Los patrones de swing altos/bajos y de velas

El autor:¿ Qué pasa?, Fecha: 2022-05-07 21:12:40Las etiquetas:al alzade baja

Este guión identifica los picos y bajos de los movimientos, así como el patrón de las velas que ocurrieron en ese punto preciso. El guión puede detectar los siguientes patrones de velas: martillo, martillo inverso, engulf bullish, hanging man, shooting star y engulf bearish.

Las anotaciones HH, HL, LH y LL que se pueden ver en las etiquetas se definen de la siguiente manera:

HH: más alto más alto HL: Más alto más bajo LH: Bajo alto LL: Bajo bajo

Configuración

Duración: Sensibilidad de la detección de altas/bajas oscilaciones, con valores más bajos que devuelven el máximo/mínimo de las variaciones de precios a corto plazo.

Uso y detalles

Puede ser interesante ver si una parte superior o inferior está asociada con un patrón de vela específico, esto nos permite estudiar el potencial de dicho patrón para indicar una inversión.

Tenga en cuenta que las etiquetas están desplazadas y aparecerán más adelante en tiempo real, por lo que este indicador no está destinado a detectar picos/fundos en tiempo real.

Los valores más altos de longitud pueden devolver errores.

Prueba posterior

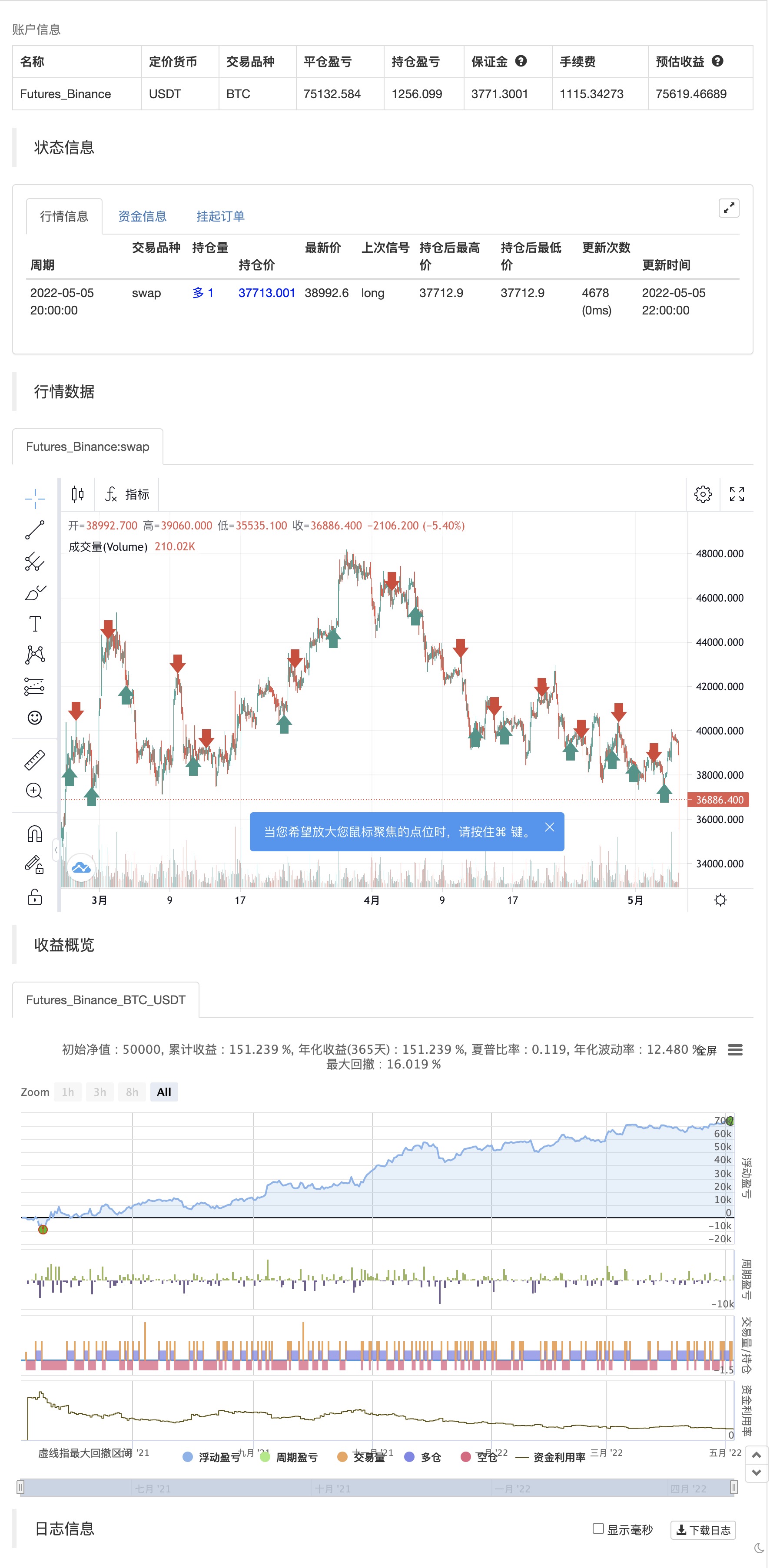

/*backtest

start: 2021-05-06 00:00:00

end: 2022-05-05 23:59:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This work is licensed under a Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0) https://creativecommons.org/licenses/by-nc-sa/4.0/

// © LuxAlgo

//@version=4

study("Swing Highs/Lows & Candle Patterns",overlay=true)

length = input(21)

//------------------------------------------------------------------------------

o = open[length],h = high[length]

l = low[length],c = close[length]

//------------------------------------------------------------------------------

ph = pivothigh(close,length,length)

pl = pivotlow(open,length,length)

valH = valuewhen(ph,c,0)

valL = valuewhen(pl,c,0)

valpH = valuewhen(ph,c,1)

valpL = valuewhen(pl,c,1)

//------------------------------------------------------------------------------

d = abs(c - o)

hammer = pl and min(o,c) - l > d and h - max(c,o) < d

ihammer = pl and h - max(c,o) > d and min(c,o) - l < d

bulleng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

hanging = ph and min(c,o) - l > d and h - max(o,c) < d

shooting = ph and h - max(o,c) > d and min(c,o) - l < d

beareng = c > o and c[1] < o[1] and c > o[1] and o < c[1]

//------------------------------------------------------------------------------

//Descriptions

//------------------------------------------------------------------------------

hammer_ = "The hammer candlestick pattern is formed of a short body with a long lower wick, and is found at the bottom of a downward trend."

+ "\n" + "\n A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up."

ihammer_ = "The inverted hammer is a similar pattern than the hammer pattern. The only difference being that the upper wick is long, while the lower wick is short."

+ "\n" + "\n It indicates a buying pressure, followed by a selling pressure that was not strong enough to drive the market price down. The inverse hammer suggests that buyers will soon have control of the market."

bulleng_ = "The bullish engulfing pattern is formed of two candlesticks. The first candle is a short red body that is completely engulfed by a larger green candle"

+ "\n" + "\n Though the second day opens lower than the first, the bullish market pushes the price up, culminating in an obvious win for buyers"

hanging_ = "The hanging man is the bearish equivalent of a hammer; it has the same shape but forms at the end of an uptrend."

+ "\n" + "It indicates that there was a significant sell-off during the day, but that buyers were able to push the price up again. The large sell-off is often seen as an indication that the bulls are losing control of the market."

shotting_ = "The shooting star is the same shape as the inverted hammer, but is formed in an uptrend: it has a small lower body, and a long upper wick."

+ "\n" + "Usually, the market will gap slightly higher on opening and rally to an intra-day high before closing at a price just above the open – like a star falling to the ground."

beareng_ = "A bearish engulfing pattern occurs at the end of an uptrend. The first candle has a small green body that is engulfed by a subsequent long red candle."

+ "\n" + "It signifies a peak or slowdown of price movement, and is a sign of an impending market downturn. The lower the second candle goes, the more significant the trend is likely to be."

//------------------------------------------------------------------------------

n = bar_index

label lbl = na

H = valH > valpH ? "HH" : valH < valpH ? "LH" : na

L = valL < valpL ? "LL" : valL > valpL ? "HL" : na

txt = hammer ? "Hammer" : ihammer ? "Inverse Hammer" :

bulleng ? "Bullish Engulfing" : hanging ? "Hanging Man" :

shooting ? "Shooting Star" : beareng ? "Bearish Engulfing" : "None"

des = hammer ? hammer_ : ihammer ? ihammer_ :

bulleng ? bulleng_ : hanging ? hanging_ :

shooting ? shotting_ : beareng ? beareng_ : ""

//------------------------------------------------------------------------------

if ph

strategy.entry("Enter Long", strategy.long)

else if pl

strategy.entry("Enter Short", strategy.short)

- ZigZag PA estrategia V4.1

- Indicador de configuración de demarque

- Fractal roto: el sueño roto de alguien es su beneficio!

- Las velas engullentes

- Estrategias de transacción de conversión de estado de la cadena de probabilidad de Markov

- La ruptura de soporte-resistencia

- Tendencia inversa de los marcos de tiempo dobles estrategias de transacción cuantitativas de forma lineal K

- EMA cruza línea media con estrategia de señales cortas

- Estrategias de cuantificación inversa y modelos de optimización de la volatilidad en el rango dinámico de RSI

- Estrategias de identificación de estado de mercado dinámico basadas en el gradiente de regresión lineal

- El MACD mágico

- Puntuación Z con señales

- La estrategia de fluctuación fácil de Shinobi en la versión en lengua de Pine

- 3EMA + Boullinger + el eje central

- Baguetas de granos

- La máquina de moler

- Indicador de inversión de K I

- Las velas engullentes

- MA Emperador en sí

- Puntos de reversión de Demark

- Superposición de TMA

- El valor de las operaciones de mercado se calcula a partir de las siguientes cifras:

- Sistema de disparo por honda CM

- Bollinger + RSI, doble estrategia v1.1

- Estrategia de bandas de Bollinger

- Seguimiento de tendencias optimizado

- Retorno mensual en las estrategias de PineScript

- ADX y DI para v4

- MacD Indicador personalizado-marco de tiempo múltiple + Todas las opciones disponibles!

- Indicador: Oscilador de tendencia de onda