Dual Confirmation MACD and RSI Strategy

Author: ChaoZhang, Date: 2024-02-18 16:24:06Tags:

Overview

This strategy combines the MACD indicator and RSI indicator to implement a dual confirmation mechanism for entry signals, balancing profitability and risk control, aiming for steady returns in the medium to long term.

Strategy Logic

The strategy mainly uses the MACD indicator to determine market trends and entry points. A MACD line crossover above the signal line is considered a buy signal, while a MACD line crossover below the signal line is as sell signal. Additionally, the overbought area of the RSI indicator is used to filter false breakouts. The strategy only issues a buy signal when the MACD buy signal occurs and the RSI indicator has not entered the overbought zone. The judgment of sell signals is similar.

To ensure the reliability of trading signals, this strategy also incorporates volume analysis. Only when the volume is greater than the 20-day average volume will the strategy issue trading signals. This avoids wrong signals when the market has insufficient trading volume.

Finally, the strategy also uses the direction of candlestick bodies as a way of tracking stops and confirmation. When the direction of the candlestick body changes, it closes out the current position. This locks in profits and prevents profit retracement.

Advantage Analysis

- MACD judges market trends and entry points, allowing entry at the beginning of trends for greater profit potential

- RSI avoids entering during overbought/oversold levels, reducing losses

- Volume analysis further filters false signals, increasing profitability

- Candlestick tracking stops reasonably control risks

Risk Analysis

- MACD has lagging capability and may miss short-term trend reversals

- Volume rules may miss trends sparked by low volumes

- Candlestick stops may get stopped out by short-term spikes

Optimization Directions

- Consider adding more filtering indicators like Bollinger Bands to further improve signal quality

- Test adding rail stops to lock in long-term profits

- Optimize MACD parameter combinations to increase indicator sensitivity

Summary

Overall this strategy balances stability and profitability. MACD judges the main trend, RSI and volume provide dual filtering to improve signal quality, candlestick tracking stops control risk. The strategy can be further improved through parameter optimization and incorporating additional technical indicators. Notably, avoiding excessive complexity and maintaining simplicity and stability is very important.

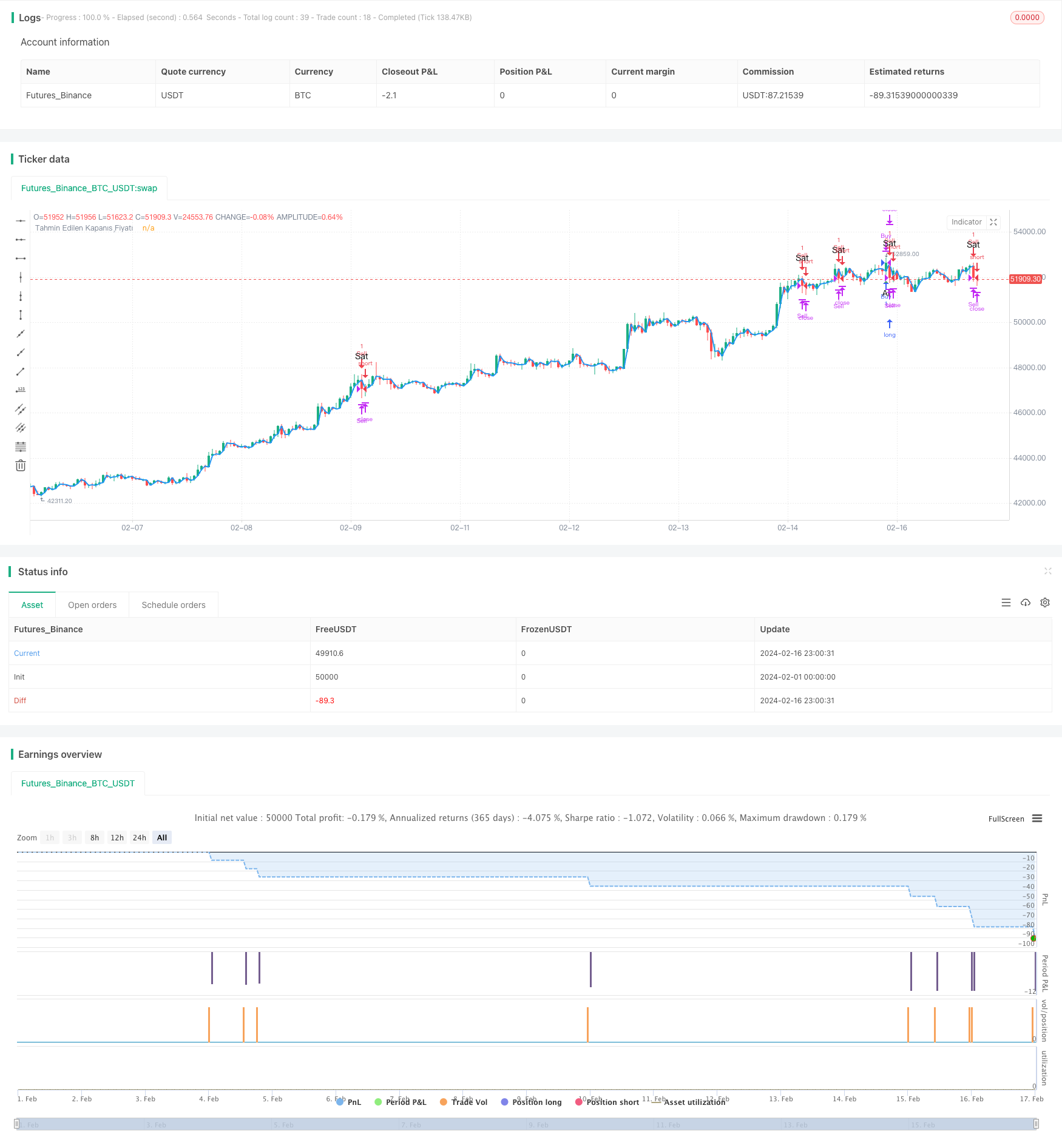

/*backtest

start: 2024-02-01 00:00:00

end: 2024-02-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Al-Sat Sinyali ve Teyidi", overlay=true)

// MACD (Hareketli Ortalama Yakınsaklık Sapma)

[macdLine, signalLine, _] = ta.macd(close, 5, 13, 5)

// RSI (Göreceli Güç Endeksi)

rsiValue = ta.rsi(close, 14)

// Hacim

volumeAverage = ta.sma(volume, 20)

// RSI ve MACD Filtreleri

rsiOverbought = rsiValue > 70

rsiOversold = rsiValue < 30

macdBuySignal = ta.crossover(macdLine, signalLine) and not rsiOverbought

macdSellSignal = ta.crossunder(macdLine, signalLine) and not rsiOversold

// Al-Sat Stratejisi

shouldBuy = ta.crossover(close, open) and not ta.crossover(close[1], open[1]) and macdBuySignal and volume > volumeAverage

shouldSell = ta.crossunder(close, open) and not ta.crossunder(close[1], open[1]) and macdSellSignal and volume > volumeAverage

strategy.entry("Buy", strategy.long, when=shouldBuy)

strategy.entry("Sell", strategy.short, when=shouldSell)

// Teyit için bir sonraki mumu bekleme

strategy.close("Buy", when=ta.crossover(close, open))

strategy.close("Sell", when=ta.crossunder(close, open))

// Görselleştirmeyi devre dışı bırakma

plot(na)

// Al-Sat Etiketleri

plotshape(series=shouldBuy, title="Al Sinyali", color=color.green, style=shape.triangleup, location=location.belowbar, size=size.small, text="Al")

plotshape(series=shouldSell, title="Sat Sinyali", color=color.red, style=shape.triangledown, location=location.abovebar, size=size.small, text="Sat")

// Varsayımsal bir sonraki mumun kapanış fiyatını hesapla

nextBarClose = close[1]

plot(nextBarClose, color=color.blue, linewidth=2, title="Tahmin Edilen Kapanış Fiyatı")

- Multi Timeframe Strategy

- Dynamic Balancing Leveraged ETF Investment Strategy

- Multi-timeframe MACD Indicator Crossover Trading Strategy

- Gem Forest 1 Minute Breakout Strategy

- Three High Candle Reversal Strategy

- MACD Moving Average Combination Cross-Period Dynamic Trend Strategy

- Gem Forest One Minute Scalping Strategy

- Signal Smoothing Ehlers Cyber Cycle Strategy

- EMA Crossover Trend Following Trading Strategy

- Trend Following Strategy Based on Candlestick Direction

- Williams Double Exponential Moving Average and Ichimoku Kinkou Hyo Strategy

- 3 10 Oscillator Profile Flagging Strategy

- Multi Timeframe RSI-SRSI Trading Strategy

- A Combined Strategy with MACD and RSI

- ATR, EOM and VORTEX Based Long Trend Strategy

- Dual Moving Average Intelligent Tracking Trading Strategy

- High Volume Low Breakout Compounded Position Sizing Strategy

- Bitcoin Dollar Cost Averaging Based on BEAM Bands

- Byron Serpent Cloud Quant Strategy

- Dual Timeframe Volatility Spread Trading Strategy