Tag:

Gambaran umum

Strategi ini menggabungkan dua rata-rata bergerak eksponensial dan tiga rata-rata bergerak Williams untuk membentuk sistem sinyal pelacakan tren dan pembalikan tren yang komprehensif.

Logika Strategi

Analisis Keuntungan

Selain itu, strategi ini memiliki ruang pengoptimalan parameter yang besar. Dengan menyesuaikan parameter rata-rata bergerak ganda dan tiga rata-rata bergerak Williams, ia dapat beradaptasi dengan karakteristik varietas dan siklus yang berbeda, dan memiliki kemampuan beradaptasi yang kuat.

Analisis Risiko

Risiko utama dari strategi ini adalah bahwa ketika pasar memasuki fluktuasi yang ganas, titik stop loss dapat rusak, menghasilkan kerugian yang lebih besar. Ini adalah masalah umum dengan strategi moving average. Selain itu, di pasar osilasi, strategi ini dapat sering membuka dan menutup posisi, meningkatkan biaya biaya perdagangan.

Arahan Optimasi

Kesimpulan

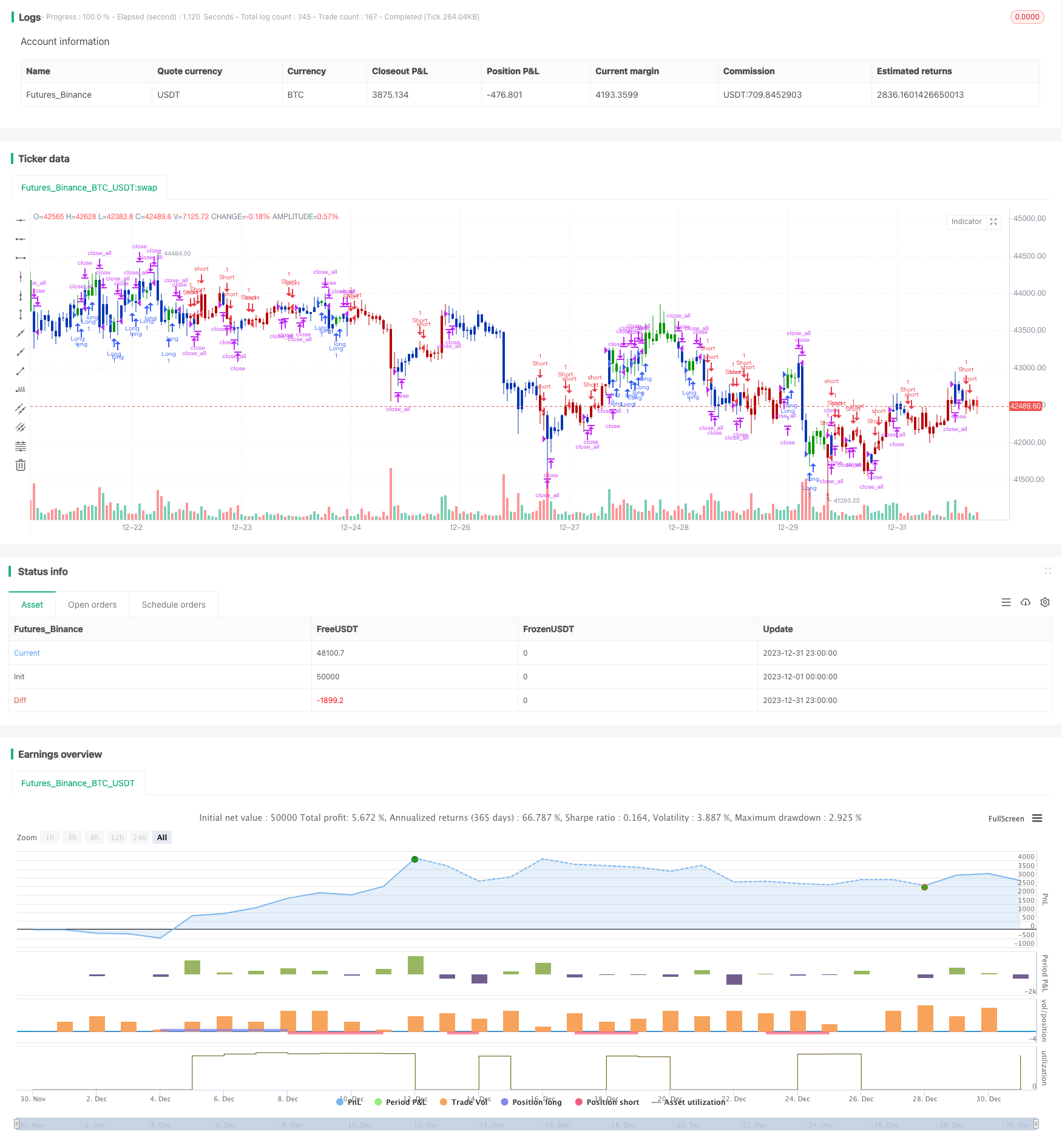

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 21/04/2022

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This indicator plots 2/20 exponential moving average. For the Mov

// Avg X 2/20 Indicator, the EMA bar will be painted when the Alert criteria is met.

//

// Second strategy

// This indicator calculates 3 Moving Averages for default values of

// 13, 8 and 5 days, with displacement 8, 5 and 3 days: Median Price (High+Low/2).

// The most popular method of interpreting a moving average is to compare

// the relationship between a moving average of the security's price with

// the security's price itself (or between several moving averages).

//

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

EMA20(Length) =>

pos = 0.0

xPrice = close

xXA = ta.ema(xPrice, Length)

nHH = math.max(high, high[1])

nLL = math.min(low, low[1])

nXS = nLL > xXA or nHH < xXA ? nLL : nHH

iff_1 = nXS < close[1] ? 1 : nz(pos[1], 0)

pos := nXS > close[1] ? -1 : iff_1

pos

BWA3Lines(LLength,MLength,SLength,LOffset,MOffset,SOffset) =>

pos = 0.0

xLSma = ta.sma(hl2, LLength)[LOffset]

xMSma = ta.sma(hl2, MLength)[MOffset]

xSSma = ta.sma(hl2, SLength)[SOffset]

pos := close < xSSma and xSSma < xMSma and xMSma < xLSma ? -1 :

close > xSSma and xSSma > xMSma and xMSma > xLSma ? 1 : nz(pos[1], 0)

pos

strategy(title='Combo 2/20 EMA & Bill Williams Averages. 3Lines', shorttitle='Combo', overlay=true)

var I1 = '●═════ 2/20 EMA ═════●'

Length = input.int(14, minval=1, group=I1)

var I2 = '●═════ 3Lines ═════●'

LLength = input.int(13, minval=1, group=I2)

MLength = input.int(8,minval=1, group=I2)

SLength = input.int(5,minval=1, group=I2)

LOffset = input.int(8,minval=1, group=I2)

MOffset = input.int(5,minval=1, group=I2)

SOffset = input.int(3,minval=1, group=I2)

var misc = '●═════ MISC ═════●'

reverse = input.bool(false, title='Trade reverse', group=misc)

var timePeriodHeader = '●═════ Time Start ═════●'

d = input.int(1, title='From Day', minval=1, maxval=31, group=timePeriodHeader)

m = input.int(1, title='From Month', minval=1, maxval=12, group=timePeriodHeader)

y = input.int(2005, title='From Year', minval=0, group=timePeriodHeader)

StartTrade = time > timestamp(y, m, d, 00, 00) ? true : false

posEMA20 = EMA20(Length)

prePosBWA3Lines = BWA3Lines(LLength,MLength,SLength,LOffset,MOffset,SOffset)

iff_1 = posEMA20 == -1 and prePosBWA3Lines == -1 and StartTrade ? -1 : 0

pos = posEMA20 == 1 and prePosBWA3Lines == 1 and StartTrade ? 1 : iff_1

iff_2 = reverse and pos == -1 ? 1 : pos

possig = reverse and pos == 1 ? -1 : iff_2

if possig == 1

strategy.entry('Long', strategy.long)

if possig == -1

strategy.entry('Short', strategy.short)

if possig == 0

strategy.close_all()

barcolor(possig == -1 ? #b50404 : possig == 1 ? #079605 : #0536b3)

- Strategi Penembusan Saluran Rata-rata yang Bergerak

- Strategi pengujian breakback waktu tetap

- Strategi MACD Multi Timeframe yang Dioptimalkan Waktu dan Ruang

- Strategi perdagangan kuantitatif berdasarkan Stock RSI dan MFI

- Strategi perdagangan komposit multi-indikator

- Strategi perdagangan jangka pendek EMA lintas

- Tren Mengikuti Strategi Berdasarkan Stop Loss Dinamis dari Crossover EMA Dual

- Bursa Bursa Breakout Darvas Box Beli Strategi

- Strategi momentum relatif

- Tren Gelombang dan Tren Berbasis VWMA Mengikuti Strategi Quant

- Strategi Crossover Rata-rata Bergerak

- Market Cypher Wave B Strategi Perdagangan Otomatis

- Strategi Pembalikan Kunci Backtest

- Reversal Candlestick Backtesting Strategi

- Swing High Low Price Channel Strategy V.1

- Strategi Perdagangan Pembalikan Momentum