Dynamic Trailing Stop Loss Strategy

Author: ChaoZhang, Date: 2024-01-31 15:05:30Tags:

Overview

This strategy is based on a dynamic trailing stop loss mechanism to set stop loss lines for long and short positions based on the highest and lowest prices of a stock. When the price hits the stop loss line, it will close the current position and open a new position in the opposite direction. The strategy is simple and effective in controlling single transaction risk.

Principle

The main steps of this strategy are:

- Input parameters: choose to go long or short, set length for period, trailing stop slippage

- Calculate highest and lowest prices: get highest and lowest prices based on input length

- Calculate trailing stop loss lines: for long, lowest price minus slippage; for short, highest price plus slippage

- Open and close positions: when price hits stop loss line, close current direction position, and open opposite direction position

The above is the basic logic of the strategy. As price moves, the stop loss line keeps updating for dynamic tracking. By trailing stop loss, it can effectively control losses per trade.

Advantage Analysis

The main advantages of this strategy:

- Simple and clean logic, easy to understand and implement

- Dynamic trailing stop loss controls single trade loss

- Flexible to choose long or short, adaptable to different market environments

- Customization of period and slippage for optimization

In summary, by simple trailing stop loss mechanisms, this strategy can effectively manage positions and is a typical Risk Management strategy.

Risk Analysis

There are also some risks to note:

- Price volatility may trigger stop loss frequently, leading to over-trading

- Improper period settings may cause unsuitable stop loss lines

- Excessive slippage setting may result in loose stop loss, unable to stop loss in time

These risks can be optimized by adjusting the period, reducing slippage reasonably to make more sensible stop loss lines.

Optimization Directions

The strategy can be upgraded from the following aspects:

- Add optimization for dynamic stop loss line adjustment, avoid improper tight or loose stop loss lines

- Add open position conditions to avoid opening positions at inappropriate times

- Incorporate trend indicators for trend-following with more profit potential

- Add position sizing to dynamically adjust positions based on risk levels

Conclusion

The trading strategy realizes dynamic positions management through simple trailing stop loss methods. It is easy to understand and implement, and can effectively control single trade loss. We analyzed the advantages, potential risks and future optimization directions. In conclusion, this is a highly typical and practical Risk Management strategy.

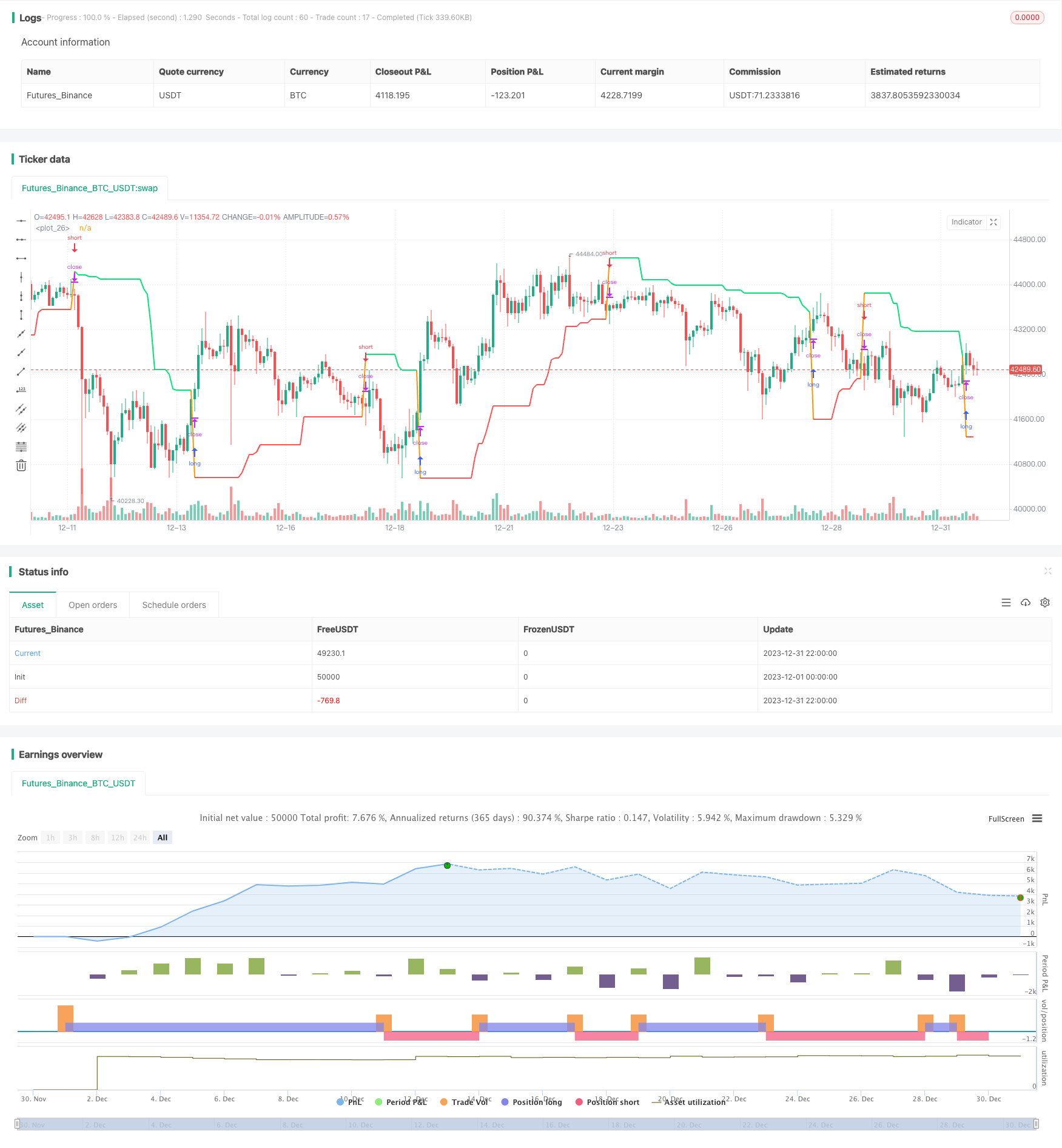

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2019

//@version=4

strategy(title = "Noro's Trailing-Stop Strategy", shorttitle = "Trailing", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(false, defval = false, title = "Short")

length = input(20, minval = 1)

shift = input(0.0, minval = 0, title = "Trailing Stop")

background = input(false)

//Levels

max = highest(high, length)

min = lowest(low, length)

//Trailing

size = strategy.position_size

longtrailing = 0.0

shorttrailing = 0.0

longtrailing := size <= 0 ? min - ((min / 100) * shift) : max(min - ((min / 100) * shift), longtrailing[1])

shorttrailing := size >= 0 ? max + ((max / 100) * shift) : min(max + ((max / 100) * shift), shorttrailing[1])

trailing = size <= 0 ? shorttrailing : longtrailing

col = size == size[1] ? size > 0 ? color.red : color.lime : na

plot(trailing, color = col, linewidth = 2, transp = 0)

//Background

bgcol = background ? size > 0 ? color.lime : color.red : na

bgcolor(bgcol, transp = 80)

if trailing > 0 and size <= 0

strategy.entry("Long", strategy.long, needlong ? na : 0, stop = trailing)

if trailing > 0 and size >= 0

strategy.entry("Short", strategy.short, needshort ? na : 0, stop = trailing)

- Donchian Trend Following Strategy

- SuperTrend RSI EMA Crossover Strategy

- Bilateral Three-Point Moving Average Quantitative Trading Strategy

- Trading Strategy Based on RSI and MACD Indicators

- CCI and EMA Based Scalping Strategy

- Improved Wave Trend Tracking Strategy

- Ichimoku Entries Strategy

- Trend Following Strategy Based on Moving Average Crossover

- RSI Trend Following Strategy with Trailing Stop Loss

- Consolidation Breakout Strategy

- Multi Timeframe Gold Reversal Tracking Strategy

- Quant W Pattern Master Strategy

- Supertrend BarUpDn Fusion Strategy

- Previous Day's Close with ATR Trend Tracking Strategy

- Crossover Strategy of Moving Average Lines and Resistance Level Breakout

- Smooth Moving Average Stop Loss Strategy

- Momentum Bollinger Bands Dual Moving Average DCA Strategy

- Momentum Breakout Trading Strategy

- Multi-factor Quantitative Trading Strategy

- Double Moving Average Crossover Strategy