Improved Wave Trend Tracking Strategy

Author: ChaoZhang, Date: 2024-01-31 15:35:41Tags:

Overview: This is a trend following strategy that utilizes the Wave Trend oscillator to identify trends. It calculates exponential moving averages of the average price and absolute price difference to plot a Wave Trend line. Trading signals are generated when the Wave Trend line crosses overbought/oversold zones. Additional filters on moving average and volume avoid false signals.

Strategy Logic:

Calculate average price ap = (high + low + close)/3

Compute n1-period EMA of ap to get esa

Compute n1-period EMA of absolute difference between ap and esa to get d

Compute Wave Trend line: ci = (ap - esa)/(0.015*d)

Compute n2-period EMA of ci to get final wave trend line tci, i.e. wt1

Compute 4-period SMA of wt1 to get wt2

Plot overbought/oversold level lines obLevel1/2 and osLevel1/2

Generate buy signal when wt1 crosses over obLevel2; generate sell signal when wt1 crosses below osLevel2

Add moving average emaFilter and volume filter volumeFilter as filters to avoid false signals

Set take profit/stop loss after entry to exit positions

Advantages:

Wave Trend line handles trend/counter-trend transitions well

Reliability improved through dual filters of moving average and volume

Multiple parameters avoid limitations of single indicator

Take profit/stop loss locks in profits and controls risk

Risks and Limitations:

Choice of parameters can lead to poor performance or overfitting

No definitive guidance on optimal parameters

Ignores broader market conditions

Risk of whip-saws in range-bound/choppy markets

Lack of exit rules besides take profit/stop loss

Enhancement Opportunities:

Test parameters across timeframes/assets to find optimal values

Incorporate volatility metrics to avoid low volatility regimes

Add indicators like RSI to improve signal accuracy

Build machine learning model to find optimal tailored parameters

Enhance exits with trailing stops or volatility event based exits

Conclusion:

This is a trend following strategy incorporating the Wave Trend indicator with additional filters. It capitalizes on the Wave Trend line’s ability to identify trend transitions, uses moving average and volume filters to avoid false signals, and aims to capture most medium/long term trends. Take profit/stop loss is used to control risk. Significant opportunity exists to improve performance across more instruments and timeframes by optimizing parameters, adding more indicators, and techniques like machine learning.

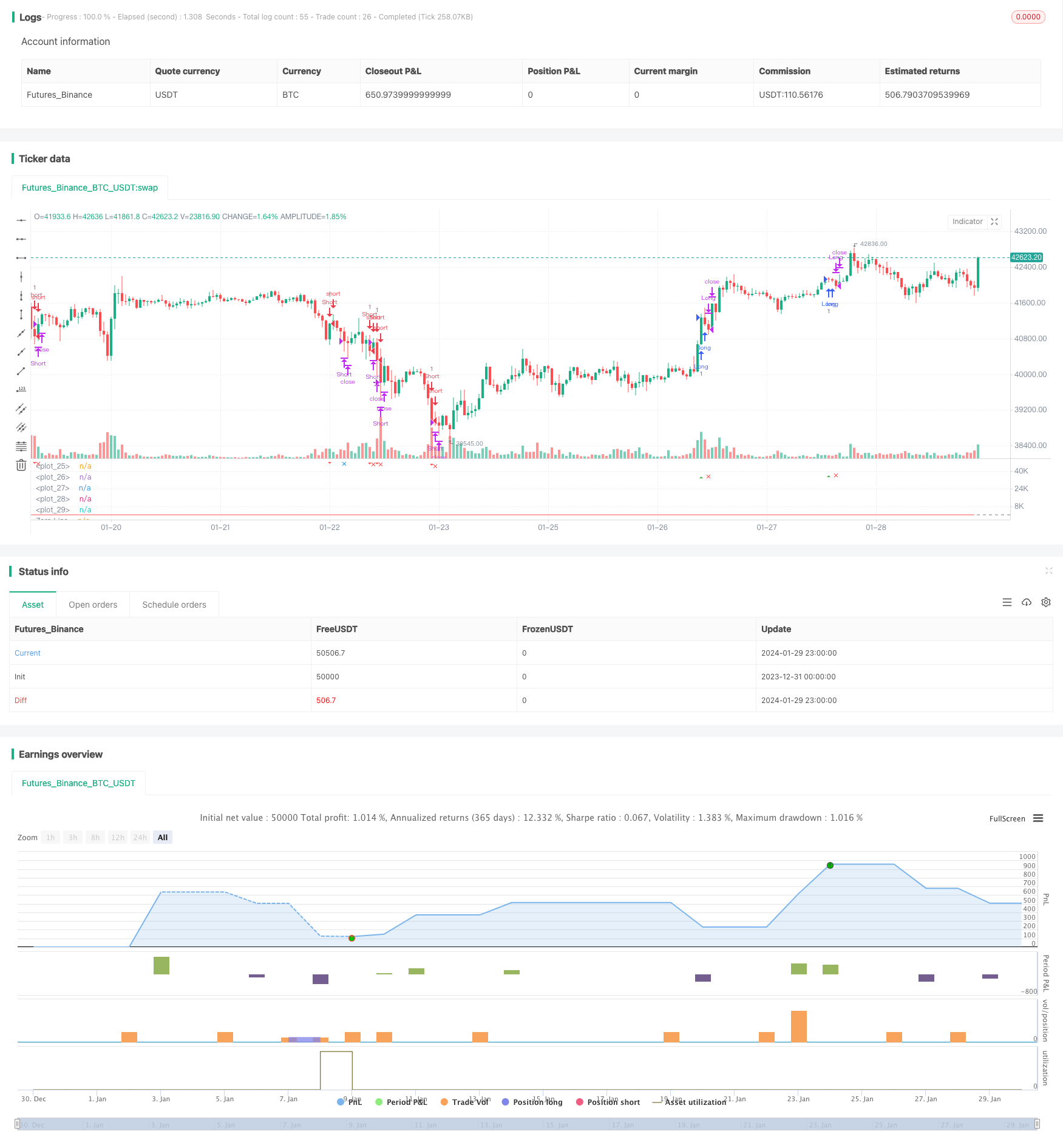

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Bush Strategy test", shorttitle="Nique Audi", overlay=false)

// Paramètres

n1 = input(10, title="Channel Length")

n2 = input(21, title="Average Length")

obLevel1 = input(60, title="Over Bought Level 1")

obLevel2 = input(53, title="Over Bought Level 2")

osLevel1 = input(-65, title="Over Sold Level 1")

osLevel2 = input(-60, title="Over Sold Level 2")

takeProfitPercentage = input(1, title="Take Profit (%)")

stopLossPercentage = input(0.50, title="Stop Loss (%)")

// Calculs

ap = hlc3

esa = ta.ema(ap, n1)

d = ta.ema(math.abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ta.ema(ci, n2)

wt1 = tci

wt2 = ta.sma(wt1, 4)

// Tracé des lignes

plot(0, color=color.gray)

plot(obLevel1, color=color.red)

plot(osLevel1, color=color.green)

plot(obLevel2, color=color.red, style=plot.style_line)

plot(osLevel2, color=color.green, style=plot.style_line)

plot(wt1, color=color.green)

plot(wt2, color=color.red, style=plot.style_line)

// Tracé de la différence entre wt1 et wt2 en bleu

hline(0, "Zero Line", color=color.gray)

// Conditions d'entrée long et court

longCondition = ta.crossover(wt1, obLevel2)

shortCondition = ta.crossunder(wt1, osLevel2)

// Tracé des signaux d'achat et de vente

plotshape(series=longCondition, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small, title="Buy Signal")

plotshape(series=shortCondition, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small, title="Sell Signal")

// Conditions d'entrée et de sortie

strategy.entry("Long", strategy.long, when=longCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

// Niveaux de prise de profit pour les positions longues et courtes

longTakeProfitLevel = strategy.position_avg_price * (1 + takeProfitPercentage / 100)

shortTakeProfitLevel = strategy.position_avg_price * (1 - takeProfitPercentage / 100)

// Vérification si les niveaux de prise de profit sont atteints

longTakeProfitReached = strategy.position_size > 0 and high >= longTakeProfitLevel

shortTakeProfitReached = strategy.position_size < 0 and low <= shortTakeProfitLevel

// Tracé des formes de prise de profit

plotshape(series=longTakeProfitReached, style=shape.xcross, location=location.belowbar, color=color.blue, size=size.small, title="Take Profit Long")

plotshape(series=shortTakeProfitReached, style=shape.xcross, location=location.abovebar, color=color.blue, size=size.small, title="Take Profit Short")

// Niveaux de stop loss pour les positions longues et courtes

longStopLossLevel = strategy.position_avg_price * (1 - stopLossPercentage / 100)

shortStopLossLevel = strategy.position_avg_price * (1 + stopLossPercentage / 100)

// Vérification si les niveaux de stop loss sont atteints

longStopLossReached = strategy.position_size > 0 and low <= longStopLossLevel

shortStopLossReached = strategy.position_size < 0 and high >= shortStopLossLevel

// Tracé des formes de stop loss

plotshape(series=longStopLossReached, style=shape.xcross, location=location.belowbar, color=color.red, size=size.small, title="Stop Loss Long")

plotshape(series=shortStopLossReached, style=shape.xcross, location=location.abovebar, color=color.red, size=size.small, title="Stop Loss Short")

// Fermeture des positions en cas de prise de profit ou de stop loss

strategy.close("Long", when=longTakeProfitReached or longStopLossReached)

strategy.close("Short", when=shortTakeProfitReached or shortStopLossReached)

- Cape Town 15-min Candle Breakout Strategy

- Dual ATR Trailing Stop Strategy

- Qullamaggie Breakout Tracking Strategy

- Extreme version of Noro's Trend Moving Averages Strategy

- Recursive Momentum Trading Strategy

- Donchian Trend Following Strategy

- SuperTrend RSI EMA Crossover Strategy

- Bilateral Three-Point Moving Average Quantitative Trading Strategy

- Trading Strategy Based on RSI and MACD Indicators

- CCI and EMA Based Scalping Strategy

- Ichimoku Entries Strategy

- Trend Following Strategy Based on Moving Average Crossover

- RSI Trend Following Strategy with Trailing Stop Loss

- Consolidation Breakout Strategy

- Dynamic Trailing Stop Loss Strategy

- Multi Timeframe Gold Reversal Tracking Strategy

- Quant W Pattern Master Strategy

- Supertrend BarUpDn Fusion Strategy

- Previous Day's Close with ATR Trend Tracking Strategy

- Crossover Strategy of Moving Average Lines and Resistance Level Breakout