Overview

This strategy uses dual moving averages to form a channel and capture trend direction. Trading signals are generated when price breaks through the channel. RSI indicator is also incorporated to filter false breakouts. It trades only during London session with max 5 trades per day and max 2% daily loss.

Strategy Logic

The strategy employs two moving averages of length 5, one calculated from highest price and the other from lowest price, to form a price channel. Long signal triggers when close price breaks above the upper band, and short signal below the lower band.

To avoid false breakout, RSI indicator is added to gauge overbought/oversold levels. Go long only if RSI is above 80, and go short only if RSI is below 20.

Also, the strategy trades only during London session (3am - 11am), with max 5 orders per day and max 2% loss of equity per day.

Advantage Analysis

Catch the trend

The dual MA channel can effectively detect price trend direction. Breaking upper band catches the upside trend, while breaking lower band catches the downside trend.

Reduce false breakout

Using RSI overbought/oversold filter reduces some false breakout signals caused by price fluctuation.

Effective risk control

Trading only during major session and having max orders per day limit trading frequency. Max 2% daily loss also defines risk tolerance.

Risk Analysis

False breakout with volatility

Significant price swing can cause some false breakout signals, leading to unnecessary losses. Parameters can be optimized and more filters added to reduce such risk.

Fixed SL/TP risk

Using fixed pips for SL/TP risks being stopped out/missing profit in volatile market. Consider percentage-based or dynamic SL/TP instead.

Limited trading session risk

Opening positions only during fixed sessions runs the risk of missing potential trades in other hours. Consider expanding session or adjust dynamically based on real-time situation.

Optimization Directions

Parameter tuning

Optimize parameters like MA length, RSI figures, fixed SL/TP pips etc to find best combination.

Additional filters

Add more indicators or conditions to verify signals, e.g. higher volume, reduced BB width etc, to avoid false breakouts.

Dynamic SL/TP

Use percentage-based or dynamic stop loss/take profit instead of fixed pips to better handle one-sided market moves.

Manual review

Manually review signals, or only enter on confirmed breakout to prevent being trapped.

Conclusion

The strategy is fairly simple and practical overall, using dual MA channel to determine trend and RSI to filter false breakouts. Risk management via trading hours and loss limit also defines risk tolerance. Still large room for improvements, e.g. parameter tuning, better SL/TP mechanism etc.

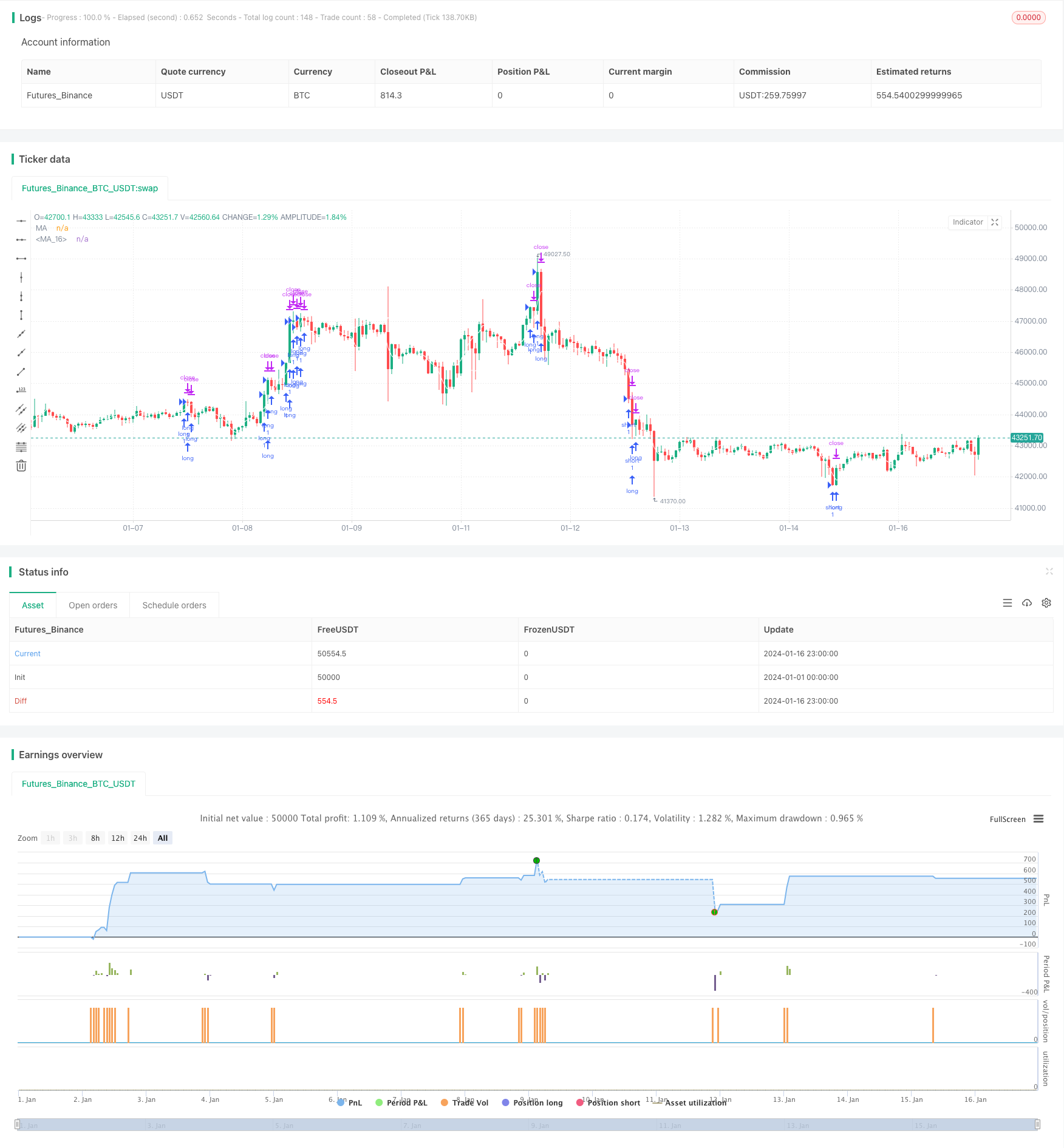

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-16 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy(title="Moving Average", shorttitle="MA", overlay=true)

timeinrange(res, sess) => time(res, sess) != 0

len = input(5, minval=1, title="Length")

src = input(high, title="Source")

offset = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

out = sma(src, len)

plot(out, color=color.white, title="MA", offset=offset)

len2 = input(5, minval=1, title="Length")

src2 = input(low, title="Source")

offset2 = input(title="Offset", type=input.integer, defval=0, minval=-500, maxval=500)

out2 = sma(src2, len2)

plot(out2, color=color.white, title="MA", offset=offset2)

length = input( 5 )

overSold = input( 10 )

overBought = input( 80 )

price = input(close, title="Source RSI")

vrsi = rsi(price, length)

longcond= close > out and close > out2 and vrsi > overBought

shortcont = close < out and close < out2 and vrsi < overSold

tp=input(150,title="tp")

sl=input(80,title="sl")

strategy.entry("long",1,when=longcond)

//strategy.close("long",when= close < out2)

strategy.exit("long_exit","long",profit=tp,loss=sl)

strategy.entry("short",1,when=shortcont)

//strategy.close("short",when=close >out)

strategy.exit("short_exit","short",profit=tp,loss=sl)

// maxOrder = input(6, title="max trades per day")

// maxRisk = input(2,type=input.float, title="maxrisk per day")

// strategy.risk.max_intraday_filled_orders(maxOrder)

// strategy.risk.max_intraday_loss(maxRisk, strategy.percent_of_equity)

// strategy.close_all(when =not timeinrange(timeframe.period, "0300-1100"))