Tendencia de onda y tendencia basada en la VWMA siguiendo la estrategia cuántica

El autor:¿ Qué pasa?, Fecha: 2024-01-26 17:35:29Las etiquetas:

Resumen general

Esta estrategia combina el oscilador de tendencia de onda y el indicador VWMA para implementar una tendencia siguiendo la estrategia de negociación cuántica. Puede identificar las tendencias del mercado y tomar decisiones de compra o venta basadas en las señales del oscilador de tendencia de onda. Mientras tanto, el tamaño de la operación está determinado por las señales del indicador VWMA.

Estrategia lógica

La estrategia se basa principalmente en los dos indicadores siguientes:

-

Oscilador de tendencia de onda: Este es un oscilador portado a TradingView por LazyBear, que identifica

ondas en las fluctuaciones de precios y genera señales de compra / venta. El cálculo específico es: primero calcular el precio promedio ap, luego calcular la EMA de ap (llamada esa), luego calcular la EMA del valor absoluto de la diferencia entre ap y esa (llamada d), finalmente calcular el índice de consistencia ci=(ap-esa) /(0.015*d), la EMA de ci es la tendencia de onda (wt1), y el SMA de 4 períodos de wt1 es wt2. Cuando wt1 cruza por encima de wt2, es una señal de compra, y cuando wt1 cruza por debajo de wt2, es una señal de venta. -

Indicador VWMA: Esta es una línea de promedio móvil ponderada por volumen. Basado en si el precio está dentro o fuera de las bandas VWMA (bandas superiores e inferiores de VWMA), genera señales +1 (bullish), 0 (neutral) o -1 (bearish).

Las señales de tendencia de onda determinan cuándo comprar y vender, mientras que las señales alcistas / bajistas del indicador VWMA determinan el tamaño específico de la operación para cada operación.

Ventajas

- Combina señales de dos indicadores para mejorar la precisión de las decisiones

- VWMA considera el flujo de volumen para evaluar la solidez del mercado

- Sesiones comerciales personalizables para evitar la volatilidad de las noticias

- Tamaño de la operación ajustado en función de las señales de la VWMA para reducir los riesgos

Los riesgos

- Potenciales señales falsas de la tendencia de onda

- Los datos de volumen inexactos pueden afectar a la VWMA

- Requiere datos históricos largos para el cálculo del indicador

- No hay pérdida de parada en su lugar

Optimización

- Prueba diferentes combinaciones de parámetros para encontrar el óptimo

- Añadir estrategias de stop loss

- Considere la combinación con otros indicadores para el filtrado de señales

- Prueba diferentes configuraciones para las sesiones de negociación

- Ajuste dinámico del cálculo del tamaño de la operación

Conclusión

Esta estrategia integra el juicio de tendencias y las capacidades de volumen para un enfoque avanzado de seguimiento de tendencias. Tiene algunas ventajas pero también riesgos a tener en cuenta.

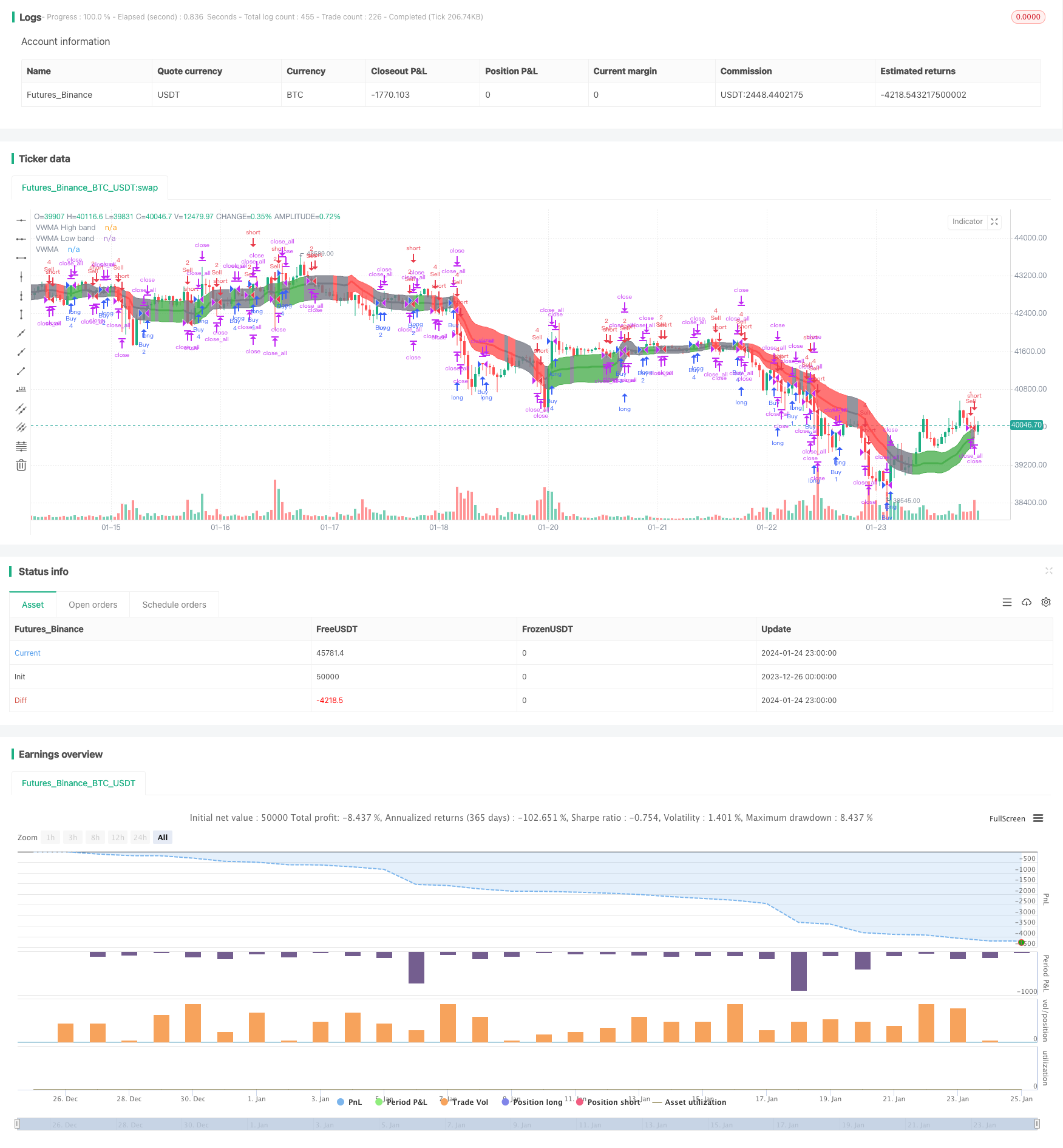

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at

// https://mozilla.org/MPL/2.0/

//

// Created by jadamcraig

//

// This strategy benefits from extracts taken from the following

// studies/authors. Thank you for developing and sharing your ideas in an open

// way!

// * Wave Trend Strategy by thomas.gigure

// * cRSI + Waves Strategy with VWMA overlay by Dr_Roboto

//

//@version=4

//==============================================================================

//==============================================================================

overlay = true // plots VWMA (need to close and re-add)

//overlay = false // plots Wave Trend (need to close and re-add)

strategy("Wave Trend w/ VWMA overlay", overlay=overlay)

baseQty = input(defval=1, title="Base Quantity", type=input.float, minval=1)

useSessions = input(defval=true, title="Limit Signals to Trading Sessions?")

sess1_startHour = input(defval=8, title="Session 1: Start Hour",

type=input.integer, minval=0, maxval=23)

sess1_startMinute = input(defval=25, title="Session 1: Start Minute",

type=input.integer, minval=0, maxval=59)

sess1_stopHour = input(defval=10, title="Session 1: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess1_stopMinute = input(defval=25, title="Session 1: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess2_startHour = input(defval=12, title="Session 2: Start Hour",

type=input.integer, minval=0, maxval=23)

sess2_startMinute = input(defval=55, title="Session 2: Start Minute",

type=input.integer, minval=0, maxval=59)

sess2_stopHour = input(defval=14, title="Session 2: Stop Hour",

type=input.integer, minval=0, maxval=23)

sess2_stopMinute = input(defval=55, title="Session 2: Stop Minute",

type=input.integer, minval=0, maxval=59)

sess1_closeAll = input(defval=false, title="Close All at End of Session 1")

sess2_closeAll = input(defval=true, title="Close All at End of Session 2")

//==============================================================================

//==============================================================================

// Volume Weighted Moving Average (VWMA)

//==============================================================================

//==============================================================================

plotVWMA = overlay

// check if volume is available for this equity

useVolume = input(

title="VWMA: Use Volume (uncheck if equity does not have volume)",

defval=true)

vwmaLen = input(defval=21, title="VWMA: Length", type=input.integer, minval=1,

maxval=200)

vwma = vwma(close, vwmaLen)

vwma_high = vwma(high, vwmaLen)

vwma_low = vwma(low, vwmaLen)

if not(useVolume)

vwma := wma(close, vwmaLen)

vwma_high := wma(high, vwmaLen)

vwma_low := wma(low, vwmaLen)

// +1 when above, -1 when below, 0 when inside

vwmaSignal(priceOpen, priceClose, vwmaHigh, vwmaLow) =>

sig = 0

color = color.gray

if priceClose > vwmaHigh

sig := 1

color := color.green

else if priceClose < vwmaLow

sig := -1

color := color.red

else

sig := 0

color := color.gray

[sig,color]

[vwma_sig, vwma_color] = vwmaSignal(open, close, vwma_high, vwma_low)

priceAboveVWMA = vwma_sig == 1 ? true : false

priceBelowVWMA = vwma_sig == -1 ? true : false

// plot(priceAboveVWMA?2.0:0,color=color.blue)

// plot(priceBelowVWMA?2.0:0,color=color.maroon)

//bandTrans = input(defval=70, title="VWMA Band Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

//fillTrans = input(defval=70, title="VWMA Fill Transparancy (100 invisible)",

// type=input.integer, minval=0, maxval=100)

bandTrans = 60

fillTrans = 60

// ***** Plot VWMA *****

highband = plot(plotVWMA?fixnan(vwma_high):na, title='VWMA High band',

color = vwma_color, linewidth=1, transp=bandTrans)

lowband = plot(plotVWMA?fixnan(vwma_low):na, title='VWMA Low band',

color = vwma_color, linewidth=1, transp=bandTrans)

fill(lowband, highband, title='VWMA Band fill', color=vwma_color,

transp=fillTrans)

plot(plotVWMA?vwma:na, title='VWMA', color = vwma_color, linewidth=3,

transp=bandTrans)

//==============================================================================

//==============================================================================

// Wave Trend

//==============================================================================

//==============================================================================

plotWaveTrend = not(overlay)

n1 = input(10, "Wave Trend: Channel Length")

n2 = input(21, "Wave Trend: Average Length")

obLevel1 = input(60, "Wave Trend: Over Bought Level 1")

obLevel2 = input(53, "Wave Trend: Over Bought Level 2")

osLevel1 = input(-60, "Wave Trend: Over Sold Level 1")

osLevel2 = input(-53, "Wave Trend: Over Sold Level 2")

ap = hlc3

esa = ema(ap, n1)

d = ema(abs(ap - esa), n1)

ci = (ap - esa) / (0.015 * d)

tci = ema(ci, n2)

wt1 = tci

wt2 = sma(wt1,4)

plot(plotWaveTrend?0:na, color=color.gray)

plot(plotWaveTrend?obLevel1:na, color=color.red)

plot(plotWaveTrend?osLevel1:na, color=color.green)

plot(plotWaveTrend?obLevel2:na, color=color.red, style=3)

plot(plotWaveTrend?osLevel2:na, color=color.green, style=3)

plot(plotWaveTrend?wt1:na, color=color.green)

plot(plotWaveTrend?wt2:na, color=color.red, style=3)

plot(plotWaveTrend?wt1-wt2:na, color=color.blue, transp=80)

//==============================================================================

//==============================================================================

// Order Management

//==============================================================================

//==============================================================================

// Define Long and Short Conditions

longCondition = crossover(wt1, wt2)

shortCondition = crossunder(wt1, wt2)

// Define Quantities

orderQty = baseQty * 2

if (longCondition)

if (vwma_sig == 1)

if ( strategy.position_size >= (baseQty * 4 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 4 + abs(strategy.position_size)

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size >= (baseQty * 2 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 2 + abs(strategy.position_size)

else

orderQty := baseQty * 2

else if (vwma_sig == -1)

if ( strategy.position_size >= (baseQty * 1 * -1) and

strategy.position_size < 0 )

orderQty := baseQty * 1 + abs(strategy.position_size)

else

orderQty := baseQty * 1

else if (shortCondition)

if (vwma_sig == -1)

if ( strategy.position_size <= (baseQty * 4) and

strategy.position_size > 0 )

orderQty := baseQty * 4 + strategy.position_size

else

orderQty := baseQty * 4

else if (vwma_sig == 0)

if ( strategy.position_size <= (baseQty * 2) and

strategy.position_size > 2 )

orderQty := baseQty * 2 + strategy.position_size

else

orderQty := baseQty * 2

else if (vwma_sig == 1)

if ( strategy.position_size <= (baseQty * 1) and

strategy.position_size > 0 )

orderQty := baseQty * 1 + strategy.position_size

else

orderQty := baseQty * 1

// Determine if new trades are permitted

newTrades = false

if (useSessions)

if ( hour == sess1_startHour and minute >= sess1_startMinute )

newTrades := true

else if ( hour > sess1_startHour and hour < sess1_stopHour )

newTrades := true

else if ( hour == sess1_stopHour and minute < sess1_stopMinute )

newTrades := true

else if ( hour == sess2_startHour and minute >= sess2_startMinute )

newTrades := true

else if ( hour > sess2_startHour and hour < sess2_stopHour )

newTrades := true

else if ( hour == sess2_stopHour and minute < sess2_stopMinute )

newTrades := true

else

newTrades := false

else

newTrades := true

// Long Signals

if ( longCondition )

strategy.order("Buy", strategy.long, orderQty)

// Short Signals

if ( shortCondition )

strategy.order("Sell", strategy.short, orderQty)

// Close open position at end of Session 1, if enabled

if (sess1_closeAll )

strategy.close_all()

// Close open position at end of Session 2, if enabled

if (sess2_closeAll )

strategy.close_all()

- Estrategia de Stop Loss y Take Profit basada en el RSI

- Estrategia de ruptura del canal de media móvil

- Estrategia de pruebas de desglose de tiempo fijo

- Estrategia MACD multi-marcos de tiempo optimizada en tiempo y espacio

- Estrategia de negociación cuantitativa basada en el índice de rentabilidad de las acciones y en las IFM

- Estrategia de negociación compuesta de múltiples indicadores

- Estrategia de negociación a corto plazo de la EMA cruzada

- Tendencia de seguir una estrategia basada en la suspensión dinámica de pérdidas del cruce de dos EMA

- Estrategia de compra de la caja de Darvas

- La estrategia de impulso relativo

- Estrategia de cruce de la media móvil

- Estrategia clave para la reversión de las pruebas de retroceso

- Estrategia de prueba de retroceso de candeleros de inversión