Overview

This strategy is called “Relative Strength Index Long-term Quant Strategy”, abbreviated as RSI Long-term Strategy. By calculating the moving average of the rise and fall ranges within a certain period, the RSI technical indicator is constructed and overbought and oversold lines are set to judge the timing of the market. When the RSI is lower than the set oversold line, long positions are gradually built in the long-term hold.

Strategy Principle

The core indicator of this strategy is Relative Strength Index (RSI). The RSI indicator compares the average increase and decrease over a period of time to determine whether the current security price is overestimated or underestimated. Its calculation formula is:

RSI = 100 - 100 / (1 + UP / DOWN)

Where UP is the average amplitude of the closing price rise in the last n days; DOWN is the average amplitude of the closing price decline in the last n days. The index oscillates between 0-100 intervals. Above 70 is the overbought zone and below 30 is the oversold zone.

This strategy sets RSI parameter Length=14 to calculate RSI based on 14-day closing prices. And set the oversold line Rsvalue=40, that is, RSI below 40 is determined to be oversold. When the RSI of the day is below 40, the buy window is opened, and positions are gradually built in the oversold area, and the final closing time is set to sell out after exceeding the closing time.

Advantage Analysis

The biggest advantage of this strategy is that by using the RSI indicator to determine the timing of the market, the capture of low prices is realized. When the RSI is below 40, it is an oversold state, which means that the previous decline was too large and there is a chance of a rebound. At this time, gradually build a position to obtain a better cost. When the RSI is above 70, it is in an overbought state, which means that the market may have peaked and positions could be reduced.

In addition, the strategy adopts a gradual position building approach to reduce the risk of a single entry. The construction window serves as the high point of the position, and the final closing time serves as the low point of the position to achieve long-term investment.

Risk Analysis

This strategy mainly relies on the RSI technical indicator, which has some lag. Especially when the market changes suddenly, the RSI may not be able to react in time. At this time, blindly following the RSI indicator to build a position may result in limited profits or increased losses.

In addition, the strategy provides probabilistic trading signals. Even if the RSI is below 40, it does not mean that there is 100% chance of a rebound. The probability that the price will hit a new low after building a position also exists. At this point, a good stop loss strategy is needed to control maximum losses.

Optimization Directions

The strategy can be optimized in the following areas:

Combine multiple stocks for portfolio trading. Single stocks are more easily affected by specific events, while portfolios can diversify individual stock risks.

Add a stop loss strategy to further control risks. For example, add a trailing stop loss to stop loss exit when prices continue to fall.

Optimize the position building strategy. For example, use time-weighted average price for gradual position building in the over-interval, rather than full position establishment.

Combine with other indicators to filter signals, such as momentum indicators, moving averages, etc., to avoid blindly following the RSI.

Summary

This strategy determines the overbought and oversold areas by constructing the RSI indicator, gradually establishes long positions in the oversold area, and sets the final closing time to achieve long-term holding. Compared with short-term trading, this strategy is more suitable as a long-term quantitative investment tool. Its advantages lie in capturing low prices and controlling costs, while the risks lie in indicator lag and signal misguidance. In the future, it can be improved in many ways such as portfolio optimization, stop loss strategies, position building optimization.

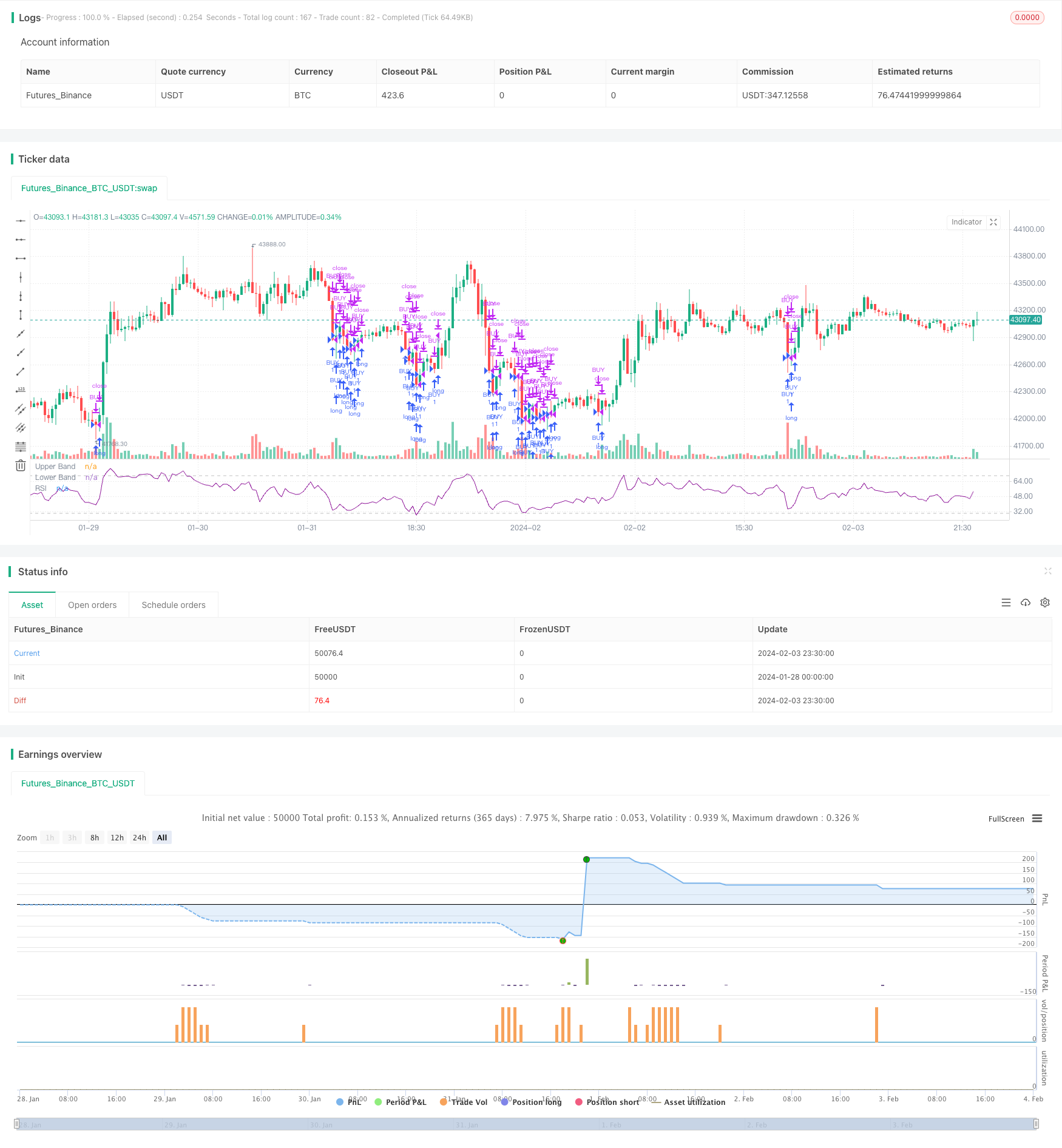

/*backtest

start: 2024-01-28 00:00:00

end: 2024-02-04 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Relative Strength Index", shorttitle="RSI")

len = input(14, minval=1, title="Length")

src = input(close, "Source", type = input.source)

up = rma(max(change(src), 0), len)

down = rma(-min(change(src), 0), len)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

plot(rsi, "RSI", color=#8E1599)

band1 = hline(70, "Upper Band", color=#C0C0C0)

band0 = hline(30, "Lower Band", color=#C0C0C0)

fill(band1, band0, color=#9915FF, title="Background")

Rsvalue = input(defval = 40, title = "RSvalue", minval = 20, maxval = 75)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2015, title = "From Year", minval = 999)

ToMonth = input(defval = 3, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 2022, title = "To Year", minval = 999)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

booking = timestamp(ToYear, ToMonth, ToDay, 23, 59)

window() => time >= start and time <= finish ? true : false

endtrade() => time >= booking ? true : false

longCondition = rsi< Rsvalue

if (longCondition)

strategy.entry("BUY", strategy.long)

strategy.close("BUY")