TradingVMA – Variable Moving Average Trading Strategy

Author: ChaoZhang, Date: 2024-02-21 11:47:43Tags:

Overview

The TradingVMA strategy is a quantitative trading strategy based on variable moving average lines. It utilizes changing moving averages to capture market trends and generate trading signals accordingly.

Strategy Logic

The core of the TradingVMA strategy is the calculation of variable length moving averages (Variable Moving Average, VMA). The moving average is a widely known technical indicator that computes the average price over a certain period. The VMA used in the TradingVMA strategy has varying period lengths.

Specifically, the strategy first computes a series of intermediate quantities, such as Price Directional Movement Indicator (PDM, MDIM), smoothed data (PDMs, MDMs). These data are eventually used to obtain the indicator strength (iS). This indicator reflects the intensity of price fluctuations.

Then, the TradingVMA strategy dynamically adjusts the moving average period based on the indicator strength. When market volatility increases, the moving average period becomes shorter, and vice versa. This allows faster response to market changes.

Finally, the strategy compares the current price with the VMA to generate trading signals. It goes long when price is above VMA and goes short when price is below VMA.

Advantage Analysis

The TradingVMA strategy has the following main advantages:

Variable Period Filters Noise More Steady – The variable moving average period adapts to market changes for filtering out noise and more stable trend signals.

Faster Response to Price Changes Improves Responsiveness – The variable moving average can respond swiftly to price changes and capture trend reversal points.

Reduces Trading Frequency Less Overtrading - Compared to fixed-period indicators, TradingVMA can reduce unnecessary trades.

Customizable Parameters Flexibility - The strategy allows users to select parameters based on their preferences to suit different market environments.

Risk Analysis

The TradingVMA strategy also has the following primary risks:

Missing Rapid Reversals – When trends reverse rapidly, the continuously adjusting moving average may lag in responding.

Lagging Bias – All moving average strategies have some degree of lagging bias, either long or short.

Wrong Signals –TradingVMA may generate incorrect long/short signals in range-bound sideways markets.

Difficult Parameter Optimization – Finding the optimal parameter combination can be challenging.

These risks can be controlled via methods like stop losses, adjusting parameter combinations, etc.

Optimization Directions

The TradingVMA strategy can also be enhanced in the following aspects:

Combine Other Indicators – Using with other trend, counter-trend indicators can improve signal quality.

Parameter Optimization – Discover optimum parameters via backtesting and optimization.

Adaptive Trading Rules – Employ different entry rules, stop losses per market regime.

Systemization – Algorithmize and systemize the strategy for easier optimization.

Conclusion

TradingVMA is an adaptive quantitative strategy. It captures market trends using a specially designed VMA indicator, with the edge of being responsive and filtering out noise. The strategy can be upgraded in multiple ways for better performance. But some inherent issues like lagging bias may persist. Overall, TradingVMA is a promising trend-following strategy.

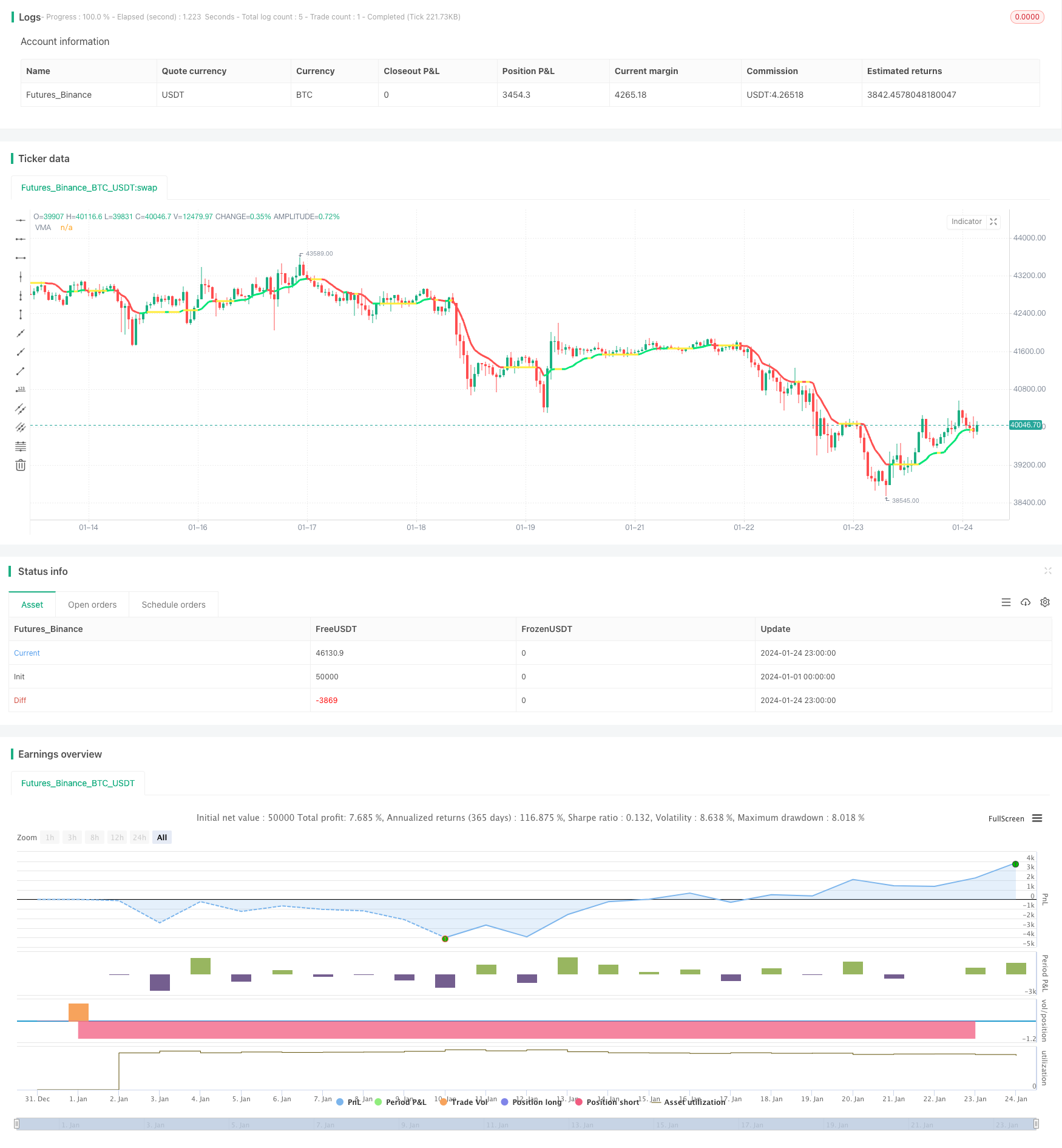

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-24 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © laptevmaxim92

//@version=4

strategy("Variable Moving Average Strategy", overlay=true)

src=close

l =input(5, title="VMA Length")

std=input(true, title="Show Trend Direction Colors")

utp = input(false, "Use take profit?")

pr = input(100, "Take profit pips")

usl = input(false, "Use stop loss?")

sl = input(100, "Stop loss pips")

fromday = input(01, defval=01, minval=01, maxval=31, title="From Day")

frommonth = input(01, defval=01, minval= 01, maxval=12, title="From Month")

fromyear = input(2000, minval=1900, maxval=2100, title="From Year")

today = input(31, defval=01, minval=01, maxval=31, title="To Day")

tomonth = input(12, defval=12, minval=01, maxval=12, title="To Month")

toyear = input(2019, minval=1900, maxval=2100, title="To Year")

use_date = (time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 00, 00))

k = 1.0/l

pdm = 0.0

pdm := max((src - src[1]), 0)

mdm = 0.0

mdm := max((src[1] - src), 0)

pdmS = 0.0

pdmS := ((1 - k)*nz(pdmS[1]) + k*pdm)

mdmS = 0.0

mdmS := ((1 - k)*nz(mdmS[1]) + k*mdm)

s = pdmS + mdmS

pdi = pdmS/s

mdi = mdmS/s

pdiS = 0.0

pdiS := ((1 - k)*nz(pdiS[1]) + k*pdi)

mdiS = 0.0

mdiS := ((1 - k)*nz(mdiS[1]) + k*mdi)

d = abs(pdiS - mdiS)

s1 = pdiS + mdiS

iS = 0.0

iS := ((1 - k)*nz(iS[1]) + k*d/s1)

hhv = highest(iS, l)

llv = lowest(iS, l)

d1 = hhv - llv

vI = (iS - llv)/d1

vma = 0.0

vma := (1 - k*vI)*nz(vma[1]) + k*vI*src

vmaC=(vma > vma[1]) ? color.lime : (vma<vma[1]) ? color.red : (vma==vma[1]) ? color.yellow : na

plot(vma, color=std?vmaC:color.white, linewidth=3, title="VMA")

longCondition = vma > vma[1]

if (longCondition)

strategy.entry("BUY", strategy.long and use_date)

shortCondition = vma < vma[1]

if (shortCondition)

strategy.entry("SELL", strategy.short and use_date)

if (utp and not usl)

strategy.exit("TP", "BUY", profit = pr)

strategy.exit("TP", "SELL", profit = pr)

if (usl and not utp)

strategy.exit("SL", "BUY", loss = sl)

strategy.exit("SL", "SELL", loss = sl)

if (usl and utp)

strategy.exit("TP/SL", "BUY", loss = sl, profit = pr)

strategy.exit("TP/SL", "SELL", loss = sl, profit = pr)

- Best ATR Stop Multiple Strategy

- Bollinger Crossing Death Golden Strategy

- Reversal Trading Strategy with Bollinger Bands, RSI, ADX and ATR

- DEMA Crossover Trend Following Strategy

- Extreme Reversal Setup Strategy

- OBV and CCI Indicators Based Trend Following Strategy

- Breakout Trading System

- Multi-timeframe Bollinger Bands Breakout Strategy Incorporating RSI

- Momentum Indicator Aggregation Trading Strategy

- Multi-indicator Quant Trading Strategy

- RSI Divergence Strategy

- Dual Donchian Channel Breakout Strategy

- Bollinger Bands Breakout Trading Strategy

- EMA Breakthrough Trap Strategy

- Golden Cross Dead Cross Trading Strategy

- Supertrend Based Multitimeframe Trend Tracking Strategy

- Manual Buy & Sell Alerts Strategy

- Quantitative Breakthrough Uptrend Reference Strategy

- Adaptive Grid Trading Strategy Based on Quantitative Trading Platform

- Quantitative Trading Strategy Based on Ichimoku Cloud and Moving Average