Supertrend BarUpDn Fusion Strategy

Author: ChaoZhang, Date: 2024-01-31 14:43:06Tags:

Overview

The Supertrend BarUpDn Fusion strategy is a strategy that fuses the Supertrend indicator and the BarUpDn indicator. The strategy will go long if either the Supertrend or BarUpDn indicator gives a long signal, and will go short if either indicator gives a short signal.

Strategy Principle

The strategy mainly utilizes two indicators:

-

Supertrend Indicator: This indicator determines the trend direction based on Average True Range and a factor. It gives long signals when price is in an uptrend channel and short signals when price is in a downtrend channel.

-

BarUpDn Indicator: This indicator judges if the current bar is a bullish bar (close higher than open) or bearish bar (open higher than close). It returns 1 for bullish bars and -1 for bearish bars.

The main logic of the strategy is:

-

Go long when Supertrend is long and BarUpDn is bullish.

-

Go short when Supertrend is short and BarUpDn is bearish.

-

Close positions timely when Supertrend changes direction.

Through this fusion, the strategy can utilize both the trend judging capability of Supertrend and the short-term judging capability of BarUpDn to achieve better entry timing.

Advantage Analysis

The main advantages of this strategy are:

-

Improved accuracy by fusing multiple indicators. Utilizing both the trend judging of Supertrend and the short-term judging of BarUpDn can improve entry timing accuracy.

-

Timely stop loss. Quickly cutting losses when the main indicator Supertrend changes direction can avoid enlarging losses.

-

Simple and easy to use. The strategy only uses a combination of two common indicators, making it very simple and easy to use.

-

Strong adaptability. Supertrend itself has adjustable parameters to adapt to different products and timeframes.

Risk Analysis

There are also some risks with this strategy:

-

Incorrect judging from improper fusion may cause misjudging. Timely stop loss when indicators give inconsistent signals.

-

Improper parameter tuning affects performance. Supertrend’s ATR Length and Factor need to be adjusted for different products.

-

Short-term reversals may cause minor losses. Small losses may occur during short-term price reversals before Supertrend turns direction.

Optimization Directions

The strategy can be optimized from the following aspects:

-

Add stop loss strategies like moving stop loss, time stop loss, breakout stop loss etc. to further control risks.

-

Optimize parameters of Supertrend to find the best parameter combinations for different products and timeframes, e.g. via machine learning.

-

Add more indicator fusion to build a voting mechanism and improve judging stability.

-

Incorporate more market factors like volume change, spread change etc. to judge signal reliability and filter misleading signals.

Summary

The Supertrend BarUpDn Fusion Strategy fuses trend judging and short-term judging by combining simple indicators, improving entry timing accuracy while keeping simplicity and ease of use. The strategy can be further enhanced by parameter optimization, stop loss optimization, indicator voting etc.

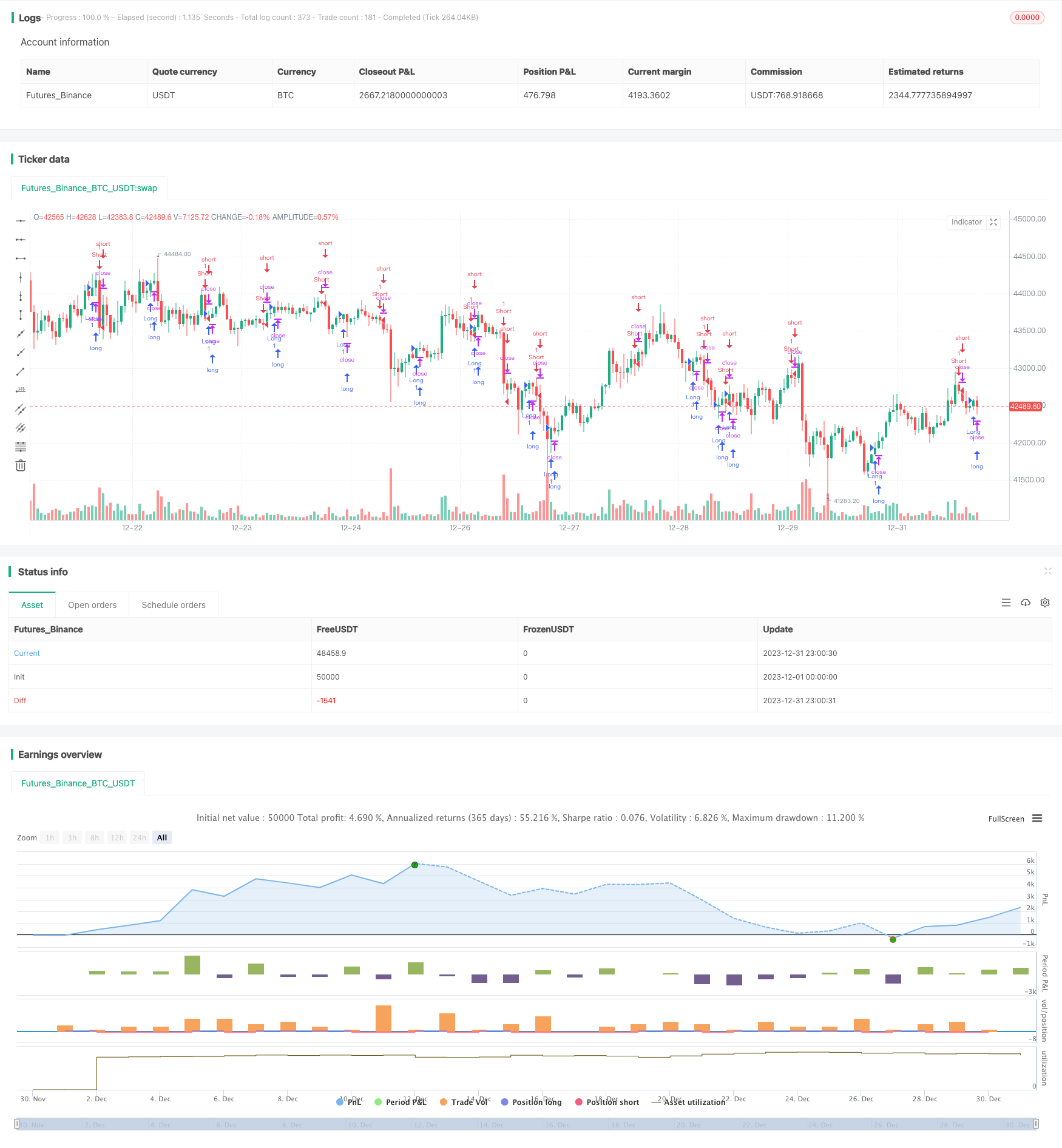

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Supertrend and BarUpDn Indicator Fusion", overlay=true)

// Supertrend indicator

atrLength = input(10, title="ATR Length")

factor = input(3.0, title="Factor")

[supertrend, direction] = ta.supertrend(factor, atrLength)

lastBar = 0

// BarUpDn indicator

barUpDn = close > open and open > close[1] ? 1 : close < open and open < close[1] ? -1 : 0

if (barUpDn == 1)

lastBar := 1

else if barUpDn == -1

lastBar := -1

// Determine long or short position

longCondition = (direction > 0 and barUpDn > 0) or (direction > 0 and lastBar == 1)

shortCondition = (direction < 0 and barUpDn < 0) or (direction < 0 and lastBar == -1)

// Enter long or short position

if (longCondition)

strategy.entry("Long", strategy.long)

lastBar := 1

else if (shortCondition)

strategy.entry("Short", strategy.short)

lastBar := -1

if (direction < 0 and barUpDn > 0)

strategy.entry("Long", strategy.long)

// Exit long or short position

if (direction > 0 and barUpDn < 0)

strategy.entry("Short", strategy.short)

// Exit long or short position

// if (direction < 0 and barUpDn > 0 or direction > 0 and barUpDn < 0)

// strategy.close_all()

- Trading Strategy Based on RSI and MACD Indicators

- CCI and EMA Based Scalping Strategy

- Improved Wave Trend Tracking Strategy

- Ichimoku Entries Strategy

- Trend Following Strategy Based on Moving Average Crossover

- RSI Trend Following Strategy with Trailing Stop Loss

- Consolidation Breakout Strategy

- Dynamic Trailing Stop Loss Strategy

- Multi Timeframe Gold Reversal Tracking Strategy

- Quant W Pattern Master Strategy

- Previous Day's Close with ATR Trend Tracking Strategy

- Crossover Strategy of Moving Average Lines and Resistance Level Breakout

- Smooth Moving Average Stop Loss Strategy

- Momentum Bollinger Bands Dual Moving Average DCA Strategy

- Momentum Breakout Trading Strategy

- Multi-factor Quantitative Trading Strategy

- Double Moving Average Crossover Strategy

- Dual-Mechanism Dynamic Trend Tracking Strategy

- Bitcoin Trading Strategy Based on Ichimoku Cloud

- Bull Market Tracking System