Best ABCD Pattern Trading Strategy with Stop Loss and Take Profit Tracking

Author: ChaoZhang, Date: 2024-02-19 11:22:48Tags:

I. Strategy Overview

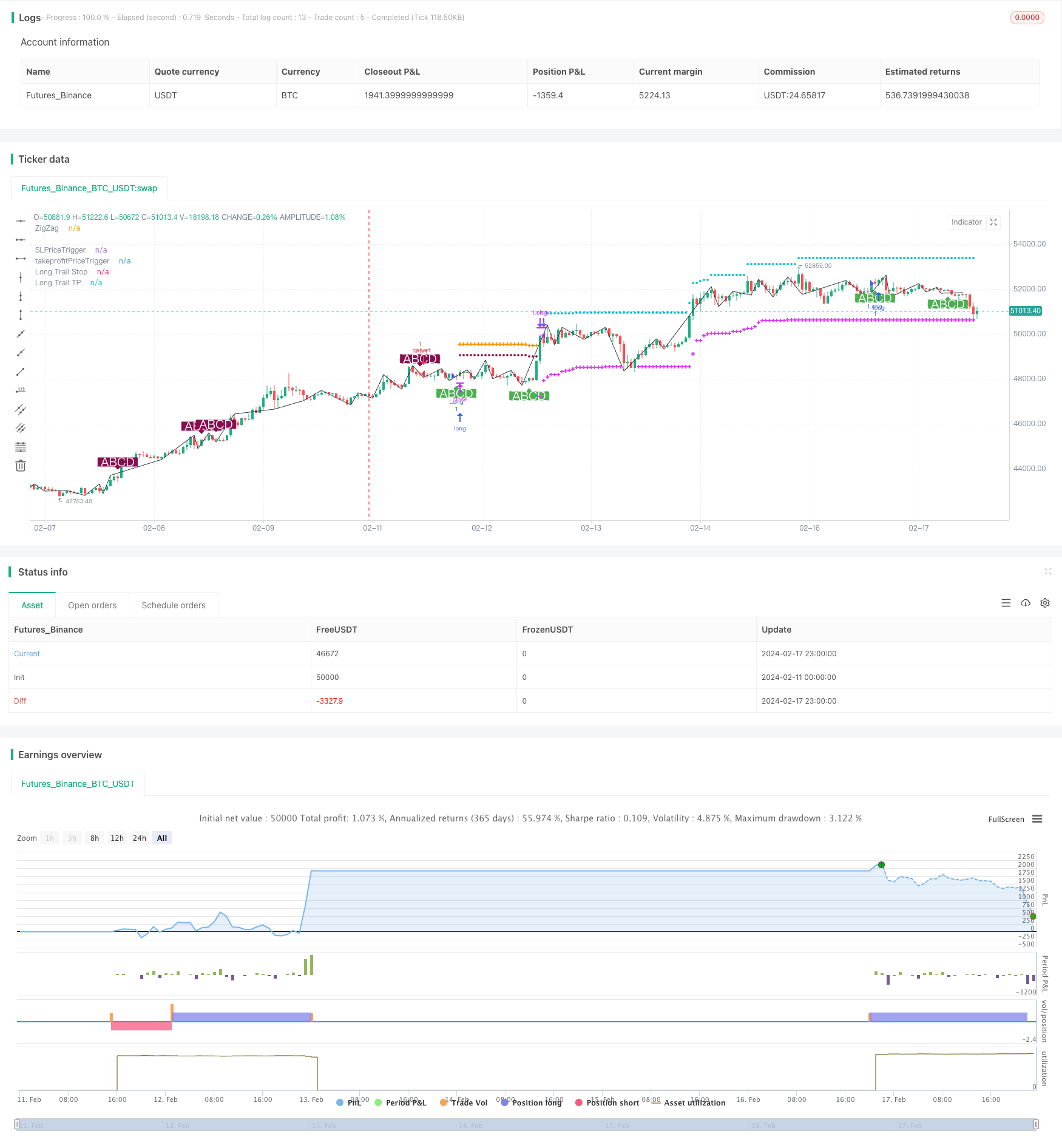

This strategy is named “Best ABCD Pattern Strategy (with Stop Loss and Take Profit Tracking)”. It is a quantitative strategy that trades based on a clear ABCD price pattern model. The main idea is to go long or short according to the direction of the ABCD pattern after identifying a complete ABCD model, and set stop loss and take profit tracking to manage positions.

II. Strategy Principle

Identify the extremum points of price using Bollinger Bands to get the ZigZag line.

Recognize complete ABCD patterns on the ZigZag line. Points A, B, C and D need to meet certain proportional relationships. Go long or go short after identifying eligible ABCD patterns.

Set trailing stop loss after opening positions to control risks. Use fixed stop loss first, turn to trailing stop loss to lock in some profits after reaching a certain profit level.

Similarly, trailing take profit is also set to secure enough profits in time and avoid losses. Trailing take profit also works in two stages: fixed take profit first and then trailing take profit.

Close positions when price hits the trailing stop loss or take profit to finish a trade cycle.

III. Advantage Analysis

Using Bollinger Bands to identify ZigZag line avoids repainting problems of traditional ZigZag, making trading signals more reliable.

ABCD pattern trading model is mature and stable with adequate trading opportunities. Also it is easy to determine the position direction.

The two-stage trailing stop loss and take profit settings help better control risks and secure profits. Trailing features provide flexibility.

Reasonable parameter design as percentages of stop loss, take profit and trailing activation are all customizable for flexibility.

The strategy can be used for any trading instruments, including forex, crypto currencies, stock indices, etc.

IV. Risk Analysis

Trading opportunities for ABCD patterns are still limited compared to other strategies, not ensuring enough frequency.

During ranging markets, stop loss and take profit may get triggered frequently. Parameters need adjustments like widening stop loss/profit ranges.

Liquidity of the trading instruments needs attention. Slippage needs consideration for illiquid products.

The strategy is sensitive to transaction costs. Brokers and accounts with low commission rates are preferred.

Some parameters can be further optimized, like the activation levels for trailing stop loss and take profit. More values can be tested to find the optimum.

V. Optimization Directions

Combining with other indicators to add more filters avoids some false signals and reduces inefficient trades.

Add judgement on the three-section market structure, only taking trades in the third section. This can improve the win rate.

Test and optimize the initial capital to find the optimum level. Both too big and too small sizes hurt return rates.

Carry out walk-forward analysis with out-of-sample data to examine the robustness of parameters over long term.

Continue optimizing activation conditions and slippage sizes of trailing stop loss and take profit to improve efficiency. Optimization of settings never ends.

VI. Strategy Summary

The strategy mainly relies on ABCD pattern for market timing and entries. Two-stage trailing stop loss and take profit settings are used to manage risks and profits. The strategy is relatively mature and stable but trading frequency may be low. We can obtain more efficient trading opportunities by adding filters and conditions. Also further parameter tuning and capital sizing can improve its profit stability. Overall speaking, this is a strategy with clear logic and easy to understand, worth in-depth research and application in actual quantitative trading.

/*backtest

start: 2024-02-11 00:00:00

end: 2024-02-18 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// @author=Daveatt - BEST

// ABCD Pattern Strat

StrategyName = "BEST ABCD Pattern Strategy (Trailing SL + TP)"

ShortStrategyName = "BEST ABCD Strategy (Trailing)"

strategy(title=StrategyName, shorttitle=ShortStrategyName, overlay=true )

filterBW = input(false, title="filter Bill Williams Fractals?")

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////// UTILITIES ///////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

// ||-----------------------------------------------------------------------------------------------------||

// ||--- Fractal Recognition Functions: ---------------------------------------------------------------||

isRegularFractal(mode, _high, _low) =>

ret = mode == 1 ? _high[4] < _high[3] and _high[3] < _high[2] and _high[2] > _high[1] and _high[1] > _high[0] :

mode == -1 ? _low[4] > _low[3] and _low[3] > _low[2] and _low[2] < _low[1] and _low[1] < _low[0] : false

isBWFractal(mode, _high, _low) =>

ret = mode == 1 ? _high[4] < _high[2] and _high[3] <= _high[2] and _high[2] >= _high[1] and _high[2] > _high[0] :

mode == -1 ? _low[4] > _low[2] and _low[3] >= _low[2] and _low[2] <= _low[1] and _low[2] < _low[0] : false

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

////////////////////////////// ABCD PATTERN ///////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

///////////////////////////////////////////////////////////////////////////////

f_abcd()=>

_r = timeframe.period

_g = barmerge.gaps_off

_l = barmerge.lookahead_on

_high = high

_low = low

filteredtopf = filterBW ? isRegularFractal(1, _high, _low) : isBWFractal(1, _high, _low)

filteredbotf = filterBW ? isRegularFractal(-1, _high, _low) : isBWFractal(-1, _high, _low)

// ||--- ZigZag:

istop = filteredtopf

isbot = filteredbotf

topcount = barssince(istop)

botcount = barssince(isbot)

zigzag = (istop and topcount[1] > botcount[1] ? _high[2] :

isbot and topcount[1] < botcount[1] ? _low[2] : na)

x = valuewhen(zigzag, zigzag, 4)

a = valuewhen(zigzag, zigzag, 3)

b = valuewhen(zigzag, zigzag, 2)

c = valuewhen(zigzag, zigzag, 1)

d = valuewhen(zigzag, zigzag, 0)

xab = (abs(b-a)/abs(x-a))

xad = (abs(a-d)/abs(x-a))

abc = (abs(b-c)/abs(a-b))

bcd = (abs(c-d)/abs(b-c))

// ABCD Part

_abc = abc >= 0.382 and abc <= 0.886

_bcd = bcd >= 1.13 and bcd <= 2.618

_bull_abcd = _abc and _bcd and d < c

_bear_abcd = _abc and _bcd and d > c

_bull = _bull_abcd and not _bull_abcd[1]

_bear = _bear_abcd and not _bear_abcd[1]

[_bull, _bear, zigzag]

lapos_x = timenow + round(change(time)*12)

[isLong, isShort, zigzag] = f_abcd()

plot(zigzag, title= 'ZigZag', color=color.black, offset=-2)

plotshape(isLong, style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), size=size.normal, text="ABCD", textcolor=color.white)

plotshape(isShort, style=shape.labeldown, location=location.abovebar, color=color.new(color.maroon, 0), size=size.normal, text="ABCD", textcolor=color.white)

long_entry_price = valuewhen(isLong, close, 0)

short_entry_price = valuewhen(isShort, close, 0)

sinceNUP = barssince(isLong)

sinceNDN = barssince(isShort)

buy_trend = sinceNDN > sinceNUP

sell_trend = sinceNDN < sinceNUP

change_trend = (buy_trend and sell_trend[1]) or (sell_trend and buy_trend[1])

entry_price = buy_trend ? long_entry_price : short_entry_price

///////////////////////////////

//======[ Trailing STOP ]======//

///////////////////////////////

// use SL?

useSL = input(true, "Use stop Loss")

// Configure trail stop level with input

StopTrailPerc = input(title="Trail Loss (%)", type=input.float, minval=0.0, step=0.1, defval=3) * 0.01

// Will trigger the take profit trailing once reached

use_SL_Trigger = input(true, "Use stop Loss Trigger")

StopTrailTrigger = input(2.0, "SL Trigger (%)",minval=0,step=0.5,type=input.float) * 0.01

StopLossPriceTrigger = 0.0

StopLossPriceTrigger := if (use_SL_Trigger)

if buy_trend

entry_price * (1 + StopTrailTrigger)

else

entry_price * (1 - StopTrailTrigger)

else

-1

var SL_Trigger_Long_HIT = false

SL_Trigger_Long_HIT := useSL and use_SL_Trigger and buy_trend and high >= StopLossPriceTrigger

? true : SL_Trigger_Long_HIT[1]

var SL_Trigger_Short_HIT = false

SL_Trigger_Short_HIT := useSL and use_SL_Trigger and sell_trend and low <= StopLossPriceTrigger

? true : SL_Trigger_Short_HIT[1]

display_long_SL_trigger = useSL and buy_trend and use_SL_Trigger

and SL_Trigger_Long_HIT == false and StopLossPriceTrigger != -1

display_short_SL_trigger = useSL and sell_trend and use_SL_Trigger

and SL_Trigger_Short_HIT == false and StopLossPriceTrigger != -1

display_SL_trigger = display_long_SL_trigger or display_short_SL_trigger

plot(display_SL_trigger ? StopLossPriceTrigger : na, title='SLPriceTrigger', transp=0,

color=color.maroon, style=plot.style_circles, linewidth=3)

// Determine trail stop loss prices

longStopPrice = 0.0, shortStopPrice = 0.0

longStopPrice := if useSL and buy_trend

stopValue = low * (1 - StopTrailPerc)

max(stopValue, longStopPrice[1])

else

0

shortStopPrice := if useSL and sell_trend

stopValue = high * (1 + StopTrailPerc)

min(stopValue, shortStopPrice[1])

else

999999

//////////////////////////////////////////////////////////////////////////////////////////

//*** STOP LOSS HIT CONDITIONS ***//

//////////////////////////////////////////////////////////////////////////////////////////

cond_long_stop_loss_hit = useSL and buy_trend and crossunder(low, longStopPrice[1])

and (SL_Trigger_Long_HIT or use_SL_Trigger == false)

cond_short_stop_loss_hit = useSL and sell_trend and crossover(high, shortStopPrice[1])

and (SL_Trigger_Short_HIT or use_SL_Trigger == false)

// Plot stop loss values for confirmation

plot(series=useSL and buy_trend and low >= longStopPrice

and (SL_Trigger_Long_HIT or use_SL_Trigger == false)

? longStopPrice : na,

color=color.fuchsia, style=plot.style_cross,

linewidth=2, title="Long Trail Stop")

plot(series=useSL and sell_trend and high <= shortStopPrice

and (SL_Trigger_Short_HIT or use_SL_Trigger == false)

? shortStopPrice : na,

color=color.fuchsia, style=plot.style_cross,

linewidth=2, title="Short Trail Stop")

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

// Use TP?

useTP = input(true, "Use take profit")

// TP trailing

ProfitTrailPerc = input(1.0, "Trailing Profit (%)",minval=0,step=0.5,type=input.float) * 0.01

use_TP_Trigger = input(true, "Use Take Profit Trigger")

// Will trigger the take profit trailing once reached

takeProfitTrigger = input(3.0, "Take Profit Trigger (%)",minval=0,step=0.5,type=input.float) * 0.01

// ttp := ttp>tp ? tp : ttp

takeprofitPriceTrigger = 0.0

takeprofitPriceTrigger := if (use_TP_Trigger)

if (buy_trend)

entry_price * (1 + takeProfitTrigger)

else

entry_price * (1 - takeProfitTrigger)

else

-1

//plot(entry_price, title='entry_price', transp=100)

var TP_Trigger_Long_HIT = false

TP_Trigger_Long_HIT := useTP and use_TP_Trigger and buy_trend and high >= takeprofitPriceTrigger

? true : TP_Trigger_Long_HIT[1]

var TP_Trigger_Short_HIT = false

TP_Trigger_Short_HIT := useTP and use_TP_Trigger and sell_trend and low <= takeprofitPriceTrigger

? true : TP_Trigger_Short_HIT[1]

display_long_TP_trigger = useTP and buy_trend and TP_Trigger_Long_HIT == false

and takeprofitPriceTrigger != -1

display_short_TP_trigger = useTP and sell_trend and TP_Trigger_Short_HIT == false

and takeprofitPriceTrigger != -1

display_TP_trigger = display_long_TP_trigger or display_short_TP_trigger

//🔷🔷🔷

// @hugo: Will display the TP trigger as long as not hit

// once the TP trigger is hit, the TP trailing will activate

plot(display_TP_trigger ? takeprofitPriceTrigger : na, title='takeprofitPriceTrigger', transp=0, color=color.orange,

style=plot.style_cross, linewidth=3)

longTrailTP= 0.0, shortTrailTP = 0.0

// Trailing Profit

// Start trailing once trigger is reached

longTrailTP := if useTP and buy_trend

tpValue = high * (1 + ProfitTrailPerc)

max(tpValue, longTrailTP[1])

else

0

shortTrailTP := if useTP and sell_trend

tpValue = low * (1 - ProfitTrailPerc)

min(tpValue, shortTrailTP[1])

else

999999

//plot(longTrailTP, title='debug longTrailTP', transp=100)

//plot(shortTrailTP, title='debug shortTrailTP', transp=100)

//////////////////////////////////////////////////////////////////////////////////////////

//*** TRAILING TAKE PROFIT HIT CONDITIONS TO BE USED IN ALERTS ***//

//////////////////////////////////////////////////////////////////////////////////////////

//🔷🔷🔷

// @hugo: I use crossover/crossunder for the alerts to trigger the events only once

cond_long_trail_tp_hit = useTP and buy_trend and crossover(high, longTrailTP[1])

and (TP_Trigger_Long_HIT or use_TP_Trigger == false)

cond_short_trail_tp_hit = useTP and sell_trend and crossunder(low, shortTrailTP[1])

and (TP_Trigger_Short_HIT or use_TP_Trigger == false)

// 🔷🔷🔷

// Plot take profits values for confirmation

// Display the trailing TP until not hit

plot(series= useTP and buy_trend and high <= longTrailTP and

(TP_Trigger_Long_HIT or use_TP_Trigger == false) ? longTrailTP : na,

color=color.aqua, style=plot.style_circles,

linewidth=2, title="Long Trail TP")

plot(series= useTP and sell_trend and low >= shortTrailTP and

(TP_Trigger_Short_HIT or use_TP_Trigger == false) ? shortTrailTP : na,

color=color.aqua, style=plot.style_circles,

linewidth=2, title="Short Trail TP")

close_long = cond_long_trail_tp_hit or cond_long_stop_loss_hit

close_short = cond_short_trail_tp_hit or cond_short_stop_loss_hit

strategy.entry("Long", 1, when=isLong)

strategy.close("Long", when=close_long)

strategy.entry("Short", 0, when=isShort)

strategy.close("Short", when=close_short)

if change_trend

SL_Trigger_Long_HIT := false

SL_Trigger_Short_HIT := false

TP_Trigger_Long_HIT := false

TP_Trigger_Short_HIT := false

- Price Channel VWAP Trading Strategy

- The Interwoven Moving Average Crossover Strategy

- Moving Average Breakout and Bollinger Band Breakout Strategy

- Absolute Momentum Indicator Strategy

- Supertrend and Moving Average Crossover Strategy

- Dual Trend Breakout Strategy

- SSL Channel and Wave Trend Quantitative Trading Strategy

- Super ATR Trend Following Strategy

- Trading-oriented Ichimoku Cloud Nine Strategy

- LPB Microcycles Adaptive Oscillation Contour Tracking Strategy

- Major Trend Indicator Long

- Multi Timeframe Strategy

- Dynamic Balancing Leveraged ETF Investment Strategy

- Multi-timeframe MACD Indicator Crossover Trading Strategy

- Gem Forest 1 Minute Breakout Strategy

- Three High Candle Reversal Strategy

- MACD Moving Average Combination Cross-Period Dynamic Trend Strategy

- Gem Forest One Minute Scalping Strategy

- Signal Smoothing Ehlers Cyber Cycle Strategy

- EMA Crossover Trend Following Trading Strategy