Strategi Kuberan: Pendekatan Konfluensi untuk penguasaan pasar

Penulis:ChaoZhang, Tanggal: 2024-03-22 14:08:11Tag:

Tinjauan Strategi

Strategi Kuberan adalah strategi perdagangan yang kuat yang dikembangkan oleh Kathir. Strategi ini menggabungkan beberapa teknik analitis untuk membentuk pendekatan perdagangan yang unik dan ampuh.

Kuberan adalah lebih dari sekadar strategi; ini adalah sistem perdagangan yang komprehensif. Ini mengintegrasikan analisis tren, indikator momentum, dan metrik volume untuk mengidentifikasi peluang perdagangan dengan probabilitas tinggi. Dengan memanfaatkan sinergi dari elemen-elemen ini, Kuberan memberikan sinyal masuk dan keluar yang jelas, cocok untuk pedagang dari semua tingkat.

Prinsip Strategi

Inti dari strategi Kuberan adalah prinsip perpaduan multi-indikator. Ini memanfaatkan kombinasi unik dari indikator yang bekerja secara harmonis untuk mengurangi kebisingan dan sinyal palsu. Secara khusus, strategi ini menggunakan komponen kunci berikut:

- Penentuan arah tren: Dengan membandingkan harga saat ini dengan level support dan resistance, ia menentukan arah tren yang berlaku.

- Tingkat support dan resistance: Mengidentifikasi level support dan resistance utama menggunakan indikator zigzag dan titik pivot.

- Deteksi divergensi: Membandingkan aksi harga dengan indikator momentum untuk menemukan potensi pembalikan tren yang ditandai oleh divergensi.

- Adaptasi volatilitas: Mengatur secara dinamis tingkat stop loss berdasarkan indikator ATR untuk beradaptasi dengan volatilitas pasar yang bervariasi.

- Pengakuan pola candlestick: Mengkonfirmasi sinyal tren dan pembalikan menggunakan kombinasi candlestick tertentu.

Dengan mempertimbangkan faktor-faktor ini secara komprehensif, strategi Kuberan dapat beradaptasi dengan berbagai kondisi pasar dan menangkap peluang perdagangan yang memiliki probabilitas tinggi.

Keuntungan Strategi

- Konfluensi multi-indikator: Kuberan memanfaatkan sinergi dari beberapa indikator, sangat meningkatkan keandalan sinyal dan mengurangi gangguan kebisingan.

- Kemampuan beradaptasi yang tinggi: Melalui penyesuaian parameter dinamis, strategi dapat beradaptasi dengan perubahan lingkungan pasar, menghindari ketinggalan zaman.

- Sinyal yang jelas: Kuberan memberikan sinyal masuk dan keluar yang jelas, menyederhanakan proses keputusan perdagangan.

- Backtesting yang kuat: Strategi telah menjalani backtesting historis yang ketat, menunjukkan kinerja yang konsisten di berbagai skenario pasar.

- Penerapan luas: Kuberan berlaku untuk berbagai pasar dan instrumen, tidak terbatas pada kendaraan perdagangan tertentu.

Risiko Strategi

- Sensitivitas parameter: Kinerja strategi Kuberan sensitif terhadap pemilihan parameter; parameter yang tidak tepat dapat menyebabkan hasil yang tidak optimal.

- Black swan events: Strategi ini terutama bergantung pada sinyal teknis dan memiliki kemampuan terbatas untuk menangani peristiwa black swan fundamental.

- Risiko overfitting: Jika terlalu banyak data historis dipertimbangkan selama optimasi parameter, strategi dapat menjadi terlalu sesuai dengan masa lalu, mengurangi kemampuan beradaptasi dengan kondisi pasar di masa depan.

- Risiko leverage: Menggunakan leverage yang berlebihan menimbulkan risiko panggilan margin selama penarikan yang signifikan.

Untuk mengurangi risiko-risiko ini, langkah-langkah pengendalian yang tepat dapat diterapkan, seperti penyesuaian parameter secara berkala, menetapkan stop-loss yang wajar, moderasi leverage, dan pemantauan perubahan fundamental.

Arahan Optimasi

- Optimasi pembelajaran mesin: Memperkenalkan algoritma pembelajaran mesin untuk secara dinamis mengoptimalkan parameter strategi dan meningkatkan kemampuan beradaptasi.

- Penggabungan faktor fundamental: Pertimbangkan untuk mengintegrasikan analisis fundamental ke dalam keputusan perdagangan untuk menangani situasi di mana sinyal teknis gagal.

- Manajemen portofolio: Pada tingkat manajemen modal, sertakan strategi Kuberan dalam portofolio yang terdiversifikasi untuk mencapai lindung nilai yang efektif dengan strategi lain.

- Optimalisasi khusus pasar: Sesuaikan parameter strategi berdasarkan karakteristik pasar dan instrumen yang berbeda.

- Transformasi frekuensi tinggi: Sesuaikan strategi menjadi versi perdagangan frekuensi tinggi untuk menangkap lebih banyak peluang perdagangan jangka pendek.

Kesimpulan

Kuberan adalah strategi perdagangan yang kuat dan dapat diandalkan yang dengan cerdik menggabungkan beberapa metode analisis teknis. Melalui prinsip pertemuan indikator, ia unggul dalam menangkap tren dan mengidentifikasi titik balik. Meskipun tidak ada strategi yang kebal terhadap risiko, Kuberan telah membuktikan kecanggihan dalam backtesting. Dengan langkah-langkah pengendalian risiko yang tepat dan upaya optimalisasi, strategi ini dapat membantu pedagang mendapatkan keunggulan dalam pertempuran pasar, mendorong pertumbuhan portofolio investasi jangka panjang dan stabil mereka.

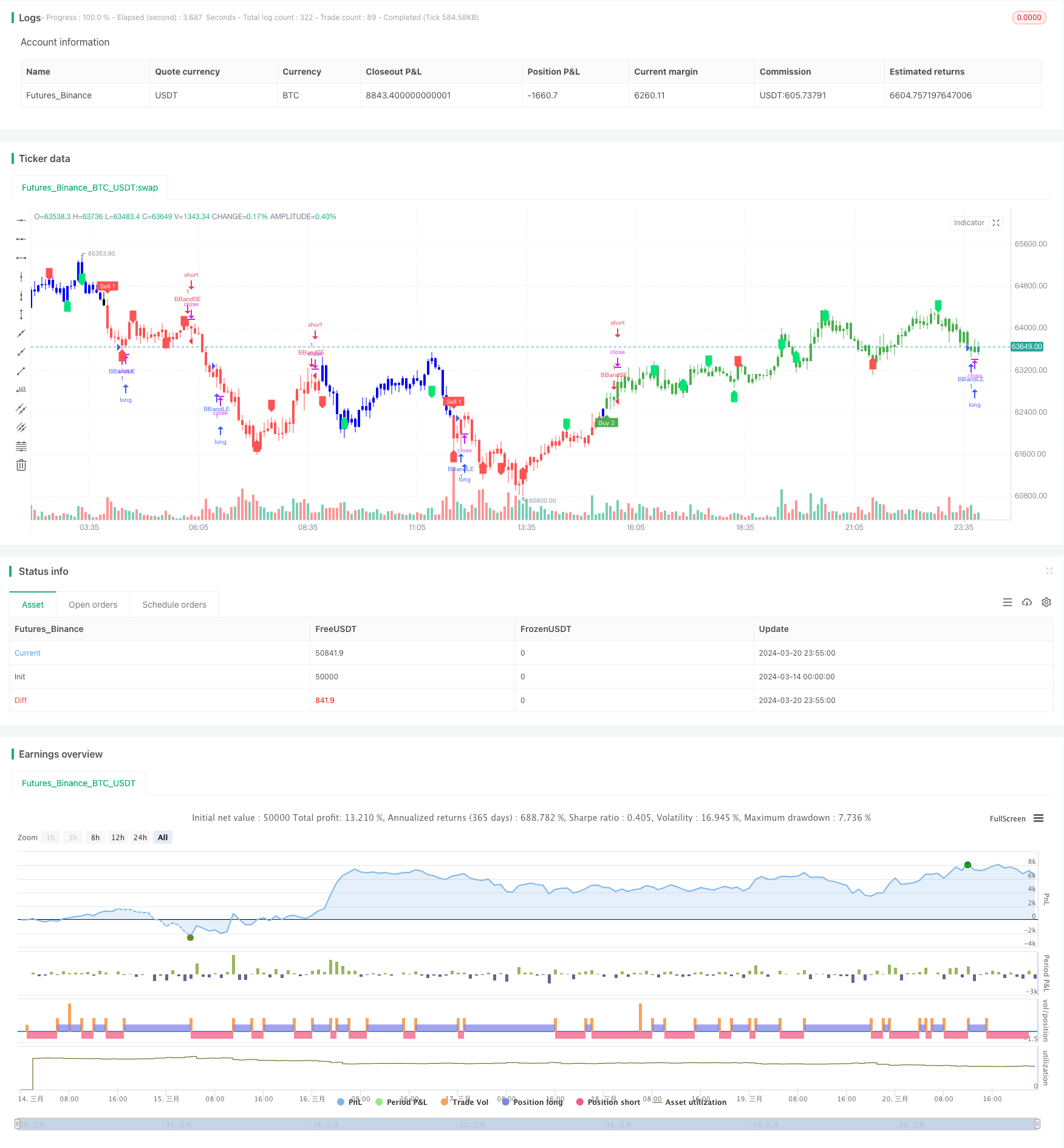

/*backtest

start: 2024-03-14 00:00:00

end: 2024-03-21 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © LonesomeThecolor.blue

//@version=5

strategy('Kuberan*', overlay=true, max_lines_count=500)

lb = input.int(5, title='Left Bars', minval=1)

rb = input.int(5, title='Right Bars', minval=1)

showsupres = input.bool(false, title='Support/Resistance', inline='srcol')

supcol = input.color(color.lime, title='', inline='srcol')

rescol = input.color(color.red, title='', inline='srcol')

// srlinestyle = input(line.style_dotted, title='Line Style/Width', inline='style')

srlinewidth = input.int(3, title='', minval=1, maxval=5, inline='style')

changebarcol = input.bool(true, title='Change Bar Color', inline='bcol')

bcolup = input.color(color.blue, title='', inline='bcol')

bcoldn = input.color(color.black, title='', inline='bcol')

ph = ta.pivothigh(lb, rb)

pl = ta.pivotlow(lb, rb)

iff_1 = pl ? -1 : na // Trend direction

hl = ph ? 1 : iff_1

iff_2 = pl ? pl : na // similar to zigzag but may have multTLiple highs/lows

zz = ph ? ph : iff_2

valuewhen_1 = ta.valuewhen(hl, hl, 1)

valuewhen_2 = ta.valuewhen(zz, zz, 1)

zz := pl and hl == -1 and valuewhen_1 == -1 and pl > valuewhen_2 ? na : zz

valuewhen_3 = ta.valuewhen(hl, hl, 1)

valuewhen_4 = ta.valuewhen(zz, zz, 1)

zz := ph and hl == 1 and valuewhen_3 == 1 and ph < valuewhen_4 ? na : zz

valuewhen_5 = ta.valuewhen(hl, hl, 1)

valuewhen_6 = ta.valuewhen(zz, zz, 1)

hl := hl == -1 and valuewhen_5 == 1 and zz > valuewhen_6 ? na : hl

valuewhen_7 = ta.valuewhen(hl, hl, 1)

valuewhen_8 = ta.valuewhen(zz, zz, 1)

hl := hl == 1 and valuewhen_7 == -1 and zz < valuewhen_8 ? na : hl

zz := na(hl) ? na : zz

findprevious() => // finds previous three points (b, c, d, e)

ehl = hl == 1 ? -1 : 1

loc1 = 0.0

loc2 = 0.0

loc3 = 0.0

loc4 = 0.0

xx = 0

for x = 1 to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc1 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc2 := zz[x]

xx := x + 1

break

ehl := hl == 1 ? -1 : 1

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc3 := zz[x]

xx := x + 1

break

ehl := hl

for x = xx to 1000 by 1

if hl[x] == ehl and not na(zz[x])

loc4 := zz[x]

break

[loc1, loc2, loc3, loc4]

float a = na

float b = na

float c = na

float d = na

float e = na

if not na(hl)

[loc1, loc2, loc3, loc4] = findprevious()

a := zz

b := loc1

c := loc2

d := loc3

e := loc4

e

_hh = zz and a > b and a > c and c > b and c > d

_ll = zz and a < b and a < c and c < b and c < d

_hl = zz and (a >= c and b > c and b > d and d > c and d > e or a < b and a > c and b < d)

_lh = zz and (a <= c and b < c and b < d and d < c and d < e or a > b and a < c and b > d)

plotshape(_hl, title='Higher Low', style=shape.labelup, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.belowbar, offset=-rb)

plotshape(_hh, title='Higher High', style=shape.labeldown, color=color.new(color.lime, 0), textcolor=color.new(color.black, 0), location=location.abovebar, offset=-rb)

plotshape(_ll, title='Lower Low', style=shape.labelup, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.belowbar, offset=-rb)

plotshape(_lh, title='Lower High', style=shape.labeldown, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), location=location.abovebar, offset=-rb)

float res = na

float sup = na

res := _lh ? zz : res[1]

sup := _hl ? zz : sup[1]

int trend = na

iff_3 = close < sup ? -1 : nz(trend[1])

trend := close > res ? 1 : iff_3

res := trend == 1 and _hh or trend == -1 and _lh ? zz : res

sup := trend == 1 and _hl or trend == -1 and _ll ? zz : sup

rechange = res != res[1]

suchange = sup != sup[1]

var line resline = na

var line supline = na

if showsupres

if rechange

line.set_x2(resline, bar_index)

line.set_extend(resline, extend=extend.none)

resline := line.new(x1=bar_index - rb, y1=res, x2=bar_index, y2=res, color=rescol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

resline

if suchange

line.set_x2(supline, bar_index)

line.set_extend(supline, extend=extend.none)

supline := line.new(x1=bar_index - rb, y1=sup, x2=bar_index, y2=sup, color=supcol, extend=extend.right, style=line.style_dotted, width=srlinewidth)

supline

iff_4 = trend == 1 ? bcolup : bcoldn

barcolor(color=changebarcol ? iff_4 : na)

// Inputs

A1 = input(5, title='Key Value. \'This changes the sensitivity\' for sell1')

C1 = input(400, title='ATR Period for sell1')

A2 = input(6, title='Key Value. \'This changes the sensitivity\' for buy2')

C2 = input(1, title='ATR Period for buy2')

h = input(false, title='Signals from Heikin Ashi Candles')

xATR1 = ta.atr(C1)

xATR2 = ta.atr(C2)

nLoss1 = A1 * xATR1

nLoss2 = A2 * xATR2

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop1 = 0.0

iff_5 = src > nz(xATRTrailingStop1[1], 0) ? src - nLoss1 : src + nLoss1

iff_6 = src < nz(xATRTrailingStop1[1], 0) and src[1] < nz(xATRTrailingStop1[1], 0) ? math.min(nz(xATRTrailingStop1[1]), src + nLoss1) : iff_5

xATRTrailingStop1 := src > nz(xATRTrailingStop1[1], 0) and src[1] > nz(xATRTrailingStop1[1], 0) ? math.max(nz(xATRTrailingStop1[1]), src - nLoss1) : iff_6

xATRTrailingStop2 = 0.0

iff_7 = src > nz(xATRTrailingStop2[1], 0) ? src - nLoss2 : src + nLoss2

iff_8 = src < nz(xATRTrailingStop2[1], 0) and src[1] < nz(xATRTrailingStop2[1], 0) ? math.min(nz(xATRTrailingStop2[1]), src + nLoss2) : iff_7

xATRTrailingStop2 := src > nz(xATRTrailingStop2[1], 0) and src[1] > nz(xATRTrailingStop2[1], 0) ? math.max(nz(xATRTrailingStop2[1]), src - nLoss2) : iff_8

pos1 = 0

iff_9 = src[1] > nz(xATRTrailingStop1[1], 0) and src < nz(xATRTrailingStop1[1], 0) ? -1 : nz(pos1[1], 0)

pos1 := src[1] < nz(xATRTrailingStop1[1], 0) and src > nz(xATRTrailingStop1[1], 0) ? 1 : iff_9

pos2 = 0

iff_10 = src[1] > nz(xATRTrailingStop2[1], 0) and src < nz(xATRTrailingStop2[1], 0) ? -1 : nz(pos2[1], 0)

pos2 := src[1] < nz(xATRTrailingStop2[1], 0) and src > nz(xATRTrailingStop2[1], 0) ? 1 : iff_10

xcolor1 = pos1 == -1 ? color.red : pos1 == 1 ? color.green : color.blue

xcolor2 = pos2 == -1 ? color.red : pos2 == 1 ? color.green : color.blue

ema1 = ta.ema(src, 1)

ema2 = ta.ema(src, 1)

above1 = ta.crossover(ema1, xATRTrailingStop1)

below1 = ta.crossover(xATRTrailingStop1, ema1)

above2 = ta.crossover(ema2, xATRTrailingStop2)

below2 = ta.crossover(xATRTrailingStop2, ema2)

buy1 = src > xATRTrailingStop1 and above1

sell1 = src < xATRTrailingStop1 and below1

buy2 = src > xATRTrailingStop2 and above2

sell2 = src < xATRTrailingStop2 and below2

barbuy1 = src > xATRTrailingStop1

barsell1 = src < xATRTrailingStop1

barbuy2 = src > xATRTrailingStop2

barsell2 = src < xATRTrailingStop2

// plotshape(buy1, title="Buy 1", text='Buy 1', style=shape.labelup, location=location.belowbar, color=color.green, textcolor=color.white, transp=0, size=size.tiny)

plotshape(sell1, title='Sell 1', text='Sell 1', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(buy2, title='Buy 2', text='Buy 2', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

// plotshape(sell2, title="Sell 2", text='Sell 2', style=shape.labeldown, location=location.abovebar, color=color.red, textcolor=color.white, transp=0, size=size.tiny)

// barcolor(barbuy1 ? color.green : na)

barcolor(barsell1 ? color.red : na)

barcolor(barbuy2 ? color.green : na)

// barcolor(barsell2 ? color.red : na)

// alertcondition(buy1, "UT Long 1", "UT Long 1")

alertcondition(sell1, 'UT Short 1', 'UT Short 1')

alertcondition(buy2, 'UT Long 2', 'UT Long 2')

// strategy.entry('long', strategy.long, when=buy2)

source = close

length = input.int(20, minval=1)

mult = input.float(2.0, minval=0.001, maxval=50)

basis = ta.sma(source, length)

dev = mult * ta.stdev(source, length)

upper = basis + dev

lower = basis - dev

buyEntry = ta.crossover(source, lower)

sellEntry = ta.crossunder(source, upper)

if (ta.crossover(source, lower) )

strategy.entry("BBandLE", strategy.long, stop=lower, oca_name="BollingerBands", comment="BBandLE")

else

strategy.cancel(id="BBandLE")

if (ta.crossunder(source, upper))

strategy.entry("BBandSE", strategy.short, stop=upper, oca_name="BollingerBands",comment="BBandSE")

else

strategy.cancel(id="BBandSE")

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

lengthTL = input.int(14, 'Swing Detection Lookback')

multTL = input.float(1., 'Slope', minval = 0, step = .1)

calcMethod = input.string('Atr', 'Slope Calculation Method', options = ['Atr','Stdev','Linreg'])

backpaint = input(true, tooltip = 'Backpainting offset displayed elements in the past. Disable backpainting to see real time information returned by the indicator.')

//Style

upCss = input.color(color.teal, 'Up Trendline Color', group = 'Style')

dnCss = input.color(color.red, 'Down Trendline Color', group = 'Style')

showExt = input(true, 'Show Extended Lines')

//-----------------------------------------------------------------------------}

//Calculations

//-----------------------------------------------------------------------------{

var upperTL = 0.

var lowerTL = 0.

var slope_phTL = 0.

var slope_plTL = 0.

var offset = backpaint ? lengthTL : 0

n = bar_index

srcTL = close

phTL = ta.pivothigh(lengthTL, lengthTL)

plTL = ta.pivotlow(lengthTL, lengthTL)

//Slope Calculation Method

slope = switch calcMethod

'Atr' => ta.atr(lengthTL) / lengthTL * multTL

'Stdev' => ta.stdev(srcTL,lengthTL) / lengthTL * multTL

'Linreg' => math.abs(ta.sma(srcTL * n, lengthTL) - ta.sma(srcTL, lengthTL) * ta.sma(n, lengthTL)) / ta.variance(n, lengthTL) / 2 * multTL

//Get slopes and calculate trendlines

slope_phTL := phTL ? slope : slope_phTL

slope_plTL := plTL ? slope : slope_plTL

upperTL := phTL ? phTL : upperTL - slope_phTL

lowerTL := pl ? pl : lowerTL + slope_plTL

var upos = 0

var dnos = 0

upos := phTL ? 0 : close > upperTL - slope_phTL * lengthTL ? 1 : upos

dnos := pl ? 0 : close < lowerTL + slope_plTL * lengthTL ? 1 : dnos

- Dual Exponential Moving Average Cloud Crossover Strategi Perdagangan Otomatis

- Strategi jangka pendek dan jangka panjang lintas EMA dua periode

- Hull Moving Average Crossover Strategi

- Dual Moving Average Crossover dengan Optimized Stop Loss Strategy

- ATR Trend Breakout Strategi

- Strategi Perdagangan Crossover RSI dan Multiple Moving Averages

- Tren berdasarkan MA dan RSI Setelah Strategi Perdagangan Swing

- Bollinger Bands + EMA Trend Mengikuti Strategi

- Tren Mengikuti Strategi Berdasarkan Dual Moving Average Crossover dan Multi-Timeframe DMI Indicator

- Strategi Dukungan/Resistansi-Psikologi-Sumber Umpan Balik-Manajemen Uang

- Strategi Penyaring Tren Pola Lilin

- Tren Rata-rata Bergerak Ganda Mengikuti Strategi

- Strategi Stop Loss dan Take Profit Dinamis Berdasarkan Stop Trailing ATR Ganda

- MACD+EMA Multi-Timeframe Breakout Strategi

- Keunggulan yang sempurna DCA Momentum dan Strategi Volatilitas

- Strategi Trading Trend Multi-Timeframe Berdasarkan MACD, ADX, dan EMA200

- RSI Strategi perdagangan dua arah dengan stop loss awal

- Strategi Stop Loss Target Panjang/Pendek yang Diprediksi Secara Otomatis Berdasarkan 9:15 Tinggi/Rendah

- Strategi SMC Menggabungkan MACD dan EMA

- Strategi Perdagangan XAUUSD yang Berbasis Multi-SMA dan MACD Dinamis