策略概述

基于K线蜡烛图的看涨吞没和看跌吞没策略是一种利用蜡烛图形态来判断市场趋势并进行交易的量化交易策略。该策略通过识别看涨吞没和看跌吞没两种形态,在形态出现时进行买入或卖出操作,以期获取市场趋势变化带来的利润。

策略原理

该策略的核心原理是利用蜡烛图中的看涨吞没和看跌吞没形态来判断市场趋势的变化。具体来说:

看涨吞没形态:当前蜡烛图的收盘价高于前一根蜡烛图的最高价,且当前蜡烛图的开盘价低于或等于前一根蜡烛图的收盘价,同时当前蜡烛图的收盘价低于或等于前一根蜡烛图的开盘价,此时形成看涨吞没形态,预示着市场可能由跌转涨。

看跌吞没形态:当前蜡烛图的收盘价低于前一根蜡烛图的最低价,且当前蜡烛图的开盘价高于或等于前一根蜡烛图的收盘价,同时当前蜡烛图的收盘价高于或等于前一根蜡烛图的开盘价,此时形成看跌吞没形态,预示着市场可能由涨转跌。

当识别出看涨吞没形态时,策略会发出买入信号进行做多操作;当识别出看跌吞没形态时,策略会发出卖出信号进行做空操作。同时,策略在持仓时也设置了止盈和止损条件,以控制风险。

策略优势

简单易懂:该策略基于经典的蜡烛图形态,原理简单清晰,易于理解和实现。

适用范围广:看涨吞没和看跌吞没形态在各种市场和品种中都有一定的适用性,因此该策略可以应用于不同的交易标的。

捕捉趋势转折:通过识别吞没形态,该策略能够较好地捕捉到市场趋势的转折点,在趋势初期介入,有望获取更多利润。

策略风险

频繁交易:由于吞没形态出现的频率较高,该策略可能会频繁发出交易信号,导致交易次数过多,增加手续费成本。

假信号:并非所有的吞没形态都能可靠地预示趋势反转,某些吞没形态可能是假信号,导致策略作出错误判断而产生亏损。

趋势延续性:吞没形态只能预示趋势反转的可能性,但无法判断反转后的趋势能够持续多久,因此该策略在趋势延续性方面存在一定的不确定性。

优化方向

结合其他指标:可以考虑将吞没形态与其他技术指标(如移动平均线、RSI等)结合使用,以提高信号的可靠性和准确性。

优化参数:对策略的入场和出场条件进行优化,如调整止盈止损的位置,以提高策略的盈利能力和风险控制能力。

加入过滤条件:对于某些特定市场情况(如震荡市、重大事件等),可以加入一些过滤条件,避免在不利环境下进行交易。

总结

基于K线蜡烛图的看涨吞没和看跌吞没策略是一种相对简单实用的量化交易策略,通过识别蜡烛图的特定形态来捕捉市场趋势的转折点,在趋势初期介入,以期获取趋势反转带来的利润。该策略优点是原理简单清晰,适用范围广,能够较好地捕捉趋势转折;但同时也存在频繁交易、假信号、趋势延续性不确定等风险。因此,在实际应用中,可以考虑从结合其他指标、优化参数、加入过滤条件等方面对策略进行优化,以提高其稳定性和盈利能力。总的来说,该策略可以作为一种辅助性的交易策略,与其他策略和分析方法相结合,为交易者提供有价值的参考和决策支持。

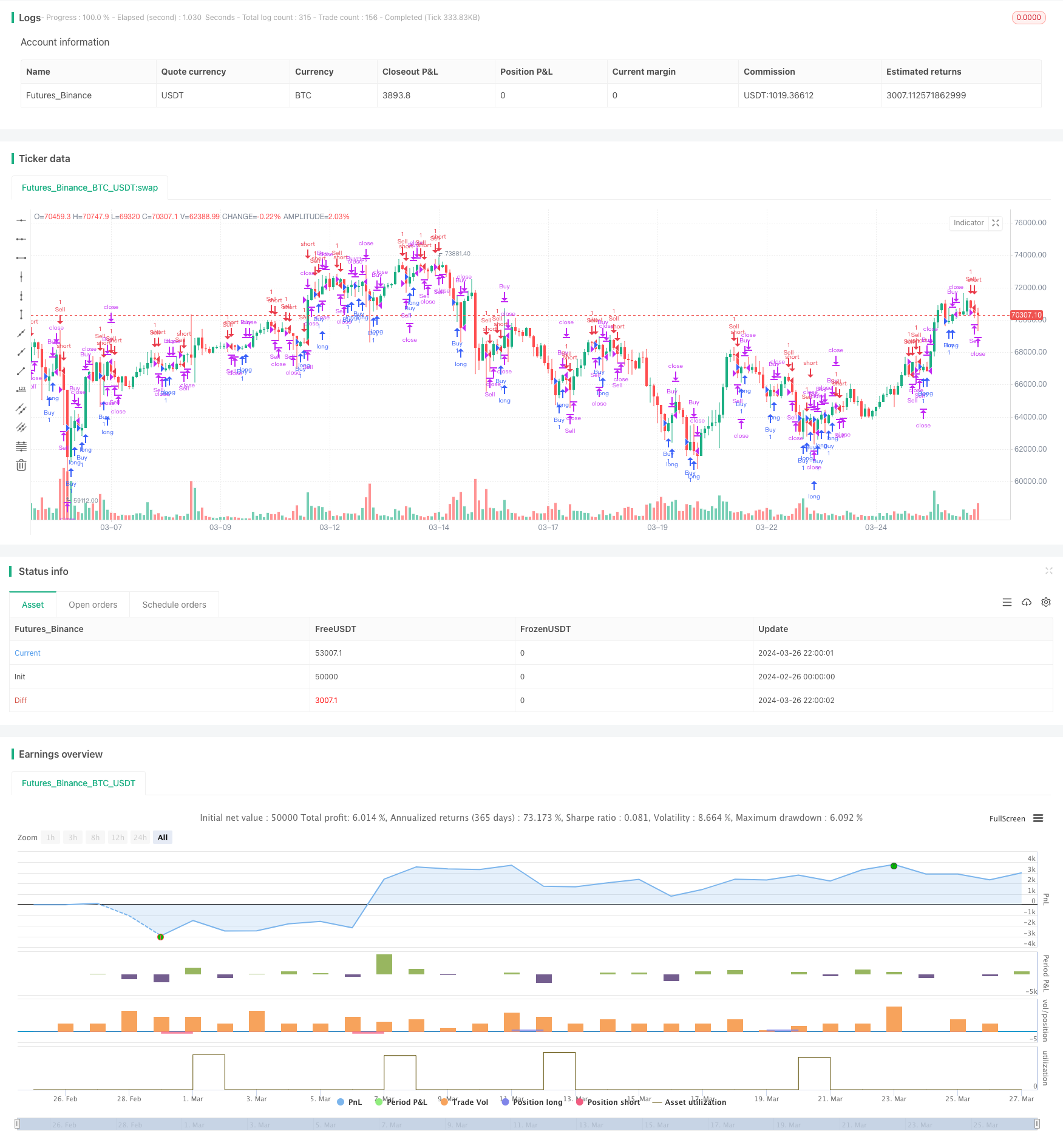

/*backtest

start: 2024-02-26 00:00:00

end: 2024-03-27 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Engulfing Strategy", overlay=true)

// Calculate bullish engulfing

bullishEngulfing = close[1] < open[1] and close > open and open <= close[1] and close <= open[1]

// Calculate bearish engulfing

bearishEngulfing = close[1] > open[1] and close < open and open >= close[1] and close >= open[1]

// Entry conditions

if (bullishEngulfing)

strategy.entry("Buy", strategy.long)

if (bearishEngulfing)

strategy.entry("Sell", strategy.short)

// Exit conditions

if (strategy.position_size > 0)

if (close > strategy.position_avg_price)

strategy.close("Buy")

else

strategy.close("Buy")

if (strategy.position_size < 0)

if (close < strategy.position_avg_price)

strategy.close("Sell")

else

strategy.close("Sell")

- 布林带与RSI交易策略

- 高斯通道自适应均线策略

- 基于目标止损比例和固定仓位的EMA交叉策略

- 移动平均回调追踪策略

- RSI止损追踪交易策略

- SMA均线交叉策略

- 布林5分钟突破日内交易策略

- 基于方差和移动平均线的波动幅度策略

- 移动平均交叉量化策略

- ADR均线交叉策略 - 融合多维度技术指标和严格止盈止损的交易方法

- 基于布林带的多头策略

- AlphaTrend和布林带相结合的均值回归+趋势跟踪策略

- 网格美元成本平均策略

- 基于三连阳/阴和双均线的量化交易策略

- 基于多重移动平均线、RSI 和标准差出场的蜡烛线高度突破交易策略

- 币安账户万向划转小工具

- 网格交易风险对冲策略

- 基于抛物线指标和移动平均线的多空趋势判断策略

- 多空线性交叉策略

- 基于趋势动量的多指标均线交叉策略