Estrategia de trading multi-temporal basada en RSI y medias móviles

Descripción general

La idea central de esta estrategia es utilizar al mismo tiempo un índice relativamente fuerte (RSI) y un promedio móvil de diferentes períodos de tiempo para identificar los puntos de reversión de la tendencia y, al mismo tiempo, realizar operaciones en línea corta para capturar tendencias de línea media y larga. La estrategia integra varias señales de negociación con el objetivo de mejorar la tasa de éxito de las operaciones.

Principio de estrategia

- Calcula el indicador RSI, así como el promedio móvil de la línea rápida EMA y la línea lenta WMA.

- Cuando la línea del indicador RSI rompe la media móvil WMA, se genera una señal de compra/venta.

- Cuando la línea rápida de EMA supera la línea lenta de WMA, se genera una señal de compra/venta.

- Cuando el RSI y la EMA rompen el WMA al mismo tiempo, se genera una fuerte señal de compra/venta.

- Al mismo tiempo, se puede reforzar la señal principal cuando el precio supera la media móvil auxiliar.

- Configuración de las condiciones para detener y detener el daño.

La estrategia integra señales de ruptura de varios indicadores técnicos, promedios móviles con diferentes parámetros para identificar tendencias en diferentes períodos, lo que mejora la fiabilidad de la estrategia. El indicador RSI determina el estado de sobreventa y sobreventa, la línea rápida EMA determina la tendencia a corto plazo, la línea lenta WMA determina la tendencia a mediano plazo y la tendencia de verificación de ruptura de precios y promedios auxiliares. La combinación de varias señales mejora la eficacia de la estrategia.

Análisis de las ventajas

- El indicador RSI tiene características de reversión que permiten aprovechar oportunidades de reversión en zonas de sobreventa y sobrecompra.

- Ayuda a los promedios móviles como filtros de tendencias para evitar falsos breaks.

- La combinación de varios períodos de tiempo permite seguir tendencias de línea larga y capturar oportunidades de línea corta.

- La combinación de señales de varios indicadores puede mejorar la tasa de éxito de las transacciones.

- Configura una estrategia de stop loss para controlar el riesgo de forma activa.

Análisis de riesgos

- El indicador RSI es propenso a generar falsas señales y necesita un filtro de media móvil auxiliar.

- El repunte bajo la tendencia de los ciclos mayores puede desencadenar señales de cambio de tendencia y debe ser tratado con cautela.

- Optimización de la configuración de los parámetros, como la duración de los ciclos RSI, los ciclos de las medias móviles, etc.

- La configuración del punto de parada debe ser cuidada para evitar ser bloqueada.

El riesgo puede ser reducido mediante la optimización de los parámetros, estrictas estrategias de stop loss y la consideración de tendencias de grandes ciclos.

Dirección de optimización

- Optimiza los parámetros del RSI para encontrar la mejor longitud de ciclo.

- Prueba diferentes tipos de combinaciones de medias móviles.

- Añade indicadores de volatilidad como ATR, para detener el stop loss de ajuste dinámico

- Se ha añadido un módulo de gestión de volúmenes.

- Utiliza técnicas de aprendizaje automático para la optimización de parámetros y la evaluación de la calidad de la señal.

Resumir

La estrategia integra el seguimiento de tendencias y el pensamiento de negociación de inversión de puntos, con el análisis de múltiples marcos temporales y el uso integral de varios indicadores, con el objetivo de mejorar la tasa de éxito de las operaciones. La clave es controlar el riesgo, optimizar la configuración de los parámetros y considerar el impacto de las tendencias de gran ciclo en las operaciones cuando sea necesario. En general, la estrategia tiene una gran utilidad y compatibilidad.

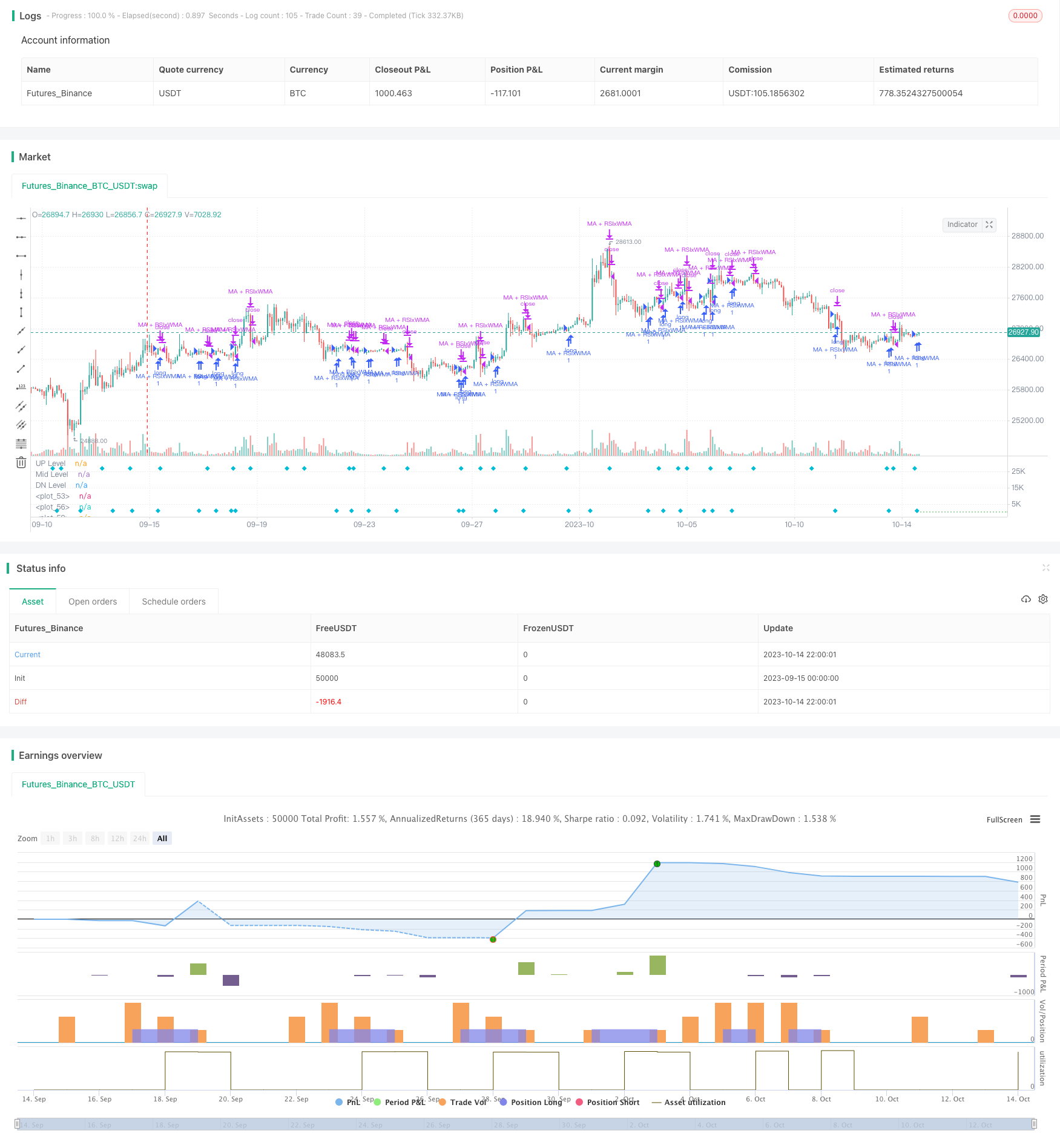

/*backtest

start: 2023-09-15 00:00:00

end: 2023-10-15 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HamidBox

//@version=4

// strategy("H-M By HamidBox-YT", default_qty_type=strategy.cash, default_qty_value= 100, initial_capital=100, currency='USD', commission_type=strategy.commission.percent, commission_value=0.1)

ma(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

WMA(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

WithMA(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

rsi_inline = input(true , title="RSI Value)", inline="rsi")

rsiLength = input(title="Length:", type=input.integer, defval=9, minval=1, inline="rsi")

rsiLineM = input(title="Level:", type=input.integer, defval=50, minval=1, inline="rsi")

rsi_OSOBinline = input(true , title="RSI)", inline="rsiosob")

rsiLineU = input(title="O-BOUGHT", type=input.integer, defval=70, minval=1, inline="rsiosob")

rsiLineD = input(title="O-SOLD", type=input.integer, defval=30, minval=1, inline="rsiosob")

ma_inline = input(true , title="Price-MA)", inline="ma")

ma_type = input(title="Type", defval="EMA", options=["EMA","SMA","WMA","VWMA"], inline="ma")

emaLength = input(title="Length", type=input.integer, defval=3, inline="ma")

wma_inline = input(true , title="Trending-MA)", inline="wma")

ma_type2 = input(title="", defval="WMA", options=["EMA","SMA","WMA","VWMA"], inline="wma")

wmaLength = input(title="Length", type=input.integer, defval=21, inline="wma")

////////////////////////////////////////////////////////////////////////////////

startTime = input(title="Start Time", type = input.time, defval = timestamp("01 Jan 2021 00:00 +0000"), group="Backtest Time Period")

endTime = input(title="End Time", type = input.time, defval = timestamp("01 Jan 2200 00:00 +0000"), group="Backtest Time Period")

inDateRange = true

////////////////////////////////////////////////////////////////////////////////

rsi = rsi(close , rsiLength)

r = plot(rsi_inline ? rsi : na, color=color.yellow, linewidth=2)

EMA = ma(rsi, emaLength, ma_type)

e = plot(ma_inline ? EMA : na, color=color.lime)

myWMA = ma(rsi, wmaLength, ma_type2)

w = plot(wma_inline ? myWMA : na, color=color.white, linewidth=2)

up = hline(rsiLineU, title='UP Level', linewidth=1, color=color.red, linestyle=hline.style_dotted)

mid = hline(rsiLineM, title='Mid Level', linewidth=2, color=color.white, linestyle=hline.style_dotted)

dn = hline(rsiLineD, title='DN Level', linewidth=1, color=color.green, linestyle=hline.style_dotted)

col_e_w = EMA > myWMA ? color.new(color.green , 85) : color.new(color.red , 85)

col_r_w = rsi > myWMA ? color.new(color.green , 85) : color.new(color.red , 85)

fill(e , w, color=col_e_w)

fill(r , w, color=col_r_w)

////////////////////////////////////////////////////////////////////////////////

//Signals = input(true,group="👇 🚦 --- Backtesting Signals Type --- 🚦 ")

///////////////////////////////////////////////////////////////////////////////

RSI_Cross = input(false, "RSI x Trending-MA", inline="wma_cross",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsiBuySignal = crossover(rsi , myWMA)

plotshape(RSI_Cross ? rsiBuySignal : na, title="RSI Crossover", style=shape.labelup, location=location.bottom, color=color.green)

rsiSellSignal = crossunder(rsi , myWMA)

plotshape(RSI_Cross ? rsiSellSignal : na, title="RSI Crossunder", style=shape.labeldown, location=location.top, color=color.red)

if rsiBuySignal and RSI_Cross and inDateRange

strategy.entry("RSIxWMA", strategy.long)

if rsiSellSignal and RSI_Cross and inDateRange

strategy.close("RSIxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

MA_Cross = input(false, "MA x Trendin-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

maBuySignal = crossover(EMA, myWMA)

plotshape(MA_Cross ? maBuySignal : na, title="MA Cross", style=shape.circle, location=location.bottom, color=color.lime)

maSellSignal = crossunder(EMA , myWMA)

plotshape(MA_Cross ? maSellSignal : na, title="RSI Crossunder", style=shape.circle, location=location.top, color=color.maroon)

if maBuySignal and MA_Cross and inDateRange

strategy.entry("MAxWMA", strategy.long)

if maSellSignal and MA_Cross and inDateRange

strategy.close("MAxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

Mix = input(false, "RSI + EMA x Trending-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_ma_buy = crossover(rsi , myWMA) and crossover(EMA, myWMA)

rsi_ma_sell = crossunder(rsi , myWMA) and crossunder(EMA, myWMA)

plotshape(Mix ? rsi_ma_buy : na, title="RSI Crossunder", style=shape.circle, location=location.bottom, color=color.lime, size=size.tiny)

plotshape(Mix ? rsi_ma_sell : na, title="RSI Crossunder", style=shape.circle, location=location.top, color=color.yellow, size=size.tiny)

if rsi_ma_buy and Mix and inDateRange

strategy.entry("RSI+EMA x WMA", strategy.long)

if rsi_ma_sell and Mix and inDateRange

strategy.close("RSI+EMA x WMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

wma_cross = input(false, "Trending-MA x 50",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

wma_buy = crossover(myWMA , rsiLineM)

plotshape(wma_cross ? wma_buy : na, title="WMA Cross", style=shape.diamond, location=location.bottom, color=color.aqua)

wma_sell = crossunder(myWMA , rsiLineM)

plotshape(wma_cross ? wma_sell : na, title="WMA Cross", style=shape.diamond, location=location.top, color=color.aqua)

if wma_buy and wma_cross and inDateRange

strategy.entry("WMA x 50", strategy.long)

if wma_sell and wma_cross and inDateRange

strategy.close("WMA x 50", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

rsi_50 = input(false, "RSI x 50",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_50_buy = crossover(rsi , rsiLineM)

plotshape(rsi_50 ? rsi_50_buy : na, title="WMA Cross", style=shape.cross, location=location.bottom, color=color.purple)

rsi_50_sell = crossunder(rsi , rsiLineM)

plotshape(rsi_50 ? rsi_50_sell : na, title="WMA Cross", style=shape.cross, location=location.top, color=color.purple)

if rsi_50_buy and rsi_50 and inDateRange

strategy.entry("RSI Cross 50", strategy.long)

if rsi_50_sell and rsi_50 and inDateRange

strategy.close("RSI Cross 50", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

RSI_OS_OB = input(false, "RSI OS/OB x Trending-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_OB_buy = (rsi < rsiLineD or rsi[1] < rsiLineD[1] or rsi[2] < rsiLineD[2] or rsi[3] < rsiLineD[3] or rsi[4] < rsiLineD[4] or rsi[5] < rsiLineD[5]) and rsiBuySignal

plotshape(RSI_OS_OB ? rsi_OB_buy : na, title="RSI OB + Cross", style=shape.circle, location=location.bottom, color=color.lime, size=size.tiny)

rsi_OS_sell = (rsi > rsiLineU or rsi[1] > rsiLineU[1] or rsi[2] > rsiLineU[2] or rsi[3] > rsiLineU[3] or rsi[4] > rsiLineU[4] or rsi[5] > rsiLineU[5]) and maSellSignal

plotshape(RSI_OS_OB ? rsi_OS_sell : na, title="RSI OS + Cross", style=shape.circle, location=location.top, color=color.red, size=size.tiny)

if rsi_OB_buy and RSI_OS_OB and inDateRange

strategy.entry("RSI-OBOS x WMA", strategy.long)

if rsi_OS_sell and RSI_OS_OB and inDateRange

strategy.close("RSI-OBOS x WMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

rsi_OB_OS = input(false, "RSI Over Sold/Bought",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsiBuy = crossover(rsi , rsiLineD)

rsiSell = crossunder(rsi, rsiLineU)

rsiExit = crossunder(rsi, rsiLineD)

plotshape(rsi_OB_OS ? rsiBuy : na, title="RSI OB", style=shape.cross, location=location.bottom, color=color.purple)

plotshape(rsi_OB_OS ? crossunder(rsi, rsiLineU) : na, title="RSI OS", style=shape.cross, location=location.top, color=color.purple)

plotshape(rsi_OB_OS ? rsiExit : na, title="RSI OS", style=shape.cross, location=location.bottom, color=color.red)

if rsiBuy and rsi_OB_OS and inDateRange

strategy.entry("RSI OB", strategy.long)

if (rsiSell or rsiExit) and rsi_OB_OS and inDateRange

strategy.close("RSI OB", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

With_MA_Vis = input(true , title="With MA Signal)", inline="WITH MA", group="With MA")

withMA_type = input(title="", defval="SMA", options=["EMA","SMA","WMA","VWMA"], inline="WITH MA", group="With MA")

with_MALen = input(title="", defval=9, type=input.integer, inline="WITH MA", group="With MA")

// TAKE-PROFIT / STOP-LOSS

Stop_Take_Vis = input(true, "TP-SL")

LongSLValue = input(title="SL %", type=input.float, defval=3, minval=0.5) * 0.01

LongTPValue = input(title="TP %", type=input.float, defval=15, minval=0.5) * 0.01

LongSLDetermine = strategy.position_avg_price * (1 - LongSLValue)

LongTPDetermine = strategy.position_avg_price * (1 + LongTPValue)

//////////////////////////

with_ma = WithMA(close, with_MALen, withMA_type)

Close_buy_MA = crossover(close , with_ma)

Close_sell_MA = crossunder(close , with_ma)

// PLOT OPTION

WithMaSignal = input(true, "MA + RSI x Trending-MA",group="With MA") // INPUT

// CONDITION IN VARIABLE

withMA_RSI_BUY = (Close_buy_MA and rsiBuySignal) and WithMaSignal and inDateRange

withMA_RSI_SELL = (Close_sell_MA and rsiSellSignal) and WithMaSignal and inDateRange

// PLOT ING

plotshape(WithMaSignal ? withMA_RSI_BUY : na, title="With MA", style=shape.diamond, location=location.bottom, color=color.aqua)

plotshape(WithMaSignal ? withMA_RSI_SELL : na, title="With MA", style=shape.diamond, location=location.top, color=color.aqua)

if withMA_RSI_BUY

strategy.entry("MA + RSIxWMA", strategy.long)

if withMA_RSI_SELL

strategy.close("MA + RSIxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

// FOR SL - TP

if (strategy.position_size > 0) and Stop_Take_Vis

strategy.exit("BUY", stop=LongSLDetermine, limit=LongTPDetermine)