Pete Wave Trading System Strategy

Author: ChaoZhang, Date: 2024-01-25 15:36:16Tags:

Pete Wave Trading System Strategy Overview

The Pete Wave trading system strategy uses fast and slow moving average lines of price to construct trading signals, together with additional filters and stop loss mechanisms to further optimize. The strategy aims to capture medium-term trends by generating buy and sell signals from price average line crossovers. The code also contains breakout confirmation filters, candle body filters, ATR filters, pullback filters and other mechanisms to avoid false breakouts. Overall, the strategy combines the advantages of trend following and breakout trading to effectively capture the trend direction after consolidation.

Pete Wave Trading System Strategy Principles

The strategy uses a fast moving average line (length 9) and a slow moving average line (length 22) to construct golden crossovers (fast line breaking through slow line from below) and death crossovers (fast line breaking through slow line from above) trading signals. A buy signal is generated when the fast line crosses above the slow line, and a sell signal is generated when the fast line crosses below the slow line.

To avoid false breakouts caused by price fluctuations, additional filter mechanisms are added to the code. These include candle body filters that require candle body percentage fluctuations to be greater than 0.5% before generating a signal; pullback filters that check if the price has pulled back a certain amplitude when the fast line and price line crossover to confirm the trend; ATR value filters that require ATRs greater than 0.5 to prove sufficient fluctuation to generate signals.

After the signal is generated, if the breakout confirmation filter is enabled, it will also determine whether the current closing price breaks through the highest or lowest price of the previous N candlesticks to confirm the breakout. Finally, the strategy locks in profits through a trailing stop loss mechanism, which moves the stop loss position based on a certain percentage of the average holding price.

Pete Wave Trading System Strategy Advantages Analysis

The strategy integrates the advantages of moving average trading and trend tracking, and can effectively identify the direction of medium-term price trends. Compared to a single moving average crossover system, combining additional filters can greatly reduce the probability of false signals. Specific advantages are as follows:

-

The combination of moving average crossovers and trend tracking avoids getting caught in volatile markets.

-

Pullback filters and breakout confirmation mechanisms avoid false breakouts.

-

ATR values and candle body filters help identify real fluctuations.

-

The trailing stop loss mechanism can effectively control single trade losses.

Pete Wave Trading System Strategy Risk Analysis

The main risks faced by this strategy are:

-

Sudden market events may trigger stop loss exits. The stop loss distance can be appropriately relaxed.

-

Holding positions for too long without timely profit taking. Shorten the moving average cycle.

-

Quiet market conditions lead to reduced trading signals. Filter standards can be appropriately lowered.

-

Improper parameter optimization results in too frequent or too few trades. Parameters need repeated testing.

Pete Wave Trading System Strategy Optimization Directions

The strategy can be optimized in the following directions:

-

Test parameters separately for different trading varieties, optimize moving average periods and other parameters.

-

Try adding more indicators such as Bollinger Bands, RSI to determine trend direction.

-

Test stop loss mechanism parameters to find the optimal stop loss ratio.

-

Try machine learning methods to automatically generate buy and sell signals.

-

Optimize signal filtering logic to reduce false signal probabilities.

-

Identify more trading opportunities by combining different time frame judgments.

Pete Wave Trading System Strategy Summary

The Pete Wave trading system strategy combines moving average crossovers, trend tracking, additional filters and other methods to build a relatively stable and reliable medium-term trading strategy. Compared to a single technical indicator, this strategy can significantly reduce the noise trades caused by price fluctuations. The added filter mechanisms also avoid the risk of false breakouts. Through parameter testing and rule optimization, this strategy can become a powerful tool for intraday trading. Overall, the Pete Wave trading system strategy has high stability, is suitable for capturing relatively clear medium-term price trends, and is a quantitative strategy worth live trading verification.

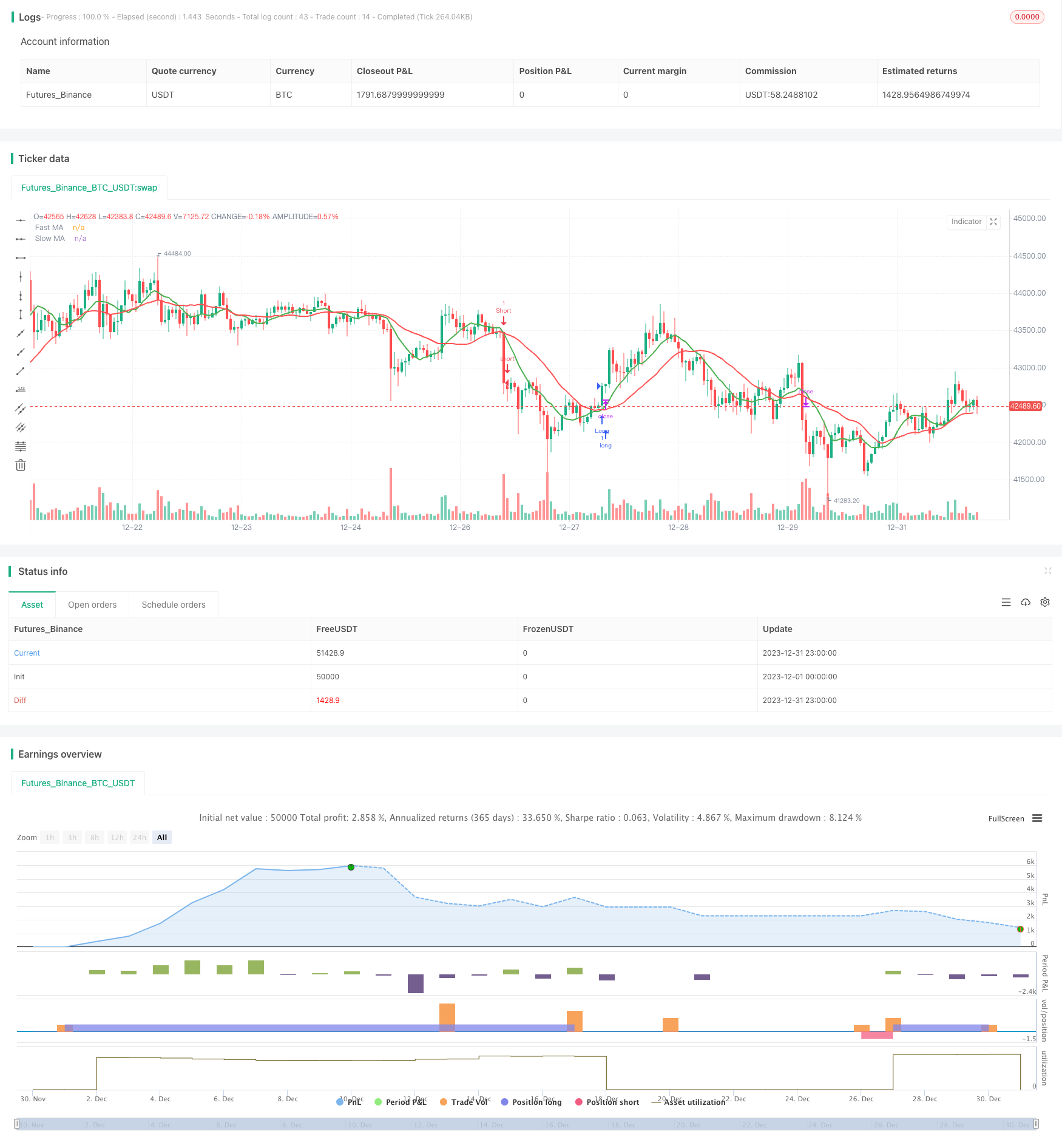

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("9:22 5 MIN 15 MIN BANKNIFTY", overlay=true)

fastLength = input(9, title="Fast MA Length")

slowLength = input(22, title="Slow MA Length")

atrLength = input(14, title="ATR Length")

atrFilter = input(0.5, title="ATR Filter")

trailingStop = input(1.5, title="Trailing Stop Percentage")

pullbackThreshold = input(0.5, title="Pullback Threshold")

minCandleBody = input(0.5, title="Minimum Candle Body Percentage")

breakoutConfirmation = input(true, title="Use Breakout Confirmation")

price = close

mafast = ta.sma(price, fastLength)

maslow = ta.sma(price, slowLength)

atrValue = ta.atr(atrLength)

long_entry = ta.crossover(mafast, maslow) and atrValue > atrFilter

short_entry = ta.crossunder(mafast, maslow) and atrValue > atrFilter

// Pullback Filter

pullbackLong = ta.crossover(price, mafast) and ta.change(price) <= -pullbackThreshold

pullbackShort = ta.crossunder(price, mafast) and ta.change(price) >= pullbackThreshold

// Include pullback condition only if a valid entry signal is present

long_entry := long_entry and (pullbackLong or not ta.crossover(price, mafast))

short_entry := short_entry and (pullbackShort or not ta.crossunder(price, mafast))

// Filter based on candle body size

validLongEntry = long_entry and ta.change(price) > 0 and ta.change(price) >= minCandleBody

validShortEntry = short_entry and ta.change(price) < 0 and ta.change(price) <= -minCandleBody

// Breakout confirmation filter

breakoutLong = breakoutConfirmation ? (close > ta.highest(high, fastLength)[1]) : true

breakoutShort = breakoutConfirmation ? (close < ta.lowest(low, fastLength)[1]) : true

long_entry := validLongEntry and breakoutLong

short_entry := validShortEntry and breakoutShort

if (long_entry)

strategy.entry("Long", strategy.long)

strategy.close("Short")

alert("Long trade iniated")

if (short_entry)

strategy.entry("Short", strategy.short)

strategy.close("Long")

alert("Short trade initated")

// Trailing Stop-Loss

long_stop = strategy.position_avg_price * (1 - trailingStop / 100)

short_stop = strategy.position_avg_price * (1 + trailingStop / 100)

strategy.exit("Exit Long", "Long", stop = long_stop)

strategy.exit("Exit Short", "Short", stop = short_stop)

plot(mafast, color=color.green, linewidth=2, title="Fast MA")

plot(maslow, color=color.red, linewidth=2, title="Slow MA")

- Leveraged Martingale Futures Trading Strategy

- Momentum Pullback Strategy

- Dual Candlestick Prediction Close Strategy

- CMO and WMA Based Dual Moving Average Trading Strategy

- Stochastic Supertrend Tracking Stop Loss Trading Strategy

- Dual Reversal Oscillating Band Trend Following Strategy

- Trend Following Strategy Based on DMI and RSI

- Quantitative Support and Resistance Oscillation Strategy

- Trend-Following Strategy with 3 EMAs, DMI and MACD

- Dual Indicators Breakthrough Strategy

- Quantitative Strategy Based on Exponential Moving Average and Volume Weighting

- Origix Ashi Strategy Based on Smoothed Moving Average

- BlackBit Trader XO Macro Trend Scanner Strategy

- Crude Oil ADX Trend Following Strategy

- MT-Coordination Trading Strategy

- Combo Strategy of Double Factors Reversal and Improved Price Volume Trend

- Trend Angle Moving Average Crossover Strategy

- This strategy makes trading decisions based on the trend of MACD Histogram

- Momentum Oscillator & 123 Pattern Strategy

- Backtesting Strategy Based on Fisher Transform Indicator