Strategi perdagangan multi-kerangka waktu berdasarkan RSI dan rata-rata pergerakan

Ringkasan

Gagasan inti dari strategi ini adalah untuk menggunakan indeks yang relatif kuat (RSI) dan rata-rata bergerak dari periode waktu yang berbeda untuk mengidentifikasi titik-titik perubahan tren, untuk menangkap tren garis panjang dan menengah dan untuk melakukan perdagangan garis pendek. Strategi ini menggabungkan beberapa sinyal perdagangan untuk meningkatkan tingkat keberhasilan perdagangan.

Prinsip Strategi

- Hitung indikator RSI, serta EMA garis cepat dan WMA garis lambat

- Ketika RSI menembus WMA, sinyal beli/jual muncul.

- Ketika EMA cepat melewati WMA lambat, menghasilkan sinyal beli/jual.

- Ketika RSI dan EMA menembus WMA pada saat bersamaan, menghasilkan sinyal beli/jual yang kuat.

- Pada saat yang sama, sinyal utama dapat diperkuat ketika harga menembus rata-rata bergerak tambahan.

- Tetapkan Stop Loss dan Stop Stop Condition.

Strategi ini mengintegrasikan sinyal-sinyal terobosan dari berbagai indikator teknis, moving averages dengan pengaturan parameter yang berbeda untuk mengidentifikasi tren dari berbagai periode, sehingga meningkatkan keandalan strategi. Indikator RSI menilai status overbought oversold, EMA garis cepat menilai tren jangka pendek, WMA garis lambat menilai tren jangka menengah, harga dan pembuktian tren terobosan dari rata-rata tambahan.

Analisis Keunggulan

- Menggunakan fitur reversal dari RSI, Anda dapat mengambil peluang reversal di zona overbought dan oversold.

- Membantu Moving Average sebagai filter tren untuk menghindari false breaks.

- Kombinasi dari beberapa periode waktu memungkinkan untuk melacak tren garis panjang dan menangkap peluang garis pendek.

- Dengan menggabungkan berbagai sinyal indikator, Anda dapat meningkatkan tingkat keberhasilan perdagangan Anda.

- Tetapkan strategi Stop Loss Stop Stop yang dapat mengontrol risiko secara proaktif.

Analisis risiko

- Indikator RSI mudah menghasilkan sinyal palsu dan membutuhkan filter rata-rata bergerak tambahan.

- Rebound di bawah tren siklus besar dapat memicu sinyal perdagangan terbalik dan perlu diperhatikan.

- Pengaturan parameter yang harus dioptimalkan, seperti panjang siklus RSI, siklus rata-rata bergerak, dll.

- Pengaturan stop loss harus dilakukan dengan hati-hati untuk menghindari terjadinya kebocoran.

Risiko dapat dikurangi dengan metode seperti pengoptimalan parameter, strategi stop loss yang ketat, dan mempertimbangkan tren siklus besar.

Arah optimasi

- Optimalkan parameter RSI untuk menemukan panjang siklus optimal.

- Uji berbagai jenis kombinasi moving average.

- Tambahkan indikator volatilitas seperti ATR, stop loss stop loss.

- Menambahkan modul manajemen volume transaksi.

- Menggunakan teknologi pembelajaran mesin untuk mengoptimalkan parameter dan menilai kualitas sinyal.

Meringkaskan

Strategi ini mengintegrasikan pemantauan tren dan ide perdagangan reversal titik, menambahkan analisis multi-frame waktu dan penggunaan komprehensif berbagai indikator, dengan tujuan untuk meningkatkan peluang perdagangan. Kuncinya adalah untuk mengendalikan risiko dengan baik, mengoptimalkan pengaturan parameter, dan mempertimbangkan dampak tren siklus besar pada perdagangan pada waktu yang tepat.

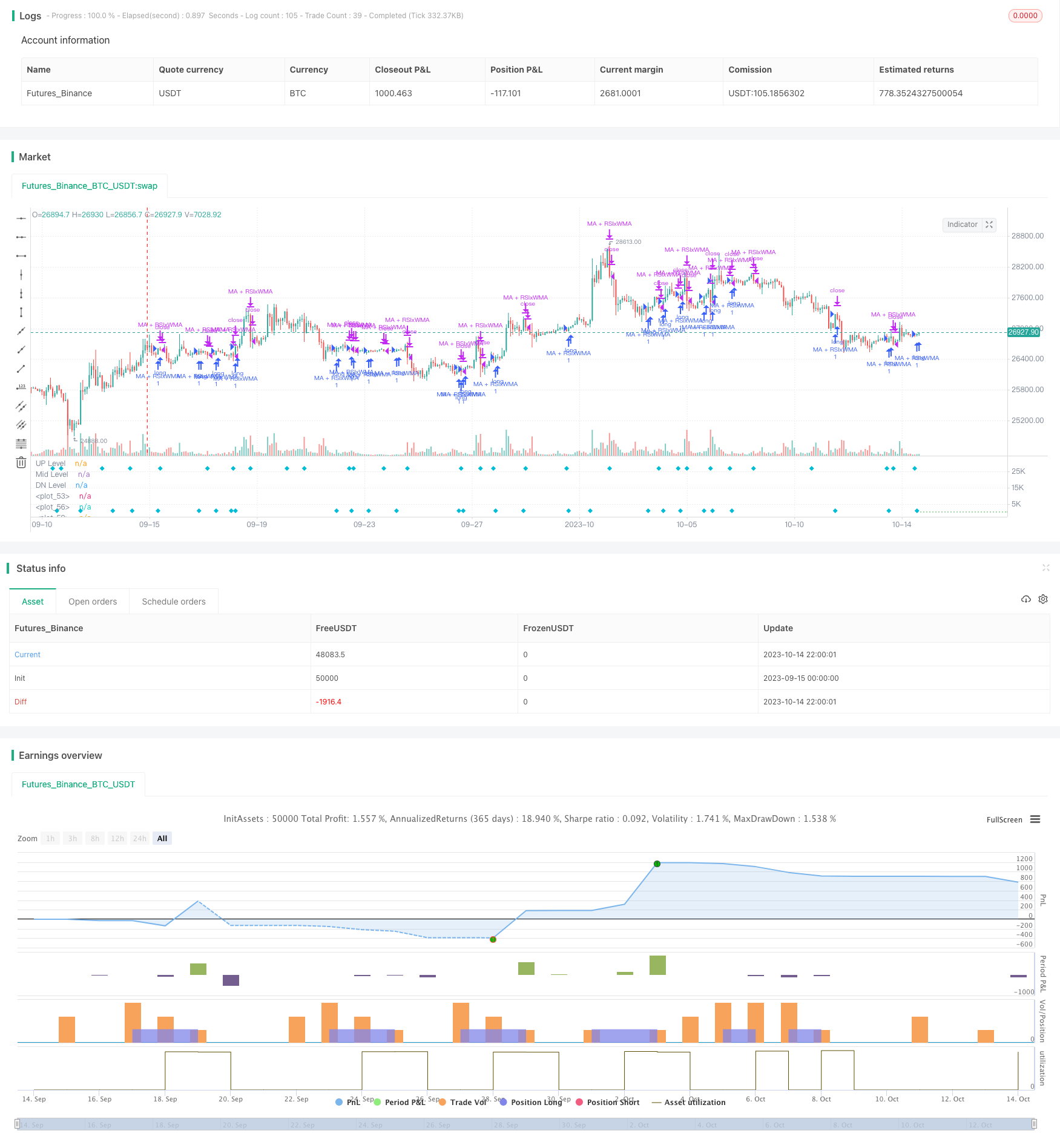

/*backtest

start: 2023-09-15 00:00:00

end: 2023-10-15 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HamidBox

//@version=4

// strategy("H-M By HamidBox-YT", default_qty_type=strategy.cash, default_qty_value= 100, initial_capital=100, currency='USD', commission_type=strategy.commission.percent, commission_value=0.1)

ma(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

WMA(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

WithMA(source, length, type) =>

type == "SMA" ? sma(source , length) :

type == "EMA" ? ema(source , length) :

type == "WMA" ? wma(source , length) :

type == "VWMA" ? vwma(source , length) :

na

rsi_inline = input(true , title="RSI Value)", inline="rsi")

rsiLength = input(title="Length:", type=input.integer, defval=9, minval=1, inline="rsi")

rsiLineM = input(title="Level:", type=input.integer, defval=50, minval=1, inline="rsi")

rsi_OSOBinline = input(true , title="RSI)", inline="rsiosob")

rsiLineU = input(title="O-BOUGHT", type=input.integer, defval=70, minval=1, inline="rsiosob")

rsiLineD = input(title="O-SOLD", type=input.integer, defval=30, minval=1, inline="rsiosob")

ma_inline = input(true , title="Price-MA)", inline="ma")

ma_type = input(title="Type", defval="EMA", options=["EMA","SMA","WMA","VWMA"], inline="ma")

emaLength = input(title="Length", type=input.integer, defval=3, inline="ma")

wma_inline = input(true , title="Trending-MA)", inline="wma")

ma_type2 = input(title="", defval="WMA", options=["EMA","SMA","WMA","VWMA"], inline="wma")

wmaLength = input(title="Length", type=input.integer, defval=21, inline="wma")

////////////////////////////////////////////////////////////////////////////////

startTime = input(title="Start Time", type = input.time, defval = timestamp("01 Jan 2021 00:00 +0000"), group="Backtest Time Period")

endTime = input(title="End Time", type = input.time, defval = timestamp("01 Jan 2200 00:00 +0000"), group="Backtest Time Period")

inDateRange = true

////////////////////////////////////////////////////////////////////////////////

rsi = rsi(close , rsiLength)

r = plot(rsi_inline ? rsi : na, color=color.yellow, linewidth=2)

EMA = ma(rsi, emaLength, ma_type)

e = plot(ma_inline ? EMA : na, color=color.lime)

myWMA = ma(rsi, wmaLength, ma_type2)

w = plot(wma_inline ? myWMA : na, color=color.white, linewidth=2)

up = hline(rsiLineU, title='UP Level', linewidth=1, color=color.red, linestyle=hline.style_dotted)

mid = hline(rsiLineM, title='Mid Level', linewidth=2, color=color.white, linestyle=hline.style_dotted)

dn = hline(rsiLineD, title='DN Level', linewidth=1, color=color.green, linestyle=hline.style_dotted)

col_e_w = EMA > myWMA ? color.new(color.green , 85) : color.new(color.red , 85)

col_r_w = rsi > myWMA ? color.new(color.green , 85) : color.new(color.red , 85)

fill(e , w, color=col_e_w)

fill(r , w, color=col_r_w)

////////////////////////////////////////////////////////////////////////////////

//Signals = input(true,group="👇 🚦 --- Backtesting Signals Type --- 🚦 ")

///////////////////////////////////////////////////////////////////////////////

RSI_Cross = input(false, "RSI x Trending-MA", inline="wma_cross",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsiBuySignal = crossover(rsi , myWMA)

plotshape(RSI_Cross ? rsiBuySignal : na, title="RSI Crossover", style=shape.labelup, location=location.bottom, color=color.green)

rsiSellSignal = crossunder(rsi , myWMA)

plotshape(RSI_Cross ? rsiSellSignal : na, title="RSI Crossunder", style=shape.labeldown, location=location.top, color=color.red)

if rsiBuySignal and RSI_Cross and inDateRange

strategy.entry("RSIxWMA", strategy.long)

if rsiSellSignal and RSI_Cross and inDateRange

strategy.close("RSIxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

MA_Cross = input(false, "MA x Trendin-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

maBuySignal = crossover(EMA, myWMA)

plotshape(MA_Cross ? maBuySignal : na, title="MA Cross", style=shape.circle, location=location.bottom, color=color.lime)

maSellSignal = crossunder(EMA , myWMA)

plotshape(MA_Cross ? maSellSignal : na, title="RSI Crossunder", style=shape.circle, location=location.top, color=color.maroon)

if maBuySignal and MA_Cross and inDateRange

strategy.entry("MAxWMA", strategy.long)

if maSellSignal and MA_Cross and inDateRange

strategy.close("MAxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

Mix = input(false, "RSI + EMA x Trending-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_ma_buy = crossover(rsi , myWMA) and crossover(EMA, myWMA)

rsi_ma_sell = crossunder(rsi , myWMA) and crossunder(EMA, myWMA)

plotshape(Mix ? rsi_ma_buy : na, title="RSI Crossunder", style=shape.circle, location=location.bottom, color=color.lime, size=size.tiny)

plotshape(Mix ? rsi_ma_sell : na, title="RSI Crossunder", style=shape.circle, location=location.top, color=color.yellow, size=size.tiny)

if rsi_ma_buy and Mix and inDateRange

strategy.entry("RSI+EMA x WMA", strategy.long)

if rsi_ma_sell and Mix and inDateRange

strategy.close("RSI+EMA x WMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

wma_cross = input(false, "Trending-MA x 50",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

wma_buy = crossover(myWMA , rsiLineM)

plotshape(wma_cross ? wma_buy : na, title="WMA Cross", style=shape.diamond, location=location.bottom, color=color.aqua)

wma_sell = crossunder(myWMA , rsiLineM)

plotshape(wma_cross ? wma_sell : na, title="WMA Cross", style=shape.diamond, location=location.top, color=color.aqua)

if wma_buy and wma_cross and inDateRange

strategy.entry("WMA x 50", strategy.long)

if wma_sell and wma_cross and inDateRange

strategy.close("WMA x 50", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

rsi_50 = input(false, "RSI x 50",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_50_buy = crossover(rsi , rsiLineM)

plotshape(rsi_50 ? rsi_50_buy : na, title="WMA Cross", style=shape.cross, location=location.bottom, color=color.purple)

rsi_50_sell = crossunder(rsi , rsiLineM)

plotshape(rsi_50 ? rsi_50_sell : na, title="WMA Cross", style=shape.cross, location=location.top, color=color.purple)

if rsi_50_buy and rsi_50 and inDateRange

strategy.entry("RSI Cross 50", strategy.long)

if rsi_50_sell and rsi_50 and inDateRange

strategy.close("RSI Cross 50", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

RSI_OS_OB = input(false, "RSI OS/OB x Trending-MA",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsi_OB_buy = (rsi < rsiLineD or rsi[1] < rsiLineD[1] or rsi[2] < rsiLineD[2] or rsi[3] < rsiLineD[3] or rsi[4] < rsiLineD[4] or rsi[5] < rsiLineD[5]) and rsiBuySignal

plotshape(RSI_OS_OB ? rsi_OB_buy : na, title="RSI OB + Cross", style=shape.circle, location=location.bottom, color=color.lime, size=size.tiny)

rsi_OS_sell = (rsi > rsiLineU or rsi[1] > rsiLineU[1] or rsi[2] > rsiLineU[2] or rsi[3] > rsiLineU[3] or rsi[4] > rsiLineU[4] or rsi[5] > rsiLineU[5]) and maSellSignal

plotshape(RSI_OS_OB ? rsi_OS_sell : na, title="RSI OS + Cross", style=shape.circle, location=location.top, color=color.red, size=size.tiny)

if rsi_OB_buy and RSI_OS_OB and inDateRange

strategy.entry("RSI-OBOS x WMA", strategy.long)

if rsi_OS_sell and RSI_OS_OB and inDateRange

strategy.close("RSI-OBOS x WMA", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

rsi_OB_OS = input(false, "RSI Over Sold/Bought",group="👇 🚦 --- Backtesting Signals Type --- 🚦 ") // INPUT

rsiBuy = crossover(rsi , rsiLineD)

rsiSell = crossunder(rsi, rsiLineU)

rsiExit = crossunder(rsi, rsiLineD)

plotshape(rsi_OB_OS ? rsiBuy : na, title="RSI OB", style=shape.cross, location=location.bottom, color=color.purple)

plotshape(rsi_OB_OS ? crossunder(rsi, rsiLineU) : na, title="RSI OS", style=shape.cross, location=location.top, color=color.purple)

plotshape(rsi_OB_OS ? rsiExit : na, title="RSI OS", style=shape.cross, location=location.bottom, color=color.red)

if rsiBuy and rsi_OB_OS and inDateRange

strategy.entry("RSI OB", strategy.long)

if (rsiSell or rsiExit) and rsi_OB_OS and inDateRange

strategy.close("RSI OB", comment="x")

if (not inDateRange)

strategy.close_all()

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

With_MA_Vis = input(true , title="With MA Signal)", inline="WITH MA", group="With MA")

withMA_type = input(title="", defval="SMA", options=["EMA","SMA","WMA","VWMA"], inline="WITH MA", group="With MA")

with_MALen = input(title="", defval=9, type=input.integer, inline="WITH MA", group="With MA")

// TAKE-PROFIT / STOP-LOSS

Stop_Take_Vis = input(true, "TP-SL")

LongSLValue = input(title="SL %", type=input.float, defval=3, minval=0.5) * 0.01

LongTPValue = input(title="TP %", type=input.float, defval=15, minval=0.5) * 0.01

LongSLDetermine = strategy.position_avg_price * (1 - LongSLValue)

LongTPDetermine = strategy.position_avg_price * (1 + LongTPValue)

//////////////////////////

with_ma = WithMA(close, with_MALen, withMA_type)

Close_buy_MA = crossover(close , with_ma)

Close_sell_MA = crossunder(close , with_ma)

// PLOT OPTION

WithMaSignal = input(true, "MA + RSI x Trending-MA",group="With MA") // INPUT

// CONDITION IN VARIABLE

withMA_RSI_BUY = (Close_buy_MA and rsiBuySignal) and WithMaSignal and inDateRange

withMA_RSI_SELL = (Close_sell_MA and rsiSellSignal) and WithMaSignal and inDateRange

// PLOT ING

plotshape(WithMaSignal ? withMA_RSI_BUY : na, title="With MA", style=shape.diamond, location=location.bottom, color=color.aqua)

plotshape(WithMaSignal ? withMA_RSI_SELL : na, title="With MA", style=shape.diamond, location=location.top, color=color.aqua)

if withMA_RSI_BUY

strategy.entry("MA + RSIxWMA", strategy.long)

if withMA_RSI_SELL

strategy.close("MA + RSIxWMA", comment="x")

if (not inDateRange)

strategy.close_all()

// FOR SL - TP

if (strategy.position_size > 0) and Stop_Take_Vis

strategy.exit("BUY", stop=LongSLDetermine, limit=LongTPDetermine)