Golden Cross SMA Strategi Perdagangan

Penulis:ChaoZhang, Tanggal: 2024-01-26 14:29:01Tag:

Gambaran umum

Strategi perdagangan SMA silang emas menghasilkan sinyal beli dan jual berdasarkan penyeberangan antara dua rata-rata bergerak dari kerangka waktu yang berbeda. Secara khusus, ketika rata-rata bergerak yang lebih cepat melintasi di atas rata-rata bergerak yang lebih lambat dari bawah, sebuah silang emas terbentuk, menunjukkan pembalikan tren bullish. Ketika MA yang lebih cepat melintasi di bawah MA yang lebih lambat dari atas, sebuah silang kematian terbentuk, menunjukkan pembalikan tren bearish.

Prinsip-prinsip

Strategi ini didasarkan pada dua prinsip:

Rata-rata bergerak dapat mencerminkan tren dan momentum pasar. MA jangka pendek menangkap pergerakan harga baru-baru ini dan pembalikan. MA jangka panjang menunjukkan tren yang berlaku.

Ketika MA yang lebih cepat membentuk salib emas dengan MA yang lebih lambat, ini menunjukkan momentum jangka pendek semakin kuat dibandingkan dengan tren jangka panjang, sehingga kemungkinan awal tren naik.

Secara khusus, strategi ini menggunakan rata-rata bergerak sederhana 13 dan 30 periode dan memperdagangkan sinyal silang mereka.

Garis emas antara MAs menghasilkan sinyal panjang, yang menunjukkan peluang pembelian.

Pembagian antara MAs menghasilkan sinyal pendek. Demikian pula, tren penurunan yang berkelanjutan diperlukan untuk mengkonfirmasi kelayakan sinyal untuk shorting.

Perbedaan kemiringan antara MA digunakan untuk mengukur kekuatan sinyal silang. Hanya ketika perbedaan melebihi ambang batas, sinyal akan dianggap cukup kuat untuk diperdagangkan. Ini membantu menghilangkan sinyal palsu.

Stop loss ditetapkan pada 20% dan mengambil keuntungan pada 100%.

Keuntungan

Strategi crossover SMA memiliki keuntungan berikut:

Logikanya sederhana dan mudah dimengerti, cocok untuk pemula.

Menggunakan rata-rata harga untuk menyaring kebisingan dan menghindari tertipu oleh fluktuasi jangka pendek.

Mengevaluasi persistensi tren daripada hanya mengikuti sinyal silang secara membabi buta, memastikan konfirmasi yang lebih besar dengan kondisi pasar secara keseluruhan.

Memperkenalkan faktor momentum kemiringan pada MAs untuk membuat sinyal lebih dapat diandalkan.

Mudah backtesting dan optimasi dengan hanya beberapa parameter kunci seperti periode MA dan durasi tren.

Risiko

Strategi ini juga memiliki risiko berikut:

Sinyal crossover bersifat lambat dan tidak dapat memprediksi pembalikan secara sempurna. Risiko penundaan ada. Harus menggunakan MA yang lebih pendek atau dikombinasikan dengan indikator prediktif.

Sistem mekanis cenderung memicu perdagangan simultan, memperburuk momentum dan membatalkan stop loss / take profit.

Harus menghindari instrumen tersebut dan fokus pada pasangan tren.

Kinerja sangat tergantung pada parameter yang dikalibrasi dengan benar seperti durasi tren.

Arahan Optimasi

Strategi dapat dioptimalkan lebih lanjut dengan:

Menambahkan evaluasi tren jangka waktu yang lebih tinggi untuk menghindari perdagangan yang bertentangan dengan tren.

Memerlukan konfirmasi volume perdagangan untuk menghilangkan sinyal palsu.

Mengoptimalkan parameter MA untuk menemukan kombinasi periode terbaik. Pertimbangkan rata-rata bergerak adaptif.

Masukkan indikator populer seperti MACD, KD untuk membantu konfirmasi sinyal dan akurasi.

Mengadopsi stop loss bertahap / mengambil keuntungan untuk mengontrol risiko dengan lebih baik.

Kesimpulan

Strategi crossover SMA sangat intuitif dan mudah ditafsirkan. Ini menggabungkan properti penyaringan kebisingan dari moving average dengan kemampuan identifikasi tren sederhana dari sinyal crossover. Konfirmasi sinyal tambahan memberikan kepraktisan dan stabilitas yang lebih besar. Di atas perbaikan yang dibahas, masih ada ruang yang cukup untuk optimasi lebih lanjut, membuat ini menjadi strategi yang layak untuk diteliti.

/*backtest

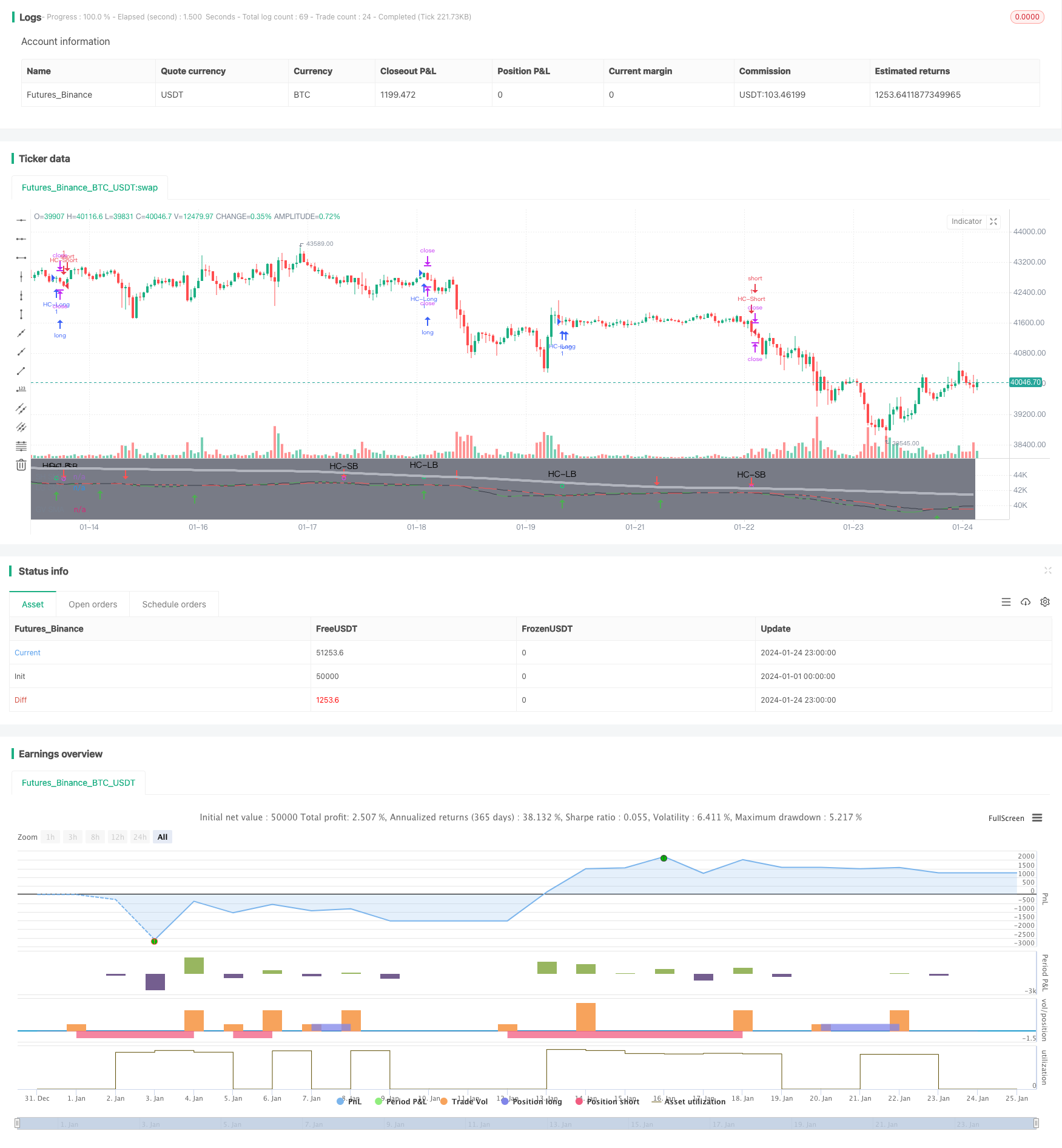

start: 2024-01-01 00:00:00

end: 2024-01-25 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © MakeMoneyCoESTB2020

//*********************Notes for continued work***************

//************************************************************

//Hello my fellow investors

//I am creating a simple non-cluttered strategy that uses 3(+1) simple means to determine: viability, entry, and exit

//1) Has a consistent trend been maintained for several days/weeks

//2) SH SMA crossover LG SMA = Bullish entry/LG SMA crossover SH SMA = Bearish entry

//3) Use the Slope factor & Weeks in Trend (WiT) to dertermine how strong of an entry signal you are comfortable with

//4) Exit position based on next SMA cross and trend reversal or stop loss%

//3+1) For added confidence in trend detection: Apply MACD check - buy--> MACD line above signal line and corssover below histogram \\ sell --> MACD line below signal line and crossover above histogram.

//*)This code also allows you to determine your desired backtesting date compliments of alanaster

//This code is the product of many hours of hard work on the part of the greater tradingview community. The credit goes to everyone in the community who has put code out there for the greater good.

//Happy Hunting!

// 1. Define strategy settings*************************************************************************************************************************************************************************

//Title

strategy("KISS Strategy: SMA + EMA", shorttitle="KISS Strat")

//define calculations price source

price = input(title="Price Source", defval=close)

// 2. Calculate strategy values*************************************************************************************************************************************************************************

//Calculate 13/30/200SMA

SH_SMA_length= input(title="SH SMA Length", defval=13) //short SMA length

LG_SMA_length= input(title="LG SMA Length", defval=30) //long SMA length

GV_SMA_length= input(title="SH SMA Length", defval=200) //Gravitational SMA length

SH_SMA=sma(price, SH_SMA_length) //short SMA

LG_SMA=sma(price, LG_SMA_length) //long SMA

GV_SMA=sma(price, GV_SMA_length) //gravitational SMA

//calculate MACD

//define variables for speed

fast = 12, slow = 26

//define parameters to calculate MACD

fastMA = ema(price, fast)

slowMA = ema(price, slow)

//define MACD line

macd = fastMA - slowMA

//define SIGNAL line

signal = sma(macd, 9)

//Determine what type of trend we are in

dcp = security(syminfo.tickerid, 'D', close) //daily close price

wcp = security(syminfo.tickerid, 'W', close) //weekly close price

WiT = input(title="Weeks In Trend", defval=1, maxval=5, minval=1) //User input for how many weeks of price action to evaluate (Weeks in Trend = WiT)

BearTrend = false //initialize trend variables as false

BullTrend = false //initialize trend variables as false

// BullTrend := (wcp > SH_SMA) and (SH_SMA > LG_SMA) //true if price is trending up based on weekly price close

// BearTrend := (wcp < SH_SMA) and (SH_SMA < LG_SMA) //true if price is trending down based on weekly price close

// BullTrend := (price > SH_SMA) and (SH_SMA > LG_SMA) //true if price is trending up

// BearTrend := (price < SH_SMA) and (SH_SMA < LG_SMA) //true if price is trending down

//Determine if the market has been in a trend for 'n' weeks

n=WiT //create loop internal counting variable

for i=1 to WiT //create loop to determine if BearTrend=true to set number of weeks

if (wcp[n] < price) //evaluate if BearTrend=false comparing the current price to a paticular week close

BearTrend := false //set value to false if older price value is less than newer: trending up

break //break out of for loop when trend first falters

if (wcp[n] > price) //evaluate if BearTrend=true comparing the current price to a paticular week close

BearTrend := true //set value to true if older price value is greater than newer: trending down

n:=n-1 //set internal counter one day closer to present

m=WiT //create loop internal counting variable

for j=1 to WiT //create loop to determine if BearTrend=true to set number of weeks

if (wcp[m] > price) //evaluate if BullTrend=false comparing the current price to a paticular week close

BullTrend := false //set value to false if older price value is greater than newer: trending down

break //break out of for loop when trend first falters

if (wcp[m] < price) //evaluate if BullTrend=true comparing the current price to a paticular week close

BullTrend := true //set value to true if older price value is less than newer: trending up

m:=m-1 //set internal counter one day closer to present

//Determine if crossings occur

SH_LGcrossover = crossover(SH_SMA, LG_SMA) //returns true if short crosses over long

SH_LGcrossunder = crossunder(SH_SMA, LG_SMA) //returns true if short crosses under long

//Determine the slope of the SMAs when a cross over occurs

SlopeFactor= input(title="Slope Factor", defval=.01, minval=0, step = 0.001) //user input variable for what slope to evaluate against

XSlopeSH = abs(SH_SMA-SH_SMA[2]) //slope of short moving average (time cancels out)

XSlopeLG = abs(LG_SMA-LG_SMA[2]) //slope of long moving average (time cancels out)

StrongSlope = iff (abs(XSlopeSH-XSlopeLG)>SlopeFactor, true, false) //create a boolean variable to determine is slope intensity requirement is met

// ************************************ INPUT BACKTEST RANGE ******************************************=== coutesy of alanaster

fromMonth = input(defval = 4, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2020, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

// === INPUT SHOW PLOT ===

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

// === FUNCTION EXAMPLE ===

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

bgcolor(color = showDate and window() ? color.gray : na, transp = 90)

// === EXECUTION ===

//strategy.entry("L", strategy.long, when = window() and crossOv) // enter long when "within window of time" AND crossover

//strategy.close("L", when = window() and crossUn) // exit long when "within window of time" AND crossunder

// 3. Output strategy data*************************************************************************************************************************************************************************

//Embolden line if a trend exists

trendcolorLG = BearTrend?color.red:color.black //highlights beartrend condition met graphically

trendcolorSH = BullTrend?color.green:color.black //highlights beartrend condition met graphically

//plot SMAs

plot(SH_SMA, title = "SH SMA", color = trendcolorSH)

plot(LG_SMA, title = "LG SMA", color = trendcolorLG)

plot(GV_SMA, title = "GV SMA", color = color.silver, linewidth = 4, transp = 70)

//Highlight crossovers

plotshape(series=SH_LGcrossover, style=shape.arrowup, location=location.belowbar,size=size.normal, color=color.green)

plotshape(series=SH_LGcrossunder, style=shape.arrowdown, location=location.abovebar,size=size.normal, color=color.red)

// 4. Determine Long & Short Entry Calculations*************************************************************************************************************************************************************************

//Define countback variable

countback=input(minval=0, maxval=5, title="Price CountBack", defval=0)

//User input for what evaluations to run: SMA or SMA + EMA

SMA_Y_N=input(defval = "Y", title="Run SMA", type=input.string, options=["Y", "N"])

MACD_Y_N=input(defval = "N", title="Run MACD", type=input.string, options=["Y", "N"])

//Calculate SMA Cross entry conditions

SMAbuy=false

SMAsell=false

SMAbuy := SH_LGcrossover and StrongSlope and BearTrend[WiT*7] //enter long if short SMA crosses over long SMA & security has been in a BearTrend for 'n' days back

SMAsell := SH_LGcrossunder and StrongSlope and BullTrend[WiT*7] //enter short if short SMA crosses under long SMA & security has been in a BullTrend for 'n' days back

//Calculate MACD Cross entry conditions

MACDbuy = iff(MACD_Y_N=="Y", crossunder(signal[countback], macd[countback]), true) and iff(MACD_Y_N=="Y", macd[countback]<0, true) and StrongSlope and BearTrend //enter long if fast MACD crosses over slow MACD & there is a strong slope & security has been in a BearTrend for 'n' days back

MACDsell = iff(MACD_Y_N=="Y", crossunder(macd[countback], signal[countback]), true) and iff(MACD_Y_N=="Y", signal[countback]>0, true) and StrongSlope and BullTrend //enter short if fast MACD crosses under slow MACD & there is a strong slope & security has been in a BullTrend for 'n' days back

//long entry condition

dataHCLB=(iff(SMA_Y_N=="Y", SMAbuy, true) and iff(MACD_Y_N=="Y", MACDbuy, true))

plotshape(dataHCLB, title= "HC-LB", color=color.lime, style=shape.circle, text="HC-LB")

strategy.entry("HC-Long", strategy.long, comment="HC-Long", when = dataHCLB and window())

//short entry condition

dataHCSB=(iff(SMA_Y_N=="Y", SMAsell, true) and iff(MACD_Y_N=="Y", MACDsell, true))

plotshape(dataHCSB, title= "HC-SB", color=color.fuchsia, style=shape.circle, text="HC-SB")

strategy.entry("HC-Short", strategy.short, comment="HC-Short", when=dataHCSB and window())

// 5. Submit Profit and Loss Exit Calculations Orders*************************************************************************************************************************************************************************

// User Options to Change Inputs (%)

stopPer = input(12, title='Stop Loss %', type=input.float) / 100

takePer = input(25, title='Take Profit %', type=input.float) / 100

// Determine where you've entered and in what direction

longStop = strategy.position_avg_price * (1 - stopPer)

shortStop = strategy.position_avg_price * (1 + stopPer)

shortTake = strategy.position_avg_price * (1 - takePer)

longTake = strategy.position_avg_price * (1 + takePer)

//exit position conditions and orders

if strategy.position_size > 0//or crossunder(price[countback], upperBB)

strategy.exit(id="Close Long", when = window(), stop=longStop, limit=longTake)

if strategy.position_size < 0 //or crossover(price[countback], lowerBB)

strategy.exit(id="Close Short", when = window(), stop=shortStop, limit=shortTake)

//Evaluate/debug equation***************************************************************************************************************************************************************************

// plotshape((n==5? true : na), title='n=5', style=shape.labeldown, location=location.abovebar, text='5', color=color.white, textcolor=color.black, transp=0) //print n value if 5

// plotshape((n==4? true : na), title='n=4', style=shape.labeldown, location=location.abovebar, text='4', color=color.white, textcolor=color.black, transp=0) //print n value if 4

// plotshape((n==3? true : na), title='n=3', style=shape.labeldown, location=location.abovebar, text='3', color=color.white, textcolor=color.black, transp=0) //print n value if 3

// plotshape((n==2? true : na), title='n=2', style=shape.labeldown, location=location.abovebar, text='2', color=color.white, textcolor=color.black, transp=0) //print n value if 2

// plotshape((n==1? true : na), title='n=1', style=shape.labeldown, location=location.abovebar, text='1', color=color.white, textcolor=color.black, transp=0) //print n value if 1

// lineValue = 11 //set random visible line value to check when equation is true

// colorP = (BearTrend==true) ? color.green : color.red

// plot (lineValue, title = "BearTrend", color = colorP) //Plot when condition true=green, false=red

// plot (XSlopeLG+15, color=color.white) //used for code debugging

// plot (XSlopeSH+15, color=color.blue) //used for code debugging

// plot (abs(XSlopeSH-XSlopeLG)+20, color=color.fuchsia) //used for code debugging

- Dual EMA Golden Cross Breakout Strategi

- Strategi Tren BB KC bertahap

- Strategi Pelacakan Otomatis SMA Ganda

- Strategi Trading Posisi Bitcoin Futures

- EMA harga dengan optimasi stokastik berdasarkan pembelajaran mesin

- Strategi Bollinger Dynamic Breakout

- Dua Tahun Baru Tinggi Retracement Moving Average Strategi

- Strategi Perdagangan Rata-rata Bergerak Ganda

- Sistem Pelacakan Tren Posisi Dinamis

- Strategi pembalikan terbuka harian

- Strategi Rata-rata Bergerak Golden Cross

- Strategi Trading Crypto MACD

- Strategi jangka pendek regresi linier dan rata-rata bergerak ganda

- Triple Overlapping Stochastic Momentum Strategi

- Strategi Tren Momentum

- Momentum Moving Average Crossover Quant Strategi

- Strategi kombinasi pembalikan rata-rata bergerak ganda dan ATR Trailing Stop

- Strategi perdagangan berjangka Martingale leveraged

- Strategi Pullback Momentum

- Dual Candlestick Prediksi Strategi Tutup