Estrategia de seguimiento de tendencias de soporte y resistencia

El autor:¿ Qué pasa?, Fecha: 2024-02-27 15:11:04Las etiquetas:

Resumen general

Esta estrategia utiliza tres indicadores técnicos - soporte, resistencia y líneas de tendencia - para automatizar las entradas y detener las pérdidas.

Estrategia lógica

- Identificar los niveles clave de soporte y resistencia.

- Usar líneas de tendencia para determinar la dirección de la tendencia del mercado.

- Cuando el precio se acerca al nivel de soporte y hay una tendencia alcista, se activa una señal de compra.

- Cuando el precio se acerca al nivel de resistencia y hay una tendencia bajista, se activa una señal de venta.

- El objetivo de obtener ganancias se calcula sobre la base de la relación riesgo-recompensación, el stop loss se establece cerca del nivel de soporte.

- El stop loss de seguimiento se puede utilizar para obtener ganancias.

Análisis de ventajas

- Utiliza plenamente el poder del soporte, la resistencia y la tendencia, tres indicadores técnicos fuertes.

- El tiempo de entrada automático elimina los errores subjetivos.

- El riesgo controlado con stop loss cerca de los niveles de soporte clave.

- Opcional para evitar la devolución de las ganancias.

Análisis de riesgos

- Riesgo de ruptura fallido: el precio puede volver a probar el nivel de soporte o resistencia roto después de la ruptura inicial.

- Riesgo de valoración errónea de la tendencia: el uso de líneas de tendencia por sí solas puede dar lugar a un sesgo de tendencia inexacto.

- Se está eliminando el riesgo de pérdida de parada - la pérdida de parada aún puede verse afectada por fluctuaciones volátiles de precios a pesar de la distancia cercana al soporte.

Soluciones:

- Permitir un rango más amplio para la validación de soporte/resistencia.

- Emplear múltiples indicadores para confirmar el sesgo de tendencia.

- Adopte un stop loss basado en el rango o una intervención manual oportuna.

Direcciones de optimización

- Añadir más indicadores para confirmar las señales de entrada, por ejemplo indicadores basados en el volumen, medias móviles, etc. Esto puede mejorar la precisión.

- Optimizar los niveles de soporte, resistencia y stop loss mediante la prueba de diferentes parámetros.

- Prueba métodos de aprendizaje automático para optimizar parámetros.

Conclusión

Esta estrategia combina el poder de múltiples herramientas técnicas. Con el ajuste adecuado de parámetros, puede lograr buenos rendimientos ajustados al riesgo. La clave es optimizar los parámetros y la secuencia de entrada. En general, el marco de la estrategia es sólido y tiene mucho potencial para mejoras.

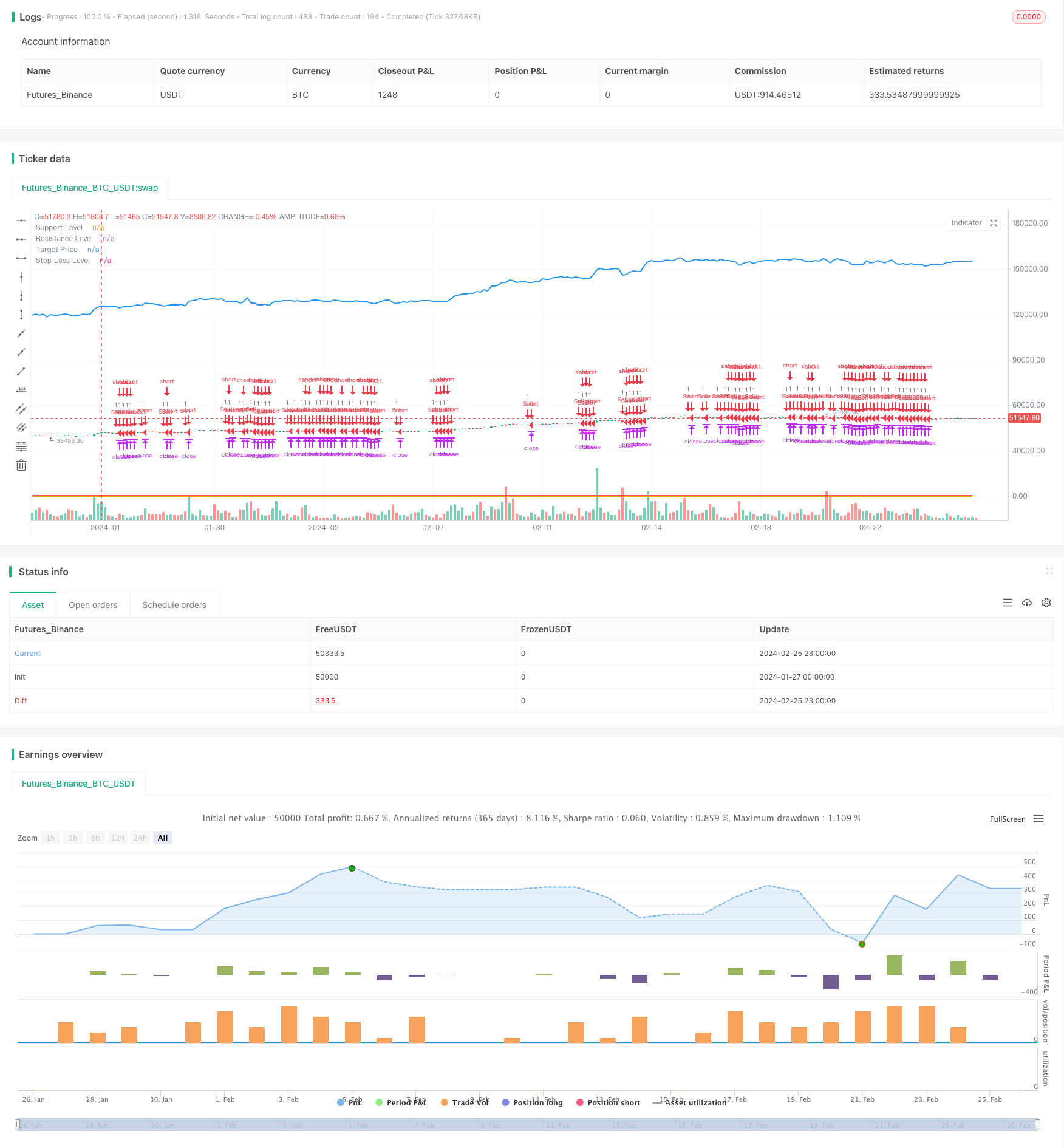

/*backtest

start: 2024-01-27 00:00:00

end: 2024-02-26 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Support Resistance Trend Strategy", overlay=true)

// Input parameters

supportLevel = input(100, title="Support Level")

resistanceLevel = input(200, title="Resistance Level")

riskRewardRatio = input(2, title="Risk-Reward Ratio")

trailStopLoss = input(true, title="Use Trailing Stop Loss")

// Calculate trend direction based on trend lines

trendUp = close > request.security(syminfo.tickerid, "D", close[1])

trendDown = close < request.security(syminfo.tickerid, "D", close[1])

// Buy signal condition

buySignal = close < supportLevel and trendUp

// Sell signal condition

sellSignal = close > resistanceLevel and trendDown

// Entry point and exit conditions

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.entry("Sell", strategy.short, when=sellSignal)

// Calculate targets and stop-loss levels

targetPrice = close + (close - supportLevel) * riskRewardRatio

stopLossLevel = supportLevel

// Plot support and resistance levels

plot(supportLevel, color=color.green, linewidth=2, title="Support Level")

plot(resistanceLevel, color=color.red, linewidth=2, title="Resistance Level")

// Plot targets and stop-loss levels

plot(targetPrice, color=color.blue, linewidth=2, title="Target Price")

plot(stopLossLevel, color=color.orange, linewidth=2, title="Stop Loss Level")

// Trailing stop-loss

strategy.exit("Take Profit/Stop Loss", from_entry="Buy", loss=stopLossLevel, profit=targetPrice)

strategy.exit("Take Profit/Stop Loss", from_entry="Sell", loss=targetPrice, profit=stopLossLevel)

// Plot trail stop loss

if (trailStopLoss)

strategy.exit("Trailing Stop Loss", from_entry="Buy", loss=stopLossLevel)

strategy.exit("Trailing Stop Loss", from_entry="Sell", loss=stopLossLevel)

Más.

- Estrategia de seguimiento de tendencias basada en la media móvil

- Tendencia transversal de la EMA siguiendo la estrategia

- Estrategia de cruce de dos medias móviles

- Estrategia de seguimiento de bandas de Bollinger

- Estrategia de cruce de medias móviles rápidas y lentas

- Una estrategia avanzada de seguimiento de tendencias de doble marco de tiempo para una acción caliente

- Estrategia de seguimiento de tendencias cuantitativas combinadas

- Excelente Oscilador Estrategia de negociación de doble estocástico filtrado con divergencia

- Estrategia cuantitativa basada en los canales de Keltner y el indicador CCI

- Estrategia dinámica de desarrollo de canales

- Estrategia de cruce del MACD con confirmación del RSI

- Estrategia dinámica de detención de tracción

- Estrategia de negociación basada en el canal de Donchain

- Estrategia de negociación de media móvil doble de canal rectángulo de impulso

- La media móvil doble sigue la estrategia

- Estrategia de optimización de filtro de tendencias duales

- Estrategia de negociación de ganancias de seguimiento dinámico

- Estrategia de negociación de retroceso basada en una media móvil dinámica

- Estrategia del surfista de impulso basada en el índice de impulso estocástico

- Estrategia de inversión de impulso basada en múltiples marcos de tiempo