Dynamic CCI Support and Resistance Strategy

Author: ChaoZhang, Date: 2024-01-22 16:37:46Tags:

Overview

This strategy uses the pivot points of the CCI indicator to calculate dynamic support and resistance levels, and combines trend judgment to find buy and sell signals. The strategy integrates the reversal characteristics of CCI and the trend tracking ability to capture reversal points in the medium-term trend for profit.

Strategy Principle

CCI indicator can show whether the market is too weak or too strong. The two extremes of 80 and -80 can be used to determine whether the market has entered an overbought or oversold state. This strategy utilizes this characteristic of CCI. By calculating the pivot points of the left and right 50 bars, the upper and lower pivot points are obtained. Then support and resistance lines are constructed dynamically by adding or subtracting a buffer on the basis of the pivot points.

A buy signal is generated when the close is higher than the open and lower than the upper support level. A sell signal is generated when the close is lower than the open and higher than the lower resistance level. In order to filter out trading signals against the main trend direction, the strategy also combines EMA and slope indicators to determine the current main trend direction. Long entry trades are only placed when the trend is determined as bullish. Short entry trades are only placed when the trend is determined as bearish.

The stop loss and take profit are calculated dynamically based on the ATR indicator, making the risk control of this strategy more reasonable.

Advantage Analysis

- Taking advantage of the reversal characteristic of CCI, entries are made near potential reversal points, increasing the probability of profit.

- Combining with trend judgment avoids trading against the trend and reduces losses.

- Dynamic stop loss and take profit settings make risk control more sensible.

- Customizable parameters such as CCI length, buffer size, etc. adapt to more market environments.

Risk Analysis

- CCI indicator tends to generate false signals, needing the filter from trend judgment.

- Reversals do not always succeed, with certain probability of loss risk.

- Improper parameter settings may lead to over-trading or missing opportunities.

Methods like parameter optimization, adjusting stop loss range, etc. can help reduce risks. Also, this strategy can be used as an auxiliary tool for other indicators, not having to completely rely on its signals.

Optimization Directions

- Optimize buffer size to adapt to markets of different volatility levels.

- Optimize ATR period parameters for more accurate dynamic stop loss and take profit.

- Test different CCI parameter settings.

- Test the effects of other types of trend judgment indicators.

Conclusion

This strategy integrates the long/short screening ability from CCI and the filter confirmation from trend judgment, possessing certain practical value. The dynamic stop loss and take profit also makes the risk controllable when applying the strategy in actual trading. Through parameter optimization and improvements, better results can be expected.

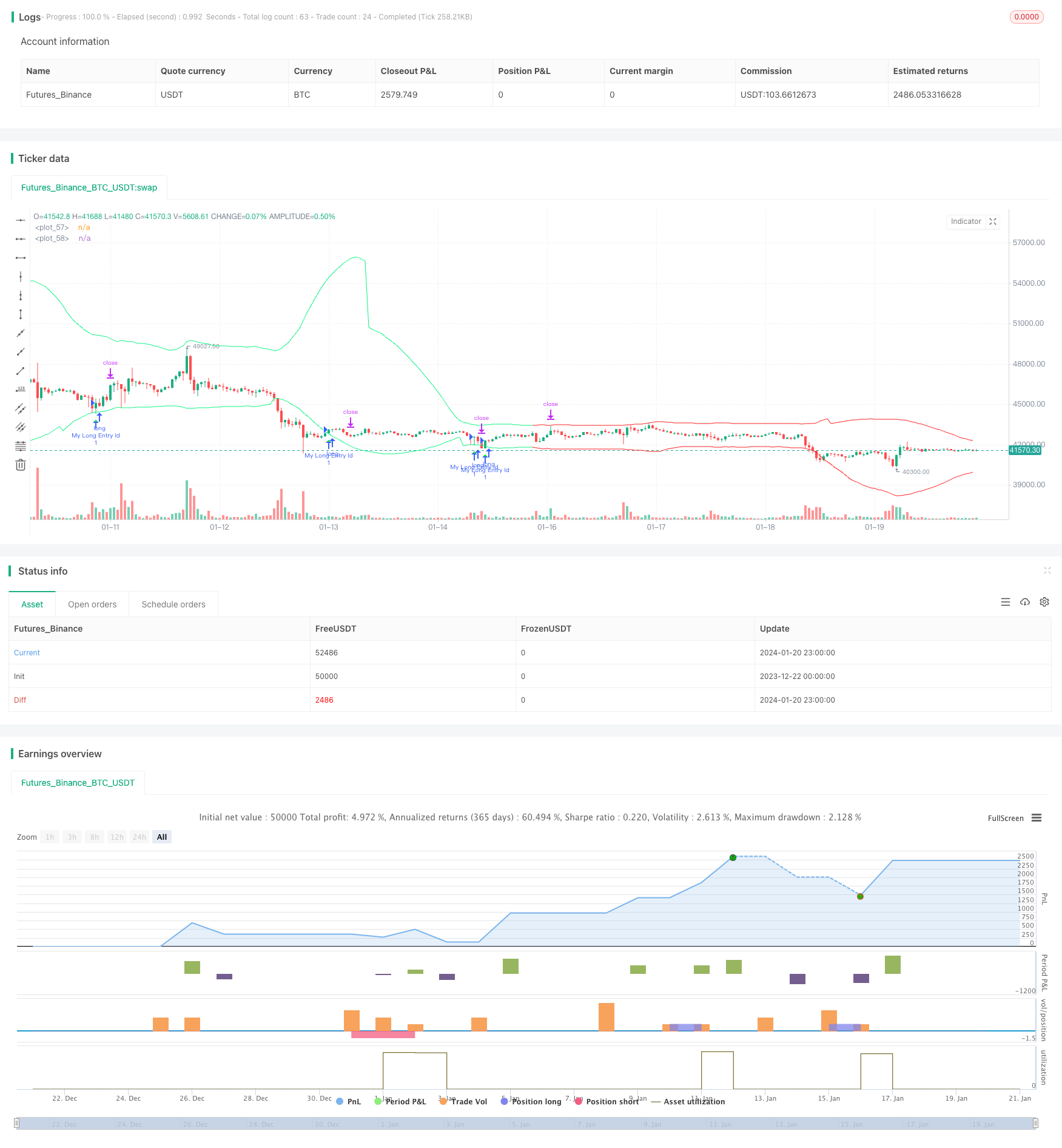

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AliSignals

//@version=5

strategy("CCI based support and resistance strategy", overlay=true )

cci_length = input.int(50, "cci length")

right_pivot = input.int(50, "right pivot")

left_pivot = input.int(50, "left pivot")

buffer = input.float(10.0, "buffer")

trend_matter = input.bool(true, "trend matter?")

showmid = input.bool ( false , "show mid?")

trend_type = input.string("cross","trend type" ,options = ["cross","slope"])

slowma_l = input.int(100, "slow ma length")

fastma_l = input.int(50, "fast ma length")

slope_l = input.int(5, "slope's length for trend detection")

ksl = input.float(1.1)

ktp = input.float(2.2)

restf = input.timeframe(title="Time Frame of Last Period for Calculating max" , defval="D")

// Calculating Upper and Lower CCI

cci = ta.cci(hlc3,cci_length)

uppercci = 0.0

lowercci = 0.0

uppercci := fixnan(ta.pivothigh(cci, left_pivot, right_pivot)) - buffer

lowercci := fixnan(ta.pivotlow (cci, left_pivot, right_pivot)) + buffer

midccci = math.avg(uppercci,lowercci)

// Support and Resistance based on CCI

res = uppercci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

sup = lowercci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

mid = midccci*(0.015*ta.dev(hlc3,cci_length))+ ta.sma(hlc3,cci_length)

// Calculating trend

t_cross = 0

t_cross := ta.ema(close,fastma_l) > ta.ema(close,slowma_l) ? 1 : ta.ema(close,fastma_l) < ta.ema(close,slowma_l) ? -1 : t_cross[1]

t_slope = 0

t_slope := ta.ema(close,slowma_l) > ta.ema(close,slowma_l)[slope_l] ? 1 : ta.ema(close,slowma_l) < ta.ema(close,slowma_l)[slope_l] ? -1 : t_slope[1]

t = 0

t := trend_type == "cross" ? t_cross : trend_type == "slope" ? t_slope : na

colort = trend_matter == false ? color.rgb(201, 251, 0) : t == 1 ? color.rgb(14, 243, 132) : t == -1 ? color.rgb(255, 34, 34) : na

bull_t = trend_matter == false or t == 1

bear_t = trend_matter == false or t == -1

plot(res, color = colort)

plot(sup, color = colort)

plot(showmid == true ? mid : na)

// Long and Short enter condition

buy = bull_t == 1 and ta.lowest (2) < sup and close > open and close > sup

sell = bear_t == 1 and ta.highest(2) > res and close < open and close < res

plotshape( buy , color=color.rgb(6, 255, 23) , location = location.belowbar, style = shape.triangleup , size = size.normal)

plotshape( sell, color=color.rgb(234, 4, 4) , location = location.abovebar, style = shape.triangledown, size = size.normal)

atr = ta.atr(100)

CLOSE=request.security(syminfo.tickerid, restf, close)

max = 0.0

max := CLOSE == CLOSE[1] ? math.max(max[1], atr) : atr

act_atr = 0.0

act_atr := CLOSE == CLOSE[1] ? act_atr[1] : max[1]

atr1 = math.max(act_atr, atr)

dis_sl = atr1 * ksl

dis_tp = atr1 * ktp

var float longsl = open[1] - dis_sl

var float shortsl = open[1] + dis_sl

var float longtp = open[1] + dis_tp

var float shorttp = open[1] - dis_tp

longCondition = buy

if (longCondition)

strategy.entry("My Long Entry Id", strategy.long)

shortCondition = sell

if (shortCondition)

strategy.entry("My Short Entry Id", strategy.short)

longsl := strategy.position_size > 0 ? longsl[1] : close - dis_sl

shortsl := strategy.position_size < 0 ? shortsl[1] : close + dis_sl

longtp := strategy.position_size > 0 ? longtp[1] : close + dis_tp

shorttp := strategy.position_size < 0 ? shorttp[1] : close - dis_tp

if strategy.position_size > 0

strategy.exit(id="My Long close Id", from_entry ="My Long Entry Id" , stop=longsl, limit=longtp)

if strategy.position_size < 0

strategy.exit(id="My Short close Id", from_entry ="My Short Entry Id" , stop=shortsl, limit=shorttp)

- A Dual Moving Average Confirmation Advantage Line Strategy

- Crypto RSI Mini-Sniper Quick Response Trend Following Strategy

- This strategy is a momentum strategy based on moving average lines

- Supply Demand Momentum Reversal Trading Strategy

- Dynamic Momentum Oscillator Trading Strategy

- Trend Following Strategy Based on Moving Average

- Trend Tracking Breakout Strategy

- Reversal RSI Trend Tracking ETF Trading Strategy

- Trend Tracking and Short-term Trading Strategy Based on ADX Indicator

- Momentum Trend Dual Strategy

- QQE Momentum Trading Strategy

- The Gauss Wave Forecasting Strategy

- Dynamic Moving EMAs Combination Quant Strategy

- Donchian Channel Trend Following Strategy

- EMA Ribbon Strategy

- Precise Trend Reversal Moving Average Crossover Strategy

- Multi-EMA Bullish Trend Strategy

- S&P500 Hybrid Seasonal Trading Strategy

- Deviation-Based Trend Tracking Strategy

- RSI Divergence Trading Strategy