Overview

This strategy combines the Relative Strength Index (RSI) and Bollinger Bands indicators to implement a dual confirmation logic for entries and exits. It generates trading signals only when both RSI and Bollinger Bands show overbought or oversold signals at the same time. This can effectively reduce false signals and improve the stability of the strategy.

Strategy Logic

- RSI Judgment Logic

- RSI crossing above 45 is considered oversold signal

- RSI crossing below 55 is considered overbought signal

- RSI crossing above 45 is considered oversold signal

- Bollinger Bands Judgment Logic

- Price crossing above Bollinger Lower Band is considered oversold

- Price crossing below Bollinger Upper Band is considered overbought

- Dual Confirmation Logic

- Long position is opened only when both RSI and Bollinger Bands show oversold signal

- Short position is opened only when both RSI and Bollinger Bands show overbought signal

- Long position is opened only when both RSI and Bollinger Bands show oversold signal

The above logic implements a stable dual confirmation strategy for entries and exits.

Advantage Analysis

The dual confirmation mechanism filters out a lot of noise trades, avoids unnecessary trades, reduces trading costs, and improves profitability.

RSI is effective in identifying trends and reversals. Bollinger Bands is effective in judging supports and resistances. The two complement each other perfectly.

Flexible parameter settings, can be adjusted based on different products and trading preferences, highly adaptable.

Risk Analysis

In ranging markets, RSI and Bollinger Bands may give out wrong signals at the same time, causing unnecessary losses. The misjudgment probability can be reduced by optimizing parameters.

The dual confirmation mechanism slightly increases entry delay, possibly missing very short-term trading opportunities. Not suitable for strategies that are very sensitive to delay.

The strategy is very sensitive to parameters. Inappropriate parameter settings may greatly reduce profitability. Sufficient backtesting and review are needed to find the optimal parameter combination.

Optimization Directions

Test RSI indicators with different periods to find the best matching period parameter to improve efficiency.

Add stop loss logic, set reasonable moving stop loss or fixed stop loss to control single trade loss risk.

Test Bollinger bandwidth parameter to optimize the channel range and improve efficiency.

Test different price inputs like close, high, low etc to find the best price input to enhance stability.

Summary

The strategy successfully combines the RSI and Bollinger Bands indicators to implement a dual confirmation logic, ensuring sufficient trading opportunities while effectively reducing noise trades. With proper parameter optimization and risk control, it can become a very stable and reliable trend tracking and trading strategy.

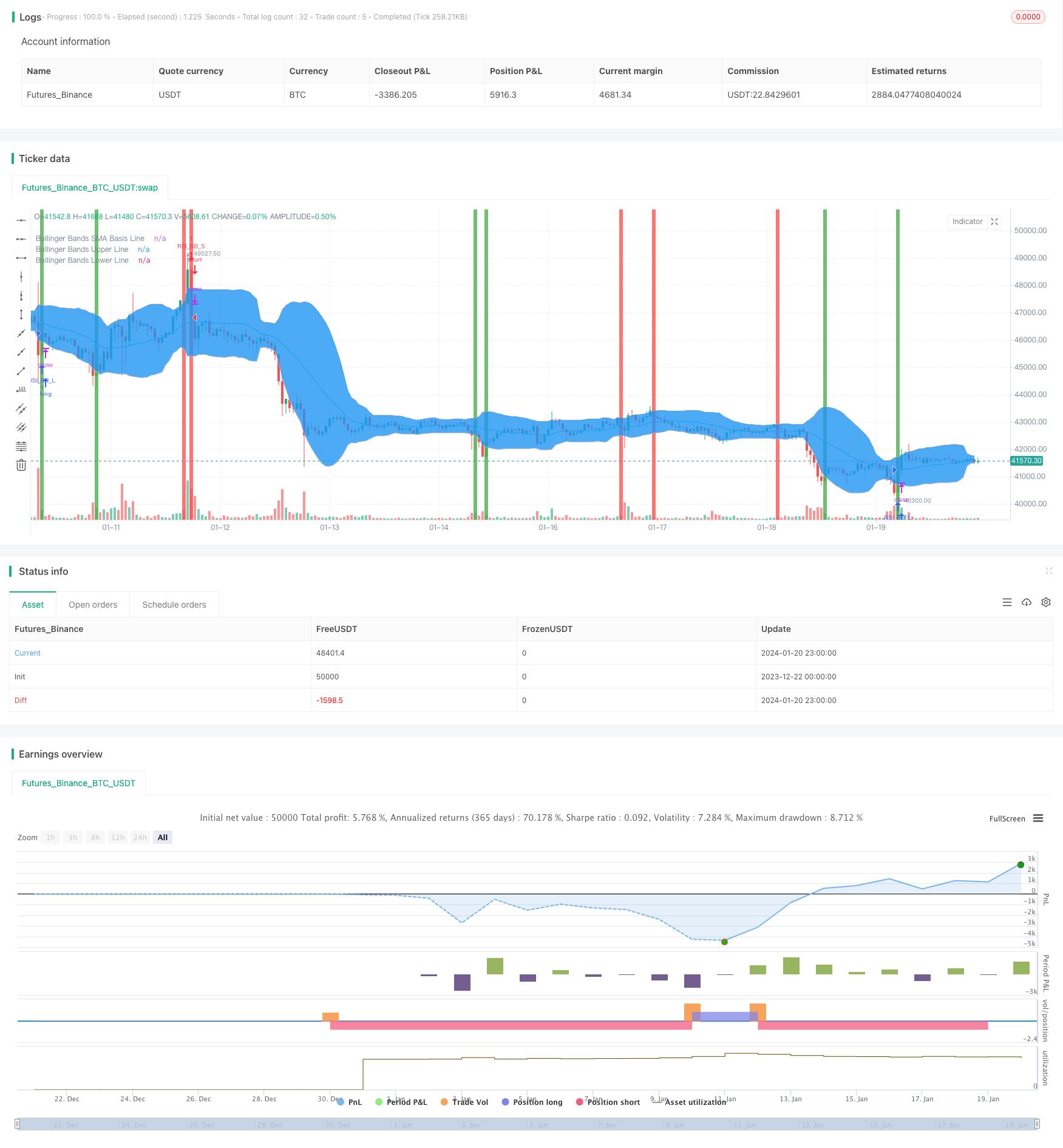

/*backtest

start: 2023-12-22 00:00:00

end: 2024-01-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("Bollinger + RSI, Double Strategy (by ChartArt)", shorttitle="CA_-_RSI_Bol_Strat", overlay=true)

// ChartArt's RSI + Bollinger Bands, Double Strategy

//

// Version 1.0

// Idea by ChartArt on January 14, 2015.

//

// This strategy uses a modfied RSI to sell

// when the RSI increases over the value of 55

// (or to buy when the value falls below 45),

// with the classic Bollinger Bands strategy

// to sell when the price is above the

// upper Bollinger Band (and to buy when

// this value is below the lower band).

//

// This simple strategy only triggers when

// both the RSI and the Bollinger Bands

// indicators are at the same time in

// a overbought or oversold condition.

//

// List of my work:

// https://www.tradingview.com/u/ChartArt/

//

// __ __ ___ __ ___

// / ` |__| /\ |__) | /\ |__) |

// \__, | | /~~\ | \ | /~~\ | \ |

//

//

///////////// RSI

RSIlength = input( 16 ,title="RSI Period Length")

RSIvalue = input( 45 ,title="RSI Value Range")

RSIoverSold = 0 + RSIvalue

RSIoverBought = 100 - RSIvalue

price = close

vrsi = rsi(price, RSIlength)

///////////// Bollinger Bands

BBlength = input(20, minval=1,title="Bollinger Bands SMA Period Length")

BBmult = input(2.0, minval=0.001, maxval=50,title="Bollinger Bands Standard Deviation")

BBbasis = sma(price, BBlength)

BBdev = BBmult * stdev(price, BBlength)

BBupper = BBbasis + BBdev

BBlower = BBbasis - BBdev

source = close

buyEntry = crossover(source, BBlower)

sellEntry = crossunder(source, BBupper)

plot(BBbasis, color=aqua,title="Bollinger Bands SMA Basis Line")

p1 = plot(BBupper, color=silver,title="Bollinger Bands Upper Line")

p2 = plot(BBlower, color=silver,title="Bollinger Bands Lower Line")

fill(p1, p2)

///////////// Colors

switch1=input(true, title="Enable Bar Color?")

switch2=input(true, title="Enable Background Color?")

TrendColor = RSIoverBought and (price[1] > BBupper and price < BBupper) ? red : RSIoverSold and (price[1] < BBlower and price > BBlower) ? green : na

barcolor(switch1?TrendColor:na)

bgcolor(switch2?TrendColor:na,transp=50)

///////////// RSI + Bollinger Bands Strategy

if (not na(vrsi))

if (crossover(vrsi, RSIoverSold) and crossover(source, BBlower))

strategy.entry("RSI_BB_L", strategy.long, stop=BBlower, comment="RSI_BB_L")

else

strategy.cancel(id="RSI_BB_L")

if (crossunder(vrsi, RSIoverBought) and crossunder(source, BBupper))

strategy.entry("RSI_BB_S", strategy.short, stop=BBupper, comment="RSI_BB_S")

else

strategy.cancel(id="RSI_BB_S")

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)