Stratégie de négociation de la SMA Golden Cross

Auteur:ChaoZhang est là., Date: 2024-01-26 14h29Les étiquettes:

Résumé

La stratégie de trading SMA croisée dorée génère des signaux d'achat et de vente basés sur le croisement entre deux moyennes mobiles de différentes périodes. Plus précisément, lorsque la moyenne mobile plus rapide traverse au-dessus de la moyenne mobile plus lente depuis le bas, une croix dorée est formée, indiquant un renversement de tendance haussière. Lorsque la MA plus rapide traverse au-dessous de la MA plus lente depuis le haut, une croix de mort est formée, indiquant un renversement de tendance baissière.

Principaux

La stratégie repose sur deux principes:

Les moyennes mobiles peuvent refléter la tendance et l'élan du marché. L'AM à court terme capte les mouvements et les inversions de prix récents. L'AM à long terme montre la tendance prédominante.

Lorsque le MA plus rapide forme une croix dorée avec le MA plus lent, cela indique que l'élan à court terme gagne en force par rapport à la tendance à long terme, donc probablement le début d'une tendance haussière.

Plus précisément, cette stratégie utilise des moyennes mobiles simples de 13 et 30 périodes et négocie leurs signaux croisés.

Le signe doré entre les MAs génère un signal long, indiquant une opportunité d'achat.

La croix de mort entre les MAs génère un signal court, de même qu'une tendance à la baisse persistante est requise pour confirmer la viabilité du signal de short.

La différence de pente entre les MA est utilisée pour mesurer la force des signaux croisés.

Le stop loss est fixé à 20% et le profit à 100%.

Les avantages

La stratégie de croisement SMA présente les avantages suivants:

La logique est simple et facile à comprendre, adaptée aux débutants.

Utilise la moyenne des prix pour filtrer le bruit et éviter d'être induit en erreur par des fluctuations à court terme.

Évalue la persistance de la tendance plutôt que de suivre aveuglément les signaux croisés, assurant ainsi une meilleure confirmation des conditions générales du marché.

Introduit un facteur de momentum de pente sur les MAs pour rendre les signaux plus fiables.

Facile backtesting et l'optimisation avec seulement quelques paramètres clés comme les périodes MA et la durée de la tendance.

Les risques

La stratégie comporte également les risques suivants:

Les signaux de croisement sont en retard par nature et ne peuvent pas prédire parfaitement les renversements.

Les systèmes mécaniques ont tendance à déclencher des transactions simultanées, exacerbant la dynamique et invalidant le stop loss / take profit.

Ne fonctionne pas bien sur les marchés latéraux agités.

Les performances dépendent en grande partie de paramètres correctement calibrés comme la durée de la tendance.

Directions d'optimisation

La stratégie peut être encore optimisée par:

Ajout d'une évaluation de tendance à plus long terme pour éviter les transactions contre-tendance.

Il faut confirmer le volume des transactions pour éliminer les faux signaux.

Optimiser les paramètres MA pour trouver la meilleure combinaison de périodes.

Incorporer des indicateurs populaires tels que MACD, KD pour faciliter la confirmation et l'exactitude du signal.

Adopter un stop loss/take profit par étapes pour mieux contrôler le risque.

Conclusion

La stratégie de croisement SMA est très intuitive et facile à interpréter. Elle combine la propriété de filtrage du bruit des moyennes mobiles avec la capacité d'identification de tendance simple des signaux de croisement.

/*backtest

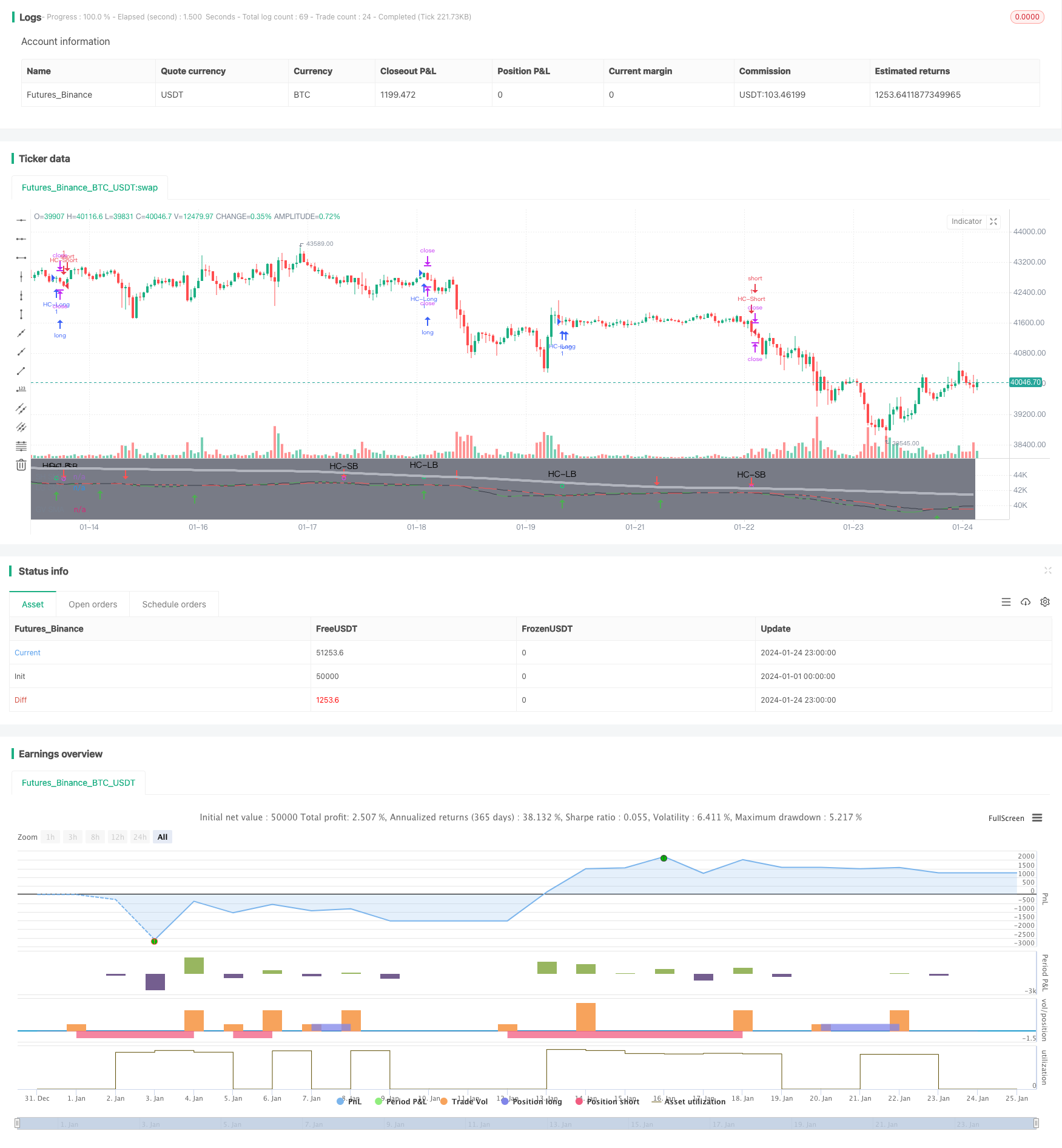

start: 2024-01-01 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MakeMoneyCoESTB2020

//*********************Notes for continued work***************

//************************************************************

//Hello my fellow investors

//I am creating a simple non-cluttered strategy that uses 3(+1) simple means to determine: viability, entry, and exit

//1) Has a consistent trend been maintained for several days/weeks

//2) SH SMA crossover LG SMA = Bullish entry/LG SMA crossover SH SMA = Bearish entry

//3) Use the Slope factor & Weeks in Trend (WiT) to dertermine how strong of an entry signal you are comfortable with

//4) Exit position based on next SMA cross and trend reversal or stop loss%

//3+1) For added confidence in trend detection: Apply MACD check - buy--> MACD line above signal line and corssover below histogram \\ sell --> MACD line below signal line and crossover above histogram.

//*)This code also allows you to determine your desired backtesting date compliments of alanaster

//This code is the product of many hours of hard work on the part of the greater tradingview community. The credit goes to everyone in the community who has put code out there for the greater good.

//Happy Hunting!

// 1. Define strategy settings*************************************************************************************************************************************************************************

//Title

strategy("KISS Strategy: SMA + EMA", shorttitle="KISS Strat")

//define calculations price source

price = input(title="Price Source", defval=close)

// 2. Calculate strategy values*************************************************************************************************************************************************************************

//Calculate 13/30/200SMA

SH_SMA_length= input(title="SH SMA Length", defval=13) //short SMA length

LG_SMA_length= input(title="LG SMA Length", defval=30) //long SMA length

GV_SMA_length= input(title="SH SMA Length", defval=200) //Gravitational SMA length

SH_SMA=sma(price, SH_SMA_length) //short SMA

LG_SMA=sma(price, LG_SMA_length) //long SMA

GV_SMA=sma(price, GV_SMA_length) //gravitational SMA

//calculate MACD

//define variables for speed

fast = 12, slow = 26

//define parameters to calculate MACD

fastMA = ema(price, fast)

slowMA = ema(price, slow)

//define MACD line

macd = fastMA - slowMA

//define SIGNAL line

signal = sma(macd, 9)

//Determine what type of trend we are in

dcp = security(syminfo.tickerid, 'D', close) //daily close price

wcp = security(syminfo.tickerid, 'W', close) //weekly close price

WiT = input(title="Weeks In Trend", defval=1, maxval=5, minval=1) //User input for how many weeks of price action to evaluate (Weeks in Trend = WiT)

BearTrend = false //initialize trend variables as false

BullTrend = false //initialize trend variables as false

// BullTrend := (wcp > SH_SMA) and (SH_SMA > LG_SMA) //true if price is trending up based on weekly price close

// BearTrend := (wcp < SH_SMA) and (SH_SMA < LG_SMA) //true if price is trending down based on weekly price close

// BullTrend := (price > SH_SMA) and (SH_SMA > LG_SMA) //true if price is trending up

// BearTrend := (price < SH_SMA) and (SH_SMA < LG_SMA) //true if price is trending down

//Determine if the market has been in a trend for 'n' weeks

n=WiT //create loop internal counting variable

for i=1 to WiT //create loop to determine if BearTrend=true to set number of weeks

if (wcp[n] < price) //evaluate if BearTrend=false comparing the current price to a paticular week close

BearTrend := false //set value to false if older price value is less than newer: trending up

break //break out of for loop when trend first falters

if (wcp[n] > price) //evaluate if BearTrend=true comparing the current price to a paticular week close

BearTrend := true //set value to true if older price value is greater than newer: trending down

n:=n-1 //set internal counter one day closer to present

m=WiT //create loop internal counting variable

for j=1 to WiT //create loop to determine if BearTrend=true to set number of weeks

if (wcp[m] > price) //evaluate if BullTrend=false comparing the current price to a paticular week close

BullTrend := false //set value to false if older price value is greater than newer: trending down

break //break out of for loop when trend first falters

if (wcp[m] < price) //evaluate if BullTrend=true comparing the current price to a paticular week close

BullTrend := true //set value to true if older price value is less than newer: trending up

m:=m-1 //set internal counter one day closer to present

//Determine if crossings occur

SH_LGcrossover = crossover(SH_SMA, LG_SMA) //returns true if short crosses over long

SH_LGcrossunder = crossunder(SH_SMA, LG_SMA) //returns true if short crosses under long

//Determine the slope of the SMAs when a cross over occurs

SlopeFactor= input(title="Slope Factor", defval=.01, minval=0, step = 0.001) //user input variable for what slope to evaluate against

XSlopeSH = abs(SH_SMA-SH_SMA[2]) //slope of short moving average (time cancels out)

XSlopeLG = abs(LG_SMA-LG_SMA[2]) //slope of long moving average (time cancels out)

StrongSlope = iff (abs(XSlopeSH-XSlopeLG)>SlopeFactor, true, false) //create a boolean variable to determine is slope intensity requirement is met

// ************************************ INPUT BACKTEST RANGE ******************************************=== coutesy of alanaster

fromMonth = input(defval = 4, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

// === INPUT SHOW PLOT ===

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

bgcolor(color = showDate and window() ? color.gray : na, transp = 90)

// === EXECUTION ===

//strategy.entry("L", strategy.long, when = window() and crossOv) // enter long when "within window of time" AND crossover

//strategy.close("L", when = window() and crossUn) // exit long when "within window of time" AND crossunder

// 3. Output strategy data*************************************************************************************************************************************************************************

//Embolden line if a trend exists

trendcolorLG = BearTrend?color.red:color.black //highlights beartrend condition met graphically

trendcolorSH = BullTrend?color.green:color.black //highlights beartrend condition met graphically

//plot SMAs

plot(SH_SMA, title = "SH SMA", color = trendcolorSH)

plot(LG_SMA, title = "LG SMA", color = trendcolorLG)

plot(GV_SMA, title = "GV SMA", color = color.silver, linewidth = 4, transp = 70)

//Highlight crossovers

plotshape(series=SH_LGcrossover, style=shape.arrowup, location=location.belowbar,size=size.normal, color=color.green)

plotshape(series=SH_LGcrossunder, style=shape.arrowdown, location=location.abovebar,size=size.normal, color=color.red)

// 4. Determine Long & Short Entry Calculations*************************************************************************************************************************************************************************

//Define countback variable

countback=input(minval=0, maxval=5, title="Price CountBack", defval=0)

//User input for what evaluations to run: SMA or SMA + EMA

SMA_Y_N=input(defval = "Y", title="Run SMA", type=input.string, options=["Y", "N"])

MACD_Y_N=input(defval = "N", title="Run MACD", type=input.string, options=["Y", "N"])

//Calculate SMA Cross entry conditions

SMAbuy=false

SMAsell=false

SMAbuy := SH_LGcrossover and StrongSlope and BearTrend[WiT*7] //enter long if short SMA crosses over long SMA & security has been in a BearTrend for 'n' days back

SMAsell := SH_LGcrossunder and StrongSlope and BullTrend[WiT*7] //enter short if short SMA crosses under long SMA & security has been in a BullTrend for 'n' days back

//Calculate MACD Cross entry conditions

MACDbuy = iff(MACD_Y_N=="Y", crossunder(signal[countback], macd[countback]), true) and iff(MACD_Y_N=="Y", macd[countback]<0, true) and StrongSlope and BearTrend //enter long if fast MACD crosses over slow MACD & there is a strong slope & security has been in a BearTrend for 'n' days back

MACDsell = iff(MACD_Y_N=="Y", crossunder(macd[countback], signal[countback]), true) and iff(MACD_Y_N=="Y", signal[countback]>0, true) and StrongSlope and BullTrend //enter short if fast MACD crosses under slow MACD & there is a strong slope & security has been in a BullTrend for 'n' days back

//long entry condition

dataHCLB=(iff(SMA_Y_N=="Y", SMAbuy, true) and iff(MACD_Y_N=="Y", MACDbuy, true))

plotshape(dataHCLB, title= "HC-LB", color=color.lime, style=shape.circle, text="HC-LB")

strategy.entry("HC-Long", strategy.long, comment="HC-Long", when = dataHCLB and window())

//short entry condition

dataHCSB=(iff(SMA_Y_N=="Y", SMAsell, true) and iff(MACD_Y_N=="Y", MACDsell, true))

plotshape(dataHCSB, title= "HC-SB", color=color.fuchsia, style=shape.circle, text="HC-SB")

strategy.entry("HC-Short", strategy.short, comment="HC-Short", when=dataHCSB and window())

// 5. Submit Profit and Loss Exit Calculations Orders*************************************************************************************************************************************************************************

// User Options to Change Inputs (%)

stopPer = input(12, title='Stop Loss %', type=input.float) / 100

takePer = input(25, title='Take Profit %', type=input.float) / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

//exit position conditions and orders

if strategy.position_size > 0//or crossunder(price[countback], upperBB)

strategy.exit(id="Close Long", when = window(), stop=longStop, limit=longTake)

if strategy.position_size < 0 //or crossover(price[countback], lowerBB)

strategy.exit(id="Close Short", when = window(), stop=shortStop, limit=shortTake)

//Evaluate/debug equation***************************************************************************************************************************************************************************

// plotshape((n==5? true : na), title='n=5', style=shape.labeldown, location=location.abovebar, text='5', color=color.white, textcolor=color.black, transp=0) //print n value if 5

// plotshape((n==4? true : na), title='n=4', style=shape.labeldown, location=location.abovebar, text='4', color=color.white, textcolor=color.black, transp=0) //print n value if 4

// plotshape((n==3? true : na), title='n=3', style=shape.labeldown, location=location.abovebar, text='3', color=color.white, textcolor=color.black, transp=0) //print n value if 3

// plotshape((n==2? true : na), title='n=2', style=shape.labeldown, location=location.abovebar, text='2', color=color.white, textcolor=color.black, transp=0) //print n value if 2

// plotshape((n==1? true : na), title='n=1', style=shape.labeldown, location=location.abovebar, text='1', color=color.white, textcolor=color.black, transp=0) //print n value if 1

// lineValue = 11 //set random visible line value to check when equation is true

// colorP = (BearTrend==true) ? color.green : color.red

// plot (lineValue, title = "BearTrend", color = colorP) //Plot when condition true=green, false=red

// plot (XSlopeLG+15, color=color.white) //used for code debugging

// plot (XSlopeSH+15, color=color.blue) //used for code debugging

// plot (abs(XSlopeSH-XSlopeLG)+20, color=color.fuchsia) //used for code debugging

- Stratégie de rupture à double EMA Golden Cross

- Stratégie de tendance progressive de BB KC

- Stratégie de suivi automatique à triple SMA

- Stratégie de négociation de positions sur les contrats à terme sur Bitcoin

- EMA des prix avec optimisation stochastique basée sur l'apprentissage automatique

- La stratégie de rupture dynamique de Bollinger

- Stratégie de moyenne mobile à retraite à deux ans

- Stratégie de négociation à moyenne mobile double

- Système de suivi des tendances de rééquilibrage dynamique de la position

- Stratégie de renversement ouvert quotidien

- Stratégie des moyennes mobiles de la Croix d'Or

- Stratégie de négociation des crypto-monnaies MACD

- Stratégie à court terme de régression linéaire et de moyenne mobile double

- Stratégie de dynamique stochastique à triple chevauchement

- Stratégie de tendance à la dynamique

- Stratégie quantitative de la moyenne mobile de l'élan

- Stratégie combinée de double inversion de la moyenne mobile et de l'arrêt de traînée ATR

- Stratégie de négociation des contrats à terme à effet de levier Martingale

- Stratégie de reprise de l' élan

- Prédiction à deux bougies stratégie de clôture