MACD Momentum with MA Strategy

Author: ChaoZhang, Date: 2024-02-22 17:51:19Tags:

Overview

The Trend Hunter - MACD Momentum with MA strategy is an exquisite trading tool designed for traders seeking to capitalize on trending markets. Built on the robust combination of Average True Range (ATR), Simple Moving Average (SMA) and Moving Average Convergence Divergence (MACD), it filters and confirms trade entries with precision.

Strategy Logic

ATR Stop Loss

Utilizes the ATR indicator to dynamically tune stop levels, adapting to market volatility by customizing ATR Length and Multiplier, providing balanced risk management.

SMA Trend Filter

Employs SMA as a trend filter. By tuning SMA Period, users align the strategy timeframe with their preferred market trend, enhancing adaptability.

MACD Entry Confirmation

Incorporates MACD to refine entry signals by comparing the MACD line against its signal line, ensuring alignment with momentum.

Entry Logic

Long: Triggered when price closes above SMA, having closed below in the prior period, with MACD line crossing above signal line. Entry set at current price plus ATR stop distance.

Short: Triggered when price closes below SMA, after closing above in previous period, with MACD line falling below signal line. Entry set at current price minus ATR stop distance.

Advantages

This strategy harnesses volatility, trend and momentum dynamics to construct systematic entry and risk rules. Its blend of indicators enhances adaptability across various market conditions, making it an ideal tool for trend-following.

By tracking trend momentum, the Trend Hunter aids in uncovering profit opportunities. Fine-tuning parameters to match trading style allows observing how the strategy plays a vital role in signaling favorable trading junctures.

Risk Analysis

The strategy relies on indicator combinations to gauge market conditions, risking misjudgments in certain situations. Trend reversals may also lead to increased losses.

Lowering false signals through parameter adjustments or wider stop distances provides solutions. Pausing strategies during abnormal volatility also averts anomalies.

Optimization Paths

Parameter Tuning

Testing and optimizing ATR Length, SMA Period and MACD inputs finds ideal values matching trading style.

More Filters

Adding indicators like KDJ, OBV etc as auxiliary filters improves accuracy. Extra conditions like volume spikes also prevent whipsaws.

Stop Loss Strategies

Trailing or volatility stops that dynamically adjust stop distance minimizes losses by tracking prices.

Conclusion

The Trend Hunter strategy amalgamates volatility, trend and momentum dynamics into a precise entry confirmation and risk management system. Parameter adjustments cater to individual trading styles, aiding in capitalizing on opportunities. Worthwhile for quants to further explore and apply.

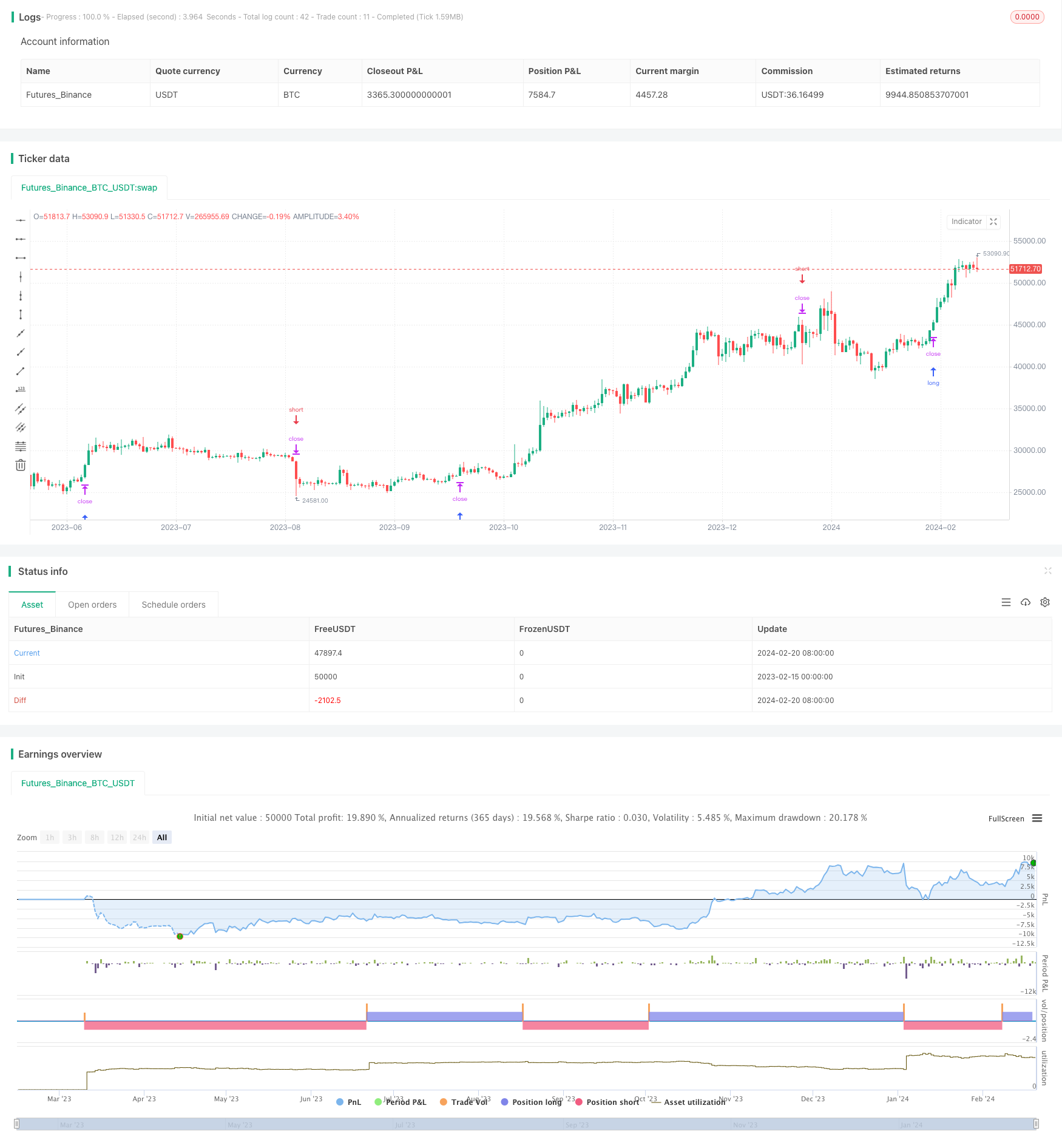

/*backtest

start: 2023-02-15 00:00:00

end: 2024-02-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("trend_hunter", overlay=true)

length = input(20, title="ATR Length")

numATRs = input(0.75, title="ATR Multiplier")

atrs = ta.sma(ta.tr, length) * numATRs

// Trend Filter

smaPeriod = input(32, title="SMA Period")

sma = ta.sma(close, smaPeriod)

// MACD Filter

macdShortTerm = input(12, title="MACD Short Term")

macdLongTerm = input(26, title="MACD Long Term")

macdSignalSmoothing = input(9, title="MACD Signal Smoothing")

[macdLine, signalLine, _] = ta.macd(close, macdShortTerm, macdLongTerm, macdSignalSmoothing)

// Long Entry with Trend and MACD Filter

longCondition = close > sma and close[1] <= sma[1] and macdLine > signalLine

strategy.entry("Long", strategy.long, stop=close + atrs, when=longCondition, comment="Long")

// Short Entry with Trend and MACD Filter

shortCondition = close < sma and close[1] >= sma[1] and macdLine < signalLine

strategy.entry("Short", strategy.short, stop=close - atrs, when=shortCondition, comment="Short")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_area)

- Moving Average Crossover Trading Strategy

- SMA System Trend Following Strategy

- Multi-Timeframe RSI Trading Strategy

- Trend Following Strategy Based on Moving Average Crossover

- Dual EMA Golden Cross Long Line Strategy

- Dynamic Regression Channel Strategy

- Reversal Momentum Breakout Strategy

- Triple Dynamic Moving Average Trend Tracking Strategy

- Momentum Breakout EMA Crossover Strategy

- Trading Dynamic Trend Tracking Strategy

- EMA Crossover Trading Strategy

- Simple Cryptocurrency Trading Strategy Based on RSI

- Quantitative Trading Strategy Based on Price Crossover with SMA

- Dual Moving Average Crossover Strategy with Stop Loss and Take Profit

- The Momentum Tracking and Trend Strategy

- Trend Following Strategy Based on MA Lines

- Trend Following Strategy Based on Bollinger Bands

- The Oscillating Breakthrough Strategy

- Adaptive Moving Average Trading Strategy

- RSI Golden Cross Short Strategy