Moving Average Crossover Trading Strategy

Author: ChaoZhang, Date: 2024-02-23 12:46:19Tags:

Overview

This strategy generates buy and sell signals based on the crossover of moving averages. It uses 8-day, 18-day and 50-day exponential moving averages (EMA). A buy signal is generated when the price breaks above the 8-day EMA and is higher than the 50-day EMA. A sell signal is generated when the 8-day EMA crosses below the 18-day EMA.

Principle

Moving averages can effectively filter price fluctuations and reflect price trends. Faster moving averages respond quicker to price changes. When the faster moving average crosses above the slower one, it signals an upward trend in prices. And when it crosses below, it signals a downward trend.

This strategy utilizes the crossover of EMAs of different periods to determine changes in price trends and generate trading signals. Specifically, it uses:

- 8-day EMA: fast-moving, to judge short-term trends

- 18-day EMA: medium-speed, to judge medium-term trends

- 50-day EMA: slow-moving, to judge long-term trends

Buy signals are generated when the short-term uptrend (8-day EMA rising) aligns with medium and long-term trends (price higher than 50-day EMA). Sell signals are generated when the short-term uptrend (8-day EMA) is broken by the medium-term downtrend (18-day EMA falling).

Advantage Analysis

The advantages of this strategy are:

- Clear trading signals and simple rules.

- Can effectively identify trend reversal using multi-period EMAs.

- EMAs filter noise and reduce unnecessary trades.

- Good real-time performance to respond to events quickly.

Risk Analysis

There are also some risks:

- EMAs have lag and may miss best timing for reversals.

- Potentially large drawdowns, requiring strict stop loss.

- Parameter setting is subjective, needs adjustment across markets.

- Too frequent signals during high volatility, increasing costs.

Some methods to optimize and mitigate risks:

- Combine other indicators to improve timing and win rate.

- Set stop loss to control downside.

- Test and optimize parameters for different markets.

- Add filters to avoid over-trading.

Optimization Directions

Some directions to further optimize the strategy:

- Optimize EMA periods to find best combinations.

- Add other indicators like RSI to improve entry timing.

- Add stop loss mechanisms like trailing stop loss.

- Combine volume analysis, only consider signals with increasing volume.

- Test robustness across different products, adjust accordingly.

Conclusion

Overall this is a simple and practical strategy, using EMA crosses to determine trend changes. It has good real-time performance but also risks requiring further testing and optimization. With robust enhancements, it can become a stable algorithmic trading strategy.

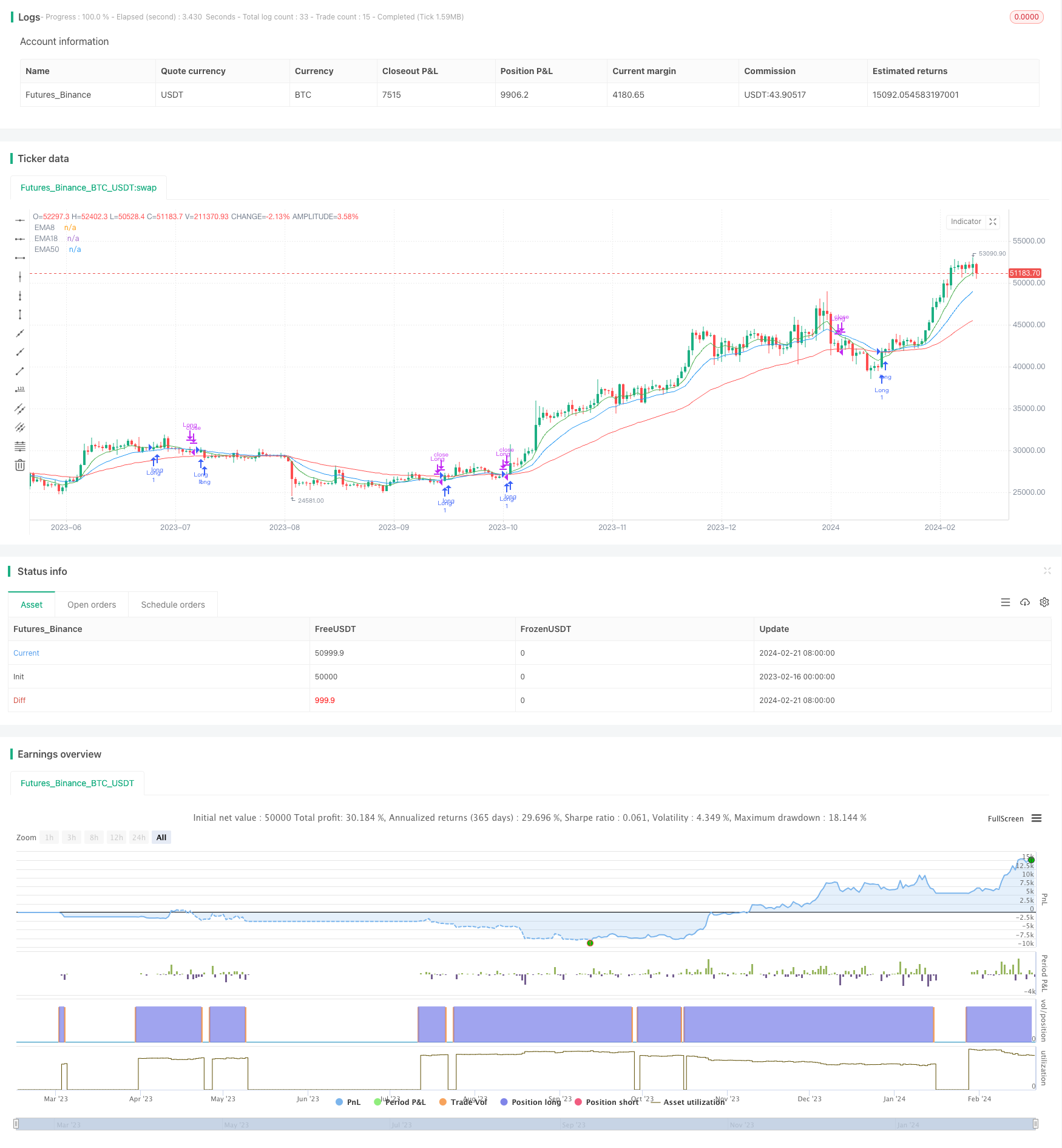

/*backtest

start: 2023-02-16 00:00:00

end: 2024-02-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy('Trading EMAs', overlay=true)

// Definir las medias móviles con colores personalizados

ema8 = ta.ema(close, 8)

ema18 = ta.ema(close, 18)

ema50 = ta.ema(close, 50)

plot(ema8, color=color.new(color.green, 0), title='EMA8')

plot(ema18, color=color.new(color.blue, 0), title='EMA18')

plot(ema50, color=color.new(color.red, 0), title='EMA50')

// Condiciones de entrada

longCondition = ta.crossover(close, ema8) and close > ema50 // Señal de compra cuando el precio de cierre cruza al alza la EMA de 8 y el precio está por encima de la EMA de 50

// Condiciones de salida

exitLongCondition = ta.crossunder(ema8, ema18) // Señal de venta cuando EMA8 cruza por debajo de EMA18

// Ejecutar las operaciones basadas en las condiciones de entrada

if longCondition

strategy.entry('Long', strategy.long)

// Salida de las operaciones basadas en las condiciones de salida

if exitLongCondition

strategy.close('Long')

- All about the ATR and EMA based trend following strategy

- Quantitative Trading Strategy Based on Bollinger Bands and MACD

- The momentum breakout strategy

- Marubozu Candle Range Balance Strategy

- Quadruple Crossing Strategy

- Reversal Bollinger Band RSI MACD Quant Strategy

- RSI Moving Average Double Cross Oscillation Strategy

- Crossing Moving Average RR Strategy

- DCA Strategy with Trailing Take Profit

- SuperTrend Bollinger Bands Dual Moving Average Trading Strategy

- SMA System Trend Following Strategy

- Multi-Timeframe RSI Trading Strategy

- Trend Following Strategy Based on Moving Average Crossover

- Dual EMA Golden Cross Long Line Strategy

- Dynamic Regression Channel Strategy

- Reversal Momentum Breakout Strategy

- Triple Dynamic Moving Average Trend Tracking Strategy

- Momentum Breakout EMA Crossover Strategy

- Trading Dynamic Trend Tracking Strategy

- MACD Momentum with MA Strategy