Combo Quantitative Trend Tracking Strategy

Author: ChaoZhang, Date: 2024-02-27 15:54:24Tags:

Overview

The core idea of this strategy is to combine the 123 reversal strategy and the rainbow oscillator indicator to achieve double trend tracking and improve the winning rate of the strategy. By tracking short-term and medium-term price trends dynamically, this strategy adjusts positions to achieve excess returns over benchmarks.

Principles

The strategy consists of two parts:

-

123 Reversal Strategy: Go long if the closing price declines for the previous two days and rises today, and the 9-day Slow K line is below 50; Go short if the closing price rises for the previous two days and falls today, and the 9-day Fast K line is above 50.

-

Rainbow Oscillator Indicator: This indicator reflects the degree of deviation of prices relative to moving averages. When the indicator is higher than 80, it indicates that the market tends to be unstable. When the indicator is lower than 20, it indicates that the market tends to reverse.

This strategy opens positions when both long and short signals appear, otherwise flattens positions.

Advantage Analysis

The advantages of this strategy are:

- Double filter improves signal quality and reduces misjudgment.

- Dynamic position adjustment reduces losses in one-way markets.

- Integrates short-term and medium-term indicators to improve stability.

Risk Analysis

The risks of this strategy include:

- Improper parameter optimization may lead to overfitting.

- Double opening increases trading costs.

- Stop loss point is vulnerable when price fluctuates violently.

These risks can be mitigated by adjusting parameters, optimizing position management, and setting stop loss reasonably.

Optimization Directions

This strategy can be optimized in the following aspects:

- Optimize parameters to find the best parameter combination.

- Add position management module to adjust positions dynamically based on volatility and drawdown.

- Increase stop loss module and set reasonable moving stop loss.

- Increase machine learning algorithms to assist in judging inflection points.

Conclusion

This strategy integrates the 123 reversal strategy and the rainbow oscillator indicator to achieve double trend tracking. While maintaining high stability, it has potential for excess returns. Further optimization can be done to improve the profitability of the strategy.

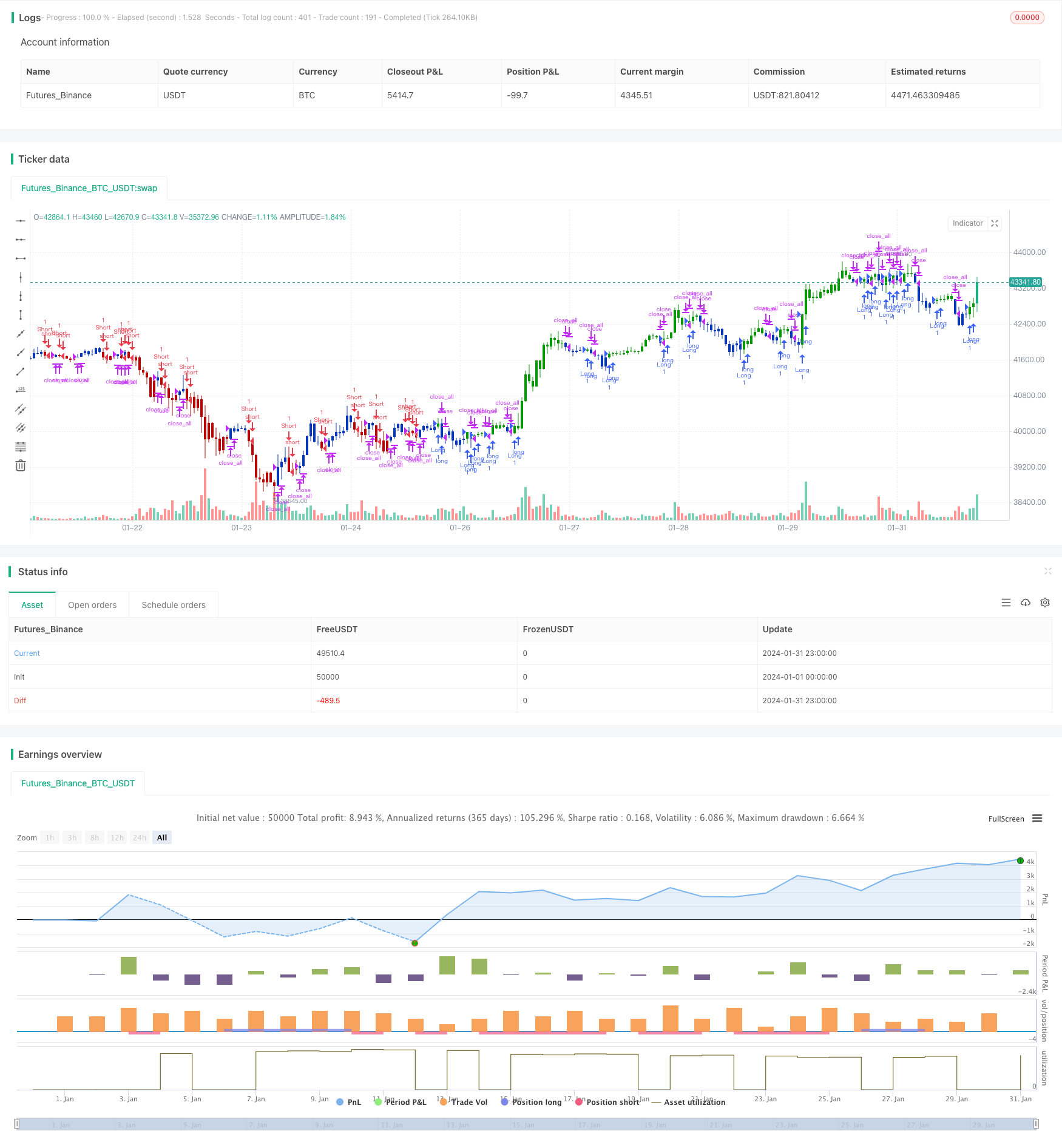

/*backtest

start: 2024-01-01 00:00:00

end: 2024-01-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 25/05/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Ever since the people concluded that stock market price movements are not

// random or chaotic, but follow specific trends that can be forecasted, they

// tried to develop different tools or procedures that could help them identify

// those trends. And one of those financial indicators is the Rainbow Oscillator

// Indicator. The Rainbow Oscillator Indicator is relatively new, originally

// introduced in 1997, and it is used to forecast the changes of trend direction.

// As market prices go up and down, the oscillator appears as a direction of the

// trend, but also as the safety of the market and the depth of that trend. As

// the rainbow grows in width, the current trend gives signs of continuity, and

// if the value of the oscillator goes beyond 80, the market becomes more and more

// unstable, being prone to a sudden reversal. When prices move towards the rainbow

// and the oscillator becomes more and more flat, the market tends to remain more

// stable and the bandwidth decreases. Still, if the oscillator value goes below 20,

// the market is again, prone to sudden reversals. The safest bandwidth value where

// the market is stable is between 20 and 80, in the Rainbow Oscillator indicator value.

// The depth a certain price has on a chart and into the rainbow can be used to judge

// the strength of the move.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

RO(Length, LengthHHLL) =>

pos = 0.0

xMA1 = sma(close, Length)

xMA2 = sma(xMA1, Length)

xMA3 = sma(xMA2, Length)

xMA4 = sma(xMA3, Length)

xMA5 = sma(xMA4, Length)

xMA6 = sma(xMA5, Length)

xMA7 = sma(xMA6, Length)

xMA8 = sma(xMA7, Length)

xMA9 = sma(xMA8, Length)

xMA10 = sma(xMA9, Length)

xHH = highest(close, LengthHHLL)

xLL = lowest(close, LengthHHLL)

xHHMAs = max(xMA1,max(xMA2,max(xMA3,max(xMA4,max(xMA5,max(xMA6,max(xMA7,max(xMA8,max(xMA9,xMA10)))))))))

xLLMAs = min(xMA1,min(xMA2,min(xMA3,min(xMA4,min(xMA5,min(xMA6,min(xMA7,min(xMA8,min(xMA9,xMA10)))))))))

xRBO = 100 * ((close - ((xMA1+xMA2+xMA3+xMA4+xMA5+xMA6+xMA7+xMA8+xMA9+xMA10) / 10)) / (xHH - xLL))

xRB = 100 * ((xHHMAs - xLLMAs) / (xHH - xLL))

pos:= iff(xRBO > 0, 1,

iff(xRBO < 0, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Rainbow Oscillator", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Rainbow Oscillator ----")

LengthRO = input(2, minval=1)

LengthHHLL = input(10, minval=2, title="HHV/LLV Lookback")

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posRO = RO(LengthRO, LengthHHLL)

pos = iff(posReversal123 == 1 and posRO == 1 , 1,

iff(posReversal123 == -1 and posRO == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Quantitative Oscillation Indicator Combination Strategy

- Ichimoku Cloud Trend Following Strategy

- Intraday Dual Moving Average Trading Strategy

- Mayan Treasure Hunting Guide

- Trend Tracking Strategy Based on Moving Average

- EMA Cross Trend Following Strategy

- Dual Moving Average Crossover Strategy

- Bollinger Band Tracking Strategy

- Fast and Slow Moving Averages Crossover Strategy

- An Advanced Dual Timeframe Trend Tracking Strategy for a Hot Stock

- Awesome Oscillator Double Stochastic Filtered Divergence Trading Strategy

- Trend Filter Quantitative Strategy Based on Keltner Channels and CCI Indicator

- Dynamic Channel Breakthrough Strategy

- Support and Resistance Trend Tracking Strategy

- MACD Crossover Strategy with RSI Confirmation

- Dynamic Trailing Stop Strategy

- Donchain Channel Based Trading Strategy

- Momentum Rectangle Channel Dual Moving Average Trading Strategy

- Dual Moving Average Following Strategy

- Dual Trend Filtering Optimization Strategy