Dual EMA Golden Cross Long Line Strategy

Author: ChaoZhang, Date: 2024-02-23 12:17:40Tags:

Overview

The Dual EMA Golden Cross Long Line strategy is a trend tracking strategy that only opens long positions. The strategy uses three moving averages, short-term EMA, medium-term EMA and long-term EMA. The specific entry rule is: open long when the price is above the long-term EMA and the short-term EMA crosses above the medium-term EMA to form a golden cross.

Strategy Logic

Calculate short-term EMA, medium-term EMA and long-term EMA using three EMA periods that are configurable.

If the price is above the long-term EMA, it proves that it is currently in a bullish trend.

If the short-term EMA crosses above the medium-term EMA from below to form a golden cross, it further proves that the bullish trend is strengthening.

When both conditions above are met at the same time, open long.

Advantage Analysis

The biggest advantage of this strategy is that it can effectively identify trends by using multi-period EMAs combined judgment to avoid being misled by short-term market noise. At the same time, stop loss is configured as a risk control means to keep losses within a certain range.

Risk Analysis

The main risk of this strategy is the long position. When the market reverses, it is unable to close positions in time, leading to the risk of expanding losses. In addition, improper EMAs period setting can also lead to frequent trading and increase transaction costs.

Optimization Direction

Increase position sizing management to reduce positions when drawdowns reach a certain percentage.

Increase stop loss settings when breaking new highs.

Optimize EMAs period parameters to reduce trading frequency.

Summary

This strategy is overall a stable high-quality long-term holding strategy. It has strong ability to identify trends with proper risk control. With further optimization, it is expected to obtain better stable returns.

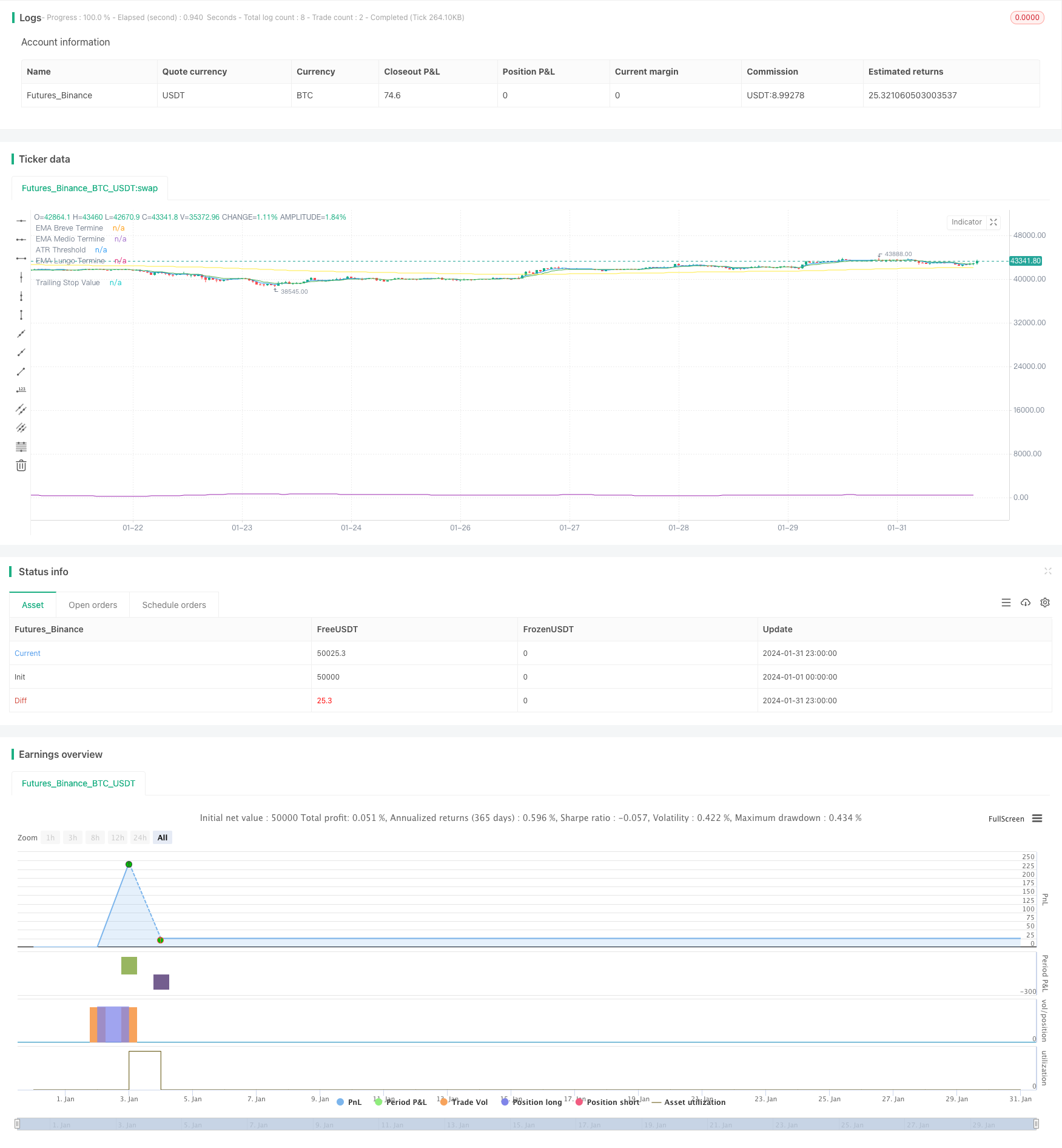

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Strategia EMA Long con Opzioni di Uscita Avanzate e Periodi EMA Personalizzabili", overlay=true)

// Parametri di input generali

useVolatilityFilter = input.bool(true, title="Usa Filtro di Volatilità")

atrPeriods = input.int(14, title="Periodi ATR", minval=1)

atrMultiplier = input.float(1.5, title="Moltiplicatore ATR", step=0.1)

useTrailingStop = input.bool(true, title="Usa Trailing Stop")

trailingStopPercent = input.float(15.0, title="Percentuale Trailing Stop", minval=0.1, step=0.1) / 100.0

useEMAExit = input.bool(true, title="Usa Uscita EMA Corta incrocia EMA Media al Ribasso")

// Parametri di input per periodi EMA personalizzabili

emaLongTermPeriod = input.int(200, title="Periodo EMA Lungo Termine", minval=1)

emaShortTermPeriod = input.int(5, title="Periodo EMA Breve Termine", minval=1)

emaMidTermPeriod = input.int(10, title="Periodo EMA Medio Termine", minval=1)

// Calcolo delle EMA con periodi personalizzabili

longTermEMA = ta.ema(close, emaLongTermPeriod)

shortTermEMA = ta.ema(close, emaShortTermPeriod)

midTermEMA = ta.ema(close, emaMidTermPeriod)

// Calcolo ATR e soglia di volatilità

atr = ta.atr(atrPeriods)

atrThreshold = ta.sma(atr, atrPeriods) * atrMultiplier

// Condizione di entrata

enterLongCondition = close > longTermEMA and shortTermEMA > midTermEMA

enterLong = useVolatilityFilter ? (enterLongCondition and atr > atrThreshold) : enterLongCondition

if (enterLong)

strategy.entry("Enter Long", strategy.long)

// Tracking del prezzo di entrata e del massimo prezzo raggiunto per il trailing stop

var float entryPrice = na

var float maxPriceSinceEntry = na

if (strategy.position_size > 0)

maxPriceSinceEntry := math.max(na(maxPriceSinceEntry) ? high : maxPriceSinceEntry, high)

entryPrice := na(entryPrice) ? strategy.position_avg_price : entryPrice

else

maxPriceSinceEntry := na

entryPrice := na

// Calcolo del valore del trailing stop

trailStopPrice = maxPriceSinceEntry * (1 - trailingStopPercent)

// Implementazione delle condizioni di uscita

exitCrossUnder = close < longTermEMA

emaCross = ta.crossunder(shortTermEMA, midTermEMA)

if (useEMAExit and emaCross)

strategy.close("Enter Long", comment="EMA Cross Exit")

if (useTrailingStop)

strategy.exit("Trailing Stop", from_entry="Enter Long", stop=trailStopPrice)

// Visualizzazioni

plot(longTermEMA, color=color.yellow, title="EMA Lungo Termine")

plot(shortTermEMA, color=color.blue, title="EMA Breve Termine")

plot(midTermEMA, color=color.green, title="EMA Medio Termine")

plot(useVolatilityFilter ? atrThreshold : na, color=color.purple, title="ATR Threshold")

plot(strategy.position_size > 0 ? trailStopPrice : na, color=color.orange, title="Trailing Stop Value", style=plot.style_linebr)

- Quadruple Crossing Strategy

- Reversal Bollinger Band RSI MACD Quant Strategy

- RSI Moving Average Double Cross Oscillation Strategy

- Crossing Moving Average RR Strategy

- DCA Strategy with Trailing Take Profit

- SuperTrend Bollinger Bands Dual Moving Average Trading Strategy

- Moving Average Crossover Trading Strategy

- SMA System Trend Following Strategy

- Multi-Timeframe RSI Trading Strategy

- Trend Following Strategy Based on Moving Average Crossover

- Dynamic Regression Channel Strategy

- Reversal Momentum Breakout Strategy

- Triple Dynamic Moving Average Trend Tracking Strategy

- Momentum Breakout EMA Crossover Strategy

- Trading Dynamic Trend Tracking Strategy

- MACD Momentum with MA Strategy

- EMA Crossover Trading Strategy

- Simple Cryptocurrency Trading Strategy Based on RSI

- Quantitative Trading Strategy Based on Price Crossover with SMA

- Dual Moving Average Crossover Strategy with Stop Loss and Take Profit