SAR Momentum Reversal Tracking Strategy

Author: ChaoZhang, Date: 2024-02-04 17:40:20Tags:

Overview

This article introduces a momentum reversal tracking strategy based on the Parabolic Stop and Reverse (SAR) indicator. This strategy utilizes the Parabolic SAR indicator to identify potential trend reversals in the Nifty Futures market for automated trend tracking trading.

The strategy is mainly suitable for traders who prefer a systematic trading approach, providing clear entry and exit signals. By capturing market trends, it helps traders achieve their financial goals.

Strategy Logic

The strategy uses the Parabolic SAR indicator to determine the price trend direction. In an uptrend, the SAR value is below the price and gradually moves up as new highs occur; In a downtrend, the SAR value is above the price and gradually moves down as new lows occur.

When the SAR value crosses above or below the price, it indicates a potential trend reversal and the strategy will take corresponding short or long positions to capture the new trend direction.

Specifically, after initially calculating the current SAR value and acceleration factor, the strategy keeps tracking new highs/lows and adjusts the SAR value accordingly. On a confirmed bar, if in an uptrend, it takes a short position below the SAR value; if in a downtrend, it takes a long position above the SAR value.

Advantage Analysis

- Captures market reversals using the classic Parabolic SAR indicator

- Provides clear systematical entry and exit signals

- Helps tracking trends and capturing additional price movement

- Automated trading system without manual decision-making

Risk Analysis

- SAR indicator signals may not be 100% reliable, false signals could occur

- Failed reversals can cause stop loss

- Impact of contract expiry needs consideration

- Trading costs impact on strategy profitability

Optimization Directions

- Optimize SAR parameters (step, initial value, maximum value, etc.)

- Combine other reversal indicators (RSI, MACD etc.) to confirm reversals

- Add condition logics (volume etc.) to filter false signals

- Consider using trailing stops instead of fixed stops

- Consider auto-adjusting position sizing

Conclusion

The strategy provides an automated system to capture market trend reversals using the Parabolic SAR indicator. It gives clear entry and exit signals for trading decisions, helping profit from trend tracking. But issues like false signals, stop loss risks also need attention. With continuous optimization, it has the potential to become a reliable trend tracking method.

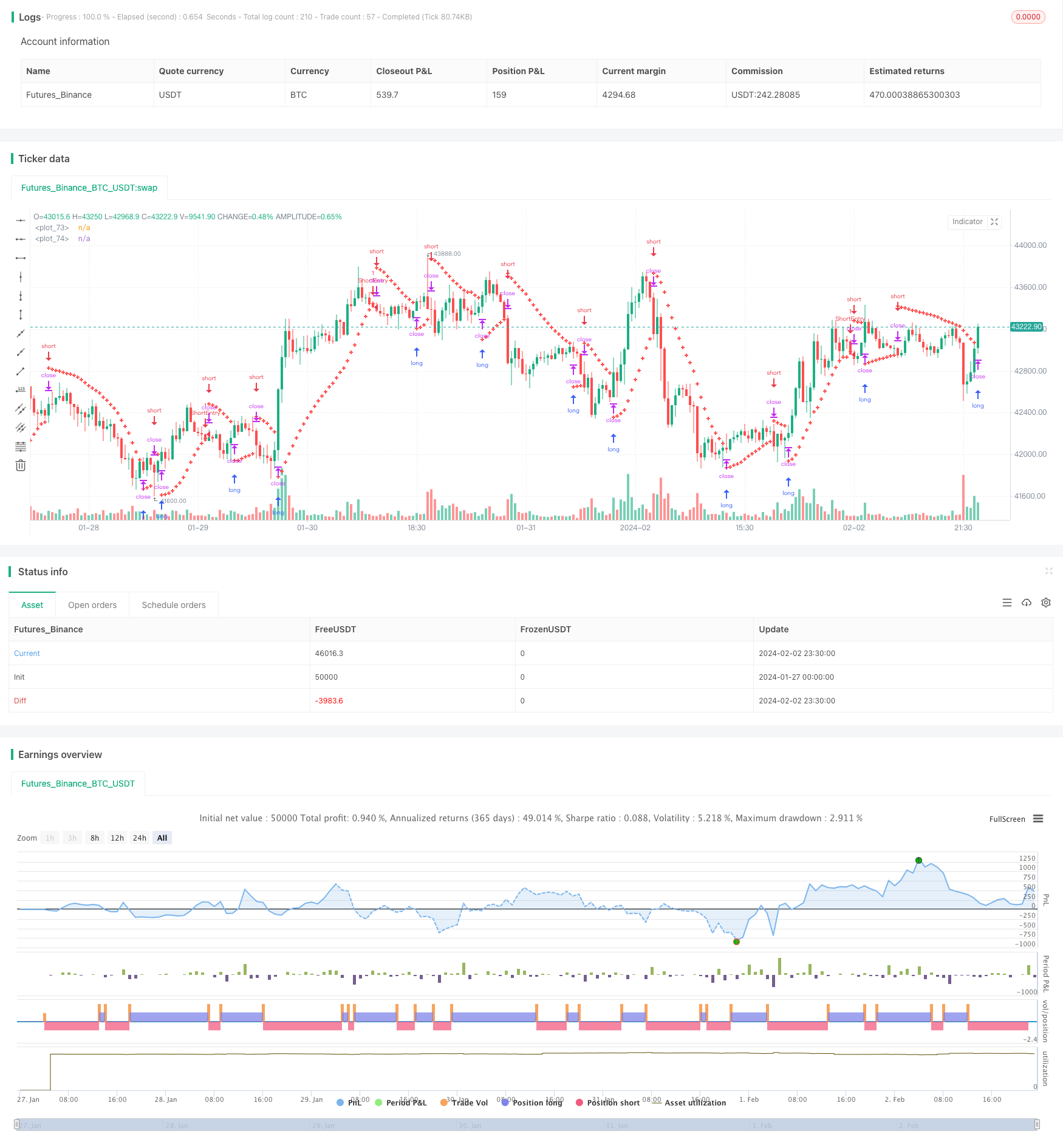

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-03 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Positional Parabolic SAR Strategy", overlay=true)

initial = input(0.02)

step = input(0.02)

cap = input(0.2)

var bool isUptrend = na

var float Extremum = na

var float SARValue = na

var float Accelerator = initial

var float futureSAR = na

if bar_index > 0

isNewTrendBar = false

SARValue := futureSAR

if bar_index == 1

float pastSAR = na

float pastExtremum = na

previousLow = low[1]

previousHigh = high[1]

currentClose = close

pastClose = close[1]

if currentClose > pastClose

isUptrend := true

Extremum := high

pastSAR := previousLow

pastExtremum := high

else

isUptrend := false

Extremum := low

pastSAR := previousHigh

pastExtremum := low

isNewTrendBar := true

SARValue := pastSAR + initial * (pastExtremum - pastSAR)

if isUptrend

if SARValue > low

isNewTrendBar := true

isUptrend := false

SARValue := math.max(Extremum, high)

Extremum := low

Accelerator := initial

else

if SARValue < high

isNewTrendBar := true

isUptrend := true

SARValue := math.min(Extremum, low)

Extremum := high

Accelerator := initial

if not isNewTrendBar

if isUptrend

if high > Extremum

Extremum := high

Accelerator := math.min(Accelerator + step, cap)

else

if low < Extremum

Extremum := low

Accelerator := math.min(Accelerator + step, cap)

if isUptrend

SARValue := math.min(SARValue, low[1])

if bar_index > 1

SARValue := math.min(SARValue, low[2])

else

SARValue := math.max(SARValue, high[1])

if bar_index > 1

SARValue := math.max(SARValue, high[2])

futureSAR := SARValue + Accelerator * (Extremum - SARValue)

if barstate.isconfirmed

if isUptrend

strategy.entry("ShortEntry", strategy.short, stop=futureSAR, comment="ShortEntry")

strategy.cancel("LongEntry")

else

strategy.entry("LongEntry", strategy.long, stop=futureSAR, comment="LongEntry")

strategy.cancel("ShortEntry")

plot(SARValue, style=plot.style_cross, linewidth=3, color=color.white)

plot(futureSAR, style=plot.style_cross, linewidth=3, color=color.red)

- Momentum Swing Trading Strategy

- Dynamic PSAR Stock Fluctuation Tracking Strategy

- Closing Price Comparison Dual Moving Average Crossover Strategy

- Ichimoku Cloud, MACD and Stochastic Based Multi-Timeframe Trend Tracking Strategy

- MACD Volume Reversal Trading Strategy

- Dynamic Moving Average Crossover Combo Strategy

- Willy Wonka Breakout Strategy

- Exponential Moving Average and Relative Strength Index Combination Trend Following Strategy

- Reversal Trend Catching and Dynamic Stop Loss Combo Strategy

- Golden Parabola Breakout Strategy

- Dynamic RSI Trading Strategy

- Crossover Strategy between Multiple Moving Averages

- Dual Moving Average Breakout Strategy

- Moving Average Crossover Strategy

- Dual Moving Average Trend Tracking Strategy

- Quadratic Momentum Double Indicators Timing Strategy

- Renko and Relative Vigor Index Trend Following Strategy

- Swing Trend Moving Average Strategy

- Bollinger Band, Moving Average and MACD Combined Trading Strategy

- Momentum Price Climbing Crypto Currency Strategy