EMA Crossover Strategy with Target/Stop-loss Ratio and Fixed Position Size

Author: ChaoZhang, Date: 2024-03-28 18:04:32Tags:

Overview

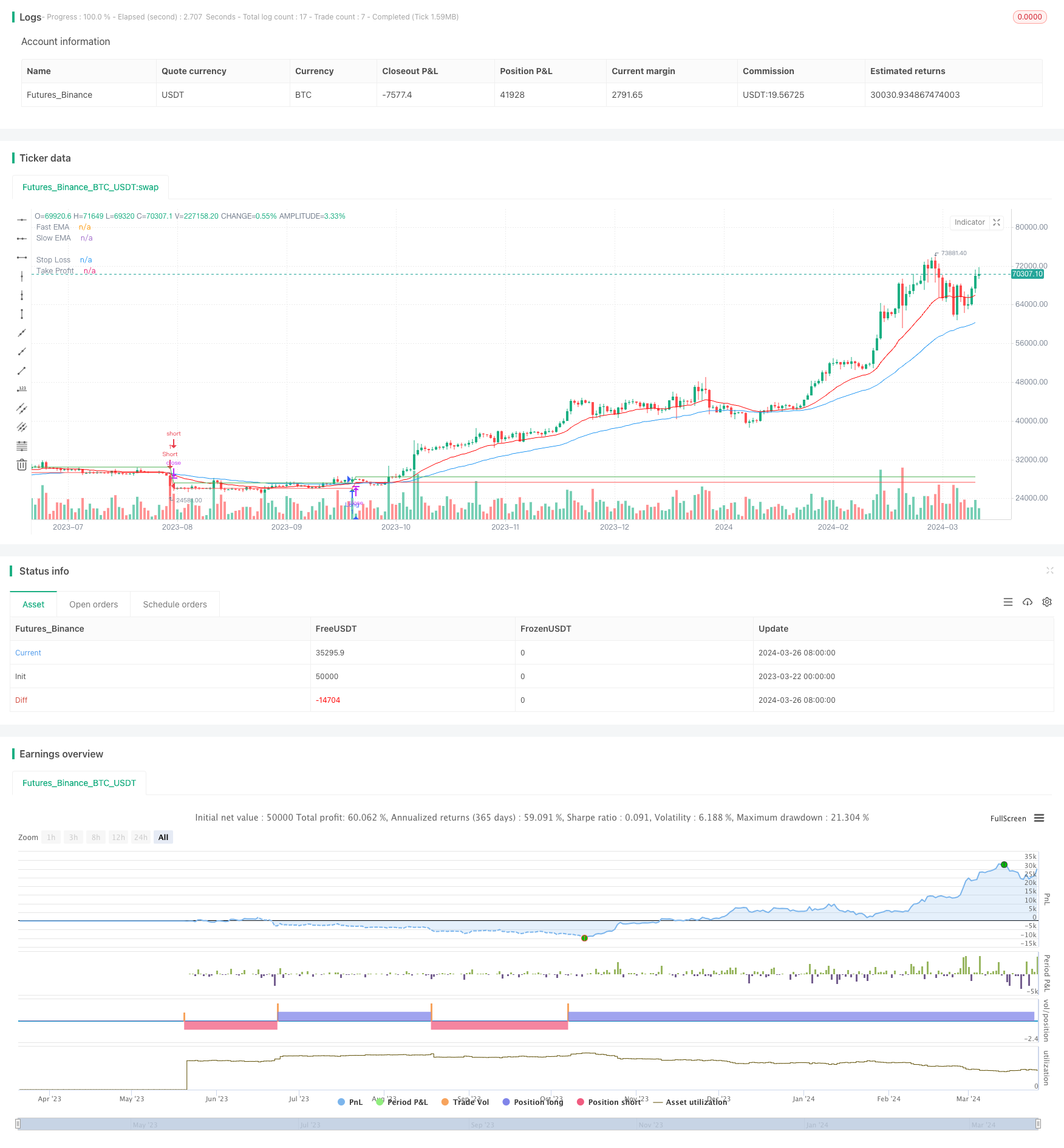

This strategy is a trading strategy based on the crossover of fast and slow exponential moving averages (EMAs). When the fast EMA crosses above the slow EMA, the strategy enters a long trade, and when the fast EMA crosses below the slow EMA, the strategy enters a short trade. The strategy uses a target/stop-loss ratio to calculate the stop-loss and take-profit prices and uses a fixed position size for each trade.

Strategy Principles

The main principle of this strategy is to use two EMAs with different periods to capture changes in price trends. When the fast EMA crosses the slow EMA, it usually indicates a change in the price trend. Specifically, when the fast EMA crosses above the slow EMA from below, it suggests that the price may start an upward trend, and the strategy will enter a long trade. When the fast EMA crosses below the slow EMA from above, it suggests that the price may start a downward trend, and the strategy will enter a short trade.

The strategy also introduces the concept of a target/stop-loss ratio to calculate the stop-loss and take-profit prices for each trade. The stop-loss price is obtained by multiplying the average entry price by (1 - target/stop-loss ratio), while the take-profit price is obtained by multiplying the average entry price by (1 + target/stop-loss ratio). This approach allows for dynamic adjustment of stop-loss and take-profit levels based on risk preferences.

Furthermore, the strategy employs a fixed position size for each trade, meaning that the amount of funds for each trade is fixed and does not adjust based on account balance or other factors. This helps to control risk and maintain consistency in the strategy.

Strategy Advantages

-

Simple and effective: The strategy is based on the classic principle of EMA crossover, which is easy to understand and implement while effectively capturing changes in price trends.

-

Dynamic stop-loss and take-profit: By introducing the target/stop-loss ratio, the strategy can dynamically adjust stop-loss and take-profit levels based on risk preferences, enhancing the flexibility and adaptability of the strategy.

-

Risk control: By using a fixed position size for each trade, the strategy helps to control the risk exposure of each trade and reduce the overall risk of the account.

-

Wide applicability: The strategy can be applied to various financial markets and trading instruments, such as stocks, futures, and forex, making it widely applicable.

Strategy Risks

-

Parameter sensitivity: The performance of the strategy depends on the selection of EMA parameters, such as the periods of the fast and slow EMAs. Different parameter combinations may lead to significant differences in strategy performance, so careful optimization and testing of parameters are required.

-

Overoptimization risk: If the strategy parameters are excessively optimized, it may lead to poor performance on out-of-sample data, i.e., overfitting. Therefore, comprehensive backtesting and forward-testing are necessary to ensure the robustness of the strategy.

-

Market risk: The performance of the strategy is influenced by market trends and volatility. During choppy or trendless markets, the strategy may generate more false signals, leading to frequent trades and capital losses.

-

Black swan events: The strategy may have poor adaptability to extreme market events (such as financial crises or geopolitical conflicts), which can cause significant drawdowns.

Strategy Optimization Directions

-

Dynamic parameter optimization: Consider dynamically adjusting the EMA period parameters based on market conditions or price volatility characteristics to adapt to different market environments. This can be achieved by introducing market state judgment indicators or volatility indicators.

-

Signal filtering: In addition to EMA crossover signals, introduce other technical indicators or market information to filter signals and improve signal reliability and accuracy. For example, volume, momentum indicators, or market sentiment indicators can be incorporated.

-

Position management optimization: Consider dynamically adjusting the trade position size based on market risk conditions or personal risk preferences, rather than using a fixed position size. This can be achieved by introducing risk control models or money management rules.

-

Long-short hedging: Consider simultaneously holding long and short positions to construct a market-neutral portfolio, reducing market risk and improving strategy stability.

Summary

This strategy is a trend-following strategy based on the principle of EMA crossover, which captures price trends while controlling risk by introducing a target/stop-loss ratio and a fixed position size mechanism. The strategy’s advantages lie in its simplicity, effectiveness, dynamic stop-loss and take-profit, and wide applicability. However, it also faces challenges such as parameter sensitivity, overoptimization risk, and market risk. In the future, improvements can be made to the strategy in terms of dynamic parameter optimization, signal filtering, position management optimization, and long-short hedging to enhance its robustness and profitability.

/*backtest

start: 2023-03-22 00:00:00

end: 2024-03-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KarthicSRSivagnanam

//@version=5

strategy("EMA Crossover Strategy with Target/Stop-loss Ratio and Fixed Position Size", shorttitle="EMA Cross", overlay=true)

// Define input variables

fast_length = input(20, title="Fast EMA Length")

slow_length = input(50, title="Slow EMA Length")

ema_color = input(color.red, title="EMA Color")

target_ratio = input(2, title="Target/Stop-loss Ratio")

position_size = input(1, title="Fixed Position Size (Rs.)")

// Calculate EMAs

ema_fast = ta.ema(close, fast_length)

ema_slow = ta.ema(close, slow_length)

// Plot EMAs

plot(ema_fast, color=ema_color, title="Fast EMA")

plot(ema_slow, color=color.blue, title="Slow EMA")

// Long entry condition: Fast EMA crosses above Slow EMA

longCondition = ta.crossover(ema_fast, ema_slow)

// Short entry condition: Fast EMA crosses below Slow EMA

shortCondition = ta.crossunder(ema_fast, ema_slow)

// Calculate stop-loss and target levels

stopLoss = strategy.position_avg_price * (1 - target_ratio / 100)

takeProfit = strategy.position_avg_price * (1 + target_ratio / 100)

// Plot stop-loss and target levels

plot(stopLoss, color=color.red, title="Stop Loss")

plot(takeProfit, color=color.green, title="Take Profit")

// Entry conditions with fixed position size

if (longCondition)

strategy.entry("Long", strategy.long, qty = position_size)

if (shortCondition)

strategy.entry("Short", strategy.short, qty = position_size)

// Plot entry signals

plotshape(series=longCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=shortCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

- Vector Candle-based Channel Breakout and Custom ChoCH Strategy

- BreakHigh EMA Crossover Strategy

- Dynamic Trend Following Strategy

- Supertrend ATR Strategy

- Triple Exponential Moving Average Convergence Divergence and Relative Strength Index Combined 1-Minute Chart Cryptocurrency Quantitative Trading Strategy

- RSI and Dual Moving Average Based 1-Hour Trend Following Strategy

- Exponential Moving Average Crossover Quantitative Trading Strategy

- SMA-based Trading Strategy for BankNifty Futures

- Bollinger Bands and RSI Trading Strategy

- Gaussian Channel Adaptive Moving Average Strategy

- Moving Average Pullback Tracking Strategy

- RSI Stop Loss Tracking Trading Strategy

- SMA Moving Average Crossover Strategy

- Bollinger 5-Minute Breakout Intraday Trading Strategy

- Variance and Moving Averages Based Volatility Strategy

- Moving Average Crossover Quantitative Strategy

- EMA Cross ADR Strategy - A Multidimensional Technical Indicator-Based Trading Method with Strict Risk Management

- Bullish and Bearish Engulfing Strategy Based on Candlestick Patterns

- Bollinger Bands Long Only Strategy

- AlphaTrend and Bollinger Bands Combined Mean Reversion + Trend Following Strategy