Trend Tracking Strategy Based on RSI and ZigZag Indicators

Author: ChaoZhang, Date: 2024-02-22 16:15:18Tags:

Overview

The strategy is named “Crypto 15-minute Trend Tracking Strategy Based on RSI and ZigZag Indicators”. It is specifically designed for 15-minute crypto markets like ETHUSD/T and BTCUSD/T. The strategy determines trend direction by combining RSI indicator to judge overbought/oversold levels and ZigZag indicator to detect price spikes. It belongs to a typical trend following strategy.

Strategy Logic

The core logic of this strategy is to use both RSI and ZigZag indicators to determine price trend. Specifically, the RSI indicator judges whether price is overbought or oversold. The ZigZag indicator detects whether price has a significant percentage spike. When both indicators give trading signals simultaneously, we determine that there is a trend reversal for a counter position.

For the RSI indicator, we set the overbought line at 75 and the oversold line at 25. When RSI rises from below 25 to above 25, it is considered a reversal from oversold to bullish. When RSI falls from above 75 to below 75, it indicates a reversal from bullish to oversold.

For the ZigZag indicator, we set the price spike threshold to 1% in percentage change. When price makes a spike over 1% in amplitude, the ZigZag line will give a signal. Combined with trend judgment, we can identify trend reversals.

When both indicators give signals, if the previous trend is bullish and now RSI overbought while ZigZag shows price spike, we determine that price is topping and may consider shorting. On the contrary, if previous trend is bearish and now RSI oversold while ZigZag shows price spike, we determine that price is bottoming and may consider longing. Through this logic, we can follow the trend.

Strategy Strengths

The biggest advantage of this strategy is improved signal quality through combining two indicators. A single indicator tends to give many false signals. But this strategy uses RSI and ZigZag for verification, filtering out many bogus signals and improving win rate.

Another strength is flexible parameter tuning. The RSI and ZigZag parameters are customizable according to different market conditions for best results. This brings great adaptiveness to the strategy.

Strategy Risks

The main risk is incorrect signals from the indicators. Despite the dual indicator validation, there can still be failures during high volatility leading to trading mistakes. Inappropriate parameter setting also impacts strategy performance.

To reduce risks, we may shorten position holding period for timely stop loss. Parameter optimization is also very important catering to market characteristics. Manual intervention may be necessary when facing abnormal market conditions.

Optimization Directions

The strategy can be improved from the following aspects:

Add more indicators like KDJ and MACD for combined judgment to further filter signals.

Introduce machine learning algorithms for automatic parameter optimization adapting to market changes.

Build an adaptive stop loss mechanism with dynamic protection based on market volatility.

Optimize position sizing based on trend strengths.

Set up alternative strategies to switch automatically in uncommon markets.

Conclusion

In summary, this is a typical trend following strategy. The core idea is to identify trend reversals using RSI and ZigZag indicators in combination. The advantage lies in improved signal quality through dual indicator filtration. Risks of indicator failure need to be fully considered, and the strategy continuously improved through parameter tuning, stop loss optimization, position sizing and so on. Overall this provides an effective trend tracking solution for the crypto market.

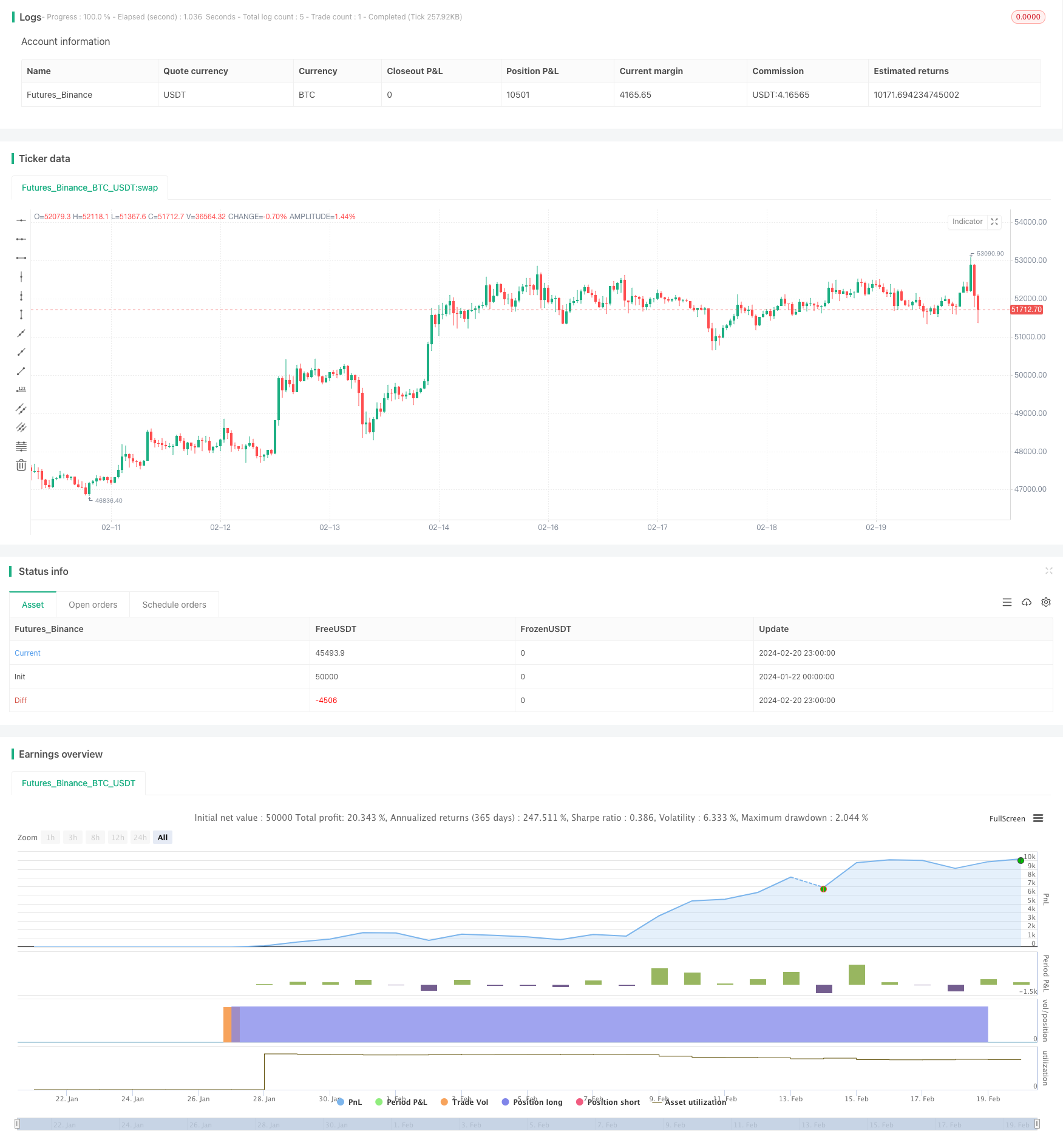

/*backtest

start: 2024-01-22 00:00:00

end: 2024-02-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © SoftKill21

//@version=4

strategy("Crypto ZigZag RSI strategy 15min",overlay=true)

length =input(5, title="RSI Length")

overSold = input(25)

overBought= input(75)

p =close

vrsi = rsi(p, length)

var bool long = na

var bool short = na

long :=crossover(vrsi,overSold)

short := crossunder(vrsi,overBought)

var float last_open_long = na

var float last_open_short = na

last_open_long := long ? close : nz(last_open_long[1])

last_open_short := short ? close : nz(last_open_short[1])

entry_value =last_open_long

entry_value1=last_open_short

//

ZZPercent = input(1, title="Minimum % Change", type=input.float)

r1Level=entry_value

s1Level=entry_value1

trend = 0

trend := na(trend[1]) ? 1 : trend[1]

LL = 0.0

LL := na(LL[1]) ? s1Level : LL[1]

HH = 0.0

HH := na(HH[1]) ?r1Level : HH[1]

Pi = ZZPercent * 0.01

zigzag = float(na)

if trend > 0

if r1Level >= HH

HH := r1Level

HH

else

if s1Level < HH * (1 - Pi)

zigzag :=r1Level[1]

trend := -1

LL := s1Level

LL

else

if s1Level <= LL

LL := s1Level

LL

else

if r1Level > LL * (1 + Pi)

zigzag := s1Level[1]

trend := 1

HH := s1Level

HH

shortc=crossunder(trend,0)

longc=crossover(trend,0)

longa =input(true)

shorta=input(false)

if(longa)

strategy.entry("long",1,when=longc)

strategy.close("long",when=shortc)

if(shorta)

strategy.entry("short",0,when=shortc)

strategy.close("long",when=longc)

- RSI Golden Cross Short Strategy

- Dual Moving Average and Bollinger Band Combination Trend Tracking Strategy

- Adaptive Fluctuation Strategy Based on Quantitative Range Breakthrough

- Bull Flag Breakout Strategy

- The Moving Average Crossover Trading Strategy

- Moving Average Crossover Gold Trading Strategy

- EMA and MACD Trend Following Strategy

- Moving Average Crossover MACD Trading Strategy

- Super Trend Daily Reversal Strategy

- Dual EMA Crossover Strategy

- Moving Average Crossover Breakout Strategy

- Momentum Breakout Backtesting Support Resistance Strategy

- MyQuant Trend Identifier Strategy

- Dual Trendlines Breakout Golden Cross Death Cross Trend Following Strategy

- Nifty 50 Quantitative Trading Strategy Based on Dynamic Position Adjustment with Support and Resistance Levels

- Dynamic Channel Moving Average Trend Tracking Strategy

- Harmonic Dual System Strategy

- Breakthrough Callback Long Strategy

- MA Crossover Trading Strategy Based on Short-term and Long-term Moving Average Crossovers

- Dual Moving Average Crossover MACD Quantitative Strategy