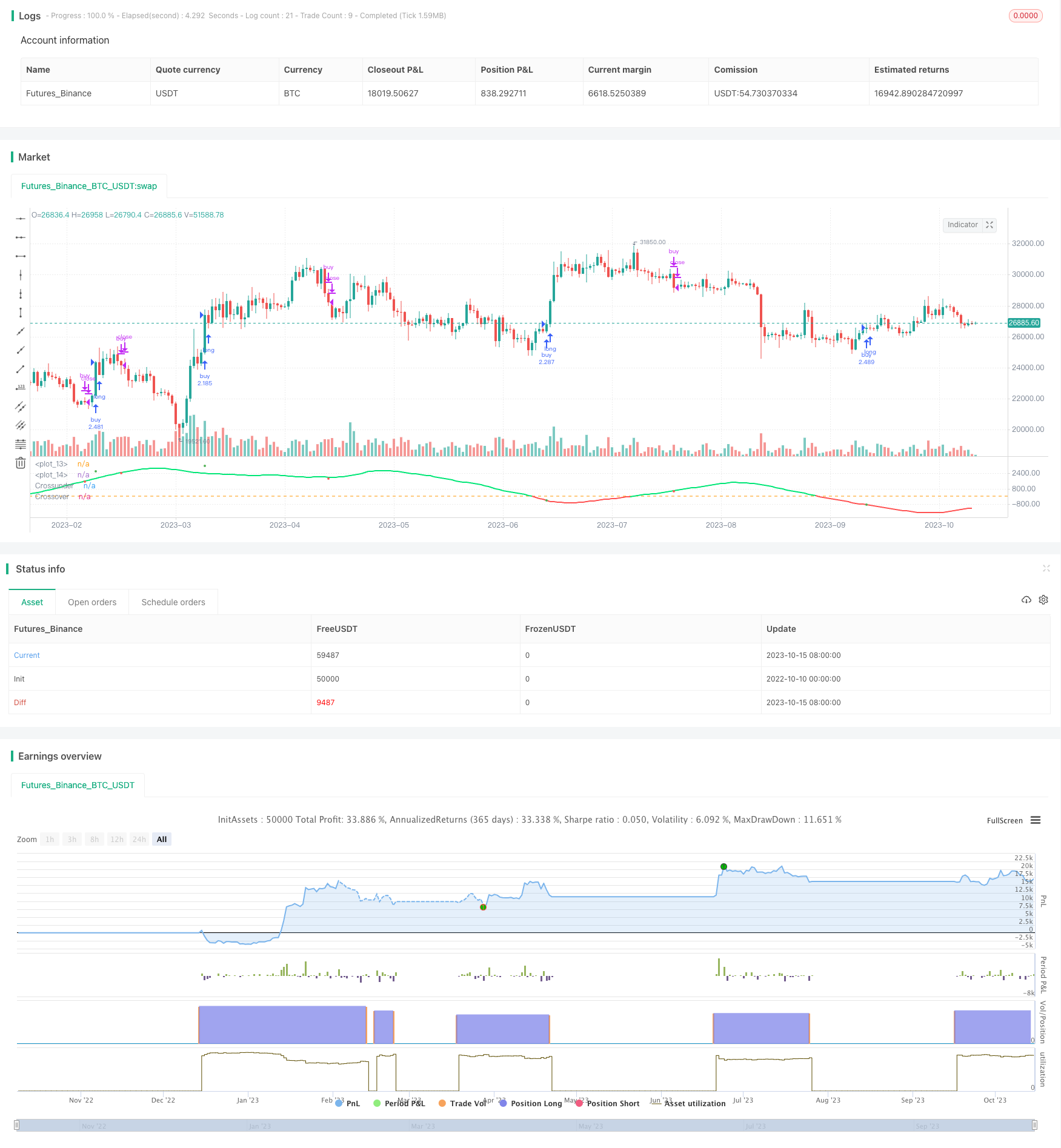

/*backtest

start: 2022-10-10 00:00:00

end: 2023-10-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//by afrazium

//@version=3

strategy(title="SMA Diff strat", shorttitle="SMAD STR", overlay=false, initial_capital=1, precision=8, default_qty_type=strategy.percent_of_equity, default_qty_value=100, commission_type=strategy.commission.percent, commission_value=0.1, calc_on_order_fills= false, calc_on_every_tick=false, pyramiding=0)

len1 = input(50, minval=1, title="Length1"), len2 = input(100, minval=1, title="Length2"), smo = input(1, minval=1, title="Smoothing")

src = input(ohlc4, title="Source")

mid = src

expr1 = sma(src, len1), expr2 = sma(src, len2)

dif = (expr1 - expr2), out1 = (mid - expr1), out2 = (mid - expr2), out3 = sma(out1, smo)

long = crossover(out3, dif) ? out3 : na, short = crossunder(out3, dif) ? out3 : na

plot(out3, color=black, linewidth=2), hline(0)

clr = out2 >= out1 ? lime : red, plot(dif, color=clr, linewidth=2)

plot(long, title = 'Crossover', color = green, style = circles, linewidth=4), plot(short, title = 'Crossunder', color = red, style = circles, linewidth=4)

strategy.entry("buy", strategy.long, when=crossover(out1, dif))

strategy.close("buy", when=crossunder(out1, dif))

//plot(out2, color=blue, linewidth=2)

//A = plot(mid/10, color=red, linewidth=1, transp=100), B = plot(mid/20, color=red, linewidth=1, transp=100)

//C = plot(-mid/10, color=green, linewidth=1, transp=100), D = plot(-mid/20, color=green, linewidth=1, transp=100)

//fill(A, B, color=red), fill(C, D, color=green)

- Adaptive Volatility Finite Volume Elements Strategy

- Trend Tracking Four Elements Strategy

- Double Moving Average Reversal Strategy

- STC MA ATR Integrated Trend Trading Strategy

- Bull Trend Riding Strategy Based on Stochastic RSI with Special Rules for Heavy Bullish Bias

- Short-Mid Term Trend Following Strategy Based on SMA Indicators

- Gold/Silver 30m Trend Following Breakout Strategy

- Adaptive Trend Tracking Stop Loss Strategy

- Short-term Bearish Strategy Based on EMA Crossover and Bear Power Indicators

- Dual EMA Crossover Trading Strategy

- Williams 9 Days Breakout Strategy

- Multi Moving Average Rating Trend Strategy

- Trend Following Maximized Moving Average Crossover Strategy

- Trend Following Buy and Sell Strategy

- He is also a member of the board of directors of the National Association for the Advancement of Science.

- RSI and Moving Average Crossover Multi Timeframe Trading Strategy

- Combo Strategy of 123 Reversal and Smoothed RSI

- Dual EMA Crossover Trading Strategy

- Dynamic ATR Stop Loss Center Line Strategy

- Dual EMA Crossover Strategy