Stratégie des moyennes mobiles doubles multi-symbole de crypto-monnaie (enseignement)

Auteur:Je suis désolée., Créé à: 2022-04-07 16:14:35, Mis à jour à: 2022-04-08 09:13:58Stratégie des moyennes mobiles doubles multi-symbole de crypto-monnaie (enseignement)

À la demande de nos utilisateurs sur les forums qui espèrent avoir une stratégie de moyenne mobile double multi-symbole comme référence de conception, une stratégie de moyenne mobile double multi-symbole sera mise en œuvre dans le partage d'aujourd'hui.

Réflexion stratégique

La logique de la stratégie de la moyenne mobile double est très simple, c'est-à-dire deux moyennes mobiles. Une moyenne mobile avec une petite période (ligne rapide) et une moyenne mobile avec une grande période (ligne lente). Lorsque les deux lignes ont une croix dorée (la ligne rapide croise la ligne lente depuis le bas), acheter long, et lorsque les deux lignes ont une croix morte (la ligne rapide vers le bas croise la ligne lente depuis le haut), vendre court. Pour la moyenne mobile, nous utilisons l'EMA.

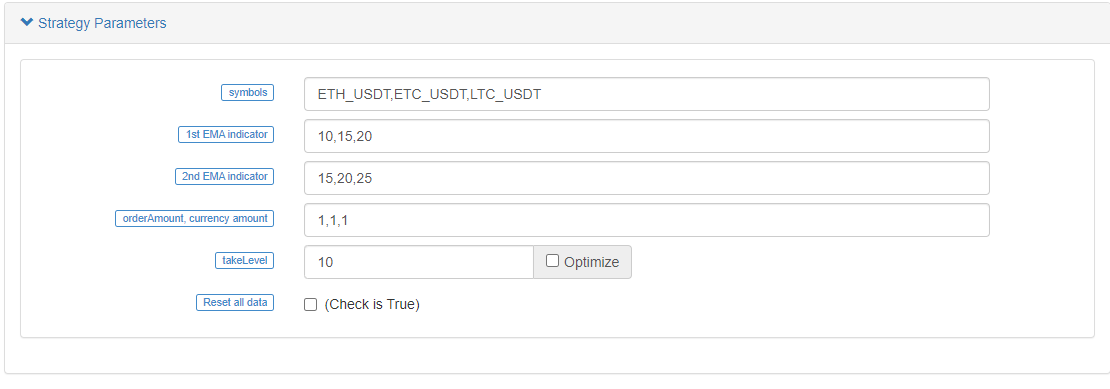

C'est juste que la stratégie doit être conçue pour plusieurs symboles, de sorte que les paramètres de différents symboles peuvent être différents (différents symboles utilisent différents paramètres de moyenne mobile), il est donc nécessaire de concevoir des paramètres dans un tableau de paramètres.

Les paramètres sont conçus sous la forme d'une chaîne, avec chaque paramètre divisé par une virgule. Ces chaînes sont analysées lorsque la stratégie commence à fonctionner, ce qui sera associé à la logique d'exécution pour chaque symbole (paire de trading).

La stratégie est conçue de manière très simple et très adaptée aux débutants; elle ne comporte que plus de 200 lignes au total.

Code de stratégie

// function effect: to cancel all pending orders of the current trading pair

function cancelAll(e) {

while (true) {

var orders = _C(e.GetOrders)

if (orders.length == 0) {

break

} else {

for (var i = 0 ; i < orders.length ; i++) {

e.CancelOrder(orders[i].Id, orders[i])

Sleep(500)

}

}

Sleep(500)

}

}

// function effect: to calculate the real-time profit and loss

function getProfit(account, initAccount, lastPrices) {

// account indicates the current account information; initAccount is the initial account information; lastPrices is the the latest prices of all current symbols

var sum = 0

_.each(account, function(val, key) {

// traverse the current total assets, and calculate asset currency (except USDT) difference and amount difference

if (key != "USDT" && typeof(initAccount[key]) == "number" && lastPrices[key + "_USDT"]) {

sum += (account[key] - initAccount[key]) * lastPrices[key + "_USDT"]

}

})

// return the asset profit and loss calculated by the current price

return account["USDT"] - initAccount["USDT"] + sum

}

// function effect: to generate chart configuration

function createChartConfig(symbol, ema1Period, ema2Period) {

// symbol indicates trading pair; ema1Period indicates the first EMA period; ema2Period indicates the second EMA period

var chart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : symbol},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick', // K-line date series

name: symbol,

id: symbol,

data: []

}, {

type: 'line', // EMA data series

name: symbol + ',EMA1:' + ema1Period,

data: [],

}, {

type: 'line', // EMA data series

name: symbol + ',EMA2:' + ema2Period,

data: []

}

]

}

return chart

}

function main() {

// reset all data

if (isReset) {

_G(null) // vacuum all persistently recorded data

LogReset(1) // vacuum all logs

LogProfitReset() // vacuum all profit logs

LogVacuum() // release the resource occupied by the bot database

Log("reset all data", "#FF0000") // print information

}

// parse parameters

var arrSymbols = symbols.split(",") // use comma to split the trading symbol strings

var arrEma1Periods = ema1Periods.split(",") // split the string of the first EMA parameter

var arrEma2Periods = ema2Periods.split(",") // split the string of the second EMA parameter

var arrAmounts = orderAmounts.split(",") // split the order amount of each symbol

var account = {} // the variable used to record the current asset information

var initAccount = {} // the variable used to record the initial asset information

var currTradeMsg = {} // the variable used to record whether the current BAR is executed

var lastPrices = {} // the variable used to record the latest price of the monitored symbol

var lastBarTime = {} // the variable used to record the time of the latest BAR, to judge the BAR update during plotting

var arrChartConfig = [] // the variable used to record the chart configuration information, to plot

if (_G("currTradeMsg")) { // for example, when restart, recover currTradeMsg data

currTradeMsg = _G("currTradeMsg")

Log("recover GetRecords", currTradeMsg)

}

// initialize account

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol)

var arrCurrencyName = symbol.split("_")

var baseCurrency = arrCurrencyName[0]

var quoteCurrency = arrCurrencyName[1]

if (quoteCurrency != "USDT") {

throw "only support quoteCurrency: USDT"

}

if (!account[baseCurrency] || !account[quoteCurrency]) {

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

}

// initialize the related data of chart

lastBarTime[symbol] = 0

arrChartConfig.push(createChartConfig(symbol, arrEma1Periods[index], arrEma2Periods[index]))

})

if (_G("initAccount")) {

initAccount = _G("initAccount")

Log("recover initial account information", initAccount)

} else {

// use the current asset information to initialize initAccount (variable)

_.each(account, function(val, key) {

initAccount[key] = val

})

}

Log("account:", account, "initAccount:", initAccount) // print asset information

// initialize the chart objects

var chart = Chart(arrChartConfig)

// reset chart

chart.reset()

// strategy logic of the main loop

while (true) {

// traverse all symbols, and execute the dual moving average logic one by one

_.each(arrSymbols, function(symbol, index) {

exchange.SetCurrency(symbol) // switch the trading pair to the trading pair recorded by by symbol string

var arrCurrencyName = symbol.split("_") // split trading pairs by "_"

var baseCurrency = arrCurrencyName[0] // string of base currency

var quoteCurrency = arrCurrencyName[1] // string of quote currency

// according to index, obtain the EMA paramater of the current trading pair

var ema1Period = parseFloat(arrEma1Periods[index])

var ema2Period = parseFloat(arrEma2Periods[index])

var amount = parseFloat(arrAmounts[index])

// obtain the K-line data of the current trading pair

var r = exchange.GetRecords()

if (!r || r.length < Math.max(ema1Period, ema2Period)) { // when the length of K-line is not long enough, return directly

Sleep(1000)

return

}

var currBarTime = r[r.length - 1].Time // record the current BAR timestamp

lastPrices[symbol] = r[r.length - 1].Close // record the current latest price

var ema1 = TA.EMA(r, ema1Period) // calculate EMA indicator

var ema2 = TA.EMA(r, ema2Period) // calculate EMA indicator

if (ema1.length < 3 || ema2.length < 3) { // when the length of EMA indicator array is too short, return derectly

Sleep(1000)

return

}

var ema1Last2 = ema1[ema1.length - 2] // EMA on the second last BAR

var ema1Last3 = ema1[ema1.length - 3] // EMA on the third last BAR

var ema2Last2 = ema2[ema2.length - 2]

var ema2Last3 = ema2[ema2.length - 3]

// write the chart data

var klineIndex = index + 2 * index

// traverse k-line data

for (var i = 0 ; i < r.length ; i++) {

if (r[i].Time == lastBarTime[symbol]) { // plot; update the current BAR and its indicator

// update

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close], -1)

chart.add(klineIndex + 1, [r[i].Time, ema1[i]], -1)

chart.add(klineIndex + 2, [r[i].Time, ema2[i]], -1)

} else if (r[i].Time > lastBarTime[symbol]) { // plot; add BAR and its indicator

// add

lastBarTime[symbol] = r[i].Time // update the timestamp

chart.add(klineIndex, [r[i].Time, r[i].Open, r[i].High, r[i].Low, r[i].Close])

chart.add(klineIndex + 1, [r[i].Time, ema1[i]])

chart.add(klineIndex + 2, [r[i].Time, ema2[i]])

}

}

if (ema1Last3 < ema2Last3 && ema1Last2 > ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// golden cross

var depth = exchange.GetDepth() // obtain the depth data of the current order book

var price = depth.Asks[Math.min(takeLevel, depth.Asks.length)].Price // select the 10th level price; taker

if (depth && price * amount <= account[quoteCurrency]) { // obtain that the depth data is normal, and the assets are enough to place an order

exchange.Buy(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2) // maker; buy

cancelAll(exchange) // cancel all pending orders

var acc = _C(exchange.GetAccount) // obtain the account asset information

if (acc.Stocks != account[baseCurrency]) { // detect the account assets changed

account[baseCurrency] = acc.Stocks // update assets

account[quoteCurrency] = acc.Balance // update assets

currTradeMsg[symbol] = currBarTime // record the current BAR has been executed

_G("currTradeMsg", currTradeMsg) // persistently record

var profit = getProfit(account, initAccount, lastPrices) // calculate profit

if (profit) {

LogProfit(profit, account, initAccount) // print profit

}

}

}

} else if (ema1Last3 > ema2Last3 && ema1Last2 < ema2Last2 && currTradeMsg[symbol] != currBarTime) {

// death cross

var depth = exchange.GetDepth()

var price = depth.Bids[Math.min(takeLevel, depth.Bids.length)].Price

if (depth && amount <= account[baseCurrency]) {

exchange.Sell(price, amount, ema1Last3, ema2Last3, ema1Last2, ema2Last2)

cancelAll(exchange)

var acc = _C(exchange.GetAccount)

if (acc.Stocks != account[baseCurrency]) {

account[baseCurrency] = acc.Stocks

account[quoteCurrency] = acc.Balance

currTradeMsg[symbol] = currBarTime

_G("currTradeMsg", currTradeMsg)

var profit = getProfit(account, initAccount, lastPrices)

if (profit) {

LogProfit(profit, account, initAccount)

}

}

}

}

Sleep(1000)

})

// variables in the table of status bar

var tbl = {

type : "table",

title : "account information",

cols : [],

rows : []

}

// write the data in the table structure of status bar

tbl.cols.push("--")

tbl.rows.push(["initial"])

tbl.rows.push(["current"])

_.each(account, function(val, key) {

if (typeof(initAccount[key]) == "number") {

tbl.cols.push(key)

tbl.rows[0].push(initAccount[key]) // initial

tbl.rows[1].push(val) // current

}

})

// display the status bar table

LogStatus(_D(), "\n", "profit:", getProfit(account, initAccount, lastPrices), "\n", "`" + JSON.stringify(tbl) + "`")

}

}

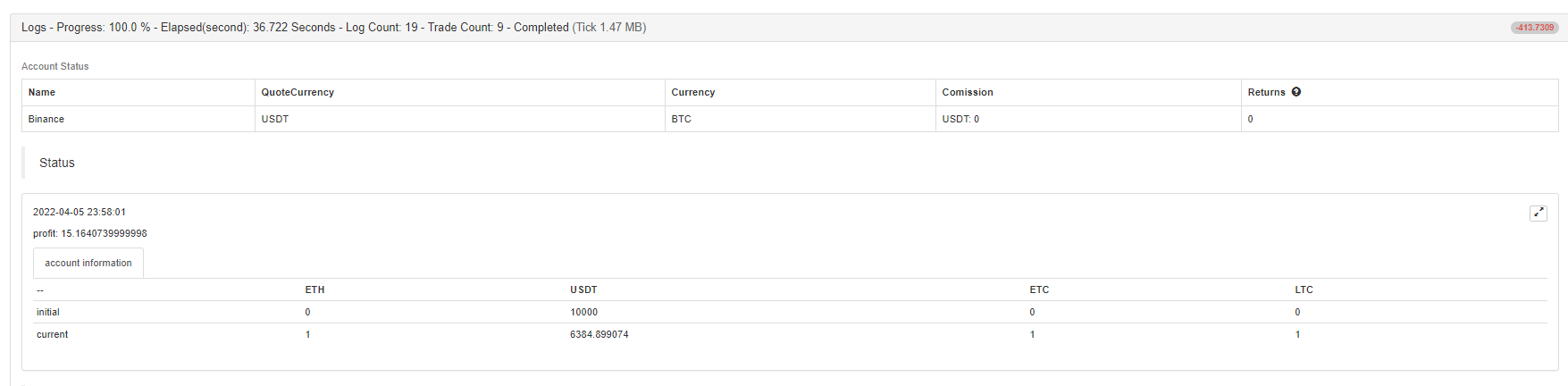

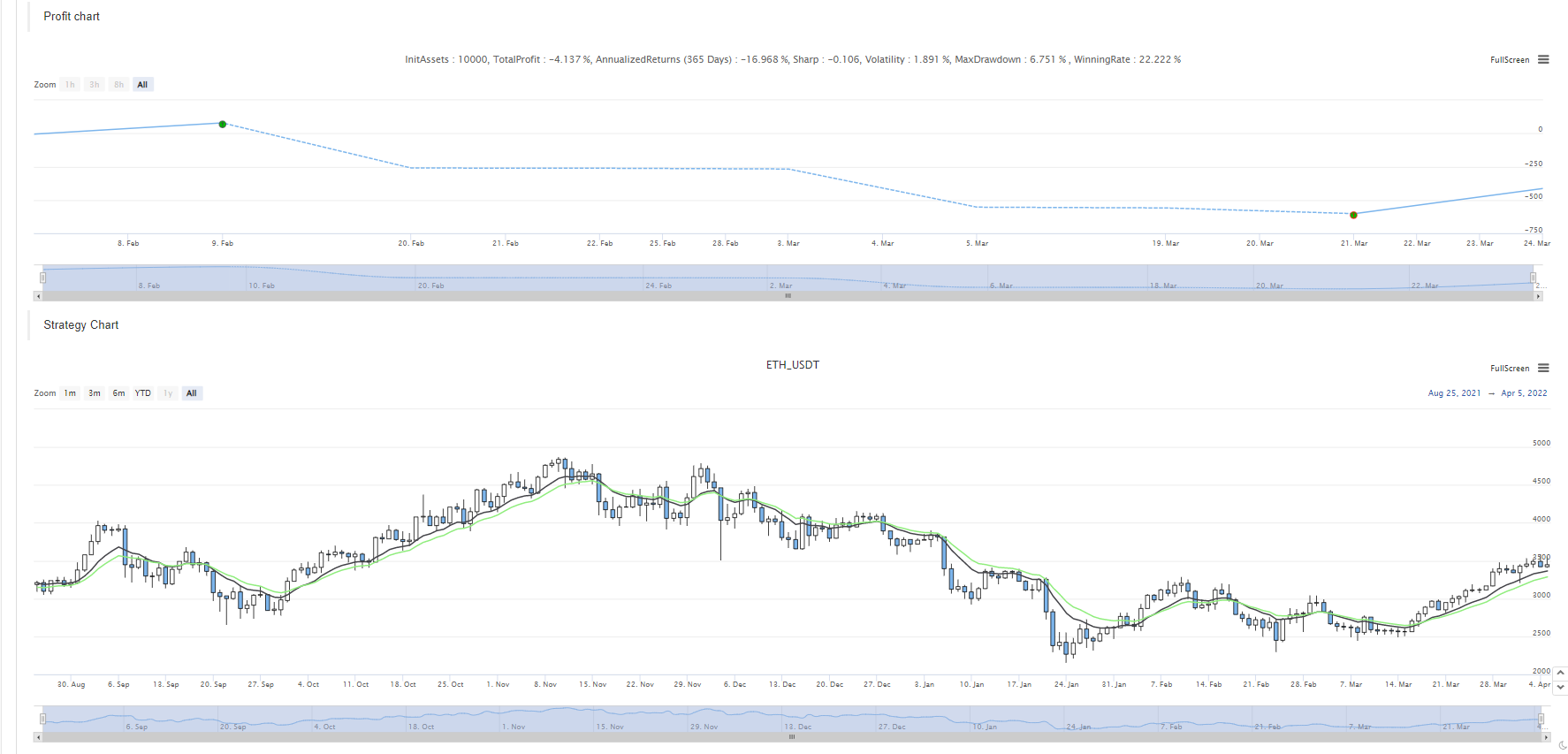

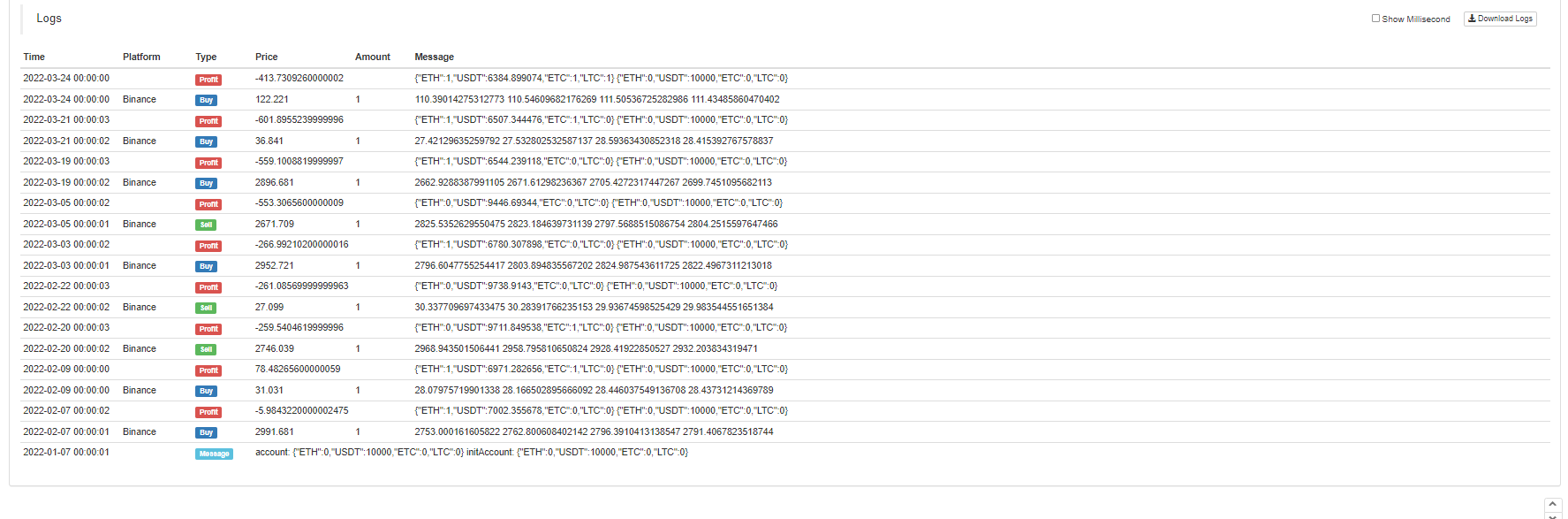

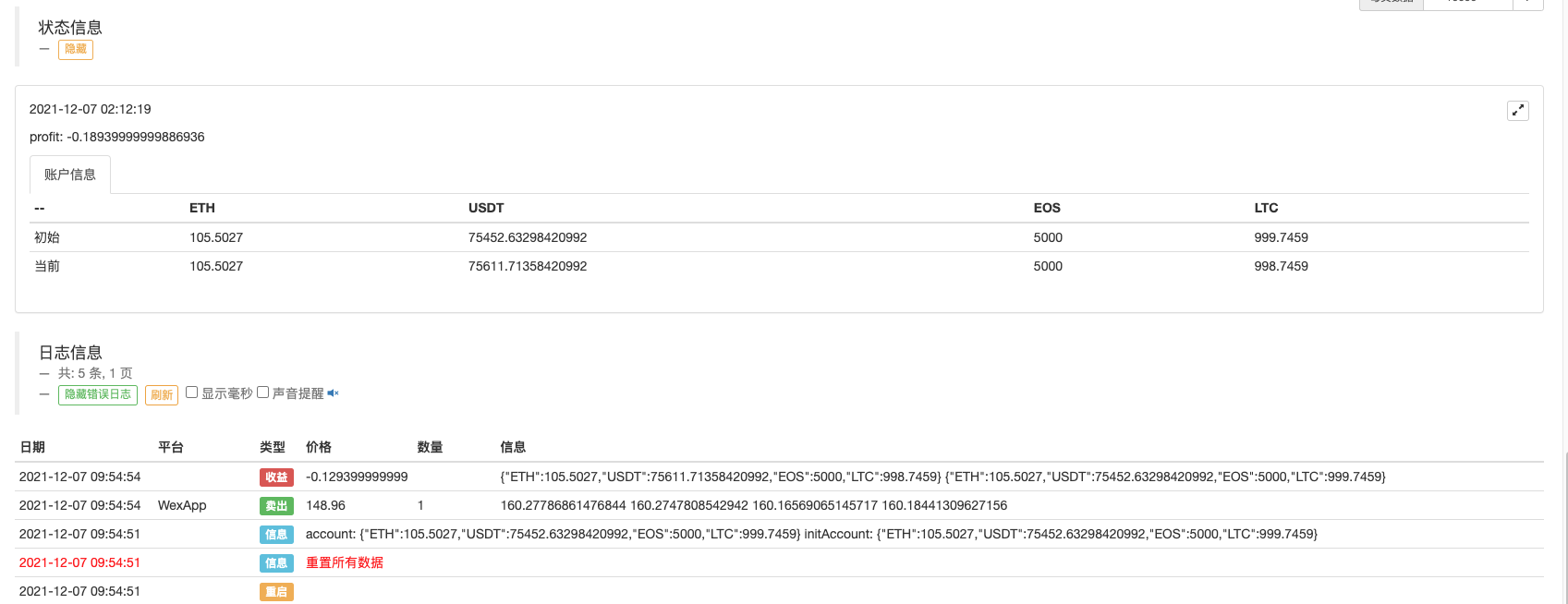

Retour sur la stratégie

Vous pouvez voir ETH, LTC et ETC ont tous eu des transactions selon les déclencheurs de la croix d'or et la croix de la mort des moyennes mobiles.

Vous pouvez aussi attendre le robot simulé pour le tester.

Le code source de la stratégie:https://www.fmz.com/strategy/333783

La stratégie n'est utilisée que pour les backtests et l'apprentissage de la conception de stratégies, alors utilisez-la avec prudence dans un bot.

- Une plateforme de paiement basée sur FMZ

- Contrats de crypto-monnaie Robot simple de supervision des ordres

- Vous voulez obtenir le temps correspondant lorsque vous utilisez getdepth

- Ignoré, résolu

- Le problème de la valeur

- Exemple de conception de stratégie dYdX

- Exploration initiale de l'application de Python Crawler sur FMZ

Crawling Contenu de l'annonce de Binance - Définition de la stratégie de couverture Recherche et exemple d'ordres en attente au comptant et à terme

- Situation récente et fonctionnement recommandé de la stratégie de taux de financement

- Stratégie de point de rupture à moyenne mobile double des contrats à terme sur crypto-monnaie (enseignement)

- Réalisation de l'indicateur Fisher en JavaScript et de la planification sur FMZ

- Le gérant

- 2021 Cryptocurrency TAQ Review & Stratégie manquée la plus simple d'augmentation de 10 fois

- Stratégie ART multi-symbole sur les contrats à terme de crypto-monnaie (enseignement)

- Mise à niveau! Stratégie de Martingale sur les contrats à terme de crypto-monnaie

- La fonction Getrecords n'arrive pas à récupérer le schéma de K en secondes

- Conception d'un système de gestion synchrone basé sur les ordres FMZ (2)

- Les données de volume retournées par Getticker sont incorrectes.

- Conception d'un système de gestion synchrone basé sur les ordres FMZ (1)

- Concevoir une bibliothèque de tracés à plusieurs graphiques